The Tennessee Department of Human Services (TDHS) Child and Adult Care Food Program (CACFP) offers a vital lifeline to child care centers through its INCOME ELIGIBILITY APPLICATION FOR CHILD CARE CENTER PARTICIPANT(S), form HS-1949, revised in May 2011. This comprehensive application serves as a gateway for families and child care centers to access federal funds that support the provision of nutritious meals to children enrolled in child care programs. It meticulously outlines the process through which eligibility for free, reduced-price, or paid meals is determined, a pivotal factor in ensuring that children receive the essential nutrition they need. The form is divided into several parts, beginning with the enrollment details of the children served by the center, and extending to detailed income information for households not receiving benefits from specified assistance programs. Crucially, it underscores the importance of honesty and accuracy in the submission of information, highlighting the penalties for misrepresentation. Furthermore, it accommodates considerations for Medicaid and State Children’s Health Insurance Programs, alongside stipulations regarding the voluntary provision of ethnic and racial identity information. The form not only facilitates the operational implementation of the CACFP but also embodies the program’s commitment to fostering an inclusive, equitable service that disregards race, color, sex, age, disability, or national origin in its pursuit to cater to the nutritional needs of children.

| Question | Answer |

|---|---|

| Form Name | Form Hs 1949 |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | Washington, 2011, Guradian, nonfoster |

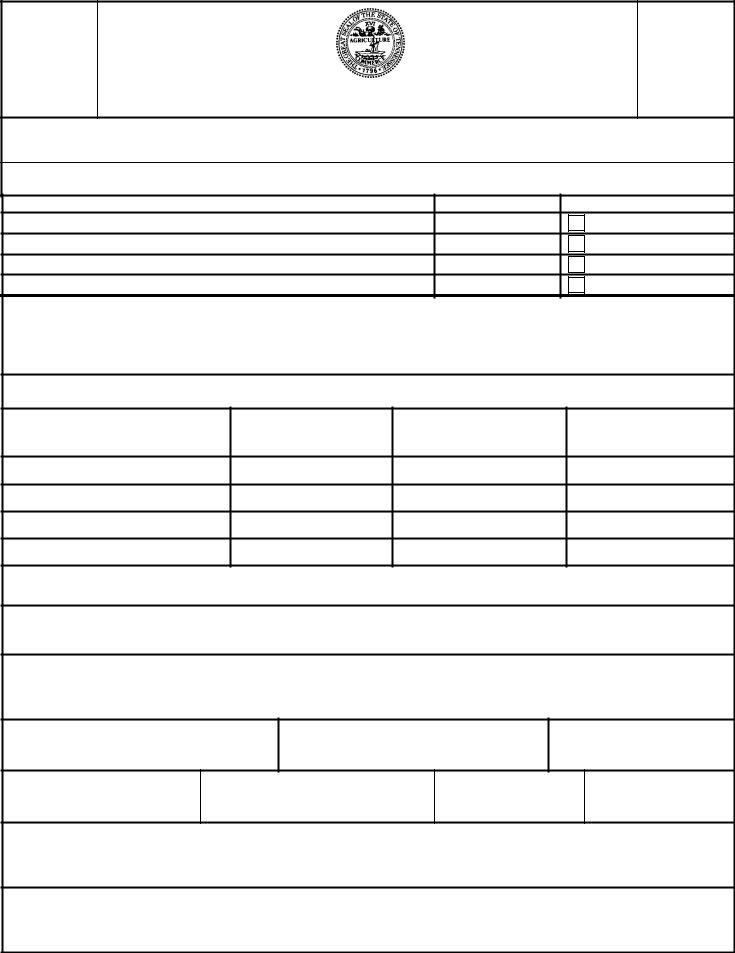

Tennessee

Department of

Human Services

(TDHS)

Child and Adult Care Food Program (CACFP)

INCOME ELIGIBILITY APPLICATION FOR CHILD CARE CENTER PARTICIPANT(S)

FORM

Revised

May 2011

PART 1A – NAME OF CHILD CARE CENTER (Enter the name of the child care center):

