When you desire to fill out IT-203, there's no need to download any sort of software - just try our PDF tool. To make our editor better and simpler to work with, we continuously work on new features, bearing in mind suggestions from our users. To start your journey, go through these easy steps:

Step 1: Open the form inside our editor by hitting the "Get Form Button" at the top of this webpage.

Step 2: With our online PDF editing tool, you can accomplish more than simply complete forms. Try all of the features and make your forms look sublime with customized textual content put in, or modify the file's original input to excellence - all comes with an ability to insert almost any images and sign the PDF off.

This PDF form will need specific details; to guarantee consistency, please be sure to consider the subsequent suggestions:

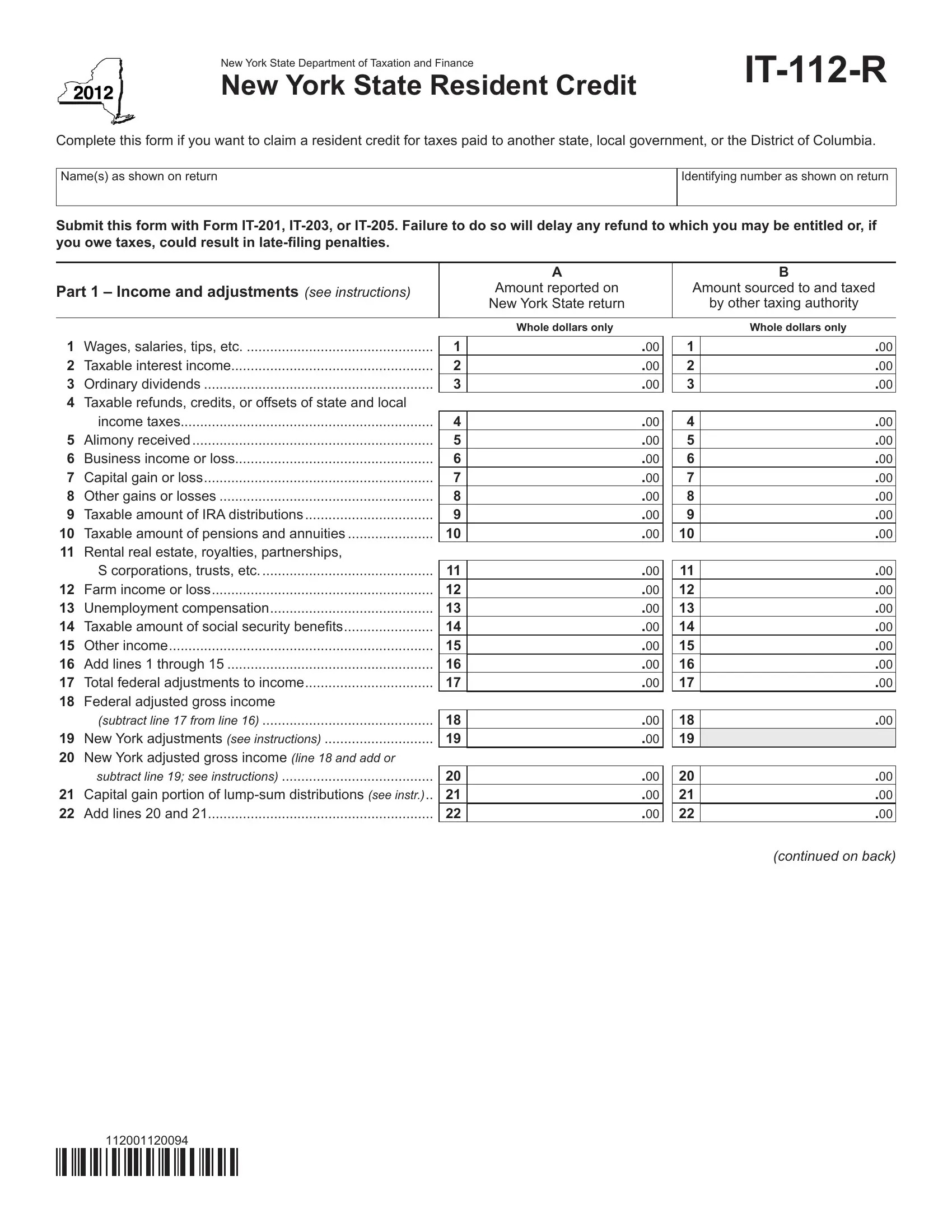

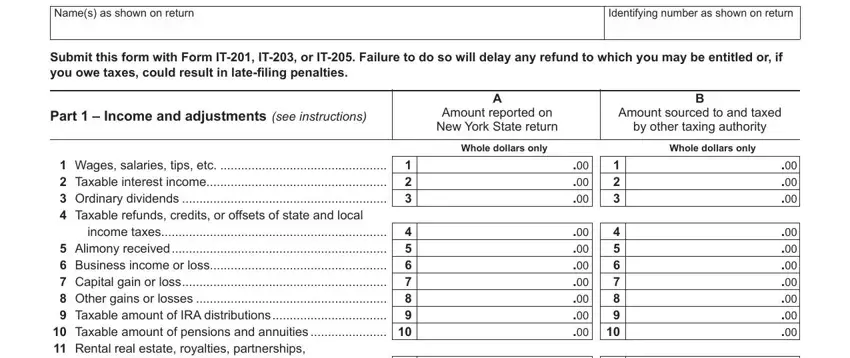

1. You need to complete the IT-203 accurately, hence be mindful when filling out the areas containing these particular fields:

