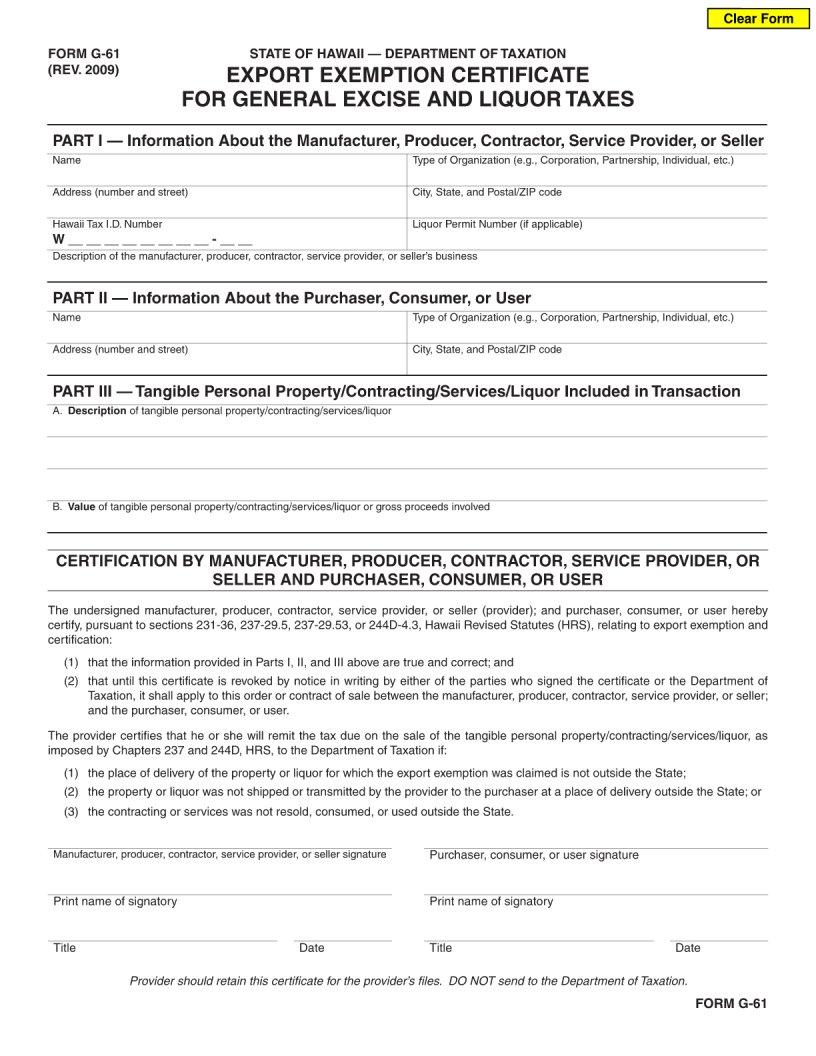

Form G 61 is a form that is used to request an adjustment to the amount of taxes that have been assessed. The form can be used to request an adjustment for tax year 2014 or for a prior year. Any taxpayer who feels that they have been incorrectly assessed may use this form to request an adjustment. Note that filing this form does not guarantee that the taxpayer will receive a refund, but it does allow them to present their case to the IRS. Taxpayers should be aware of the deadline for submitting this form, which is April 15th of the year following the year in which the taxes were assessed.

| Question | Answer |

|---|---|

| Form Name | Form G 61 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | HAWAII, Serviceshawaii, G-61, hawaii form g 61 |