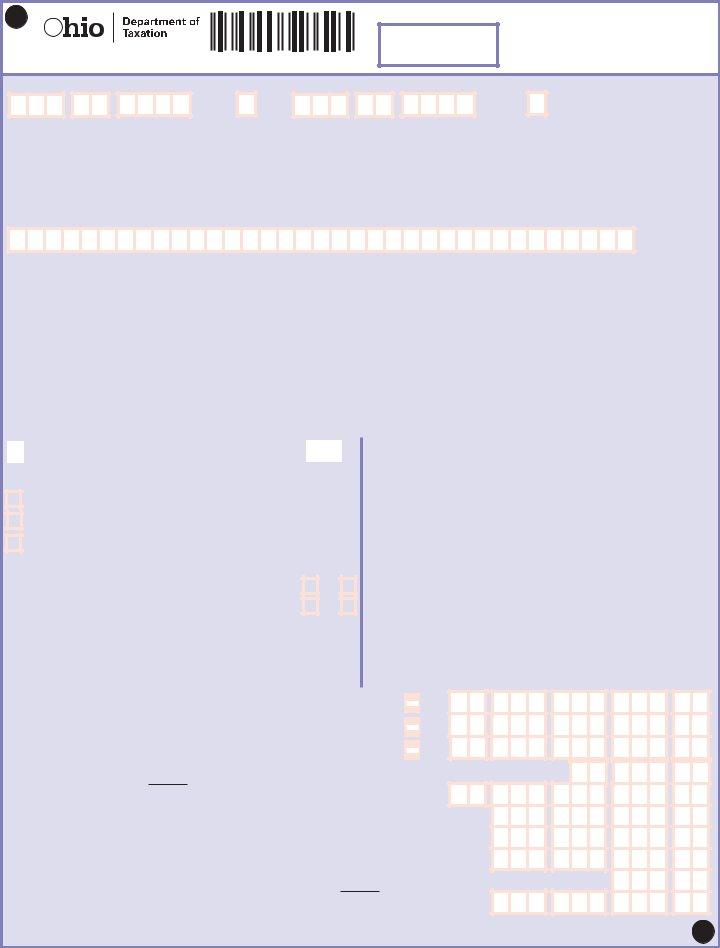

The IT 1040 Ohio form serves as the cornerstone for individual income tax return filings within the state of Ohio, encompassing a wide spectrum of critical sections tailored to capture detailed taxpayer information, income, and tax liability for the taxable year beginning in 2012. Importantly, filers are directed to employ black ink and refrain from using staples, tape, or glue to ensure the processability of their returns. The form meticulously requires the taxpayer's Social Security number—emphasizing the necessity if filing jointly to include the spouse's Social Security number as well—and instructs on the use of uppercase letters for clarity. Addressing residency status, it differentiates between full-year, part-year, and nonresident filers, alongside providing options for filing status that correlate with the federal income tax return. Furthermore, it supports the option to contribute to the Ohio Political Party Fund, reinforcing the state’s encouragement for political engagement without affecting the individual’s tax or refund. Encompassing income adjustments, exemptions, credits, and detailed instructions for calculating Ohio taxable income, the form encompasses schedules for specific tax scenarios, including credits for retirement income, adjustments for non-Ohio residents, and particulars regarding income adjustments. The presentation of the information indicates a comprehensive approach toward ensuring accurate tax liability assessment and facilitating taxpayer participation in state funds, demonstrating a balance between straightforward tax filing procedures and nuanced financial considerations inherent to the Ohio tax system.

| Question | Answer |

|---|---|

| Form Name | Form It 1040 Ohio |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | PIT_IT1040 2012it1040 fillable form |

Do not use staples.

Use only black ink. |

12000102 |

Taxable year beginning in

2012

IT 1040 Rev. 10/12

Individual

Income Tax Return

Taxpayer Social Security no. (required) |

If deceased |

Spouse’s Social Security no. (only if joint return) |

If deceased |

Use UPPERCASE letters. |

check box |

check box |

|

|

Your first name |

M.I. |

|

Last name |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s fi rst name (only if married filing jointly) |

M.I. |

|

Last name |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address (for faster processing, use a street address)

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP code |

Ohio county (fi rst four letters) |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (if different from mailing address) – do NOT show city or state |

|

|

|

|

|

|

|

ZIP code |

|

|

County (fi rst four letters) |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country (provide this information if the mailing address is outside the U.S.) |

|

|

Foreign postal code |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ohio Residency Status – Check applicable box |

