The FR Y-8 form, officially titled "Report of Bank Holding Company Intercompany Transactions and Balances," serves as a critical tool used by the Federal Reserve System to monitor and regulate the financial interactions between a bank holding company and its subsidiaries. Mandated by Section 5(c) of the Bank Holding Company Act and Section 225.5(b) of Regulation Y, this report plays a pivotal role in ensuring the financial stability and integrity of the banking system. It requires detailed disclosure of transactions and balances, aiming to identify and mitigate potential risks that could adversely affect subsidiary banks. The importance of accurate and comprehensive reporting cannot be overstated, as it furnishes the Federal Reserve with essential data to maintain oversight and enforce compliance. Additionally, the form encompasses various transaction types, ranging from securities and loans to real estate and other assets, highlighting the broad scope of intercompany activities. The confidentiality of the information provided is strictly maintained unless disclosure is deemed necessary, in which case respondents are notified. The semiannual submission of the FR Y-8, along with interim reports under specific conditions, underscores the continuous regulatory effort to safeguard the financial system at large. With an average completion time of three hours, the FR Y-8 form represents a significant but necessary investment in regulatory compliance and transparency.

| Question | Answer |

|---|---|

| Form Name | Form Fr Y 8 |

| Form Length | 16 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 4 min |

| Other names | y89706 interfirm print broker form |

Board of Governors of the Federal Reserve System

FR

OMB Number

Report of Bank Holding Company Intercompany Transactions and

This report is required by law: Section 5(c) of the Bank Holding Company Act (12 U.S.C. 1844) and Section 225.5(b) of Regulation Y (12 C.F.R. 225.5(b)).

The Report of Bank Holding Company Transactions and Balances are to be prepared in accordance with the instructions provided by the Federal Reserve System.

The Federal Reserve System regards the individual company information provided by each respondent as confidential. If it should be determined subsequently that any information collected on this form must be released, respondents will be notified.

I,

Name and Title of Officer

an authorized officer of the named bank holding company, hereby declare that this report has been examined by me and is true and complete to the best of my knowledge and belief.

Signature of Bank Holding Company Official

Date of Signature

Date of Report:

Month / Date / Year (BHCD 9999)

Legal Title of Bank Holding Company (TEXT 9010)

(Mailing Address of the Bank Holding Company) Street / P.O. Box (TEXT 9110)

City (TEXT 9130) |

State (TEXT 9200) ZIP Code (TEXT 9220) |

PLEASE CHECK TYPE OF REPORT:

|

|

|

|

Location of principal office: |

|

_____ Original |

_____ Interim* |

_____Revised |

|

||

|

|

|

|

|

|

|

|

|

|

City |

County |

|

|

|

|||

*In addition to the semiannual report, an interim report is required under certain |

|

||||

conditions (see instructions). |

|

|

|

||

|

State |

ZIP Code |

|||

|

|

|

|

||

Return to the appropriate Federal Reserve District Bank the completed original and the number of copies specified by that District Bank.

For Federal Reserve Bank Use Only

BHC Number

RSSD Number

Person to whom questions about this report should be directed:

Name / Title (TEXT 8901)

Area Code / Phone Number (TEXT 8902)

The Federal Reserve may not conduct or sponsor, and an organization is not required to respond to, a collection of information unless it displays a currently valid OMB control number.

Public reporting burden for this information collection is estimated at an average of 3.0 hours per response, including time to gather and maintain data in the required form and to review instructions and complete the information collection. Comments regarding this burden estimate or any other aspect of this information collection, including suggestions for reducing the burden, may be sent to Secretary, Board of Governors of the Federal Reserve System, Washington, D.C. 20551, and to the Office of Management and Budget, Paperwork Reduction Project

Name of Bank Holding Company

Report of Bank Holding Company Intercompany Transactions and Balances

Report at the close of business ____________________________ , _________

Section

FR

Page 1

For Federal Reserve Bank Use Only

BHC Number |

|

|

|

RSSD Number |

|

|

|

Should this report be |

|

|

|

BHCD |

|

||

checked for additional |

|

||

8360 |

|

||

information sent by |

|

||

|

|

||

|

|

||

the respondent? |

|

|

|

(1=Yes, 2=No) |

|

|

|

|

|

|

|

PLEASE READ INSTRUCTIONS BEFORE COMPLETING THIS REPORT

|

|

|

|

|

|

|

|

|

|

|

|

Amount Transferred |

||||

|

|

|

|

|

Total Amount Transferred |

|

|

|

in Column B that was |

|||||||

|

|

|

|

|

During the Reporting Period |

|

|

|

Past Due, Nonaccrual, |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

or Restructured² |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

A. |

|

|

B. |

|

|

C. |

||||||

|

|

TO: Subsidiary Banks |

|

TO: Other BHC |

|

TO: Other BHC |

||||||||||

|

|

and Their Subsidiaries |

|

Members |

|

Members |

||||||||||

|

|

FROM: Other BHC |

FROM: Subsidiary Banks |

FROM: Subsidiary Banks |

||||||||||||

Dollar Amounts in Thousands |

|

|

Members³ |

and Their Subsidiaries |

and Their Subsidiaries |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Securities (including obligations |

