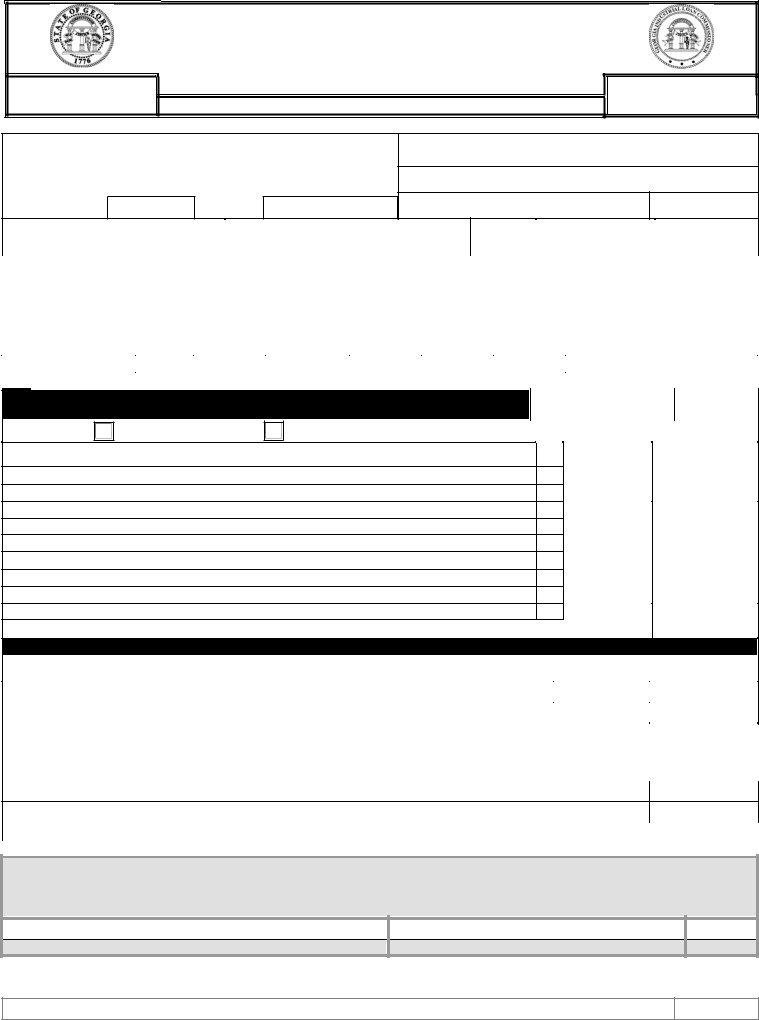

Within the structured framework of financial and insurance regulations, the GID-012-IL form serves as a critical quarterly report for licensees under the oversight of the Industrial Loan Commissioner and the Commissioner of Insurance, currently Ralph T. Hudgens. Operating from the bustling offices on Martin Luther King Jr. Drive in Atlanta, Georgia, these entities mandate the meticulous documentation of insurance and loan activities conducted by licensed operatives within the state. The form not only demands up-to-date information on any changes pertaining to ownership or office location but also encompasses detailed records spanning from insurance policies underwritten to the nuanced computations of industrial loan taxes. Equally important is the attestation section, underscoring the gravity of truth and accuracy in the submission under the penalties of perjury. Furthermore, it’s worth noting the inclusive and non-discriminatory policy echoed in the document's accessibility options, reflecting a broader commitment to equality and support for individuals with disabilities, ensuring no one is left behind in compliance processes. The form embodies a bridge between regulatory oversight and business operation, highlighting the intricate balance of transparency, accountability, and operational integrity crucial to the financial and insurance sectors.

| Question | Answer |

|---|---|

| Form Name | Form Gid 012 Il |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | GID 012 IL gid 12a il gainsurance form |

INDUSTRIAL LOAN COMMISSIONER

COMMISSIONER OF INSURANCE •INDUSTRIAL LOAN COMMISSIONER•SAFETY FIRE COMMISSIONER

Ralph T. Hudgens, Commissioner

2 Martin Luther King Jr., Dr., Suite 702, West Tower, Atlanta, GA 30334

www.gainsurance.org |

Phone |

INDUSTRIAL LOAN |

|

|

|

|

|

|

QUARTERLY INSURANCE AND LOAN REPORT |

||

Licensees must submit return to be in the Commissioner’s office by the 20th of the month following end of quarter. Any changes in ownership and/or location of a licensed office must be registered with the Industrial Loan Commissioner. A completed copy of this return must be filed locally at each licensee’s office.

