Tennessee Department of

Human Services (TDHS)

Child and Adult Care Food Program (CACFP)

Application for Participation and Management Plan for

Sponsor of Affiliated Child and/or Adult Care Centers

Form HS-1965A

Revised January 2011

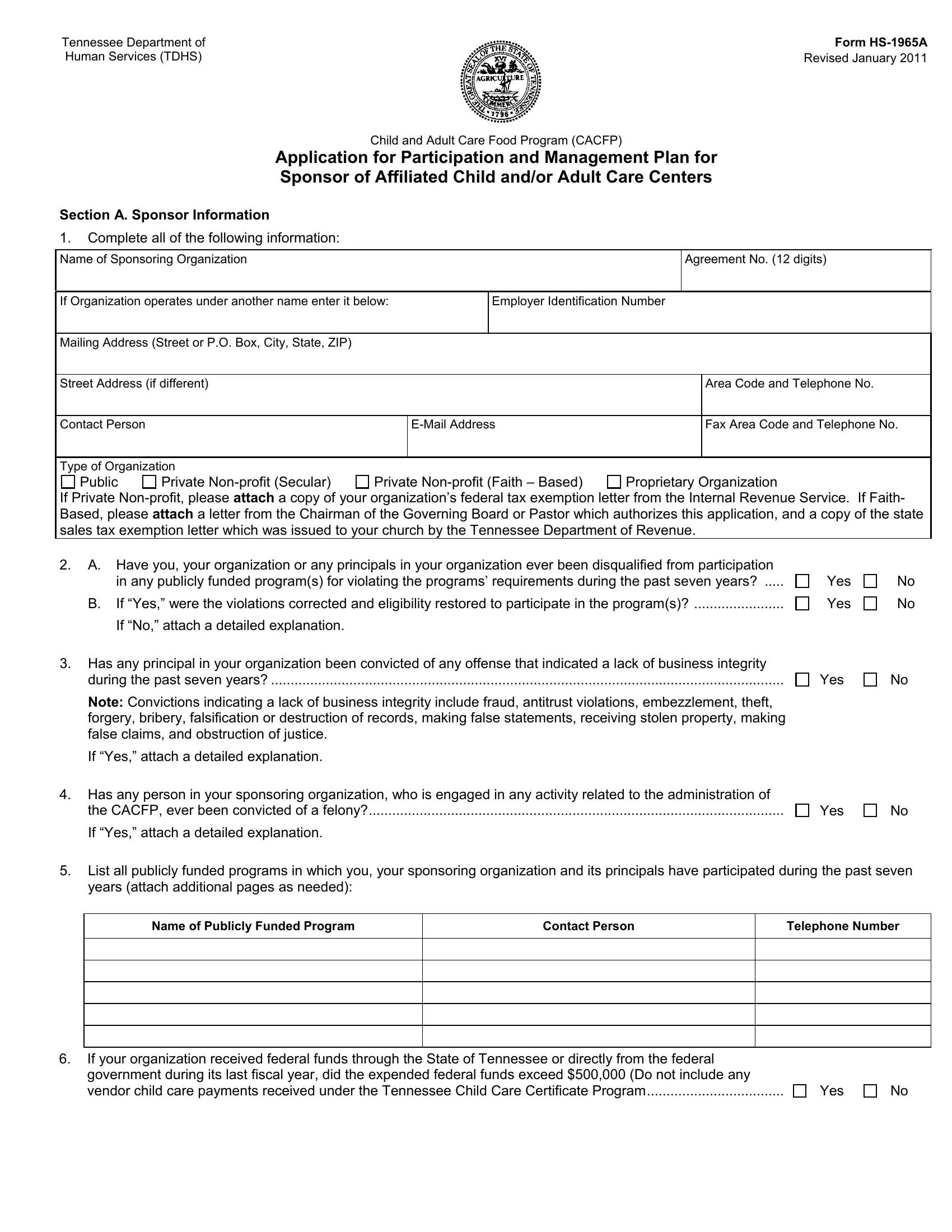

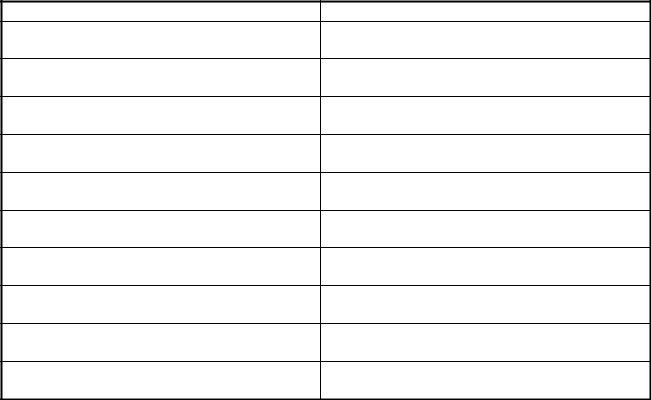

Section A. Sponsor Information

1.Complete all of the following information:

