You can fill out form g 49 printable easily by using our PDFinity® PDF editor. To make our editor better and more convenient to work with, we consistently design new features, with our users' feedback in mind. Starting is simple! All you have to do is follow the following easy steps below:

Step 1: Click on the orange "Get Form" button above. It is going to open our pdf editor so that you can start filling out your form.

Step 2: Using our online PDF editor, you'll be able to accomplish more than merely fill out blank form fields. Express yourself and make your documents look professional with customized textual content added, or fine-tune the original content to excellence - all that backed up by an ability to incorporate your own images and sign the PDF off.

This document needs some specific details; in order to ensure consistency, please make sure to pay attention to the suggestions down below:

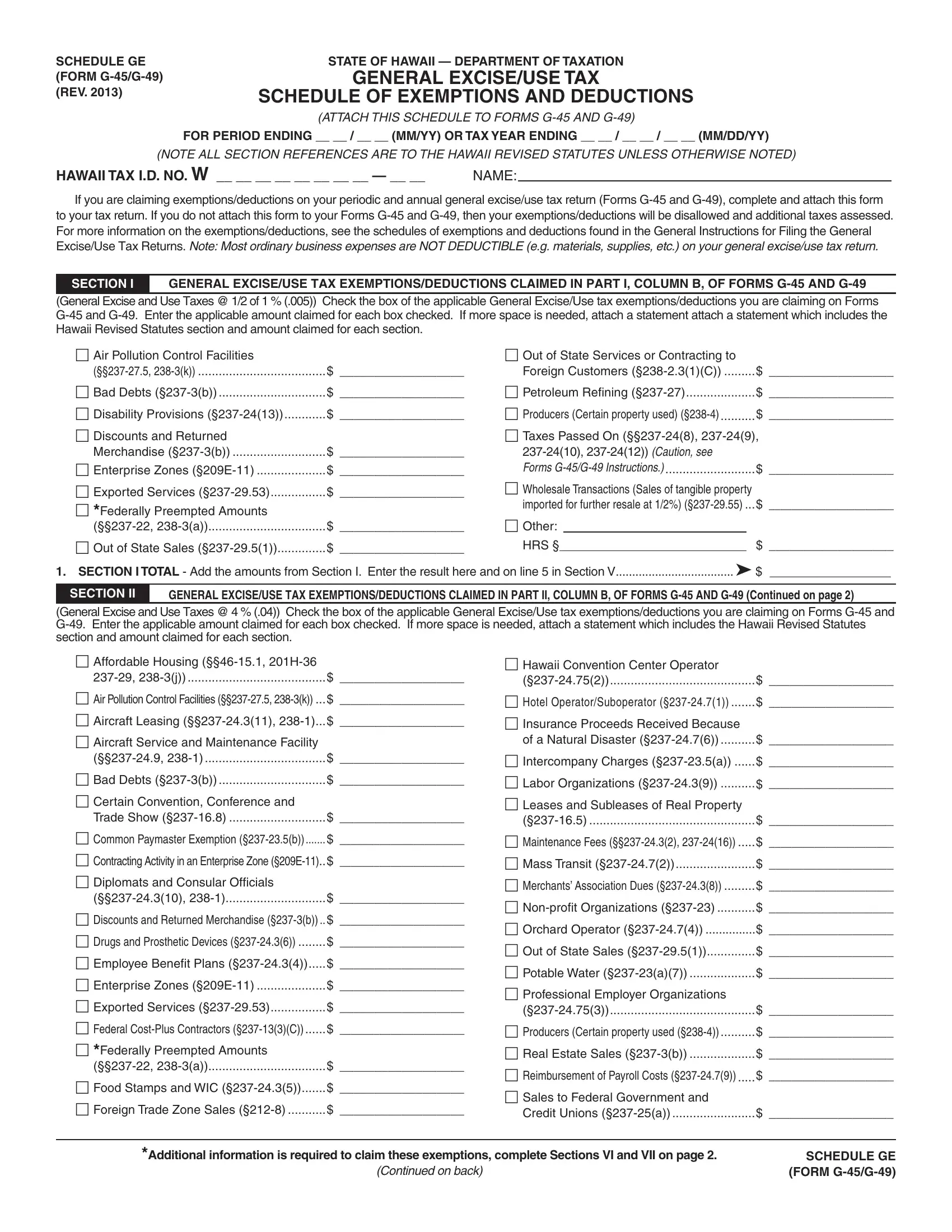

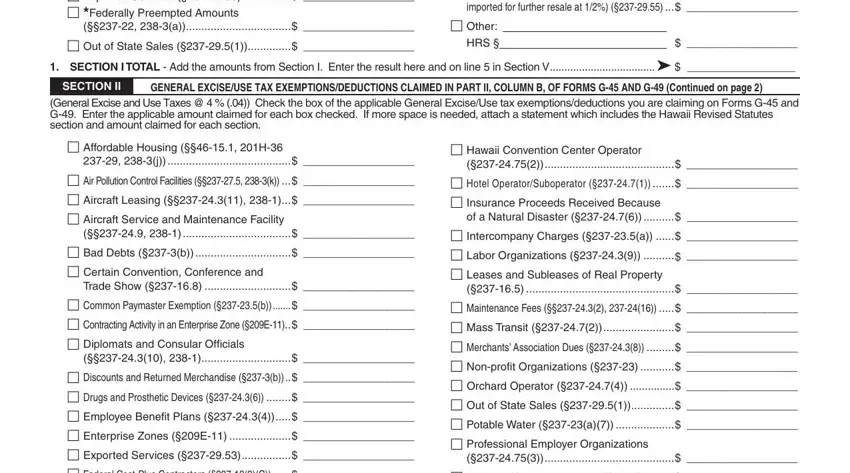