Check applicable box for spouse (only if married filing jointly) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

Nonresident |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonresident |

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

resident |

|

|

resident |

|

|

Indicate state |

|

|

|

|

|

|

|

|

|

|

resident |

|

|

|

|

resident |

|

|

Indicate state |

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filing Status – Check one (as reported on federal income tax return) |

|

|

|

Do not use staples, tape or glue. Place your |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

Single or head of household or qualifying widow(er) |

|

|

|

|

|

(payable to Ohio Treasurer of State) and Ohio form |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

Married filing jointly |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IT 40P on top of your return. Include forms |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

Married filing separately |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

documents or statements after the last page of your return. |

||||||||||||||||||||||||||||||||||||||

|

|

|

(enter spouse’s SS#) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ohio Political Party Fund |

|

|

|

|

|

|

|

|

|

Yes No |

|

|

|

|

|

|

|

|

Go paperless. It’s FREE! |

|||||||||||||||||||||||||||||||||||||||||||

|

Do you want $1 to go to this fund? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Visit tax.ohio.gov to try Ohio |

||||||||||||||||||||||||||||||||||||||||||||||||||

|

If joint return, does your spouse want $1 to go to this fund?... |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Note: Checking “Yes” will not increase your tax or decrease your refund. |

|

|

|

Most electronic fi lers receive their refunds |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Ohio School District Number for 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

in |

||||||||||||||||||||||||||||||||||||||||||||||||

|

(see pages |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

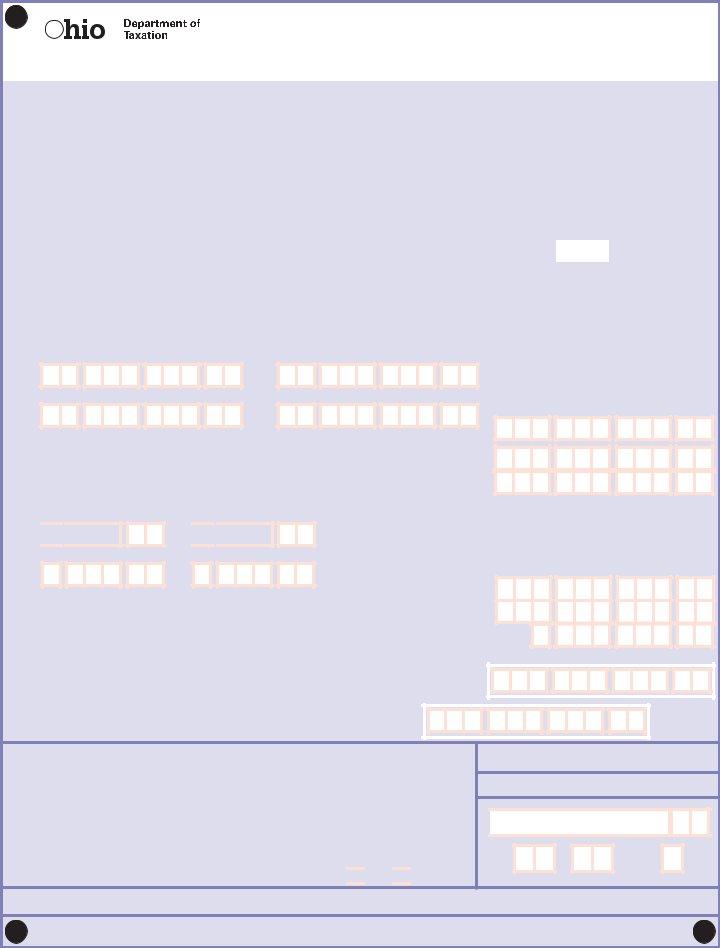

INCOME AND TAX INFORMATION – If amount is negative, shade the negative sign |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Federal adjusted gross income (from IRS form 1040, line 37; 1040A, line 21; |

|

, |

, |

, |

. 0 0 |

||

|

1040EZ, line 4; 1040NR, line 36; or |

.... 1. |

||||||

2. |

Adjustments from line 47 on page 3 of Ohio form IT 1040 (enclose page 3) |

.... 2. |

, |

, |

, |

. 0 0 |

||

3. |

Ohio adjusted gross income (line 2 added to or subtracted from line 1) |

.... 3. |

, |

, |

, |

. 0 0 |

||

4. |

Personal exemption and dependent exemption deduction – multiply your personal |

|

|

|

, |

. 0 0 |

||

|

and dependent exemptions |

times $1,700 and enter the result here |

4. |

|

|

|||

5. |

Ohio taxable income (line 3 minus line 4; enter |

5. |

, |

, |

, |

. 0 0 |

||

6. |

Tax on line 5 (see tax tables on pages |

|

6. |

, |

, |

. 0 0 |

||

7. |

Schedule B credits from line 57 on page 4 of Ohio form IT 1040 (enclose page 4) |