|

BHCD/ |

Bil |

|

Mil |

Thou |

BHCD/ |

Bil |

|

Mil |

Thou |

BHCD/ |

Bil |

|

Mil |

Thou |

|

|

BHCI 4 |

|

BHCI 4 |

|

BHCI 4 |

|

|||||||||

of States and political |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

subdivisions of the U.S., but |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

excluding U.S. Treasury |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

securities, obligations of other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. government agencies and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

corporations, and securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8300 |

|

|

|

|

8301 |

|

|

|

|

8302 |

|

|

|

|

issued by other BHC members) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2. Loans secured by real estate |

|

8303 |

|

|

|

|

8304 |

|

|

|

|

8305 |

|

|

|

|

3. Other loans, lease financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

receivables, and other assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8306 |

|

|

|

|

8307 |

|

|

|

|

8308 |

|

|

|

|

representing extensions of credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4. Real estate owned other than |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

premises |

|

8309 |

|

|

|

|

8310 |

|

|

|

|

8311 |

|

|

|

|

5. Other assets, excluding those |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8312 |

|

|

|

|

8313 |

|

|

|

|

8314 |

|

|

|

|

listed in the detailed instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6. TOTAL AMOUNT TRANSFERRED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Sum each column) |

|

8315 |

|

|

|

|

8316 |

|

|

|

|

8317 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7.TRANSFERS OF PAST DUE, NONACCRUAL, OR RESTRUCTURED ASSETS. If the total amount reported in any individual cell under column C of Section 1 (items 1 through 5) exceeds five percent (5%) of total banking equity or $10 million, whichever is less, the following information should be provided on a separate page to be attached to the report form:

(1) the amount and date of each individual transfer making up the total reported, (2) the names of the entities involved in each transfer, and (3) a brief statement as to the purpose of the transfer. (TEXT 8357)

8.TRANSFERS OF OPERATIONS. Report the transfer of any subsidiary or activity (division or operation) from (to) subsidiary banks and their subsidiaries to (from) other BHC members if, and only if, assets have been transferred in an amount in excess of five percent (5%) of total banking equity² or $10 million, whichever is less. The following information on such asset transfers should be provided on a separate page to be attached to the report form: (1) the amount and date of assets transferred, (2) the names of the entities involved in the transfer, and (3) a brief statement as to the purpose of the transfer. (TEXT 8358)

1.

2.

3.

4.

5.

6.

¹Negative numbers should not be reported in Section 1. ² See the definitions section of the General Instructions.

³ The phrase “other BHC members” is defined in the instructions to this report to include (a) the parent company (if the parent is not a bank) and

(b)all other subsidiaries of the bank holding company that are neither banks nor direct or indirect subsidiaries of banks.

4 The mnemonic “BHCI” should be used to transmit interim report data.

6/97

FR

Page 2

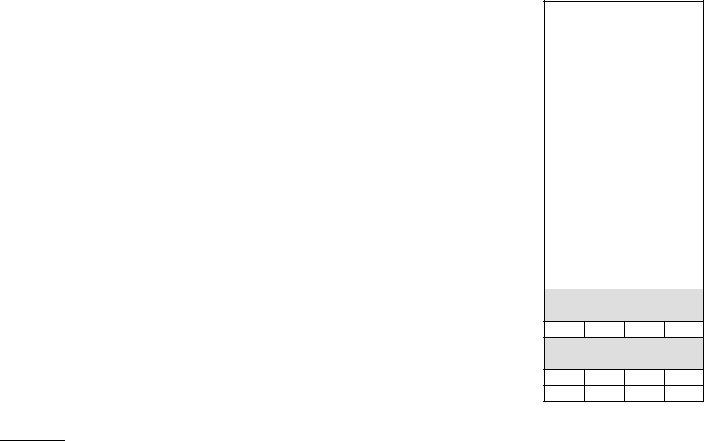

Report of Bank Holding Company Intercompany

Transactions and

Section

|

|

Dollar Amounts |

||

PLEASE READ INSTRUCTIONS BEFORE COMPLETING THIS REPORT |

|

in Thousands |

||

|

|

|

|

|

|

|

|

|

|

1. Income recognized (during the reporting period) by subsidiary banks and their subsidiaries |

BHCD |

Bil |

Mil |

Thou |

|

||||

from other BHC members: |

|

|

|

|

a. Interest |

8318 |

|

|

|

8319 |

|

|

|

|

b. Management and other service fees |

|

|

|

|

2. Average balance of credit extended by subsidiary banks and their subsidiaries to other |

|

|

|

|

BHC members (include loans, advances, capitalized leases, nonequity investments, |