Name of Sponsoring Organization

Agreement No. (12 digits)

If Organization operates under another name enter it below: |

|

Employer Identification Number |

|

|

|

|

|

|

Mailing Address (Street or P.O. Box, City, State, ZIP) |

|

|

|

|

|

|

|

|

|

|

|

Street Address (if different) |

|

|

|

|

Area Code and Telephone No. |

|

|

|

|

|

|

Contact Person |

|

|

E-Mail Address |

|

Fax Area Code and Telephone No. |

|

|

|

|

|

|

Type of Organization |

|

|

|

|

|

Public |

Private Non-profit (Secular) |

Private Non-profit (Faith – Based) |

Proprietary Organization |

If Private Non-profit, please attach a copy of your organization’s federal tax exemption letter from the Internal Revenue Service. If Faith- Based, please attach a letter from the Chairman of the Governing Board or Pastor which authorizes this application, and a copy of the state sales tax exemption letter which was issued to your church by the Tennessee Department of Revenue.

2.A. Have you, your organization or any principals in your organization ever been disqualified from participation in any publicly funded program(s) for violating the programs’ requirements during the past seven years? .....

B.If “Yes,” were the violations corrected and eligibility restored to participate in the program(s)? .......................

If “No,” attach a detailed explanation.

3.Has any principal in your organization been convicted of any offense that indicated a lack of business integrity during the past seven years? ...................................................................................................................................

Note: Convictions indicating a lack of business integrity include fraud, antitrust violations, embezzlement, theft, forgery, bribery, falsification or destruction of records, making false statements, receiving stolen property, making false claims, and obstruction of justice.

If “Yes,” attach a detailed explanation.

4.Has any person in your sponsoring organization, who is engaged in any activity related to the administration of the CACFP, ever been convicted of a felony?..........................................................................................................

If “Yes,” attach a detailed explanation.

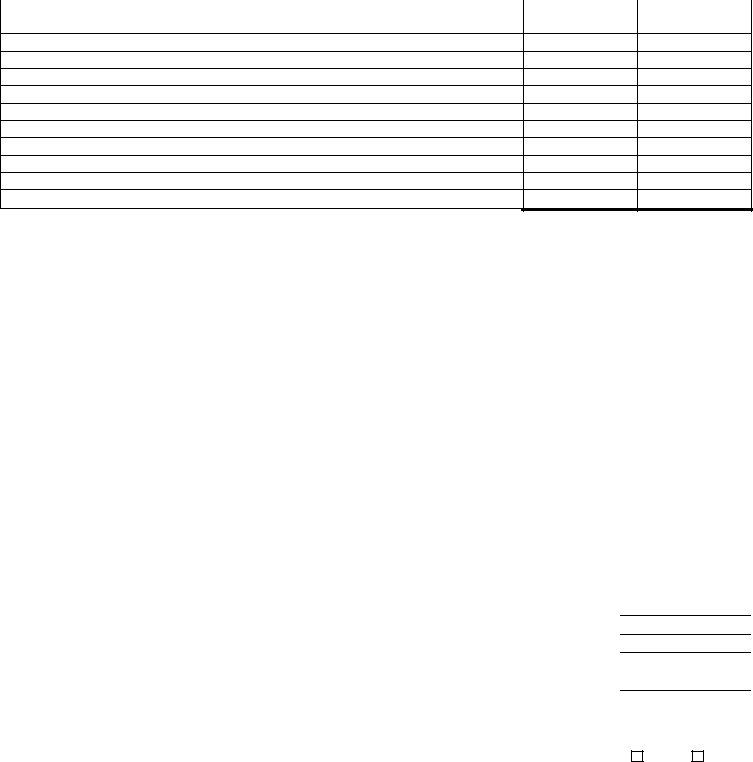

5.List all publicly funded programs in which you, your sponsoring organization and its principals have participated during the past seven years (attach additional pages as needed):

Name of Publicly Funded Program

6.If your organization received federal funds through the State of Tennessee or directly from the federal government during its last fiscal year, did the expended federal funds exceed $500,000 (Do not include any vendor child care payments received under the Tennessee Child Care Certificate Program...................................

Form HS-1965A

Revised January 2011

Page 2

Section B. Financial Viability

1.Each sponsoring organization must have adequate sources of funds to withstand temporary interruptions in program payments and/or fiscal claims against the organization. To address this requirement, please attach a comprehensive financial statement that identifies all expenditures and sources of income to your organization as a whole for your organization’s last fiscal year. You may attach a copy of your organization’s last audit report in lieu of the comprehensive financial statement.

Section C. Budget

Each sponsoring organization must have adequate financial resources to operate the program on a daily basis. To address this requirement, please complete the following budget information. All program costs must be necessary, reasonable and allowable.

1.Number of Sponsored Facilities: Enter the number of child or adult care centers that you plan to sponsor, and complete Exhibit 1 to identify the centers .............................................................................................................

