With the online tool for PDF editing by FormsPal, it is easy to complete or change fillable indiana form st 103 here and now. The editor is constantly maintained by our team, acquiring new awesome functions and turning out to be better. All it requires is a few basic steps:

Step 1: Click on the orange "Get Form" button above. It is going to open our editor so that you could begin completing your form.

Step 2: When you access the online editor, you will see the document all set to be filled out. Aside from filling out different fields, you might also do various other things with the form, such as putting on custom textual content, modifying the initial text, inserting graphics, signing the form, and more.

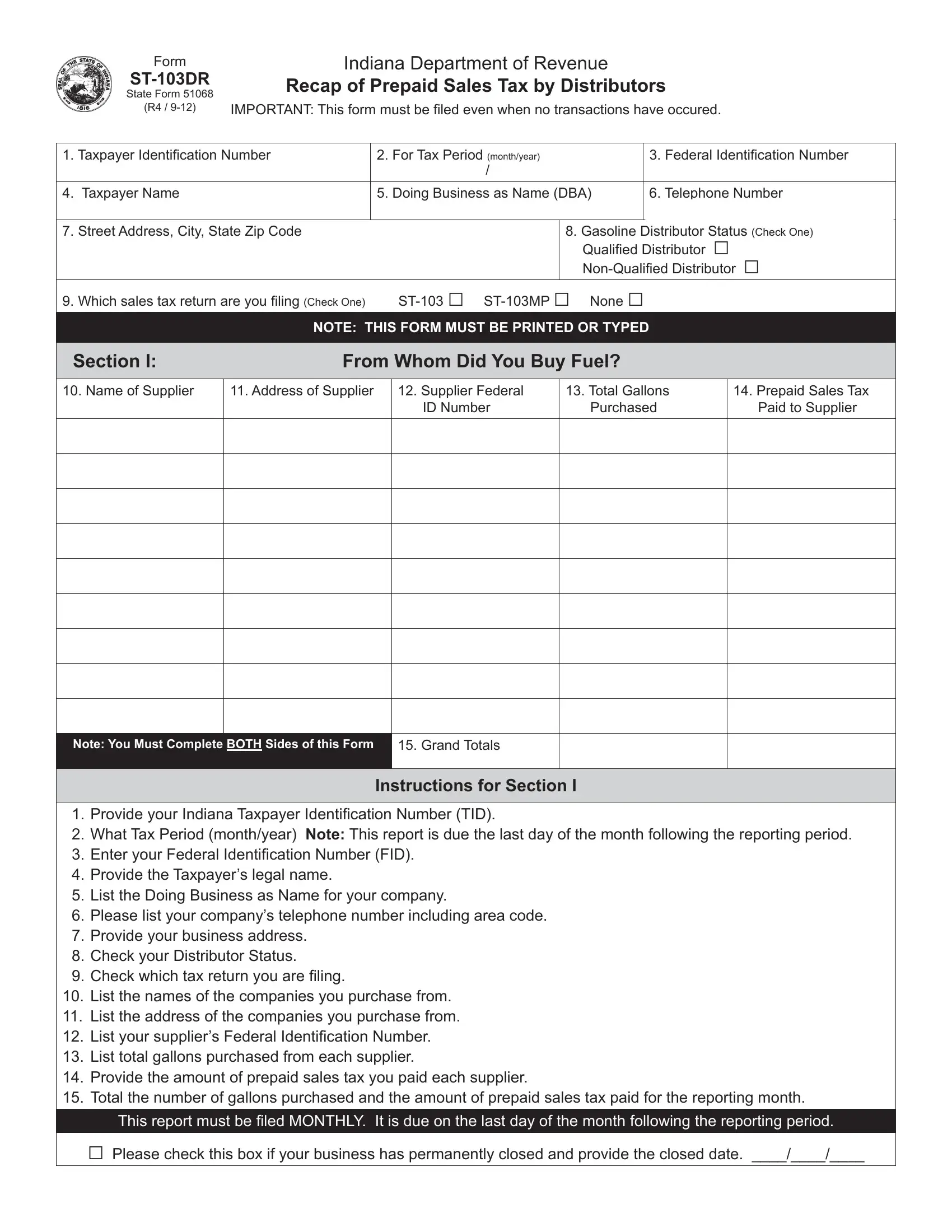

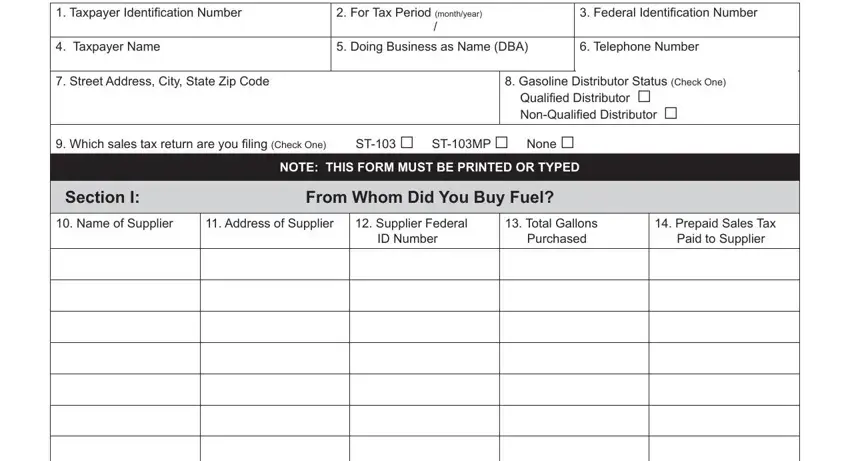

This PDF form requires particular information to be filled out, therefore you should definitely take whatever time to provide precisely what is required:

1. When submitting the fillable indiana form st 103, make sure to include all necessary fields in their relevant form section. This will help to facilitate the work, making it possible for your details to be processed without delay and appropriately.

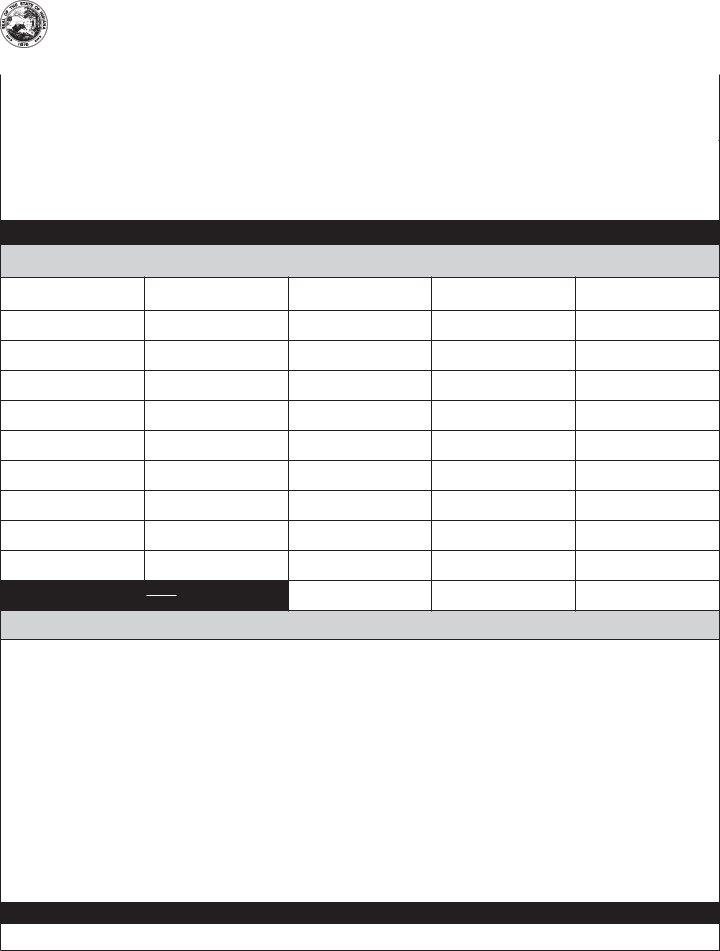

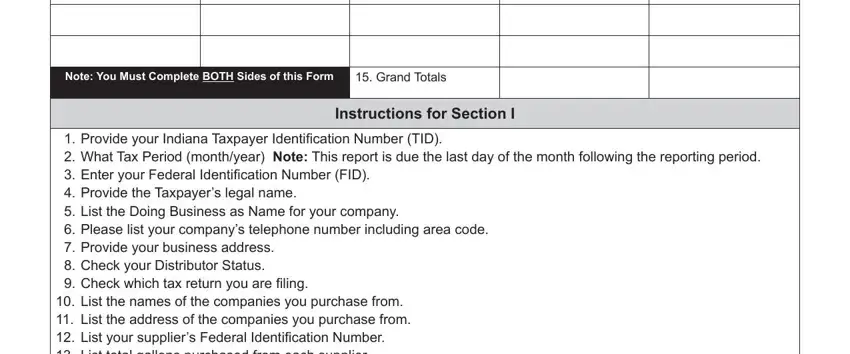

2. The third part would be to complete these particular fields: Note You Must Complete BOTH Sides, Grand Totals, Instructions for Section I, Provide your Indiana Taxpayer, and List the names of the companies.

Always be extremely careful when filling in List the names of the companies and Note You Must Complete BOTH Sides, since this is where a lot of people make some mistakes.

3. The following section will be focused on This report must be fi led MONTHLY, and Please check this box if your - fill out each of these empty form fields.