7. |

, |

, |

. 0 0 |

|||

8. |

Ohio tax less Schedule B credits (line 6 minus line 7; enter |

8. |

, |

, |

. 0 0 |

|||

9. |

Exemption credit: Number of personal and dependent exemptions |

times $20 |

9. |

|

|

. 0 0 |

||

10. |

Ohio tax less exemption credit (line 8 minus line 9; enter |

10. |

, |

, |

. 0 0 |

|||

2012 IT 1040

pg. 1 of 4 |

2012 IT 1040 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable year beginning in |

|

IT 1040 Rev. 10/12 |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012 |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

SS# |

|

|

|

|

|

|

|

|

|

|

|

|

12000202 |

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax Return |

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

10a. |

Amount from line 10 on page 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10a. |

|

|

|

|

, |

|

|

|

, |

|

|

|

. |

0 |

0 |

|

|||||||||||||

11. |

Joint filing credit. See the instructions on page 20 for eligibility and documentation requirements |

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

0 |

0 |

|

|||||||||||||||||||||||||||||||||||||

|

(this credit is for married filing jointly status only). |

|

|

|

|

|

|

|

|

% times line 10a (limit $650) |

11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

12. |

Ohio income tax less joint filing credit (line 10a minus line 11) |

...................................................... |

|

|

|

|

|

|

|

|

|

12. |

|

|

|

|

, |

|

|

|

, |

|

|

|

. |

0 |

0 |

|

|||||||||||||||||||||||||||

13. |

Total credits from line 69 on page 4 of Ohio form IT 1040 (enclose page 4) |

13. |

|

|

|

|

, |

|

|

|

, |

|

|

|

. |

0 |

0 |

|

|||||||||||||||||||||||||||||||||||||

14. |

Manufacturing equipment grant. You must include the grant request form |

14. |

|

|

|

|

, |

|

|

|

, |

|

|

|

. |

0 |

0 |

|

|||||||||||||||||||||||||||||||||||||

15. |

Ohio income tax (line 12 minus lines 13 and 14; enter |

|

|

|

|

|

, |

|

|

|

, |

|

|

|

. |

0 |

0 |

|

|||||||||||||||||||||||||||||||||||||

|

than line 12) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

16. |

Interest penalty on underpayment of estimated tax. Enclose Ohio form IT/SD 2210 (see page |

|

|

|

|

|

, |

|

|

|

, |

|

|

|

. |

0 |

0 |

|

|||||||||||||||||||||||||||||||||||||

|

21 of the instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

. |

0 |

0 |

|

|||||||||||||||

17. |

Unpaid Ohio use tax (see the worksheet on page 33 of the instructions) |

17. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

18. |

Total Ohio tax liability (add lines 15, 16 and 17) |

.................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL TAX |

18. |

|

|

|

|

, |

|

|

|

, |

|

|

|

. |

0 |

0 |

|

||||||||||||

19. |

Ohio income tax withheld (box 17 on |

|

|

|

|

|

, |

|

|

|

, |

|

|

|

. |

0 |

0 |

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

AMOUNT WITHHELD |

19. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

20. |

Add the 2012 Ohio form IT 1040ES payment(s), 2012 Ohio form IT 40P extension payment(s) |

|

|

|

|

|

, |

|

|

|

, |

|

|

|

. |

0 |

0 |

|

|||||||||||||||||||||||||||||||||||||

|

and 2011 overpayment credited to 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