PART 1B – PARTICIPANT(S) SERVED BY CENTER (Enter the information below for all children from your household that are enrolled for care at the child care center):

Name

Age

Check if Foster Child

PART 2A – HOUSEHOLDS WHICH ARE CURRENTLY RECEIVING BENEFITS THROUGH THE SUPPLEMENTAL NUTRITION ASSISTANCE PROGRAM (SNAP), OR FAMILIES FIRST (FF) CASH ASSISTANCE OR FAMILIES FIRST (FF) CHILD CARE ASSISTANCE (If your household is now receiving benefits under one or more of these programs, complete this part, and sign the statement in Part 4 – Do not complete Part 2B.): ACCENT Case No. for SNAP or FF Cash Assistance: ___________________ OR FF Child

Care Assistance Case No.: _____________________

PART 2B – ALL OTHER HOUSEHOLD MEMBERS (If no information is entered in Part 2A above, complete this part for all household members not identified in Part 1B above and sign the statement in Part 4. Attach additional sheets as necessary)

Names of All Other Household

Members

Earnings from Work

(Before

Deductions)

Child Support, Alimony or

Other Income

Payments Received from Pensions, Retirement, & Social Security

1.

$______________ per year

$______________ per year

$______________ per year

2.

$______________ per year

$______________ per year

$______________ per year

3.

$______________ per year

$______________ per year

$______________ per year

4.

$______________ per year

$______________ per year

$______________ per year

Total Number of Household Members: ___ Total Yearly Income for Household from All Sources: $ ________________ Yearly income is calculated as follows:

Multiply Weekly income by 52,

PART 3 – Medicaid and State Children’s Health Insurance Programs – Please check if you do not want the information in this application to be shared with the Medicaid and State Children’s Health Insurance Programs: ___ DO NOT WANT APPLICATION INFORMATION TO BE SHARED WITH THE MEDICAID AND STATE CHILDREN’S HEALTH INSURANCE PROGRAMS.

PART 4 – SIGNATURE (An adult household member must sign the application.) PENALTIES FOR MISREPRESENTATION: I certify that all of the above information is true and correct. I understand that this information is being given for the receipt of Federal Funds; that institution officials may verify the information on the statement; and that the deliberate misrepresentation of the information may subject me to prosecution under applicable State and Federal laws.

Printed Name of Adult :

Signature of Adult:

Social Security Number (only last four digits):

Street:

City:

State and Zip Code:

Home Telephone:

PART 5 – ETHNIC/RACIAL IDENTITY (You are not required to answer this question.): For Ethnicity, please check one of

the following: ___ Hispanic or Latino ___ Not Hispanic or Latino. For Race, please check one or more of the following: ___

American Indian or Alaskan Native ___ Asian ___ Black or African American ___ Native Hawaiian or Other Pacific Islander

___ White. Please see the definitions of Ethnicity and Race on the back of this application.

FOR INSTITUTION USE ONLY: To identify the eligibility classification of the enrolled children identified above, please circle:

Free,

Determining Official Signature: ____________________________________________ Date: _______________

INCOME ELIGIBILITY APPLICATION INSTRUCTIONS

PART 1A – NAME OF CHILD CARE CENTER: Enter the name of the child care center.

PART 1B – PARTICIPANT(S) SERVED BY CENTER: Print the name and age of the children from your household that are enrolled for care at the child care center. Also, enter a “Check” for any child(ren) who are foster children.

responsibility of a state children services agency or court, and is categorically eligible for free meals.

PART 2A – HOUSEHOLDS RECEIVING SUPPLEMENTAL NUTRITION ASSISTANCE PROGRAM BENEFITS, FAMILIES FIRST CASH ASSISTANCE OR FAMILIES FIRST CHILD CARE ASSISTANCE: COMPLETE THIS PART AND PART 4.

(1)Enter your household’s current case number for Supplemental Nutrition Assistance Program , Families First Cash Assistance or Families First Child Care Assistance. Do not complete Part 2B.

(2)An adult household member must sign the statement in Part 3.

PART 2B - ALL OTHER HOUSEHOLD MEMBERS: COMPLETE THIS PART AND PART 4.