1. You'll want to fill out the form g 49 printable correctly, hence be attentive when working with the segments including these blank fields:

2. Once your current task is complete, take the next step – fill out all of these fields - Merchandise b Enterprise Zones, a Out of State Sales, Wholesale Transactions Sales of, imported for further resale at, Other HRS, SECTION I TOTAL Add the amounts, SECTION II, GENERAL EXCISEUSE TAX, General Excise and Use Taxes, Affordable Housing H, j Air Pollution Control, Bad Debts b Certain, Trade Show Common Paymaster, Discounts and Returned, and Hawaii Convention Center Operator with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

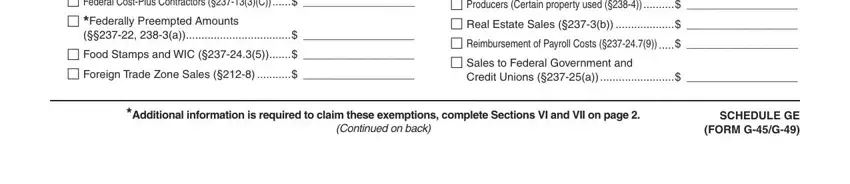

3. This third part is hassle-free - fill in all of the fields in Discounts and Returned, a Food Stamps and WIC, Producers Certain property, Credit Unions a, Additional information is required, Continued on back, and SCHEDULE GE FORM GG to finish the current step.

