STATE OF HAWAII

DEPARTMENT OF LABOR AND INDUSTRIAL RELATIONS

DISABILITY COMPENSATION DIVISION

830 Punchbowl Street, Princess Keelikolani Building, Room 209, Honolulu, Hawaii 96813

INSTRUCTION SHEET FOR FORM HC-6

EMPLOYER'S REQUEST FOR PREMIUM SUPPLEMENTATION

Instructions

ATTENTION: SMALL EMPLOYERS (THOSE WITH LESS THAN 8 REGULAR EMPLOYEES) SUBJECT TO HAWAII’S PREPAID HEALTH CARE (PHC) ACT, CHAPTER 393*, HAWAII REVISED STATUTES (HRS)

A special fund for health care premium supplementation is available to employers who meet the criteria established under Section 393-45, HRS. A claim for premium supplementation must be filed with the Department of Labor and Industrial Relations within two years after the end of the employer’s taxable year.

Section 393-45 of the PHC Act specifies that an employer is entitled to premium supplementation if the employer satisfies all of the following qualifying conditions:

1.Employer employs less than eight employees entitled to PHC coverage.

2.The employer’s health care plan is approved under Section 393-7(a) of the PHC Act.

3.Employer’s share of the premium cost for eligible employees (single coverage only) exceeds 1.5% of the total wages payable to such employees and the amount of such excess is greater than 5% of the employer’s income before taxes directly attributable to the business.

4.The fund will not supplement employee’s share of the premium, dependent’s coverage and the additional premium cost for the more expensive plan should the employer have more than one plan.

If you meet the above criteria, please contact the Disability Compensation Division at (808) 586-9199 and request a copy of Form HC-6, Employer’s Request for Premium Supplementation.

Please complete Form HC-6 and return it with the following documents:

1.Individual payroll records

2.Copy of the State of Hawaii income tax return for the business certified by the Department of Taxation

3.Copy of the U.S. income tax return for the business

4.Quarterly payroll tax reports (Forms UC-B6 and 941)

5.Form W-2, wage and tax statement

6.Health care contractor’s monthly medical billing statements

7.Any other related documents pertaining to the request for PHC premium supplementation

8.Temporary disability insurance premium statements

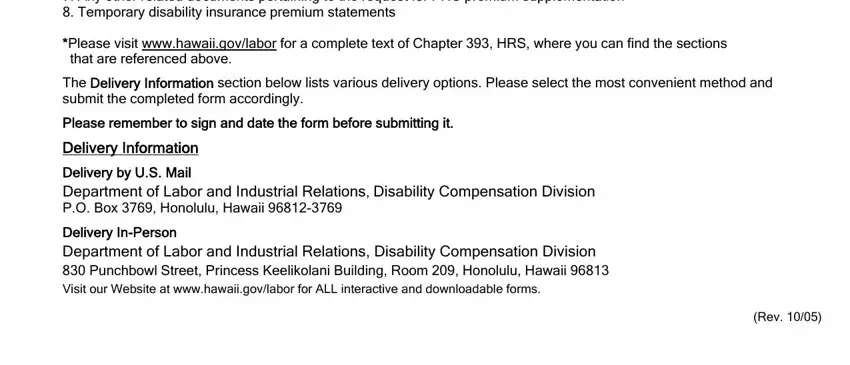

*Please visit www.hawaii.gov/labor for a complete text of Chapter 393, HRS, where you can find the sections that are referenced above.

The Delivery Information section below lists various delivery options. Please select the most convenient method and submit the completed form accordingly.

Please remember to sign and date the form before submitting it.

Delivery Information

Delivery by U.S. Mail

Department of Labor and Industrial Relations, Disability Compensation Division

P.O. Box 3769, Honolulu, Hawaii 96812-3769

Delivery In-Person

Department of Labor and Industrial Relations, Disability Compensation Division

830 Punchbowl Street, Princess Keelikolani Building, Room 209, Honolulu, Hawaii 96813

Visit our Website at www.hawaii.gov/labor for ALL interactive and downloadable forms.

(Rev. 10/05)

STATE OF HAWAII

DEPARTMENT OF LABOR AND INDUSTRIAL RELATIONS

DISABILITY COMPENSATION DIVISION

830 Punchbowl Street, Princess Keelikolani Building, Room 209, Honolulu, Hawaii 96813

FORM HC-6 EMPLOYER'S REQUEST FOR PREMIUM SUPPLEMENTATION

DOL Account No. |

|

Federal I.D. No./Social Security No. |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

Health Care Contractor Name |

Plan Name |

|

|

|

|

Total Number of Employees Eligible for PHC Coverage |

Total annual wages paid to employees eligible |

$ |

|

for and covered under employer’s PHC plan |

|

|

|

|

|

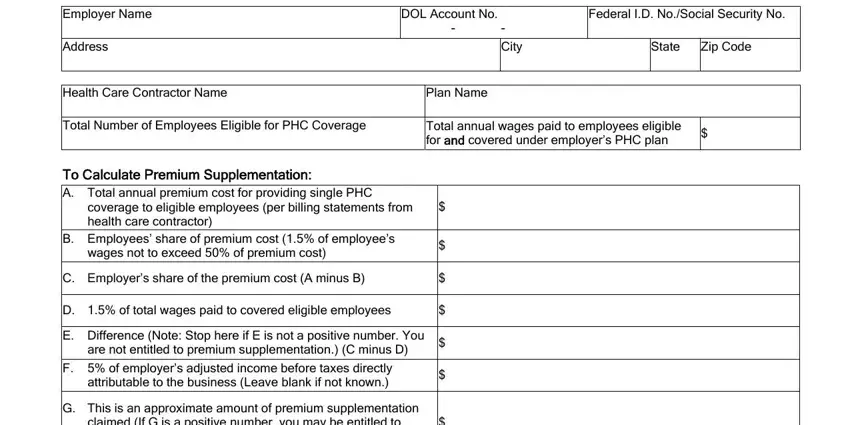

To Calculate Premium Supplementation:

A.Total annual premium cost for providing single PHC

|

coverage to eligible employees (per billing statements from |

$ |

|

|

|

|

|

|

|

|

health care contractor) |

|

|

|

|

|

|

|

|

B. |

Employees’ share of premium cost (1.5% of employee’s |

$ |

|

|

|

|

|

|

|

|

wages not to exceed 50% of premium cost) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. |

Employer’s share of the premium cost (A minus B) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. |

1.5% of total wages paid to covered eligible employees |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E. |

Difference (Note: Stop here if E is not a positive number. You |

$ |

|

|

|

|

|

|

|

|

are not entitled to premium supplementation.) (C minus D) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F. |

5% of employer’s adjusted income before taxes directly |

$ |

|

|

|

|

|

|

|

|

attributable to the business (Leave blank if not known.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G. |

This is an approximate amount of premium supplementation |

|

|

|

|

|

|

|

|

|

claimed (If G is a positive number, you may be entitled to |

$ |

|

|

|

|

|

|

|

|

premium supplementation.) (E minus F) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

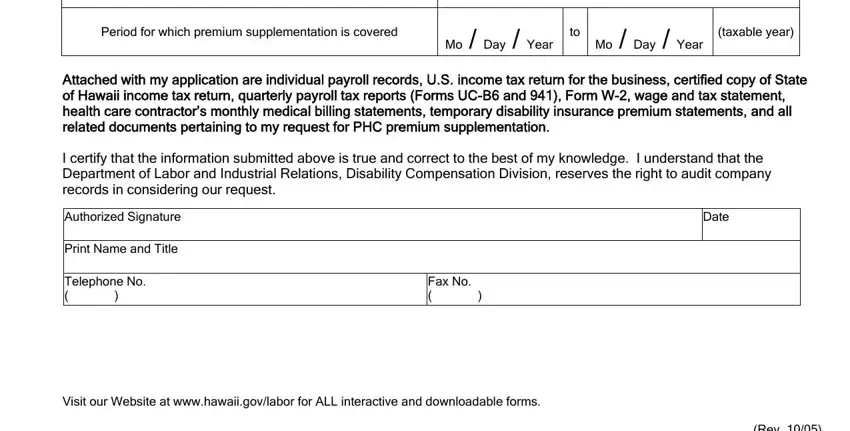

Period for which premium supplementation is covered |

Mo / |

Day / |

|

to |

Mo / |

Day / |

|

(taxable year) |

|

|

Year |

|

Year |

|

Attached with my application are individual payroll records, U.S. income tax return for the business, certified copy of State of Hawaii income tax return, quarterly payroll tax reports (Forms UC-B6 and 941), Form W-2, wage and tax statement, health care contractor’s monthly medical billing statements, temporary disability insurance premium statements, and all related documents pertaining to my request for PHC premium supplementation.

I certify that the information submitted above is true and correct to the best of my knowledge. I understand that the Department of Labor and Industrial Relations, Disability Compensation Division, reserves the right to audit company records in considering our request.

Authorized Signature

Print Name and Title

Telephone No.

()

Visit our Website at www.hawaii.gov/labor for ALL interactive and downloadable forms.

(Rev. 10/05)

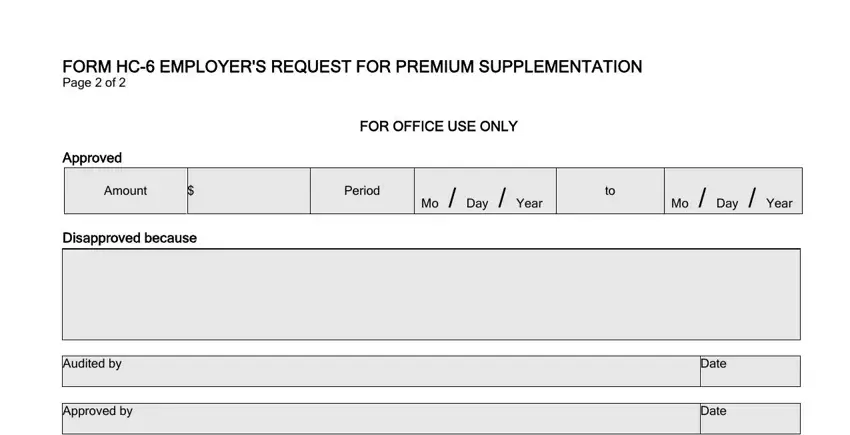

FORM HC-6 EMPLOYER'S REQUEST FOR PREMIUM SUPPLEMENTATION

Page 2 of 2

FOR OFFICE USE ONLY

Approved

Auxiliary aids and services are available upon request. Please call: (808) 586-9199; TTY (808) 586-8847; and for neighbor islands, TTY 1-888-569-6859. A request for reasonable accommodation(s) should be made no later than ten working days prior to the needed accommodation(s).

It is the policy of the Department of Labor and Industrial Relations that no person shall, on the basis of race, color, sex, marital status, religion, creed, ethnic origin, national origin, age, disability, ancestry, arrest/court record, sexual orientation, and National Guard participation, be subjected to discrimination, excluded from participation in, or denied the benefits of the Department’s services, programs, activities, or employment.

Visit our Website at www.hawaii.gov/labor for ALL interactive and downloadable forms.

(Rev. 10/05)