2.Estimated Reimbursements: Enter the total estimated annual meal reimbursements to be received by your organization ...........................................................................................................................................................

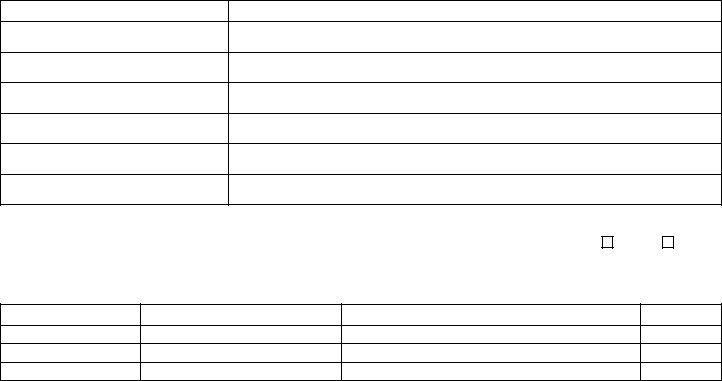

3.Operational Labor – Provide detailed information for each operational position to perform CACFP duties and to be funded by the CACFP meal reimbursements from the TDHS. Operational labor includes the preparation and serving of meals. Labor costs include base salary, employment taxes, fringe benefits, overtime pay, holiday pay, compensatory leave, incentive payments and severance pay.

A. |

B. |

C. |

D. |

E. |

FOR TDHS USE ONLY |

Number of |

Annual Base |

Fringe Benefits |

Total Base Salary |

Total Salary and |

(Amount Approved) |

Personnel in |

Salary |

(Include only |

and Benefits |

Fringe Benefits Paid |

|

this Position |

|

employer’s |

(B + C) |

from CACFP Annually |

|

|

|

share) |

|

|

|

Position: |

|

|

|

|

|

CACFP Duties: |

|

|

|

|

|

Position:

CACFP Duties:

Position:

CACFP Duties:

Position:

CACFP Duties:

|

Annually |

TDHS |

|

|

APPROVED |

Total Operational Labor Costs |

$ |

$ |

Form HS-1965A

Revised January 2011

Page 3

Section C. Budget (continued)

4.Administrative Labor – Provide detailed information for each administrative position to perform CACFP duties and to be funded by the CACFP meal reimbursements from the TDHS. Administrative labor includes planning, organizing and managing the CACFP food service. Labor costs include base salary, employment taxes, fringe benefits, overtime pay, holiday pay, compensatory leave, incentive payments and severance pay.

|

A. |

B. |

C. |

D. |

E. |

FOR TDHS USE ONLY |

|

Number of |

Annual Base |

Fringe Benefits |

Total Base Salary |

Total Salary and |

(Amount Approved) |

|

Personnel in |

Salary |

(Include only |

and Benefits |

Fringe Benefits Paid |

|

|

this Position |

|

employer’s |

(B + C) |

from CACFP Annually |

|

|

|

|

share) |

|

|

|

Position: |

|

$ |

$ |

$ |

$ |

$ |

CACFP Duties: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Position: |

|

$ |

$ |

$ |

$ |

$ |

CACFP Duties: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Position: |

|

$ |

$ |

$ |

$ |

$ |

CACFP Duties: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annually |

TDHS |

|

|

|

|

|

|

APPROVED |

|

|

Total Administrative Labor Costs |

$ |

$ |

Other Costs - Include only those expenses to be paid with CACFP meal reimbursements.

|

|

|

A. |

|

|

B. |

|

|

|

|

|

|

|

FOR TDHS USE |

|

|

|

|

|

Total Cost Paid |

|

|

|

|

|

Cost Category |

|

|

|

ONLY |

|

|

|

|

|

from CACFP |

|

|

(Amount |

|

|

|

|

|

Annually |

|

|

Approved) |

|

|

5. |

Food Costs (must be at least 50% of estimated CACFP reimbursements for program |

|

|

|

|

|

|

|

year) |

|

|

|

|

|

|

|

|

Total Food Costs |

|

5A. |

|

5B. |

|

|

|

|

|

|

|

|

|

|

6. |

Expendable Supplies (i.e., napkins, straws, dishwashing detergent, etc.) |

|

|

|

|

|

|

|

|

Total Expendable Supplies Costs |

|

6A. |

|

6B. |

|

|

|

|

|

|

|

|

|

|

7. |

Durable Supplies (i.e., items costing less than $5,000 with life expectancy of more |

|

|

|

|

|

|

|

than 1 year) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Durable Supplies Costs |