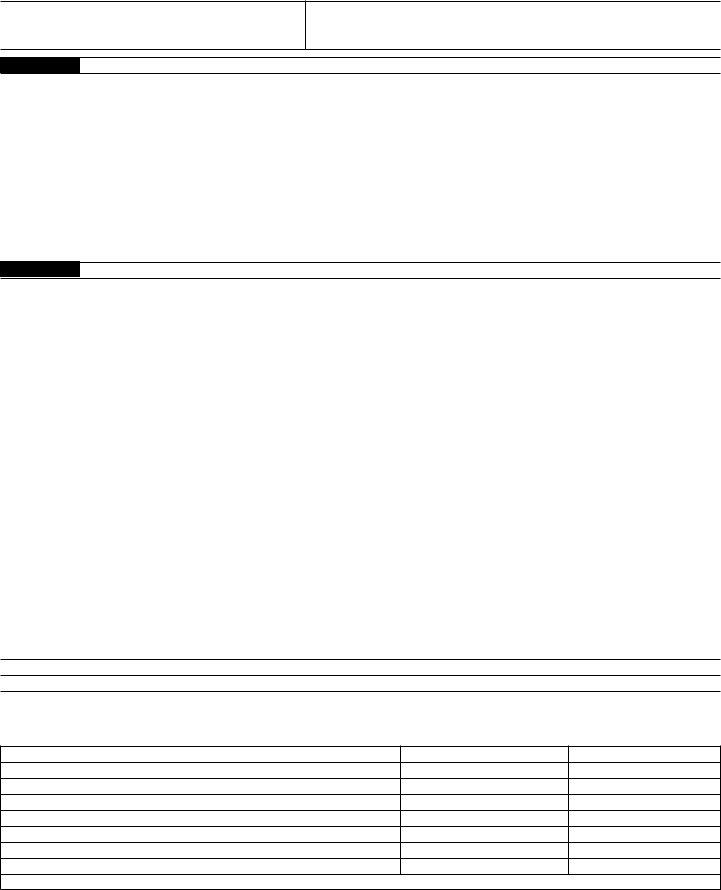

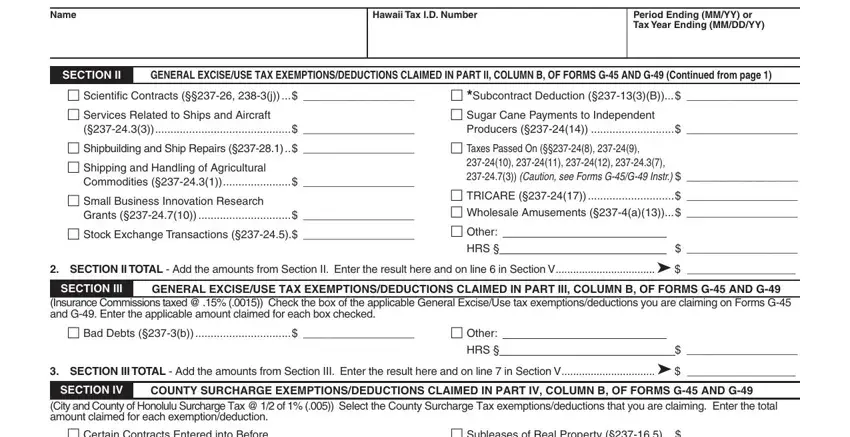

4. To go onward, this next form section requires typing in several fields. These comprise of Name, Hawaii Tax ID Number, Period Ending MMYY or Tax Year, GENERAL EXCISEUSE TAX, SECTION II Scientific Contracts j, Shipbuilding and Ship Repairs, Commodities, Small Business Innovation Research, Grants Stock Exchange, Subcontract Deduction B Sugar, Producers, Taxes Passed On, Caution see Forms GG Instr, SECTION II TOTAL Add the, and SECTION III, which you'll find vital to carrying on with this form.

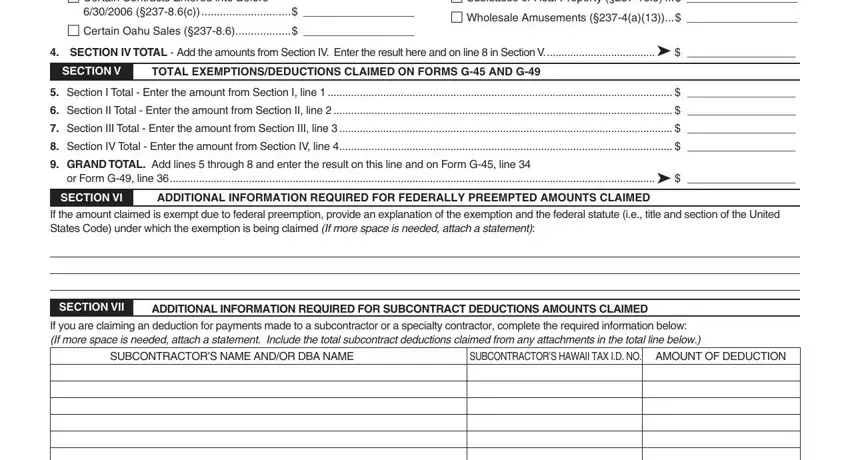

5. The last section to submit this PDF form is pivotal. You must fill in the displayed blanks, consisting of City and County of Honolulu, Subleases of Real Property, c Certain Oahu Sales, SECTION IV TOTAL Add the amounts, SECTION V, TOTAL EXEMPTIONSDEDUCTIONS CLAIMED, Section I Total Enter the amount, Section II Total Enter the, Section III Total Enter the, Section IV Total Enter the, GRAND TOTAL Add lines through, or Form G line, SECTION VI, ADDITIONAL INFORMATION REQUIRED, and If the amount claimed is exempt, before finalizing. If not, it can result in an incomplete and probably nonvalid document!

Always be really attentive when filling out TOTAL EXEMPTIONSDEDUCTIONS CLAIMED and Section III Total Enter the, since this is the part in which many people make errors.

Step 3: Go through all the information you have entered into the form fields and then hit the "Done" button. Make a 7-day free trial plan at FormsPal and obtain immediate access to form g 49 printable - downloadable, emailable, and editable inside your FormsPal cabinet. FormsPal guarantees your information confidentiality by using a secure method that in no way records or distributes any kind of personal data involved in the process. Be confident knowing your documents are kept confidential every time you use our services!