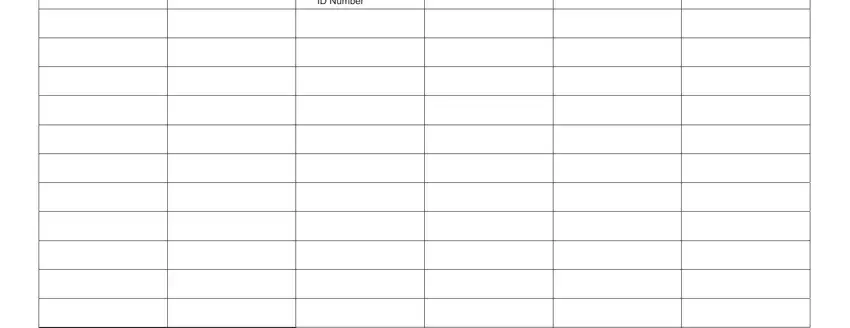

4. The next section requires your information in the following areas: ID Number. Just be sure you give all requested details to go onward.

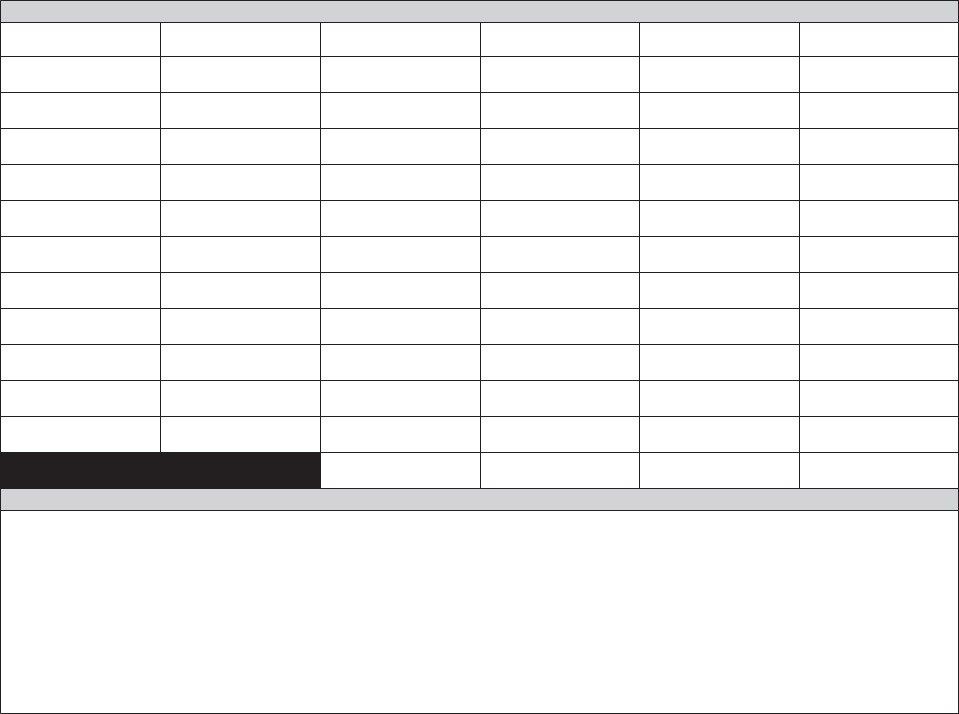

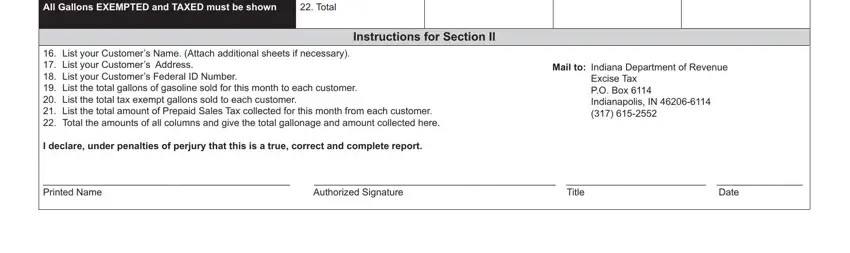

5. The pdf must be finalized by going through this section. Below you'll find an extensive listing of form fields that need accurate information in order for your document usage to be faultless: All Gallons EXEMPTED and TAXED, Total, Instructions for Section II, List your Customers Name Attach, Mail to Indiana Department of, Excise Tax PO Box Indianapolis IN, Printed Name, Authorized Signature, Title, and Date.

Step 3: Right after rereading your entries, press "Done" and you're all set! Right after starting a7-day free trial account with us, you'll be able to download fillable indiana form st 103 or email it immediately. The file will also be readily accessible through your personal account menu with your each modification. We don't sell or share the information that you type in whenever working with forms at our site.