Using the online tool for PDF editing by FormsPal, you'll be able to fill out or alter IHA here and now. To keep our editor on the forefront of practicality, we strive to put into operation user-driven features and improvements on a regular basis. We are at all times grateful for any feedback - help us with remolding the way you work with PDF documents. Starting is simple! All you need to do is follow the following easy steps directly below:

Step 1: Open the PDF file in our tool by clicking on the "Get Form Button" at the top of this page.

Step 2: With the help of our advanced PDF editing tool, you're able to accomplish more than merely complete blank form fields. Edit away and make your documents look sublime with custom text added in, or optimize the original input to excellence - all accompanied by the capability to insert any type of images and sign the PDF off.

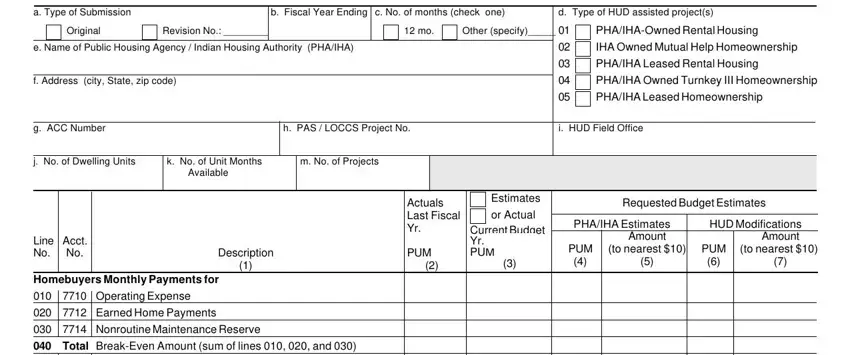

This document will need specific information to be filled in, hence be sure to take some time to enter exactly what is requested:

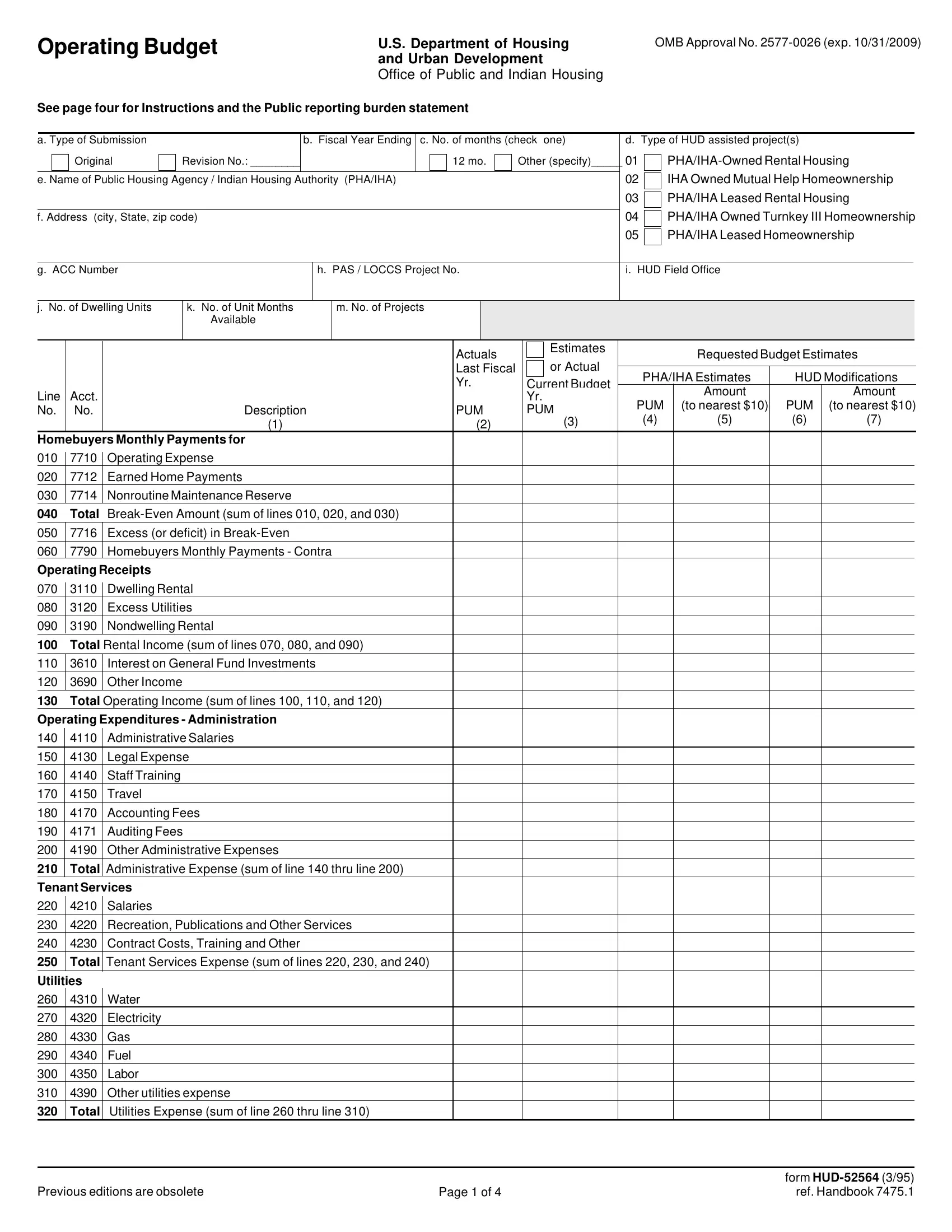

1. You need to fill out the IHA accurately, thus pay close attention when filling out the segments containing these specific blank fields:

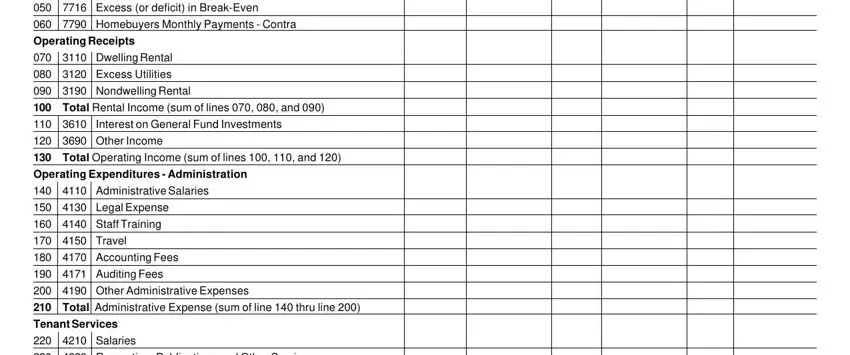

2. Just after completing the last part, head on to the subsequent stage and complete the necessary particulars in these fields - Excess or deficit in BreakEven, Homebuyers Monthly Payments, Operating Receipts, Dwelling Rental, Excess Utilities, Nondwelling Rental, Total Rental Income sum of lines, Interest on General Fund, Other Income, Total Operating Income sum of, Operating Expenditures, Administrative Salaries, Legal Expense, Staff Training, and Travel.

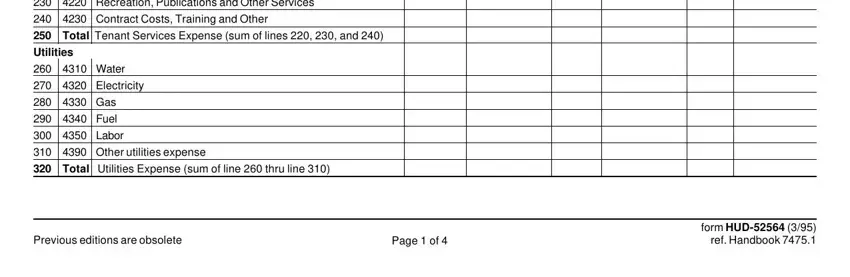

3. In this step, take a look at Recreation Publications and, Contract Costs Training and Other, Total Tenant Services Expense sum, Utilities, Water, Electricity, Gas, Fuel, Labor, Other utilities expense, Total Utilities Expense sum of, Previous editions are obsolete, Page of, and form HUD ref Handbook. All these will have to be taken care of with utmost precision.