(1)Write the names of everyone in your household not entered in 1B. Households with foster and

(2)Write the amount of the income received on a yearly basis for each household member. The income may be for the current month, the amount projected for the first month the application is made for, or for the month prior to application. This income is the amount before taxes or any deductions are made. Also, indicate the source of the income. Refer to examples below for income to report.

|

INCOME TO REPORT |

|

|

Earnings from Work |

Retirement/Social Security |

Other Income Sources |

Child Support/Alimony |

Wages/salaries/tips |

Pensions |

Disability benefits |

Alimony/child support |

Strike benefits |

Supplemental Security Income |

Cash withdrawn from savings |

benefits/payments |

Unemployment benefits |

Retirement income |

Interest/dividends |

|

Worker's Compensation |

Veteran's payments |

Income from estates/trusts/investments |

|

Net income from |

Social Security Income |

Regular contributions from persons |

|

|

not living in the household |

|

|

|

|

Net royalties/annuities/net rental income |

|

PART 3 – MEDICAID AND STATE CHILDREN’S HEALTH INSURANCE PROGRAMS – Federal law allows the sharing of the information on this application with Medicaid and State Children’s Health Insurance Programs. At this time, no procedures are in place to share this information. Since the procedures to share this information with the Medicaid and State Children’s Health Insurance Programs may be established in the future, please indicate if you do not want this information to be shared. The Medicaid and State Children’s Health Insurance Programs can only use the information to identify children who may be eligible for free or low cost health insurance and to enroll them in either Medicaid or the State Children’s Health Insurance Program. They are not allowed to use the information for any other purpose. If this information is not shared, it will not affect the eligibility of your child(ren) for free or

PART 4 – SIGNATURE AND SOCIAL SECURITY NUMBER: All households complete this part.

(1)All income eligibility statements must have the signature of an adult household member.

(2)The adult household member who signs the statement must include the last four digits of his/her Social Security Number. If he/she does not have a Social Security Number, write "none". If you listed an ACCENT case number for Supplemental Nutrition Assistance Program or Families First cash assistance, or a case number for Families First Child Care Assistance, the last four digits of the Social Security Number are not needed.

(3)The income eligibility application is valid for one calendar year from the date of the signature of the Determining Official. You will be contacted by the staff of the child care institution serving your child(ren) to update the information contained in this application before the close of the eligibility period. The staff of the child care institution is required to verify and certify the eligibility of your household every 12 months. Section 9 of the National School Lunch Act requires that, unless the participant's Supplemental Nutrition Assistance Program or Families First case number is provided, you must include the last four digits of the Social Security Number of the household member signing the statement or an indication that the household member signing the statement does not possess a Social Security Number. Provision of the last four digits of a Social Security Number is not mandatory, but if this Social Security information is not provided or an indication is not made that the adult household member signing the statement does not have a Social Security Number, the statement cannot be approved.

PART 5 - RACIAL/ETHNIC IDENTITY: You are not required to answer this question to receive meal benefits. However, this information will help ensure that everyone is treated fairly.

Definition of Ethnicity: Hispanic or Latino means a person of Cuban, Mexican, Puerto Rican, South or Central American, or other Spanish culture or origin, regardless of race.

Definition of Race: American Indian or Alaskan Native means a person having origins in any of the original peoples of North and South America (including Central America), and who maintains tribal affiliation or community attachment. Asian means a person having origins in any of the original peoples of the Far East, Southeast Asia, or the Indian subcontinent, including, for example, Cambodia, China, India, Japan, Korea, Malaysia, Pakistan, the Philippine Islands, Thailand, and Vietnam. Black or African American means a person having origins in any of the black racial groups of Africa. Native Hawaiian or Other Pacific Islander means a person having origins in any of the original peoples of Hawaii, Guam, Samoa, or other Pacific Islands. White means a person having origins in any of the original peoples of Europe, the Middle East, or North Africa.)

No person shall be excluded from participation in, be denied benefits of, or be otherwise subjected to discrimination in the CACFP on the grounds of race, color, sex, age, disability, national origin, or any other classification protected by Federal, Tennessee State constitutional, or statutory law.