|

|

|

|

repurchase agreements, and other extensions of credit) |

8320 |

|

|

|

3. Credit lines, compensating balances, and correspondent relationships: |

|

|

|

|

a. Credit lines associated with compensating balances |

8321 |

|

|

|

8322 |

|

|

|

|

b. Current amount of credit used in the credit lines reported in 3.a |

|

|

|

|

c. Average amount of compensating balances maintained over the reporting period by |

|

|

|

|

subsidiary banks at unrelated banks in connection with credit lines extended and |

|

|

|

|

services provided to other BHC members |

8323 |

|

|

|

d. Amount of compensation, if any, recognized during the period by subsidiary banks |

|

|

|

|

for maintaining the balances reported in 3.c |

8324 |

|

|

|

|

|

|

|

|

4.

|

8325 |

with credit extended by third parties to other BHC members |

|

5. Gross amounts transferred during the reporting period related to Federal, State, and |

|

foreign income taxes: |

|

|

8326 |

a. From subsidiary banks and their subsidiaries to other BHC members |

|

|

8327 |

b. From other BHC members to subsidiary banks and their subsidiaries |

|

1.a.

1.b.

2.

3.a.

3.b.

3.c.

3.d.

4.

5.a.

5.b.

This report is required to collect data on the movement of funds between a domestic bank holding company and its subsidiaries in order to identify broad categories of intercompany transactions and balances that may have an adverse impact on the financial condition of the subsidiary bank(s).

6/97

Board of Governors of the Federal Reserve System

Instructions for Preparation of the

Report of Bank Holding Company

Intercompany Transactions

and Balances

Reporting Form FR

Reissued June 1997

Read carefully and save for future use.

Questions related to these instructions or the preparation of the Report of Bank Holding Company Intercompany Transactions and Balances should be addressed to the appropriate Federal Reserve Bank.

Contents for

FR

GENERAL INSTRUCTIONS FOR THE PREPARATION OF THE

REPORT OF BANK HOLDING COMPANY INTERCOMPANY TRANSACTIONS AND BALANCES

Who must report |

||

Frequency of Reporting and Submission Dates |

||

Semiannual reporting |

||

Interim reporting |

||

Where to Submit the Reports |

||

Signature . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

Confidentiality |

||

Definitions |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

Miscellaneous General Instructions |

||

Rounding |

||

Waiver of Reporting Requirements |

||

LINE ITEM INSTRUCTIONS FOR THE REPORT OF |

|

|

BANK HOLDING COMPANY INTERCOMPANY TRANSACTIONS |

|

|

AND BALANCES |

|

|

Section 1. |

Assets Transferred |

|

Section 2. |

Other Intercompany Transactions and Balances |

|

Instructions for Preparation of Reporting Form FR |

|

Contents June 1997 |

|

GENERAL INSTRUCTIONS FOR THE PREPARATION OF

The Report of Bank Holding Company

Intercompany Transactions and Balances

(FR

Who Must Report

The Report of Bank Holding Company Intercompany Transactions and Balances (FR

Frequency of Reporting

and Submission Dates

Semiannual reporting

The FR

Interim reporting

In addition to the semiannual reporting requirement, certain large asset transfers MUST be reported on an interim report prior to the semiannual reporting dates. The following types of transfers should be reported to the appropriate Federal Reserve Bank within 10 calendar days after their occurrence:

Instructions for Preparation of Reporting Form FR

(1)the transfer of any asset(s) of the type reportable in Section 1 of this report between subsidiary banks and their subsidiaries and other BHC members1 if the amount is greater than five percent (5.0%) of total bank equity1 or $10 million, whichever is less, or

(2)the transfer of any past due, nonaccrual, or restruc- tured asset(s) of the type reportable in Section 1 of this report between subsidiary banks and their sub- sidiaries and other BHC members, if the amount is greater than five percent (5.0%) of total bank equity or $10 million, whichever is less.

Note that interim reporting criteria are to be applied to asset transfers for individual bank subsidiaries (or their subsidiaries) rather than to aggregate transfers by all bank subsidiaries.

An interim report should include an original and two copies of the first two pages (the cover page and Sec- tion 1) of FR

(1)the amount and date of each transfer making up the total reported,

(2)the names of the entities involved in each transfer, and

(3)a brief statement as to the purpose of the transfer.

