Dealing with PDF forms online is simple using our PDF tool. You can fill in il-1000-e here in a matter of minutes. FormsPal professional team is continuously working to enhance the editor and ensure it is much easier for clients with its many features. Take your experience to a higher level with constantly improving and exceptional opportunities available today! Starting is simple! All you should do is stick to these basic steps down below:

Step 1: Click on the "Get Form" button at the top of this webpage to access our PDF editor.

Step 2: With this advanced PDF tool, you can actually do more than simply complete blanks. Edit away and make your docs appear faultless with customized text incorporated, or fine-tune the original input to excellence - all that supported by the capability to add any type of graphics and sign the document off.

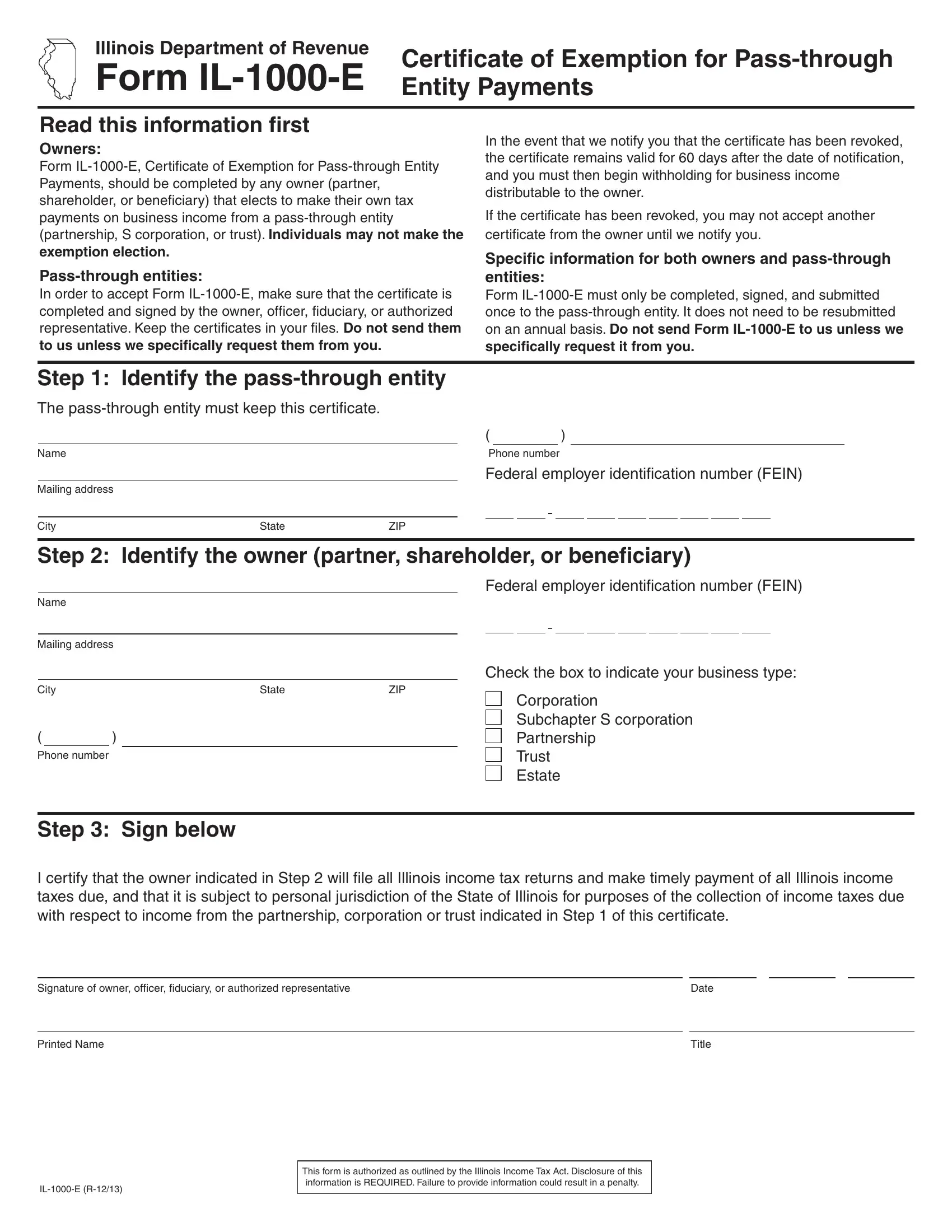

In an effort to finalize this form, ensure that you type in the required details in every single blank:

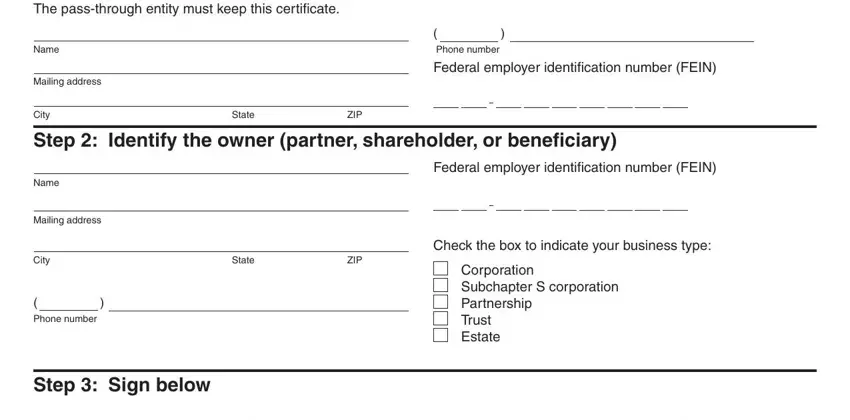

1. Begin filling out the il-1000-e with a selection of major blanks. Get all of the necessary information and make sure there is nothing missed!

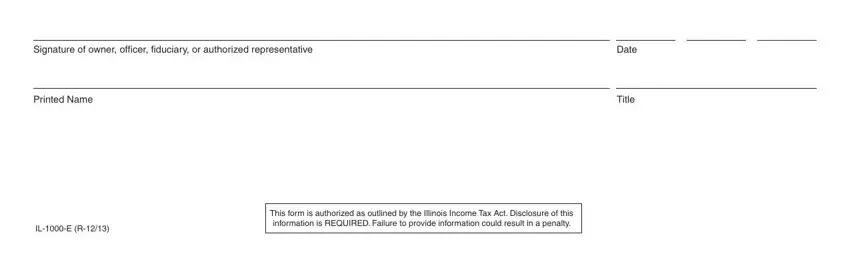

2. Once your current task is complete, take the next step – fill out all of these fields - Signature of owner officer fiduciary, Printed Name, Date, Title, ILE R, and This form is authorized as with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It's easy to make a mistake while filling out your Date, hence make sure to look again before you'll send it in.

Step 3: Confirm that your information is accurate and then simply click "Done" to continue further. Join FormsPal today and immediately use il-1000-e, ready for downloading. Every last modification made is handily kept , allowing you to edit the form at a later time when required. FormsPal ensures your data confidentiality with a secure system that never records or distributes any private data used in the form. You can relax knowing your paperwork are kept protected when you work with our tools!