CHILD AND ADULT CARE FOOD PROGRAM

SAMPLE PARENT/GUARDIAN LETTER FOR

NONPRICING CHILD CARE CENTER

Dear Parent/Guradian:

This child care center participates in the Child and Adult Care Food Program (CACFP) administered by the Tennessee Department of Human Services and funded by the U.S. Department of Agriculture. The CACFP provides reimbursements to our facility for the costs of serving nutritious meals to all enrolled children. This allows our facility to better serve your child(ren).

As provided by the program’s regulations, the amount of reimbursement which we may receive for our meal services is dependent upon the income eligibility of your child(ren). The eligibility categories for enrolled children are free,

To determine the amount of meal reimbursements to be received by our facility for your child(ren), we need your assistance. Copies of the income eligibility application and income guidelines for the

For clarification purposes in completing the application, “household” is defined as a group of related or

If you now receive benefits under the Supplemental Nutrition Assistance Program, Families First Cash Assistance or Families First Child Care Assistance Programs for your child(ren), you do not have to enter any income information on the application. If these benefits are received, please only provide your case number(s) for these programs, and the name of your child who is enrolled at our facility. Please note that the receipt of Families First Child Care Assistance is identified by the code “FF” in the category section of the child care certificate. You are required to notify our facility if the benefits under the Supplemental Nutrition Assistance Program, Families First Cash Assistance or Families First Child Care Assistance Programs are terminated for your child(ren).

If you do not receive benefits under the Supplemental Nutrition Assistance Program, Families First Cash Assistance or Families First Child Care Assistance Programs, please provide income information for your household. Also, if codes of AR, TFF or CCD appear in the category section of your child care certificate(s), please provide the income information as requested on the application. The income to be reported on the application should include the gross income of all members of your household. If your household income is equal to or less than the attached income guidelines, your child(ren) are eligible for the free or

Parent/Guradian

Date

Page 2

now receives and the source of the income, and the last four digits of the Social Security Number of the primary wage earner or the adult household member who signs the application. If the adult household member does not have a Social Security Number, please enter “none”. Please be sure that an adult member of your household signs the application. To enter yearly income amounts, you will need to convert your income as follows: Multiple Weekly income by 52,

Foster children are categorically eligible for free meals. If your household has both foster and non- foster children, please include the foster child(ren) as household members, as well as any personal income earned by the foster child(ren), on the same household application that includes your non- foster child(ren). This may help your family’s

Federal law allows the sharing of the information on your income eligibility application with the Medicaid and State Children’s Health Insurance Programs. At this time, no procedures are in place to disclose this information. Since the procedures to share this information with the Medicaid and State Children’s Health Insurance Programs may be established in the future, please indicate if you do not want this information to be shared. The Medicaid and State Children’s Health Insurance Programs can only use the information to identify children who may be eligible for free or low cost health insurance and to enroll them in either Medicaid or the State Children’s Health Insurance Program. They are not allowed to use the information for any other purpose. If this information is not shared, it will not affect the eligibility of your child(ren) for free or

The meal services provided by our child care institution are available to all enrolled children regardless of race, color, national origin, sex, disability, or age. If you believe that you or your child(ren) have been discriminated against, you may file a grievance. The grievance procedures are attached. You may also immediately write to one or both of the following addresses:

U.S. Department of Agriculture

Director of Office of Civil Rights

Whitten Building, Room

1400 Independence Avenue, SW

Washington, DC

Telephone: (202)

Tennessee Department of Human Services

Child and Adult Care Services

400 Deaderick Street

Nashville, Tennessee

Telephone (615)

Parent/Guradian

Date

Page 3

You may also file a complaint with our institution.

Please return the completed and signed application by ____________________ to

_____________________________________________________________________________

Name of Authorized Official for Child Care Institution

_____________________________________________________________________________

Name of Child Care Institution

_____________________________________________________________________________

Street Address

_____________________________________________________________________________

City |

State |

Zip Code |

Thank you for your cooperation.

Sincerely,

______________________________________________

Name of Title of Facility Representative

_____________________________

Date

Attachments: Income Eligibility Application

Income Eligibility Guidelines for

Grievance Form and Procedures