In navigating the complexities of tax compliance within the realm of motor fuel transactions in New York, the FT-940 Certification of Use of Motor Fuel emerges as a pivotal document. Drafted by the New York State Department of Taxation and Finance, this form plays a critical role in the commercial exchange of motor fuel, specifically when purchased in volume. Sellers and purchasers are brought together under a legal framework that dictates the certification process to ensure tax compliance. The form lays out clear directives: it must be duly completed by the purchaser, indicating whether the fuel will be resold or consumed. This classification bears significant tax implications, distinguishing between only the prepaid sales tax being included in the purchase price or the sales tax being computed on the actual selling price. Furthermore, it underscores the importance of accurate record-keeping, mandating sellers to retain the certificate for a minimum of three years post the last sale it substantiates. This document not only facilitates a smoother transactional process but also aims to curb tax evasion, warning of misdemeanor charges should the information provided prove to be false. Thus, the FT-940 form is imperative for both parties engaged in the high-volume motor fuel market, ensuring that every transaction adheres to the state’s taxation laws.

| Question | Answer |

|---|---|

| Form Name | Form Ft 940 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | Purchasers, false, Furnishing, substantiated |

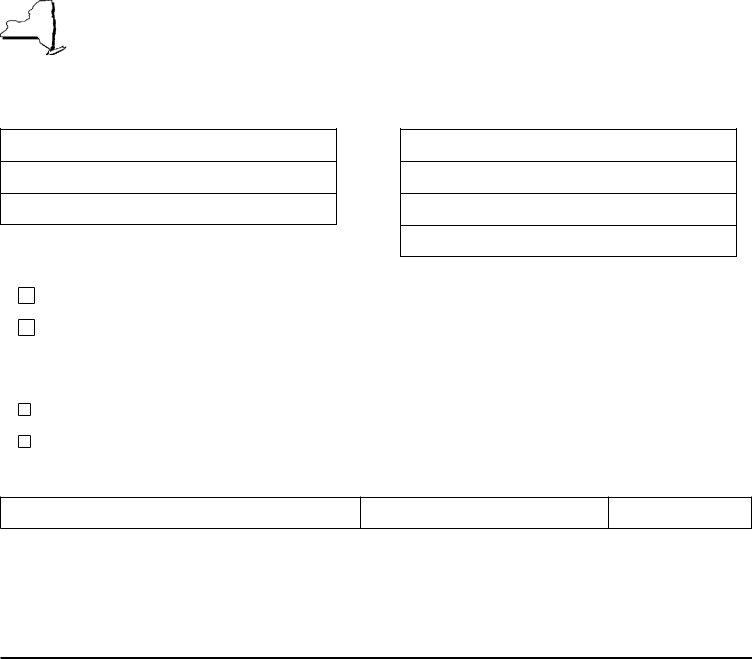

New York State Department of Taxation and Finance |

||

Certification of Use of Motor Fuel |

||

(6/03) |

Purchased in Volume

To be completed by the purchaser and given to the seller who must keep it for at least three years after the date of the last sale substantiated by this certificate.

Name of seller

Name of purchaser

Street address

Street address

City |

State |

ZIP code |

City |

State |

ZIP code |

Purchaser’s certificate of authority number (if any)

Check applicable box:

Single purchase certificate

Blanket certificate

I certify that the motor fuel I am purchasing:

1

2

will be resold by me and therefore only the prepaid sales tax should be included in my purchase price.

or

will be used by me and not resold. Therefore, the sales tax due on this purchase must be computed on the actual selling price at the combined state and local sales tax rate in effect where the fuel is delivered.

Signature of purchaser or authorized representative

Title

Date

To the purchaser:

Failure to furnish this certificate to a seller of motor fuel will require them to charge you the greater of either the prepaid sales tax or the tax computed on the selling price.

Furnishing false information in completing this certificate with intention to evade tax is a misdemeanor.

Instructions

This certificate must be completed by anyone purchasing motor fuel in volume. Purchasing in volume does not include purchases at retail where the motor fuel will be dispensed directly into the purchaser’s motor vehicle or into a small fuel container.

If Box 2 is checked, the seller will compute and collect the sales tax due on the actual purchase price at the combined state and local sales tax rate in effect where the fuel is delivered to the purchaser.

This certificate must be given to the seller to certify that the fuel will be either resold or consumed by the purchaser.

If Box 1 is checked, the seller will pass through the amount of sales tax they have prepaid on the fuel and they must give the purchaser a properly completed Form

Recordkeeping

This certificate must be properly completed by the purchaser and given to the seller at the time of the first purchase from that seller.

Unless it is marked as a single purchase certificate, it shall be considered to be part of any order given to the seller and shall remain in effect until revoked by the purchaser. The seller must retain this certificate for at least three years after the last sale to which it is applicable.