Transactions that are reported in the interim report should also be included in the semiannual report filed at the end of the

1. See the definitions of the General Instructions.

General Instructions

Where to Submit the Report

An original and two copies of the semiannual report shall be submitted to the Federal Reserve Bank of the District in which the BHC is registered.

All reports should be filled out clearly by typewriter or in ink. Reports completed in pencil are not acceptable. Legible photocopies are preferred. However, when car- bons are used to prepare copies, the copies must be legible and prepared carefully to ensure that the figures and other information appear in the correct position on all copies. Computer printouts are also acceptable, pro- vided that they are in a format identical to that of the report form, including all item and column captions.

Signature

The original report shall be manually signed by an autho- rized officer of the BHC in the appropriate place on the cover sheet of the report form. The title of the officer shall also be entered in the appropriate space. The report does not have to be certified by an independent public accountant.

Confidentiality

The Federal Reserve System regards the individual com- pany information provided by each respondent as confi- dential. If it should be determined subsequently that any information collected on this form must be released, respondents will be notified.

Definitions

Act: The Bank Holding Company Act of 1956, as amended.

Bank Holding Company (BHC): This term as defined in Section 2(a) of the Act, refers to any company which has control over any bank or over any company that is or becomes a bank holding company by virtue of the Bank Holding Company Act.

Subsidiary: This term is defined as in Section 2(d) of the Act and includes (1) any company (as defined below) 25 per cent or more of whose voting shares (excluding shares owned by the United States or by any company wholly owned by the United States) are directly or indirectly owned or controlled by a BHC or are held by it with power to vote; (2) any company the election of a

majority of whose directors is controlled by a BHC; and

(3)any company with respect to the management or policies of which such BHC has the power, directly or indirectly, to exercise a controlling influence, whether or not such a determination has been made by the Board of Governors of the Federal Reserve System.

Company: This term is defined as in Section 2(b) of the Act and means any corporation, partnership, business trust, association, or similar organization, or any other trust unless by its terms it must terminate within 25 years or not later than 21 years and 10 months after the death of individuals living on the effective date of the trust, but shall not include any corporation the majority of the shares of which are owned by the United States or by any State.

Bank: This term is defined as in Section 225.2 of the Act and includes:

(1)an insured bank as defined in section 3(h) of the Federal Deposit Insurance Act; or

(2)an institution organized under the laws of the United States, any State of the United States, the District of Columbia, any territory of the United States, Puerto Rico, Guam, American Samoa, or the Virgin Islands, which both—

a.accepts demand deposits or deposits that the depositor may withdraw by check or similar means for payment to third parties or others; and

b.is engaged in the business of making commercial loans.

‘‘Bank’’ does not include those institutions qualifying under the exceptions listed in Section 2(c)(2) of the Bank Holding Company Act of 1956 (12 USC 1841(c)(2)).

Subsidiary banks and their subsidiaries: The phrase ‘‘subsidiary banks and their subsidiaries’’ is defined herein to include (1) any bank that is a direct or indirect subsidiary (as defined in the Act) of a BHC and (2) any direct or indirect subsidiary of a subsidiary bank. Any organization operating under Sections 25 or 25(a) of the Federal Reserve Act (Edge and Agreement corporations) would normally be a subsidiary of a bank (and included as part of the consolidated bank) unless more than 50 per cent of such a corporation were owned by the BHC.

Instructions for Preparation of Reporting Form FR

General Instructions

Other BHC members: The phrase ‘‘other BHC mem- bers’’ is defined herein to include (1) the parent organiza- tion (if the parent is not a bank) and (2) all other subsidiaries of the BHC that are neither banks nor direct or indirect subsidiaries of banks. It excludes those enti- ties which fall under the definition of subsidiary banks and their subsidiaries.

Past Due, Nonaccrual, or Restructured Assets: The phrase ‘‘past due, nonaccrual, or restructured assets’’ consists of all loans and leases reported on a consoli- dated basis that are past due, in a nonaccrual status, or restructured. The full outstanding credit balances, net of unearned income, should be reported. Restructured assets refers to assets that are involved in troubled debt restruc- turing per Financial Accounting Standards Board (FASB) Statement No. 15 or other debt restructuring that pro- vides for full repayment according to modified terms. This classification includes all credits, regardless of whether they are secured or guaranteed by the govern- ment or by others. Include also in this classification other assets which would be considered nonperforming by the reporting organization’s own internal audit or loan review staff, or assets that are designated as ‘‘classified’’ by a Federal or State supervisory agency.

Past Due Assets: Loans, leases or other assets that are contractually past due 90 days or more as to interest or principal payments.

Nonaccrual Assets: Assets are to be classified in a nonaccrual status if:

(1)they are maintained on a cash basis because of deterioration in the financial position of the borrower,

(2)payment in full of interest or principal is not expected, or

(3)principal or interest has been in default for a period of 90 days or more unless the obligation is well secured and in the process of collection.