|

7A. |

|

7B. |

|

|

|

|

|

|

|

|

|

Form HS-1965A |

|

|

|

|

|

|

|

Revised January 2011 |

|

|

|

|

|

|

|

|

Page 4 |

Section C. Budget (continued) |

|

|

|

|

|

|

|

|

|

|

|

A. |

|

|

B. |

|

|

|

|

|

|

|

|

FOR TDHS USE |

|

|

|

|

|

|

Total Cost Paid |

|

|

|

|

|

Cost Category |

|

|

|

|

ONLY |

|

|

|

|

|

|

from CACFP |

|

|

(Amount |

|

|

|

|

|

|

Annually |

|

|

Approved) |

|

|

|

|

|

|

|

|

|

|

|

8. Contracted Meal Services (If meals are to be purchased from private company, attach |

|

|

|

|

|

|

|

|

copy of contract to purchase meals) |

|

|

|

|

|

|

|

|

|

Total Contracted Meal Services Costs |

|

8A. |

|

8B. |

|

|

|

|

|

|

|

|

|

9. Contract Personnel (Non-employees who are under contract to prepare/serve meals) |

|

|

|

|

|

|

|

|

|

Total Contracted Personnel Costs |

|

9A. |

|

9B. |

|

|

|

|

|

|

|

|

|

10. |

Food Service Equipment Purchase (must attach description of each equipment item) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Food Service Equipment Costs |

|

10A. |

|

10B. |

|

|

|

|

|

|

|

|

|

11. |

Office Supplies |

|

|

|

|

|

|

|

|

|

Total Office Supplies Costs |

|

11A. |

|

11B. |

|

|

|

|

|

|

|

|

|

12. Communications |

|

|

|

|

|

|

|

|

|

Total Communications Costs |

|

12A. |

|

12B. |

|

|

|

|

|

|

|

|

|

13. |

Postage, Printing and Publications |

|

|

|

|

|

|

|

|

|

Total Postage, Printing and Publications Costs |

|

13A. |

|

13B. |

|

|

|

|

|

|

|

|

|

14. |

Occupancy, Rental Costs (Attach copies of contracts) |

|

|

|

|

|

|

|

|

|

Total Occupancy, Rental Costs |

|

14A. |

|

14B. |

|

|

|

|

|

|

|

|

|

15. |

In-State Travel Cost for Training/Monitoring |

|

|

|

|

|

|

|

|

|

Total Travel Costs |

|

15A. |

|

15B. |

|

16. |

Out-of-State Travel Cost (Attach additional information) |

|

|

|

|

|

|

|

|

|

Total Travel Costs |

|

16A. |

|

16B. |

|

|

|

|

|

|

|

|

|

17. |

Indirect Costs (Attach approval letter from governmental agency) |

|

|

|

|

|

|

|

|

|

Total Indirect Costs |

17A. |

|

17B. |

|

|

|

|

|

|

|

|

|

18. |

Utilities costs. |

|

|

|

|

|

|

|

|

|

Total Facilities and Space Costs |

|

18A. |

|

18B. |

|

|

|

|

|

|

|

|

|

19. |

Purchased Services (Includes security services, maintenance and janitorial |

|

|

|

|

|

|

|

|

services) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Purchased Services Costs |

|

19A. |

|

19B. |

|

|

|

|

|

|

|

|

20. |

Financial Costs (Includes accounting, audits and bonding costs) |

|

|

|

|

|

|

|

|

Total Financial Costs |

|

20A. |

|

20B. |

|

|

|

|

|

|

|

Form HS-1965A |

|

|

|

|

|

|

|

Revised January 2011 |

|

|

|

|

|

|

|

|

Page 5 |

|

Section C. Budget (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

A. |

|

|

|

B. |

|

|

|

|

|

|

|

|

FOR TDHS USE |

|

|

|

|

|

Total Cost Paid |

|

|

|

|

|

Cost Category |

|

|

|

|

|

ONLY |

|

|

|

|

|

from CACFP |

|

|

|

(Amount |

|

|

|

|

|

Annually |

|

|

|

Approved) |

|

|

|

|

|

|

|

|

|

|

|

|

21. Other Costs – This cost category includes any other costs associated with the |

|

|

|

|

|

|

|

|

|

nonprofit food service. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTES: Financial Instruction 796-3, Rev. 3 requires that certain costs receive “Specific Prior Written Approval” by the TDHS. These costs include, but are not limited to, any direct costs that must be allocated between administrative and operating costs, between allowable and unallowable costs, and between the TN CACFP and CACFP costs incurred in other states for multi-state institutions; costs required to make goods or services donated to the institution usable for the program; equipment purchase and depreciation methods; employer costs for in-house publications, first-aid clinics, and employee counseling services; special lease arrangements; allocation of maintenance and operation costs for leased facilities when such costs are included in rent or other special charges; insurances not required by the TDHS; less-than-arms-length financial arrangements or transactions; changes in the institution’s compensation policy that would result in substantial increases in employee compensation; overtime pay, holiday pay for work performed on a non-holiday, and compensatory leave; severance pay; deferred compensation; travel costs and registration fees for attending conferences when the CACFP is only part of a larger agenda; and costs of memberships for civic and community organizations. When such costs are included in your budget, you must

request approval for these costs in a separate letter to the TDHS.