21. |

Refundable credits. Include certifi cate(s) and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

a. Business jobs credit |

|

|

|

b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

, |

, |

. 0 0 |

c. Historic preservation credit |

|

|

, |

, |

. 0 0 |

d. Motion picture production credit

, |

, |

. 0 0 |

, |

, |

. 0 0 |

22. Add lines 19, 20 and 21a, b, c and d |

TOTAL PAYMENTS |

22. |

||

If line 22 is MORE THAN line 18, go to line 23. If line 22 is LESS THAN line 18, skip to line 27. |

|

|||

23. |

If line 22 is MORE THAN line 18, subtract line 18 from line 22 |

AMOUNT OVERPAID |

23. |

|

24. |

Amount of line 23 to be credited to 2013 income tax liability |

CREDIT TO 2013 |

24. |

|

25. |

Amount of line 23 that you wish to donate to the following fund(s): |

|

|

|

|

a. Military injury relief |

b. Ohio Historical Society |

|

|

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

,

. 0 0 |

,

. 0 0 |

c. Wildlife species |

d. Natural areas |

|

, |

. 0 0 |

, |

. 0 0 |

|

|

, |

, |

. 0 0 |

26. |

Line 23 minus the sum of lines 24 and 25a, b, c and d. Enter here, then skip to line 28 |

26. |

|||||||

27. |

If line 22 is LESS THAN line 18, subtract line 22 from line 18 |

AMOUNT DUE |

27. |

, |

, |

. 0 0 |

|||

28. |

Interest and penalty due on |

|

, |

, |

. 0 0 |

||||

|

instructions) |

|

INTEREST AND PENALTY |

28. |

|||||

If you entered an amount on line 26, skip to line 30. If you entered an amount on line 27, go to line 29. |

|

|

|

||||||

29. Amount due plus interest and penalty (add lines 27 and 28). If payment is enclosed, make |

|

, |

, |

. 0 0 |

|||||

|

check payable to Ohio Treasurer of State and include Ohio form IT 40P (see our Web site at |

|

|||||||

|

tax.ohio.gov) |

|

AMOUNT DUE PLUS INTEREST AND PENALTY |

29. |

|

|

|

||

30. Refund less interest and penalty (line 26 minus line 28). Enter the amount here. |

, |

, |

. 0 0 |

|

|||||

|

(If line 28 is more than line 26, you have an amount due. Subtract line 26 from |

|

|||||||

|

|

|

|

|

|||||

|

line 28 and enter this amount on line 29.) |

.............................YOUR REFUND |

30. |

|

|

|

|

||

SIGN HERE (required)

I have read this return. Under penalties of perjury, I declare that, to the best of my knowledge and belief, the return and all enclosures are true, correct and complete.

Your signature |

Date |

|

|

Spouse’s signature (see page 10 of the instructions) |

Phone number (optional) |

|

|

Preparer’s printed name (see page 11 of the instructions) |

Phone number |

Do you authorize your preparer to contact us regarding this return? Yes No

If your refund is less than $1.01, no refund will be issued. If you owe less than $1.01, no payment is necessary.

For Department Use Only

, , .

Code

MAILING INFORMATION: |

NO Payment Enclosed – Mail to: Ohio Department of Taxation, P.O. Box 2679, Columbus, OH |

|

Payment Enclosed – Mail to: Ohio Department of Taxation, P.O. Box 2057, Columbus, OH |