A debt is

Instructions for Preparation of Reporting Form FR

responsible party. A debt is ‘‘in the process of collec- tion’’ if collection of the debt is proceeding in due course either through legal action, including judgement enforce- ment procedures, or, in appropriate circumstances, through collection efforts not involving legal action which are reasonably expected to result in the repayment of the debt or in its restoration to current status.

Restructured Assets: Assets whose terms have been renegotiated or compromised due to the deteriorating financial condition of the obligor. This includes assets considered to involve ‘‘troubled debt restructuring’’ under the provisions of FASB No. 15 or other debt restructuring that provides for full repayment under modified terms due to a deteriorating financial position. This would include any ‘‘workout’’ situations. It does not include debt for which the effective interest rate has been reduced as the result of changes in current market inter- est rates rather than changes in the debtor’s financial condition or ability to pay normal rates.

Total Bank Equity: The sum of the total equity capital of all subsidiary banks as reported on the latest available Consolidated Reports of Condition and Income (Forms FFIEC 031, 032, 033 or 034) or other financial state- ments submitted to other regulators. If these forms are not available, the amount of equity capital which is reflected on the subsidiary bank’s financial records may be used. Note that interim reporting criteria are to be applied to asset transfers for individual bank subsidi- aries (or their subsidiaries) rather than to aggregate transfers by all bank subsidiaries.

Miscellaneous General Instructions

Rounding

Any dollar amounts should be rounded to the nearest thousand. For example, an amount of $1,527,605.22 would be reported as $1,528 thousand. Report items between $1,000 and $1,499 as $1 thousand; report items less than $1,000 as zero. Place any negative amounts in parentheses.

If additional space is necessary to answer an item or if an item requires further explanation, furnish such infor- mation on a separate page to be attached to the report form.

General Instructions

Waiver of Reporting Requirements

Reporting requirements for transactions of a recurring nature, or any transaction that would result in an undue burden or expense, may be waived by the Board of

Governors of the Federal Reserve System upon receipt of a written request to be submitted through the appropri- ate Federal Reserve Bank.

Instructions for Preparation of Reporting Form FR |

|

|

General Instructions June 1997 |

DETAILED INSTRUCTIONS FOR

Section 1

Assets Transferred

Size Criteria

To calculate a total for each cell under Section 1, items 1 through 5, include only individual intercompany trans- actions that involve the transfer of $100,000 or more in assets. Transfers should be included if at least one side of the transaction involves the transfer of $100,000 or more in assets. The transfer of a group of assets, such as a group of loans or securities, shall be considered as an individual transaction if the assets are purchased as a group or as a single package or if their purchase is negotiated on a group basis.

Calculation of asset transfer totals should be based on the value of the asset as carried on the books of the trans- feror (at the time of the transfer) gross, ignoring any valuation allowance and allocated transfer risk reserve, but net of any adjustments (such as principal repayments or

If the total for any individual cell in Section 1, items 1 through 5, does not exceed

Types of transfers to be reported

Report only the transfer of noncash assets, such as intercompany transfers of loans, lease financing receiv- ables, real estate, securities, equipment, and so forth. Line item instructions for items 1 through 8 of Section 1 are provided on pages 9 through 13 of these instructions.

Asset transfers that should not be reported in this section are listed as exclusions on page

Asset transfers are usually

Instructions for Preparation of Reporting Form FR

transferred in exchange for cash, another loan, or some other noncash assets. (Noncash assets include loans, receivables, securities, leases, real estate, and equip- ment.) If a noncash asset(s), such as a loan or group of loans, is exchanged for cash, report the transfer of the noncash asset, but not the transfer of cash. If a noncash asset is exchanged for another noncash asset, both sides of the transfer should be reported. If an asset is trans- ferred more than once during the period, each transfer should be reported.

Column

Assets transferred to subsidiary banks and their subsidi- aries from other BHC members are to be reported under column A of Section 1.

Columns B and

Assets transferred to other BHC members from subsidi- ary banks and their subsidiaries are to be reported under column B of Section 1 and, if appropriate, under col- umn C. Only assets that were past due, nonaccrual, or restructured are to be reported under column C.

Line Item Instructions

Item 1 Securities including obligations of States and political subdivisions of the U.S., but excluding U.S. treasury securities, obligations of other U.S. government agencies and corporations, and securities issued by other BHC members.

Report the book value, as carried on the books of the transferor at the time of transfer, of securities (except as

Section 1

noted below) and loans to and obligations of states and political subdivisions of the U.S. that were transferred during the period. Include transfers of bonds, notes, debentures, and corporate stock.

Exclude the following from this item: (1) U.S. Treasury securities and U.S. government agencies and corporation obligations, including all holdings of U.S. Government- issued or

Item 2 Loans secured by real estate.