A Written Compensation Policy must be maintained for each position. This policy must address the rates of pay; work hours, including breaks and meal periods; and payment schedules. In addition, a Time and Attendance Report must be completed and signed by each CACFP funded employee for each pay period and also signed by the employee’s supervisor. The Time and Attendance Report must reflect the starting time, ending time, and absences for each working day in each pay period. If any employee will perform both operational and administrative duties under the CACFP, or duties for the CACFP and other programs, a Time Distribution Report must be completed by the employee for each pay period and signed by the employee’s supervisor. The signatures of the employee and employee’s supervisor for the Time and Attendance Report and Time Distribution Report will follow a statement that the information provided by the employee is true and correct. In addition, all payroll records required by Financial Instruction 796-2, Revision 3 must be maintained to support all labor costs charged to the CACFP.

22.Summary of Projected Costs and Revenue

Reimbursements under the CACFP subsidize the non-profit food service operation but may not be sufficient to cover all non-profit food service expenses. Any funds specifically designated as non-profit food service account funds are restricted and may not be used to fund any other costs in your organization.

a.Total annual costs of food service (Section C. 3. – 21.):

b.Enter the projected annual CACFP meal reimbursements from Section C. 2. above:

c.Enter the total of other income to the food service account:

(Other income refers to funds specifically designated for use in food service.)

d.Enter the total of lines b and c:

23.Sponsoring organizations applying to participate in the CACFP are required to disclose and identify related party transactions, less- than-arms-length transactions, ownership interests in equipment, supplies, vehicles, and facilities, or disclose any other information that inhibits the TDHS from making an informed assessment of the allowability of a particular cost.

Do you have any expenses that require disclosure?................................................................................................

If yes, attach a detailed explanation.

Form HS-1965A

Revised January 2011

Page 6

Section D. Administrative Capability

Each sponsoring organization must have an adequate number and type of staff with appropriate qualifications to administer the CACFP.

1.Complete the chart below to describe the qualifications you require for any of the following positions(s) that perform CACFP duties. Attach additional sheets if necessary.

CACFP Director/Manager

Teacher

Cook

Monitor

Civil Rights Officer

CACFP Claim Preparer

2.You must demonstrate that you have an adequate number of staff to conduct required monitoring. Do you sponsor 25 or more child or adult care centers?......................................................................................................

If yes, complete and attach form for Monitoring Staff Information.

3.The following information must be provided for the persons responsible for the overall operation of the CACFP. (Use additional sheets if necessary.)

Name |

Residence Mailing Address |

Date of Birth |

Executive Director

Chairman of the Board

Owner (Proprietary)

Section E. Program Accountability

The sponsoring organization must have internal controls and other management systems to ensure fiscal accountability and program compliance with federal and state regulations.

1.Complete and attach the Sample Form to Document Required Management Controls

2.Enter your organization’s anticipated date(s) for in-house training for the program year beginning October 1 and ending September 30. Training for each employee performing CACFP duties must be provided at least once per program year.

_________________________________________________ ___________________________________________________

_________________________________________________ ___________________________________________________

3.Please identify the names of the personnel to perform the required monitoring reviews of your sponsored centers:

_________________________________________________ ___________________________________________________

_________________________________________________ ___________________________________________________

Each sponsoring organization must ensure that the meals services of each sponsored center is monitored subject to the following requirements: (a) Each center must be visited at least three times each program year to complete the monitoring reviews; (b) The monitoring visits to each center must occur not more than six months apart; (c) One of the required monitoring visits for each center must occur during the first four weeks of CACFP operations; (d) At least two of the monitoring visits to each center must be unannounced; and (e) The findings of all monitoring visits must be identified in written reports which are maintained for inspection by state and federal personnel.

Form HS-1965A

Revised January 2011

Page 7

Section F. Potential Eligible Beneficiaries by Ethnic/Racial Categories

1.Provide the number of potential eligible children in your service area by the ethnic categories below:

Hispanic or Latino: ________ Not Hispanic or Latino: ________

2.Provide the number of potential eligible children in your service area by the racial categories below:

American Indian or Alaskan Native: ________ Asian: ________ Black or African American: ________

Native Hawaiian or Other Pacific Islander: ________ White: ________

Section G. News Releases

1.Each organization must distribute news releases announcing its participation in the program. Identify below the names of the local news media, minority or other grassroots organizations to receive these news releases. The news releases are to be distributed after approval for CACFP participation is received from the Tennessee Department of Human Services. Your organization is not required to have the news releases published in newspapers as a legal notice. A sample form for the news release is attached. Attach additional sheets if needed.

A.

B.

C.

D.

Section H. Personnel to Review Participant/Provider Application Information

1.The following employee(s) will be designated to review family size and income documentation and make determinations of free and reduced-price eligibility for participants:

A.

B.

C.

D.