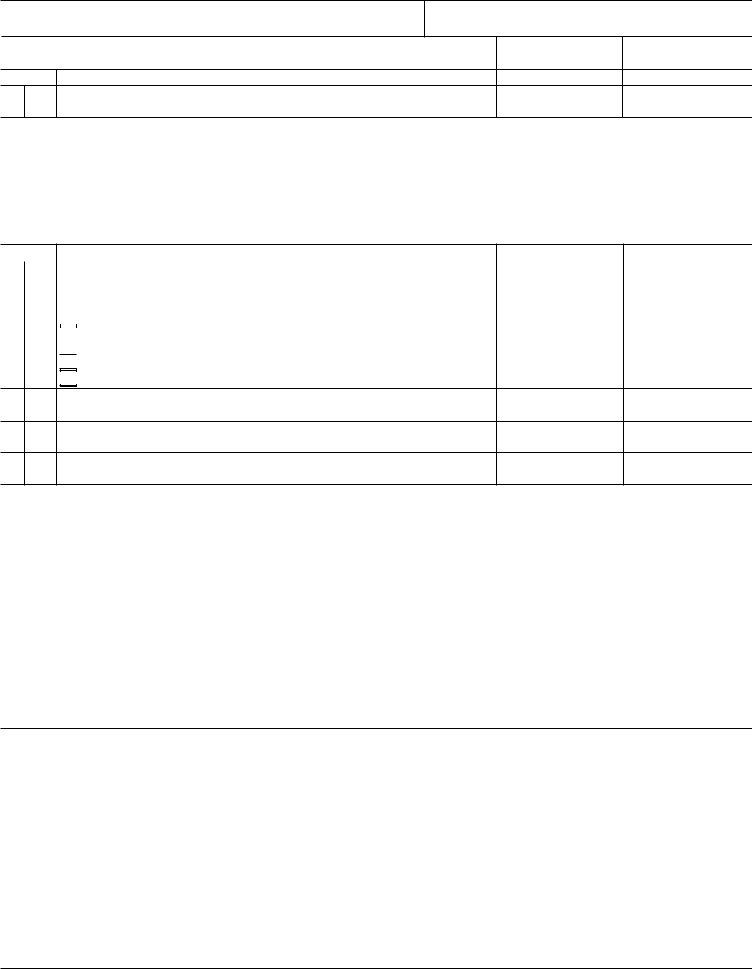

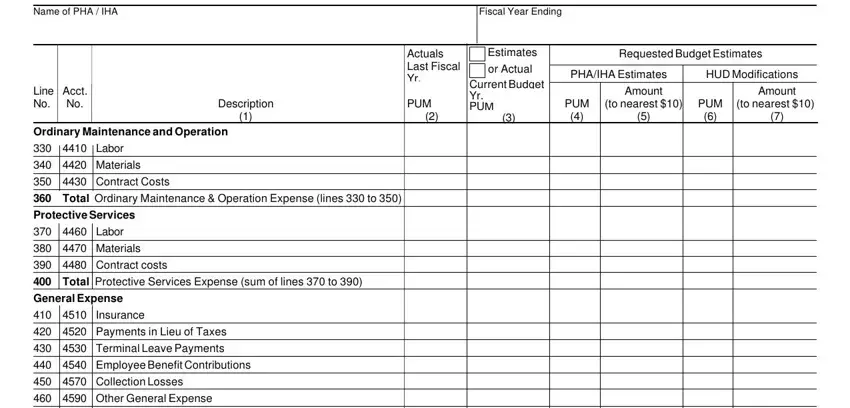

4. This next section requires some additional information. Ensure you complete all the necessary fields - Name of PHA IHA, Fiscal Year Ending, Actuals Last Fiscal Yr PUM, Estimates, or Actual, Current Budget Yr PUM, Requested Budget Estimates, PHAIHA Estimates, HUD Modifications, Amount, Amount, PUM to nearest, PUM to nearest, Line Acct No No, and Description - to proceed further in your process!

People frequently get some points wrong while filling out Estimates in this part. Remember to read again what you type in right here.