Report the book value, as carried on the books of the transferor at the time of transfer, of all real estate loans transferred during the period. Include in loans secured by real estate:

(1)All loans (other than those to states and political subdivisions in the U.S.), regardless of purpose, and regardless of whether originated directly or pur- chased from another party that are secured by real estate as evidenced by mortgages, deeds of trust, land contracts, or other instruments, whether first or junior liens (for example, equity loans or second mortgages) on real estate.

(2)Loans secured by residential properties that are guar- anteed by the Farmers Home Administration (FmHA) and extended, collected, or serviced by the BHC or one of its subsidiaries.

(3)Loans secured by properties and guaranteed by gov- ernmental entities in foreign countries.

(4)Loans secured by real estate originated by banking and nonbanking subsidiaries and transferred to and held by other BHC members.

(5)Loans secured by real estate originated and packaged by nonbanking subsidiaries and transferred to other BHC members for subsequent sale.

Exclude from loans secured by real estate:

(1)All loans indirectly representing real estate as defined under item 4, ‘‘Real estate owned other than premises.’’

(2)Obligations (other than securities) of states and political subdivisions in the U.S. secured by real estate.

(3)All loans and sales contracts indirectly representing other real estate as defined under item 4, ‘‘Real estate owned other than premises.’’

(4)Loans to real estate companies, real estate invest- ment trusts, mortgage lenders, and foreign nongov- ernmental entities that specialize in mortgage loan originations and that service mortgages for other lending institutions, when the real estate mortgages or similar liens on real estate are not sold to the reporting entity but are merely pledged as collateral. Such loans should be reported in item 3.

(5)Notes issued and insured by the Farmers Home Administration and instruments (certificates of ben- eficial ownership and insured note insurance con- tracts) representing an interest in Farmers Home

(6)Bonds issued by the Federal National Mortgage Association or by the Federal Home Loan Mortgage Corporation (FHLMC) that are collateralized by residential mortgages. Such bonds should not be reported in Section 1.

(7)Pooled residential mortgages against which certifi- cates guaranteed by the U.S. Government have been issued. Treat such pooled mortgages as having been sold outright and report such certificates purchased or held as obligations of U.S. government agencies and corporations. Such instruments should not be reported in Section 1.

(8)Pooled mortgages against which certificates are issued and guaranteed by the FHLMC. Such certifi- cates should not be reported in Section 1.

Special treatment of private (i.e., nongovernment- issued or

(1)If certificates of participation in a pool of residential mortgages

Instructions for Preparation of Reporting Form FR

Section 1

borrowings. In these cases, the underlying mortgage loans must continue to be reported as loans secured by real estate.

(2)If certificates of participation in a pool of residential mortgages

Item 3 Other loans, lease financing receivables, and other assets representing extensions of credit.

Report the book value (as carried on the books of the transferor at the time of transfer) of all loans, lease financing receivables, and other assets that represent extensions of credit which were transferred during the period. Loans are extensions of credit resulting either from direct negotiation between lender and borrower or the purchase of such assets from others. Loans include extensions of credit in the form of promissory notes, acknowledgements of advance, due bills, invoices, over- drafts, commercial paper, acceptances, and similar (writ- ten or oral) obligations.

Exclude the following from other loans, lease financing receivables, and other assets representing extensions of credit:

(1)deposits at financial institutions;

(2)federal funds sold and securities purchased under agreements to resell, unless these securities were past due, nonaccrual or restructured; and

(3)loans secured by real estate (to be reported in Item 2).

Item 4 Real estate owned other than premises.

Report the book value (as carried on the books of the transferor at the time of transfer), less accumulated depreciation, of all real estate other than premises actu- ally owned by the BHC or its subsidiaries that was transferred during the period. Do not deduct mortgages or other liens on such property.

Instructions for Preparation of Reporting Form FR

Include as real estate owned other than premises:

(1)real estate acquired in any manner for debts previ- ously contracted (including but not limited to, real estate acquired through foreclosure and real estate acquired by deed in lieu of foreclosure);

(2)real estate acquired and held for investment purposes (other than bank premises);

(3)real estate acquisition, development, or construction (ADC) arrangements which are accounted for as investments in real estate;

(4)property formerly but no longer used for operations;

(5)property originally acquired for future expansion but no longer intended to be used for that purpose;

(6)receivables resulting from sales of other real estate owned if all criteria have not been met for applying the full accrual method of accounting as specified in FASB Statement No. 66, ‘‘Accounting for Sales of Real Estate;’’

(7)loans, sales contracts and other assets based on prop- erties

(8)sales or transfers of real estate in which someone other than the reporting entity takes title for the convenience of the reporting entity.

Item 5 Other assets.