Section I. Governing Board of Directors

Attach a list of your Governing Board of Directors. The list should identify the name, address and telephone number of each member.

Section J. Outside Employment Policy

Attach your organization’s outside employment policy. The policy must restrict other employment by employees that interferes with an employee’s performance of CACFP related duties and responsibilities, including outside employment that constitutes a real or apparent conflict of interest.

Section K. Employees to Sign/Electronically Submit Reimbursement Claims

1.Enter the name(s) and title(s) of the employees authorized to sign/electronically submit claims:

A.

Form HS-1965A

Revised January 2011

Page 8

Section K. Employees to Sign/Electronically Submit Reimbursement Claims (continued)

B.

C.

D.

Section L. Claim Edit Checks

1.Does your organization have the following claim edit checks in place: ___ Yes ___ No

How are they performed: ___ Manually ___ Automated

A.Edit check to ensure that each home is paid only for those meal types for which it has been approved to serve under the CACFP

B.Edit check to ensure that the number of meals claimed by each home does not exceed the number derived by multiplying approved meal types times days of operation times enrollment

Section M. Civil Rights Compliance

All personnel who perform CACFP duties must complete Civil Rights training. To complete this training, please enter the following link on your computer browser: http://tn.gov/humanserv/adfam/ccfp_forms/index.html

At the bottom of the web page, please click on the Civil Rights Training link and then open the PowerPoint training document. When all CACFP personnel have reviewed the training document, please print the Training Roster, enter on the Training Roster the names and job titles of the CACFP personnel who have reviewed the PowerPoint training document, and return the Training Roster with this application.

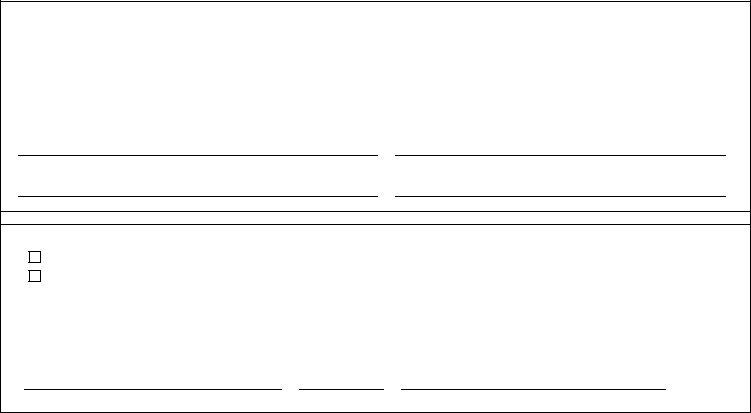

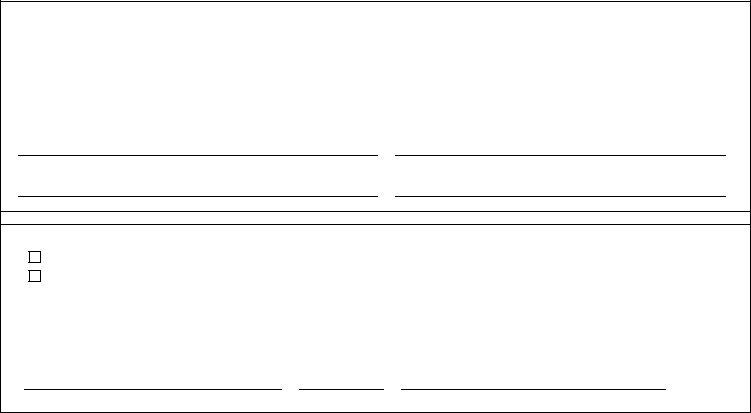

Section N. Certification

I certify that the information on this form is true and correct to the best of my knowledge, and that I will immediately report to the Tennessee Department of Human Services any changes that occur to the information submitted in my application. I also certify that reimbursement will be claimed only for approved meals served to eligible participants during the hours they are in attendance at approved child care homes. I understand that deliberate misrepresentation or withholding of information may result in prosecution under applicable state and federal statutes. I understand that the submittal of false information in this document will result in the denial of my application and termination of my agreement to participate in the CACFP. I also understand that my sponsoring organization and all individuals providing false information in this document will be placed on the National Disqualified List (NDL) and will be subject to any other applicable civil or criminal penalties.