||

|

2012 IT 1040

pg. 2 of 4 |

2012 IT 1040 |

|

If line 2 (on page 1) is

SS#

12000302

Taxable year beginning in

2012

IT 1040 Rev. 10/12

Individual

Income Tax Return

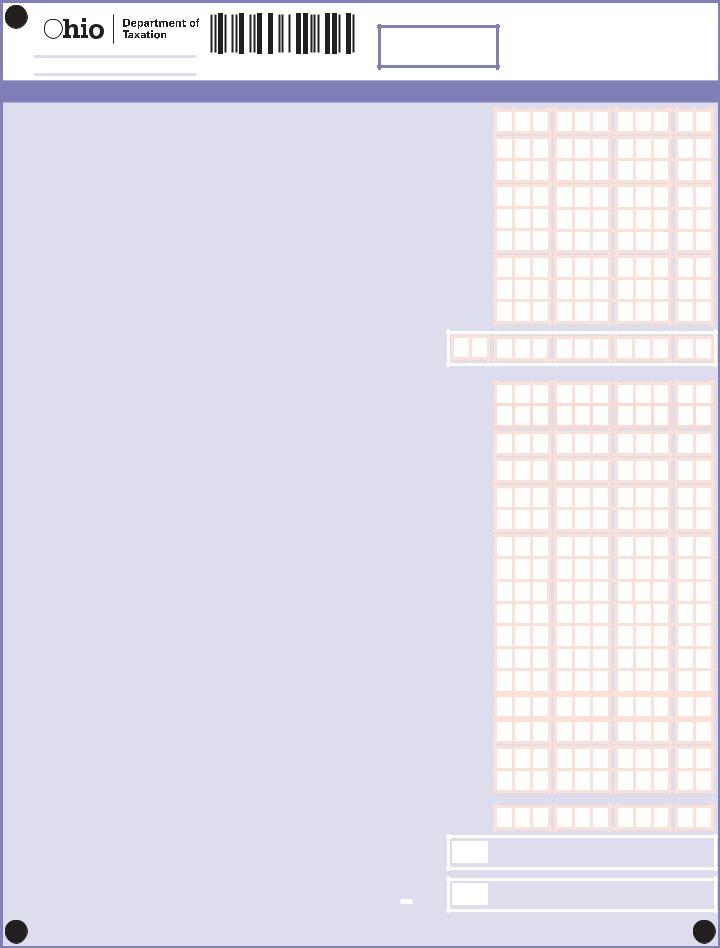

SCHEDULE A – Income Adjustments (Additions and Deductions) |

|

|

|

|

|

|

Additions (add income items only to the extent not included on page 1, line 1). |

|

|

, |

, |

. 0 0 |

|

31. |

31. |

|||||

32. |

Certain |

|

, |

, |

. 0 0 |

|

|

32. |

|||||

33a. |

Federal interest and dividends subject to state taxation |

33a. |

, |

, |

. 0 0 |

|

b. Reimbursement of college tuition expenses and fees deducted in any previous year(s) and |

|

, |

, |

. 0 0 |

||

|

noneducation expenditures from a college savings account |

b. |

||||

c. Losses from sale or disposition of Ohio public obligations |

c. |

, |

, |

. 0 0 |

||

d. Nonmedical withdrawals from a medical savings account |

d. |

, |

, |

. 0 0 |

||

e. Reimbursement of expenses previously deducted for Ohio income tax purposes, but only if |

|

, |

, |

. 0 0 |

||

|

the reimbursement is not in federal adjusted gross income |

e. |

||||

f. Lump sum distribution |

f. |

, |

, |

. 0 0 |

||

g. Adjustment for Internal Revenue Code sections 168(k) and 179 depreciation expense |

g. |

, |

, |

. 0 0 |

||

34. |

Total additions (add lines 31 through 33g and enter here). You must complete the |

|

, |

, |

, |

. 0 0 |

|

applicable line items above |

34. |

|

|

|

|

Deductions (deduct income items only to the extent included on page 1, line 1). |

|

|

|

|

. 0 0 |

|

35a. Federal interest and dividends exempt from state taxation |

35a. |

, |

, |

|||

b. Adjustment for Internal Revenue Code sections 168(k) and 179 depreciation expense |

b. |

, |

, |

. 0 0 |

||

36. |

Employee compensation earned in Ohio by |

, |

, |

. 0 0 |

||

|

income earned by military nonresidents and civilian nonresident spouses |

36. |

||||

37a. |

Military pay for Ohio residents, but only if the military pay is included on line 1 of this return |

|

, |

, |

. 0 0 |

|

|

and is received while the military member was stationed outside Ohio |

37a. |

||||

b. Military retirement income and military injury relief fund amounts included in federal adjusted |

|

, |

, |

. 0 0 |

||

|

gross income (line 1 on page 1) |

b. |

||||

38a. |

State or municipal income tax overpayments shown on IRS form 1040, line 10 |

38a. |

, |

, |

. 0 0 |

|

b. Refund or reimbursements shown on IRS form 1040, line 21 for itemized deductions claimed |

|

, |

, |

. 0 0 |

||

|

on a prior year federal income tax return |

b. |

||||

c. Repayment of income reported in a prior year and miscellaneous federal tax adjustments |

c. |

, |

, |

. 0 0 |

||

39. |

Disability and survivorship benefi ts (do not include pension continuation benefits) |