Report the book value (as carried on the books of the transferor at the time of transfer) of premises, furniture and fixtures, debt and equity securities issued by the BHC or any of its subsidiaries, and other assets that have been transferred during the period that cannot be prop- erly reported against items 1 through 4. See exclusions on page

Item 6 Total Amount Transferred.

Report the sum of items 1 through 5 in columns A through C.

Section 1

Item 7 Transfers of past due, nonaccrual, or restructured assets.

If the amount reported in any individual cell under column C of Section 1, items 1 through 5, exceeds five percent (5.0%) of total bank equity1 or $10 million, whichever is less, the following information should be provided on a separate page to be attached to the report form:

(1)the amount and date of each transfer making up the total reported,

(2)the names of the entities involved in each transfer, and

(3)a brief statement as to the purpose of the transfer.

Item 8 Transfers of operations.

Report the transfer of any subsidiary or activity (division or operation) from (to) subsidiary banks and their subsid- iaries to (from) other BHC members only if the amount of the assets transferred was greater than five percent (5.0%) of total bank equity1 or $10 million, whichever is less. The following information on such asset transfers should be provided on a separate page to be attached to the report form:

(1)the amount and date of assets transferred,

(2)the names of the entities involved in the transfer, and

(3)a brief statement as to the purpose of the transfer.

Exclusions

Asset transfers which should not be reported in Section 1

Do not report the following types of asset transfers in Section 1 of this report:

1. See the definitions section of the General Instructions.

(1)Transfers of cash, U.S. Treasury securities, or U.S. government agencies and corporation obligations. (Cash payments for management or other service fees and lease and rental contracts are to be reported in item 1 of Section 2; and cash payments for tax settlements are to be reported in item 5 of Section 2.)

(2)Federal funds transactions.

(3)Sales of loans or securities under agreements to repurchase or purchases of loans or securities under agreements to resell unless such loans or securities are past due, nonaccrual, or restructured.

(4)Intercompany loans or advances; that is, direct loans or advances made by one member of the BHC to another member of the BHC.

(5)Asset transfers that have been formally approved by federal bank regulatory authorities.

(6)Asset transfers where one member of the BHC acts as purchasing agent for another member of the BHC. Do not report assets purchased by one member of the BHC with the intention that they be transferred or sold immediately (within seven calendar days of the purchase) to another member. However, if assets were purchased for a member’s own account but were transferred to another member more than seven calendar days after the date of the initial purchase, the transfer must be reported in Section 1.

(7)Loan participations (that is, loans that are made in cooperation with and shared with at least one other lender) or participations in purchasing securities, the purchase of which is shared by members of the BHC at the time of loan origination. Do not report pur- chases upon origination of participations in a pool of securities or loans if origination occurred in less than seven days before the reporting date. However, trans- fers between members of the BHC of any existing interest in a participation or pool of loans or securi- ties are to be reported if such a transfer occurs more than seven calendar days after the date on which the participation or interest in the pool was purchased.

Instructions for Preparation of Reporting Form FR |

|

|

Section 1 June 1997 |

DETAILED INSTRUCTIONS FOR

Section 2

Other Intercompany Transactions and Balances

Line Item Instructions

Item 1 Income recognized (during the reporting period) by subsidiary banks and their subsidiaries from other BHC members.

Item l(a) Interest.

Report interest income recognized during the reporting period by subsidiary banks and their subsidiaries on loans, advances, and other extensions of credit to other BHC members. All interest income reported in this item must be classified as an interest expense by other BHC members. Consequently, interest from any interest- bearing obligation issued by other BHC members, such as subordinated debt, term notes, capital leases, or short- term loans, should be reported. However, interest on a subsidiary bank participation in

Item l(b) Management and other service fees.

Report management and other service fees recognized by subsidiary banks and their subsidiaries for services ren- dered to other BHC members. Include fees charged for management and advisory services, data processing ser- vices, loan servicing, and so forth.

Item 2 Average balance of credit extended by subsidiary banks and their subsidiaries to other BHC members.

Report the average balance of credit extended (including overdraft balances) by subsidiary banks and their subsid- iaries to other BHC members during the period. Exclude contingent liabilities, noncapitalized leases, and payables that do not represent extensions of credit to other BHC members. Average balances may be calculated by using daily, weekly, or monthly averages.

Instructions for Preparation of Reporting Form FR

Item 3 Credit lines, compensating balances, and correspondent relationships.

Item 3(a) Credit lines associated with compensating balances.

Report the total amount of credit lines extended to other BHC members by unrelated banks in connection with which compensating balances (to be reported in item 3(c)) were maintained by subsidiary banks and their subsidiaries during the period. Report the total amount of credit lines extended, whether used or unused.

Item 3(b) Current amount of credit used in the credit lines reported in 3a.