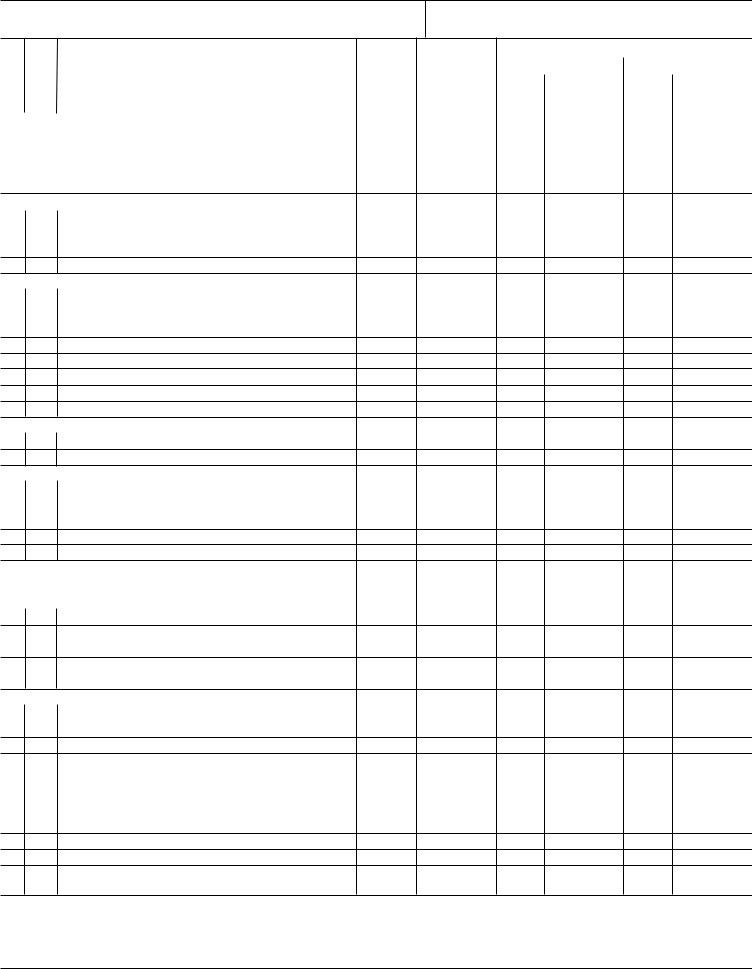

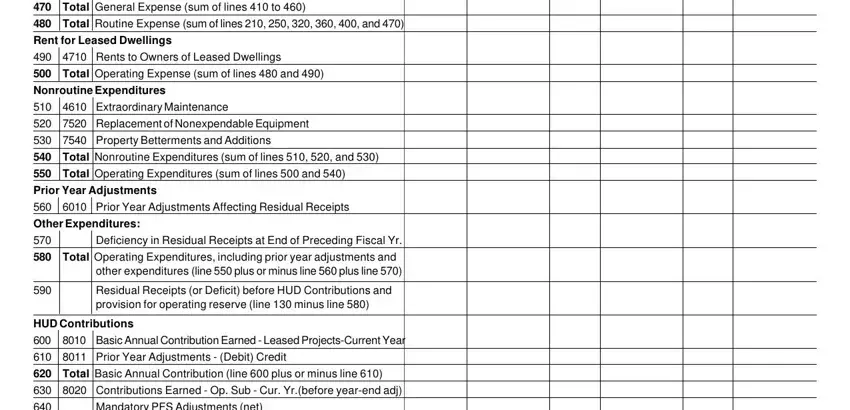

5. As you near the last parts of your form, you will find a few more requirements that need to be met. Mainly, Total General Expense sum of, Total Routine Expense sum of, Rent for Leased Dwellings, Rents to Owners of Leased, Total Operating Expense sum of, Nonroutine Expenditures, Extraordinary Maintenance, Replacement of Nonexpendable, Property Betterments and, Total Nonroutine Expenditures sum, Total Operating Expenditures sum, Prior Year Adjustments, Prior Year Adjustments Affecting, Other Expenditures, and Deficiency in Residual Receipts at must be filled in.

Step 3: Right after going through the fields and details, click "Done" and you're all set! Go for a free trial plan with us and acquire instant access to IHA - with all transformations preserved and accessible from your FormsPal account page. FormsPal guarantees protected document completion devoid of personal data record-keeping or any type of sharing. Be assured that your data is safe with us!