39. |

, |

, |

. 0 0 |

|

|

|

|

||||

40. |

Qualifying Social Security benefi ts and certain railroad retirement benefits |

40. |

, |

, |

. 0 0 |

|

|

|

|

||||

41a. |

Education: Ohio 529 contributions; tuition credit purchases |

41a. |

, |

, |

. 0 0 |

|

|

|

. 0 0 |

||||

b. |

Pell/Ohio College Opportunity taxable grant amounts used to pay room and board |

b. |

, |

, |

||

42. |

Certain Ohio National Guard reimbursements and benefits |

42. |

, |

, |

. 0 0 |

|

43a. |

Unreimbursed |

|

, |

, |

. 0 0 |

|

|

premiums and excess health care expenses (see worksheet on page 27 of the instructions) ... |

43a. |

||||

b. Funds deposited into, and earnings of, a medical savings account for eligible health care |

|

, |

, |

. 0 0 |

||

|

expenses (see worksheet on page 28 of the instructions) |

b. |

||||

|

|

|

|

|||

c. Qualifi ed organ donor expenses (maximum $10,000 per taxpayer) and amounts contributed |

|

, |

, |

. 0 0 |

||

|

to an individual development account |

c. |

||||

44. |

Wage expense not deducted due to the targeted jobs or the work opportunity tax credits |

44. |

, |

, |

. 0 0 |

|

45. |

Interest income from Ohio public obligations and from Ohio purchase obligations; gains from |

|

|

|

|

|

|

the sale or disposition of Ohio public obligations; public service payments received from the |

|

, |

, |

. 0 0 |

|

|

state of Ohio or income from a transfer agreement |

45. |

||||

46. |

Total deductions (add lines 35a through 45 only). You must complete the applicable |

||

|

line items above |

46. |

|

47. |

Net adjustments – If line 34 is MORE THAN line 46, enter the difference here |

|

|

|

and on line 2 as a positive amount. If line 34 is LESS THAN line 46, enter |

|

.... 47. |

|

|

||

|

the difference here and on line 2 as a negative amount |

|

|

|

|

, |

|

|

|

, |

|

|

|

, |

|

|

|

. |

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

, |

|

|

|

. |

0 |

0 |

2012 IT 1040

pg. 3 of 4 |

2012 IT 1040 |

If line 7 (page 1) and line 13 (page 2) are both

SS# |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12000402 |

||||||||||||||||||||||||

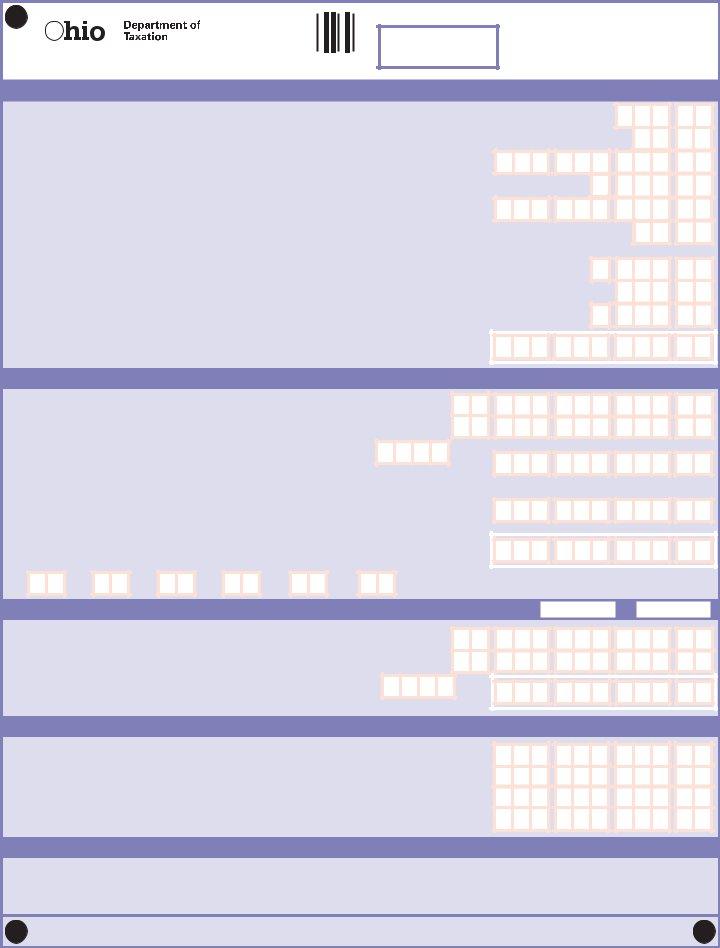

SCHEDULE B – Nonbusiness Credits

Taxable year beginning in

2012

IT 1040 Rev. 10/12

Individual

Income Tax Return

48. |

Retirement income credit (limit $200 per return). See the table on page 29 of the instructions .... |