Report the current amount of credit lines reported in item 3(a) that is in use or has been ‘‘taken down’’ as of the report date.

Item 3(c) Average amount of compensating balances maintained over the reporting period by subsidiary banks at unrelated banks in connection with credit lines extended and services provided to other BHC members.

Report the average amount of compensating balances maintained with unrelated banks during the reporting period by subsidiary banks and their subsidiaries to secure lines of credit or other services for other BHC members. The amount reported should equal the amount of compensating balances required, if any, by the unre- lated bank for the line of credit or other services, minus any balances directly maintained by other BHC members for such services at that bank. Except as provided in the following paragraph, if there is no explicit or implicit understanding between the unrelated bank and other BHC members or subsidiary banks and their subsidiaries regarding any minimum compensating balances, then the response to the question should be zero.

Section 2

If the unrelated bank has extended a line of credit to other BHC members and does not require a compen- sating balance because the subsidiary bank(s) maintains correspondent balances with the unrelated bank, then estimate the amount of compensating balances that would have been required had the subsidiary bank(s) not maintained correspondent balances. Subtract from that amount any balances directly maintained by other BHC members at the unrelated bank and report the difference.

Item 3(d) Amount of compensation, if any, recognized during the period by subsidiary banks for maintaining the balances reported in 3c.

Report the amount of compensation received from other BHC members, if any, and recognized as such by sub- sidiary banks and their subsidiaries for maintaining the balances (during the reporting period) reported in item 3(c).

Item 4

Report the amount of all outstanding loans or other obligations made by subsidiary banks and their subsidi- aries in connection with credit extended other BHC members by third parties. Subsidiary bank obligations would include, but not limited to, loans, commitments for loans (unused portion only), ‘‘guarantees,’’ and standby letters of credit.

Report the book value of all loans. Loans are extensions of credit resulting either from direct negotiations between lender and borrower or from the purchase of loan assets from other lenders. Loans include extensions of credit in the form of promissory notes, acknowledgements of advance, due bills, invoices, overdrafts, and similar obli- gations (written or oral), as well as more marketable instruments such as commercial paper and bankers’ acceptances.

Report all outstanding unused commitments made by subsidiary banks and their subsidiaries to lend funds to a

third party where the commitments were originated in connection with the third party’s extension of credit to other BHC members. (Exclude all other loan commit- ments.) Include as commitments only official promises to lend that are expressly conveyed, orally or in writing, to the third party. Such commitments are usually in the form of a formally executed agreement or a letter signed by an officer (of a subsidiary bank or one of its subsidi- aries). Oral commitments made by officers to a third party (customer) are usually accompanied by some docu- mentation for the bank’s own records such as a notation in the customer’s credit file. Exclude authorizations (internal guidance lines) in which the customer is not informed of the amount. Exclude cases such as those when loan funds are temporarily unavailable pending loan committee approval. Include only unused commit- ments (that is, the amounts still available under commit- ment arrangements, but not borrowed as of the date of reporting). Exclude any takedowns, expirations or can- cellations. Do not omit commitments merely because they are not legally binding or do not require a commit- ment fee.

Include the outstanding amount of any ‘‘guarantees’’ or similar arrangements, however named or described, that represent contracts under which subsidiary banks or their subsidiaries are obligated to make payment to third par- ties contingent upon the failure of other BHC members to perform under their contract with those third parties. For example, guarantees may obligate subsidiary banks or their subsidiaries to make payments to third parties in the event that other BHC members default on loans or debentures.

Include the outstanding amount of standby letters of credit or similar arrangements, however named or described, representing obligations on the part of subsid- iary banks or their subsidiaries to make payment to, or to the order of, a designated third party (‘‘beneficiary’’) contingent upon the failure of other BHC members to perform under the terms of the latter’s underlying con- tract with the beneficiary. The underlying contract may entail either financial or nonfinancial undertakings of other BHC members with the beneficiary. For example, standby letters of credit may obligate a subsidiary bank or one of its subsidiaries to make certain payments to the beneficiary in the event of default or nonperformance by other BHC members on a loan.

Instructions for Preparation of Reporting Form FR

Section 2

Item 5 Gross amounts transferred during the reporting period related to Federal, State, and foreign income taxes.

Item 5 (a) From subsidiary banks and their subsidiaries to other BHC members.

Report the gross amount forwarded during the reporting period from subsidiary banks and their subsidiaries to other BHC members related to Federal, State, and for- eign income taxes.

Item 5(b) From other BHC members to subsidiary banks and their subsidiaries.

Report the gross amount forwarded from other BHC members to subsidiary banks and their subsidiaries related to Federal, State, and foreign income taxes.

Instructions for Preparation of Reporting Form FR |

|

Section 2 June 1997 |

|