Division of Motorist Services

Bureau of Commercial Vehicle and Driver Services

RECORD KEEPING AGREEMENT

(Not to be signed by Agents or Powers of Attorney)

As a Florida-based registrant under the International Registration Plan (IRP) or licensee under the International Fuel Tax Agreement (IFTA), you are required to keep detailed records of your operations in each jurisdiction. These records must support the mileage reported for IRP registration purposes and/or the mileage and fuel purchased/placed in propulsion tanks as reported on IFTA tax returns. All information is subject to verification and, if found inadequate, WILL result in additional fees and/or financial penalties. Records may be kept in paper or electronic format, and, if requested, must be made available for audit purposes. More information and specific requirements related to record keeping can be found in Section P500 of the IFTA Procedures Manual and Sections 1000, 1005 and 1010 of the IRP Plan.

DISTANCE RECORDS REQUIRED TO BE MAINTAINED (IFTA & IRP): Driver trip sheets or Individual Vehicle Distance Records (IVDR) for each IFTA qualified vehicle MUST be maintained and MUST INCLUDE the following:

✓Date(s) of trip (starting and ending)

✓Trip origin and destination

✓Route of travel (highway numbers)

✓Beginning and Ending odometer/hub odometer readings for trip

✓Distance (trip miles/kilometers) traveled in each jurisdiction

✓Total Distance (trip miles/kilometers)

✓Power Unit number or vehicle identification number

✓Registrant/Licensee name

FUEL RECORDS REQUIRED TO BE MAINTAINED (IFTA Only): Evidence of taxes paid on fuel purchased and pumped into each IFTA qualified vehicle MUST be maintained.

OVER THE ROAD FUEL PURCHASES: Unaltered vendor-generated receipts, invoices, credit card receipts, or automated transaction listings MUST be maintained in order to receive credit on your IFTA tax return for taxes already paid. All fuel receipts/invoices MUST INCLUDE the following:

✓ |

Date of Purchase |

✓ Price per gallon/liter or total amount of sale |

✓ Name and Address of seller |

✓ |

Unit number or vehicle identification number |

✓ Number of gallons/liters purchased |

✓ |

Driver/purchaser’s name |

✓ |

Type of fuel purchased |

✓ PREPAID FUEL RECEIPTS/INVOICES ARE NOT ACCEPTABLE |

|

|

|

|

BULK STORAGE FUEL PURCHASES/WITHDRAWALS: Fuel delivery tickets/receipts showing taxes paid, bulk fuel meter readings, inventory measurements, and monthly reconciliations MUST be maintained. In addition, the following information MUST BE INCLUDED:

✓ |

Date of Withdrawal |

✓ |

Driver/purchaser’ signature |

✓ |

Number of gallons/liters withdrawn |

✓ |

Unit Number or vehicle identification number |

SUMMARIES REQUIRED (IFTA and IRP):

✓Monthly Summaries recapping (by each individual vehicle) the miles/kilometers traveled in each jurisdiction; the total fleet miles/kilometers; and (for IFTA) all tax paid fuel (both over the road and bulk withdrawals) placed in the propulsion tank of each IFTA qualified motor vehicle.

✓Quarterly Summaries recapping the miles/kilometers traveled in each jurisdiction; total fleet miles/kilometers; and (for IFTA) all tax paid fuel (both over the road and bulk withdrawals) placed in the propulsion tank of all IFTA qualified motor vehicles.

✓Yearly Summaries (for IRP only) of the distance (mileage) information that was used to prepare your IRP renewal. Use the information from the quarterly recaps. The yearly summary must support your actual miles/kilometers reported for the mileage reporting period.

HOW LONG ARE RECORDS REQUIRED TO BE KEPT?

✓IRP records supporting a particular registration year must be kept for four (4) years after the end of that registration year.

✓IFTA records supporting each quarterly tax return must be kept for four (4) years from the tax return due date or filing date, whichever is later.

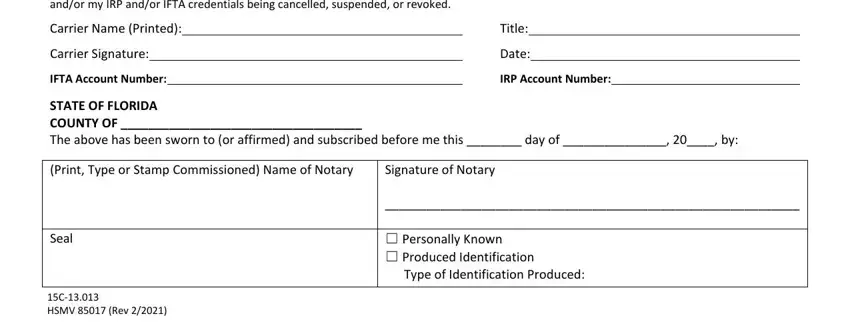

I certify I have read the above information, and I agree to prepare, maintain, and make available all records required under IRP and IFTA. I understand that failure to keep the required records may result in my owing additional taxes; my being assessed substantial penalties and interest; and/or my IRP and/or IFTA credentials being cancelled, suspended, or revoked.

|

|

|

|

|

|

|

|

Carrier Name (Printed): |

|

Title: |

|

Carrier Signature: |

|

|

Date: |

|

IFTA Account Number: |

|

|

IRP Account Number: |

|

STATE OF FLORIDA

COUNTY OF ___________________________________

The above has been sworn to (or affirmed) and subscribed before me this ________ day of _______________, 20____, by:

(Print, Type or Stamp Commissioned) Name of Notary |

Signature of Notary |

|

____________________________________________________________ |

|

|

Seal |

☐ Personally Known |

|

☐ Produced Identification |

|

Type of Identification Produced: |

|

|

15C-13.013

HSMV 85017 (Rev 2/2021)