NAME

►

STREET

►

CITY

►

ZIP

►

_______________________________________________

Insurance Agent’s Name

__________________________

Insurance License No

Type of Insurance |

Policies |

Premiums |

Premiums |

Net |

Claims |

Amount |

Name of Insuring Company |

|

|

Issued |

Charged |

Refunded |

Premiums |

Paid |

Paid |

|

|

|

|

|

|

|

|

|

|

|

Credit Life |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit A & S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Household Goods Fire |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Auto Collision |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NRI |

|

|

|

|

|

|

|

|

TOTALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REPORT OF CHANGES IN LOAN AND INTEREST BALANCES DURING QUARTER ENDING |

|

|

|

|

|

|

|

|

|

|

|

Month |

Year |

|||

|

|

|

|

|

|

|||

|

Cash Basis * |

Accrual Basis |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Shaded areas are not to be filled in if reporting on the cash basis.

1.Beginning Balance (Same as Line 9 of previous report)

2.ADD Loans Made During Quarter

3.ADD Recovered Loans (Previously charged off)

4.Totals of Lines, 1, 2, and 3

5.SUBTRACT Loans Charged Off As Uncollectible (See Note 3)

6.SUBTRACT Refunds (See Note 4)

7.SUBTRACT Loans Sold or Transferred

8.SUBTRACT Collections (See Note 5)

9.Ending Balances, Line 4 minus Lines 5, 6, 7 and 8

10.Net Interest Charged During Quarter (Cash Basis Only; Line 4 minus 5 and 6)

►

►

►

►

►

►

►

►

►

GROSS LOANS |

INTEREST |

(NOTE 1) |

(NOTE 2) |

|

|

$ |

|

|

|

+ |

+ |

|

|

+ |

+ |

|

|

$ |

$ |

|

|

- |

- |

|

|

- |

- |

|

|

- |

- |

|

|

- |

- |

|

|

$ |

$ |

|

|

|

$ |

COMPUTATION OF INDUSTRIAL LOAN TAX LIABILITY

11. |

Gross Tax (Cash Basis: Multiply Line 10 by 3 per cent) |

|

|

$ |

|

(Accrual Basis: Multiply sum of Lines 7 and 8, “Interest” Column, by 3 per cent) |

|

|

|

12. |

Estimated Tax Paid 1st Month of Quarter |

____________, 20_______ |

$ |

|

|

|

|

|

|

13. |

Estimated Tax Paid 2nd Month of Quarter |

____________, 20_______ |

+ |

|

|

|

|

|

|

14. |

Other Credits |

|

|

- |

|

|

|

|

|

15. |

Total Credits (Add Lines 12, 13 and 14) |

|

|

|

|

|

|

|

|

16. |

NET TAX DUE – If Line 15 is less than Line 11, enter difference here and remit in full with this form |

|

|

|

|

|

|

|

|

17.PENALTY – (Line 16 times 25%)

18.TOTALS – (Add Lines 16 and 17)

19. NET OVERPAYMENT – If Line 15 is greater than Line 11, enter difference here and refund or credit will be made |

$ |

|

|

ATTESTATION

Under penalties of perjury, the below named, affirms that all the foregoing information submitted, including any accompanying documentation, was completed in good faith, is true, complete and correct to the best of my knowledge.

(Name of Attestator)

(Position Title of Attestator)

(Date)

This office does not discriminate by race, color, national origin, sex, religion, age or disability in employment, programs or services. Disabled persons needing this document in another format can contact the ADA Coordinator for this office at No. 2 Martin Luther King Jr., Dr., Suite 620, Atlanta, GA 30334 - Phone

Page 1 of 1

NOTES

1.Amounts shown in “Gross Loans” column represent principal, interest, fees, and other miscellaneous charges. Georgia Law does not provide for collection of tax on purchased accounts since all taxes must be paid by the original lender. Therefore, purchased loans need not be shown on this report. If, however, to avoid extra bookkeeping, taxpayer elects to combine all accounts into one ledger, the amount of purchased loans and interest shall be entered on Line 2. The taxpayer must recognize that this action results in the payment of taxes on purchased loans.

2.Amounts shown in the “Interest” column represent that portion of “Gross Loans” which is interest.

3.Amounts shown in the “Gross Loans” column represent interest and other miscellaneous charges which are removed from the books as uncollectible. The amounts shown in the “Interest” column represent that portion of the “Gross Loans” figure which is uncollectible interest.

4.Amounts shown in the “Gross Loans” column represent interest and other miscellaneous charges not collected or which were returned to the borrower. The amounts shown in the “Interest” column represent interest not collected or which was returned to the borrower. The amounts of principal, interest, fees, and miscellaneous collected from the borrower are shown on Line 8. DO NOT confuse these refunds with rebates or refunds associated with uncollectible accounts which are described in note 3 above.

5.Licensees reporting on the accrual basis should compute the interest portion of total collections as follows: Divide the beginning interest balance by the beginning gross loan balance and multiple by the total collections in the “Gross Loans” column.