Signature - Official of Sponsoring Organization

Printed Name of the Signing Official

Date

Title of the Sponsoring Organization Official

For TDHS Use Only

Approved

Denied (If checked, provide explanation below):

Signature - TDHS Representative |

Date |

Title of the TDHS Representative |

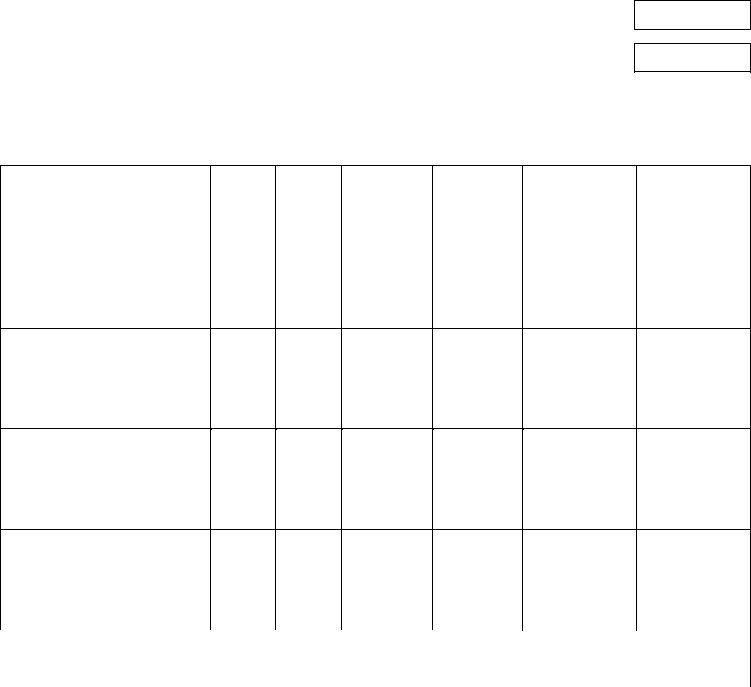

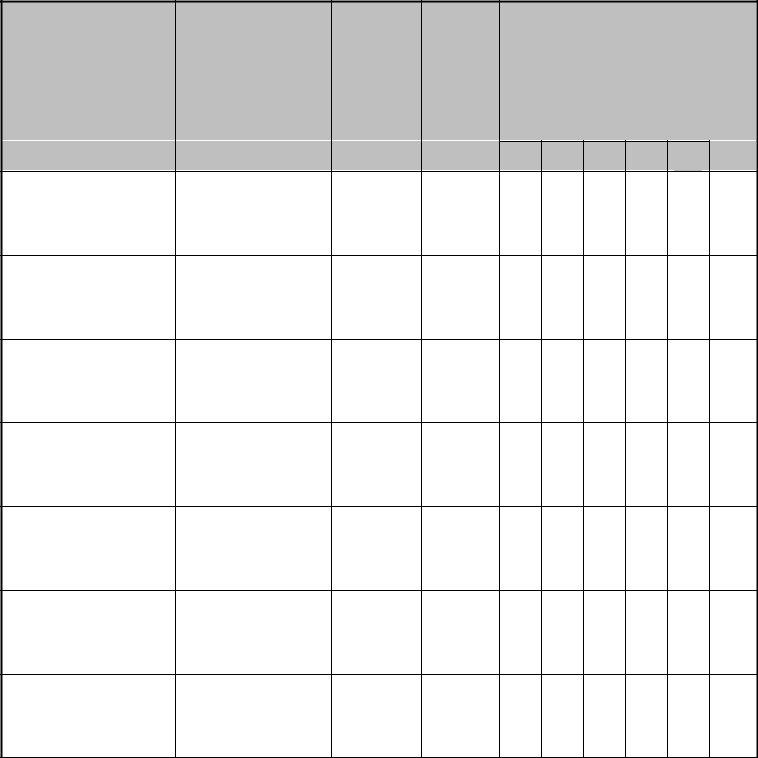

“EXHIBIT 1”

INFORMATION FOR CENTERS SPONSORED

County: _________________________

NAME AND ADDRESS

OF EACH CENTER

TYPE OF CENTER

C = Child Care Center

A = Adult Care Center

O = Outside School

Hours Center

F = For-Profit Center

|

IDENTIFY MEALS TO BE |

|

|

|

CLAIMED: |

|

|

Breakfast = B |

|

|

|

|

AM Snack = AM |

|

|

|

Lunch = L |

|

|

|

|

PM Snack = PM |

|

|

|

Supper = S |

|

|

|

|

Evening Snack = ES |

|

|

|

B |

AM |

L |

PM |

S |

ES |

SAMPLE FORM TO DOCUMENT REQUIRED MANAGEMENT CONTROLS

As mandated by the federal regulation at 7 CFR Part 226.6 (b) (18), each new or renewing institution must have a financial system with written management controls. To document the management controls utilized by your institution, please provide the following information:

1.What is the frequency for depositing all cash receipts (including checks) at your banking institution:

_________________________________________________________________

2.Who is authorized to perform the following:

a.Receive all child care fees from parents and guardians:

Name: _____________________ |

Position Title: ________________ |

Name: _____________________ |

Position Title: ________________ |

b.Deposit all cash receipts (including checks) at your banking institution:

|

Name: _____________________ |

Position Title: ________________ |

|

Name: _____________________ |

Position Title: ________________ |

c. |

Open the mail: |

|

|

Name: _____________________ |

Position Title: ________________ |

|

Name: _____________________ |

Position Title: ________________ |

d.Review the CACFP budget (approved by the Tennessee Department of Human Services) before incurring costs that are charged to the program:

Name: _____________________ |

Position Title: ________________ |

Name: _____________________ |

Position Title: ________________ |

e.Review vendor invoices for correctness of the quantities received and prices charged before payment is made:

Name: _____________________ |

Position Title: ________________ |

Name: _____________________ |

Position Title: ________________ |

f.Ensure that pre-numbered checks are utilized for the payment of all costs:

|

Name: _____________________ |

Position Title: ________________ |

|

Name: _____________________ |

Position Title: ________________ |

g. |

Record all checks when issued: |

|

|

Name: _____________________ |

Position Title: ________________ |

|

Name: _____________________ |

Position Title: ________________ |

h.Safeguard all unused checks:

|

Name: _____________________ |

Position Title: ________________ |

|

Name: _____________________ |

Position Title: ________________ |

i |

Retaining all voided checks: |

|

|

Name: _____________________ |

Position Title: ________________ |

|

Name: _____________________ |

Position Title: ________________ |

j.Ensure that no checks are issued payable to cash:

|

Name: _____________________ |

Position Title: ________________ |

|

Name: _____________________ |

Position Title: ________________ |

k. |

Mail checks: |

|

|

Name: _____________________ |

Position Title: ________________ |

|

Name: _____________________ |

Position Title: ________________ |

l.Receive statements and cancelled checks from your banking institution:

Name: _____________________ |

Position Title: ________________ |

Name: _____________________ |

Position Title: ________________ |

m.Reconcile monthly bank statements:

Name: _____________________ |

Position Title: ________________ |

Name: _____________________ Position Title: ________________

n.Review reconciled bank statements:

Name: _____________________ |

Position Title: ________________ |

Name: _____________________ |

Position Title: ________________ |

o.Review monthly statements for outstanding balances owed:

Name: _____________________ |

Position Title: ________________ |

Name: _____________________ |

Position Title: ________________ |

p.Approve, sign, and distribute payroll checks:

Name: _____________________ |

Position Title: ________________ |

Name: _____________________ |

Position Title: ________________ |

q.Prepare monthly CACFP claims for reimbursement:

Name: _____________________ |

Position Title: ________________ |

Name: _____________________ |

Position Title: ________________ |

r.Contact the Tennessee Department of Human Services on all CACFP claims that are not paid within 30 days of submission;

Name: _____________________ |

Position Title: ________________ |

Name: _____________________ |

Position Title: ________________ |

3.Who is responsible for ensuring that all labor costs charged to the CACFP are supported by Time and Attendance Records which identify the starting time, ending time, and absences for each working day in each pay period:

Name: _____________________ |

Position Title: ________________ |

Name: _____________________ |

Position Title: ________________ |

4.Who is responsible for ensuring that Time Distribution Records are maintained for all employees who perform both CACFP operational and administrative duties, or duties for the CACFP and other programs.

Name: _____________________ |

Position Title: ________________ |

Name: _____________________ |

Position Title: ________________ |

5.Who is responsible for ensuring that payroll records are maintained for each employee charged to the CACFP:

The payroll records must include the following information:

a.Employee name;

b.Rate of pay;

c.Hours worked;

d.Benefits earned;

e.Any reductions or increases to the employee’s base compensation, such as overtime pay;

f.Gross pay;

g.Net pay;

h.Date of payment;

i.Method of payment, such as check or electronic funds transfer; and

j.Verification that employee has been paid, such as canceled checks or electronic funds transfer deposit verification.

6.Describe the procedures for employees to request and receive approval for annual and sick leave:

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

7.Who has access to the personnel files of employees:

Name: _____________________ Position Title: ________________

Name: _____________________ Position Title: ________________

8.Who is responsible for maintaining an inventory of all equipment purchased with CACFP funds:

Name: _____________________ |

Position Title: ________________ |

Name: _____________________ |

Position Title: ________________ |

The CACFP defines equipment as an item of non-expendable personal property with a useful life of more than 1 year and an acquisition cost of $5,000 or more per unit.

NAME AND TITLE OF AUTHORIZED INSTITUTION OFFICIAL:

________________________ |

________________ |

NAME |

DATE |

SIGNATURE OF AUTHORIZED INSTITUTION OFFICIAL: |

|

____________________________________ |

________________ |

SIGNATURE |

DATE |

PUBLIC RELEASE FOR

CHILD AND ADULT CARE FOOD PROGRAM

______________________________________________________ announces

participation in (NAME OF SPONSORING ORGANIZATION)

the Child and Adult Care Food Program. Meals will be provided at no separate charge to eligible children served at the following site(s):

All meals will be provided in accordance with the U.S. Department of Agriculture non- discrimination policy which prohibits discrimination based on race, color, national origin, sex, age and disability. (Not all prohibited bases apply to all programs.)

The income eligibility guidelines for free and reduced price meals are attached.