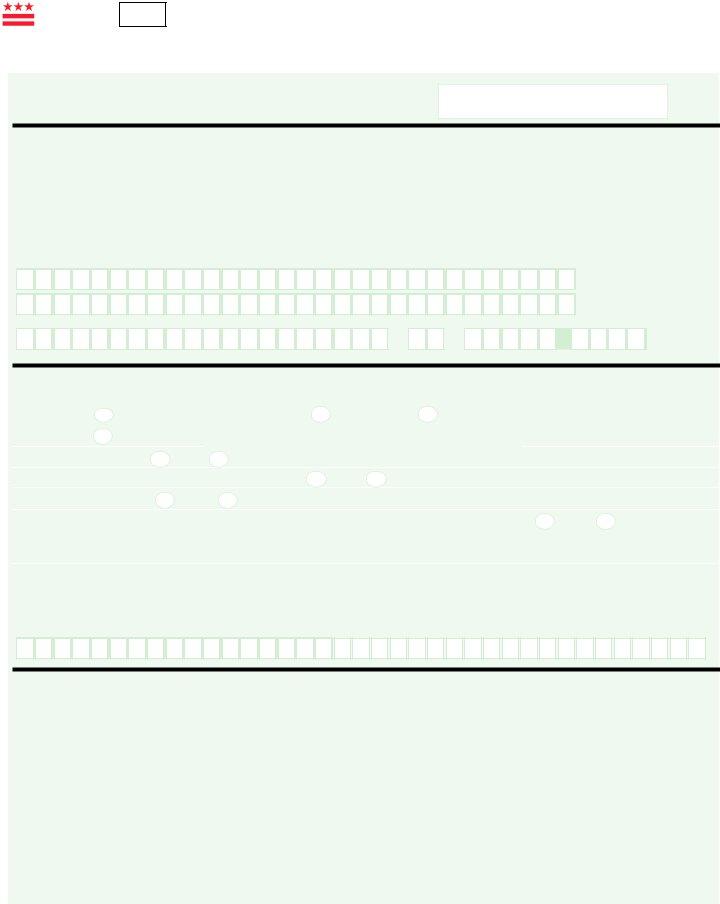

When a taxpayer in the District of Columbia passes away, handling their final affairs can include dealing with taxes. The FR-147 form, known as the Statement of Person Claiming Refund Due, plays a crucial role in this process. It is specifically designed for individuals who are claiming a tax refund on behalf of someone who has died. The form requires various pieces of information to be filled out, such as the deceased’s personal information, their taxpayer identification number, and the date of death. Additionally, the claimant must provide their relationship to the deceased and assert whether the deceased left a will, along with information on the executor or administrator of the estate. This form also asks for details about who paid the deceased's DC income tax for the year 2020 and outlines the requirements for proving entitlement to the refund, including the necessity of attaching a death certificate or other proof of death, and possibly a court certificate of appointment if filing as an executor or administrator. It concludes with a declaration by the claimant, affirming the accuracy of the information under penalty of law. Designed with strict attention to detail, the FR-147 ensures that refunds due to the deceased are correctly processed and dispatched to the rightful claimants, thereby safeguarding both the interests of the claimant and the integrity of the tax system in the District of Columbia.

| Question | Answer |

|---|---|

| Form Name | Form Fr 147 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | Fillable Online otr cfo dc Download Form FR-147 - Office ... |

Government of the District of Columbia

2020

a Deceased Taxpayer |

*201470110000* |

• |

|

Claiming Refund Due

Important: Print in CAPITAL letters using black ink.

OFFICIAL USE ONLY

Vendor ID# 0000

Personal information

Deceased’s First name |

|

|

|

|

|

|

|

|

|

|

|

|

|

M.I. |

Last name |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deceased’s taxpayer identification number (TIN) |

|

Date of death (MMDDYYYY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of person claiming the refund (First name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

M.I. |

Last name |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address of person claiming the refund (number, street and suite/apartment number if applicable)

CityState Zip code +4

Statement of Claimant

Your relationship to the deceased |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Fill in only one: |

Spouse/registered domestic partner |

|

Administrator |

|

Executor |

|

|

|||||||||||||||

|

Other 4Specify |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Did the deceased leave a will? |

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Has an executor or administrator been appointed for the estate? |

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|||||||||

If NO, will one be appointed? |

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Will you pay out the refund to beneficiaries according to the laws of the state where the deceased was a legal resident? |

Yes |

No |

||||||||||||||||||||

If NO, a refund cannot be made until you submit a court certificate showing your appointment as personal representative or other evidence that you are entitled, under DC law, to receive the refund.

If other than the deceased, who paid deceased’s 2020 DC income tax?

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Claimant’s TIN |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relationship to deceased

Signature I request a refund of DC income tax overpaid by or on behalf of the deceased. Under penalties of law, I declare that I have examined this claim and, to the best of my knowledge, it is correct.

Signature of person claiming refund |

|

Date |

|

|

|

|

|

|

Attach this form to the deceased’s

•

Revised 04/2020

•