48. |

|

|

. 0 0 |

|

49. |

Senior citizen credit (you must be 65 or older to claim this credit; limit $50 per return) |

............. |

49. |

|

|

. 0 0 |

50. |

Lump sum distribution credit (you must be 65 or older to claim this credit) |

50. |

, |

, |

. 0 0 |

|

51. |

Child care and dependent care credit (see the worksheet on page 30 of the instructions) |

51. |

|

, |

. 0 0 |

|

52. |

Lump sum retirement credit |

52. |

, |

, |

. 0 0 |

|

53. |

If line 5 on page 1 is $10,000 or less, enter $88; otherwise, enter |

53. |

|

|

. 0 0 |

|

54. |

Displaced worker training credit (see the worksheet and instructions on pages 30 and 31) |

|

|

, |

. 0 0 |

|

|

(limit $500 per taxpayer) |

54. |

|

|||

55. |

Ohio political contributions credit (limit $50 per taxpayer) |

55. |

|

|

. 0 0 |

|

56. |

Ohio adoption credit ($1,500 per child adopted during the year) |

56. |

|

, |

. 0 0 |

|

57. |

Total Schedule B credits (add lines 48 through 56). Enter here and on page 1, line 7 |

57. |

, |

, |

. 0 0 |

|

|

|

|

||||

SCHEDULE C – |

|

|

|

|

|

|

58. |

Enter the portion of line 3 on page 1 subjected to tax by other states or the District of |

|

, |

, |

, |

. 0 0 |

|

Columbia while you are an Ohio resident (limits apply – see page 31 of the instructions).... |

58. |

||||

59. |

Enter Ohio adjusted gross income (line 3 on page 1) |

59. |

, |

, |

, |

. 0 0 |

60. |

Divide line 58 by line 59 and enter the result here (four digits; do not round). . |

|

|

, |

, |

. 0 0 |

|

Multiply this factor by the amount on line 12 on page 2 and enter the result here |

60. |

||||

61. |

Enter the 2012 income tax, less all credits other than withholding and estimated tax payments and |

|

|

|

||

|

overpayment carryforwards from previous years, paid to other states or the District of Columbia |

, |

, |

. 0 0 |

||

|

(limits apply – see page 31 of the instructions) |

61. |

||||

62. |

Enter the smaller of line 60 or line 61. This is your Ohio resident tax credit. Enter here and on |

|

, |

, |

. 0 0 |

|

|

line 67 below. If you fi led a return for 2012 with a state(s) other than Ohio, enter the |

|

||||

|

|

|

|

|

||

|

state abbreviation in the box(es) below |

62. |

|

|

|

|

SCHEDULE D – Nonresident / |

to |

) |

63. |

Enter the portion of Ohio adjusted gross income (line 3) that was not earned or received |

, |

, |

, |

. 0 0 |

||

|

in Ohio. Include Ohio form IT 2023 if required (see page 31 of the instructions) |

63. |

|||||

64. |

Enter the Ohio adjusted gross income (line 3 on page 1) |

64. |

, |

, |

, |

. |

0 0 |

65. |

Divide line 63 by line 64 and enter the result here (four digits; do not round). . |

|

65. |

, |

, |

. |

0 0 |

|

Multiply this factor by the amount on line 12. Enter here and on line 68 below |

|

|

|

|

||

SUMMARY OF CREDITS FROM SCHEDULES C, D AND E

66. |

Enter the amount from line 10 of Schedule E, Nonrefundable Business Credits (see page 32 of |

|

|

the instructions) |

66. |

67. |

Enter the amount from line 62 above |

67. |

68. |

Enter the amount from line 65 above |

68. |

69. |

Add lines 66, 67 and 68. Enter here and on page 2, line 13 |

69. |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

MAILING INFORMATION

NO Payment Enclosed – Mail to:

Ohio Department of Taxation

P.O. Box 2679

Columbus, OH

Enclose your federal income

tax return if line 1 on page 1 of this

return is

Payment Enclosed – Mail to: Ohio Department of Taxation P.O. Box 2057

Columbus, OH

2012 IT 1040

pg. 4 of 4 |

2012 IT 1040 |

|