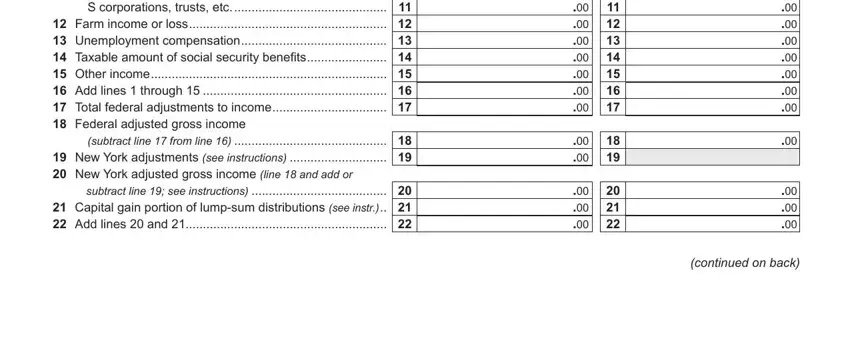

2. Soon after completing this step, head on to the subsequent step and enter the necessary details in all these blanks - continued on back, Wages salaries tips etc, and subtract line see instructions.

As for subtract line see instructions and continued on back, make sure that you double-check them in this section. These could be the most important fields in the document.

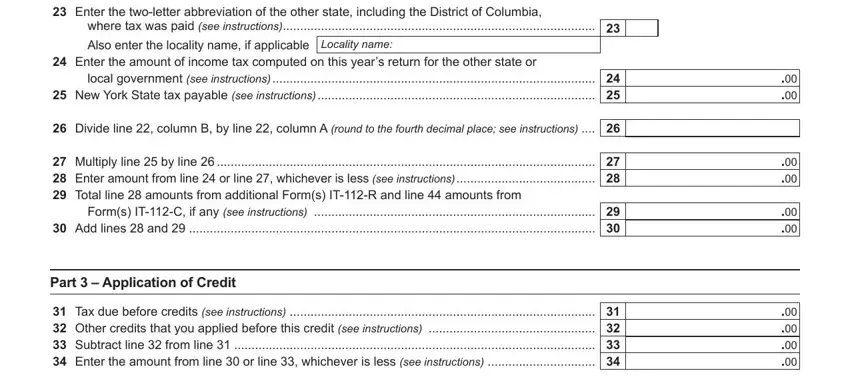

3. Completing Enter the twoletter abbreviation, where tax was paid see, Enter the amount of income tax, Divide line column B by line, Multiply line by line Enter, Part Application of Credit, and Tax due before credits see is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

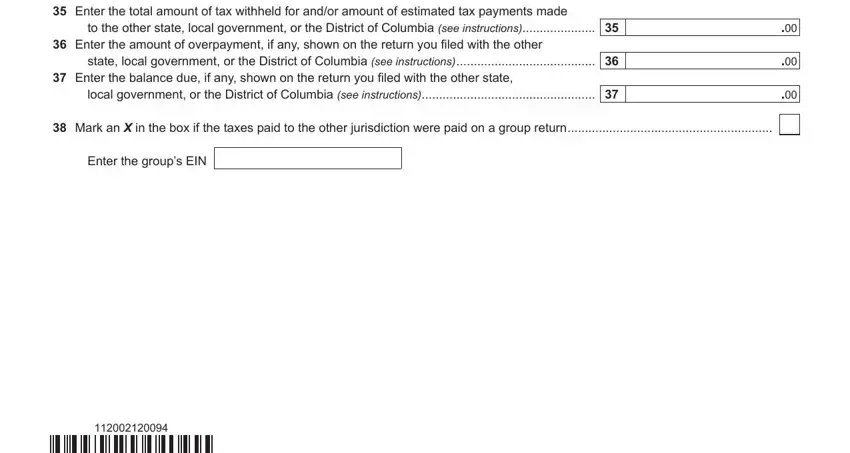

4. This next section requires some additional information. Ensure you complete all the necessary fields - to the other state local, Enter the total amount of tax, state local government or the, local government or the District, Mark an X in the box if the taxes, and Enter the groups EIN - to proceed further in your process!

Step 3: You should make sure the details are right and then click "Done" to conclude the project. After starting afree trial account here, you will be able to download IT-203 or email it right off. The PDF form will also be accessible from your personal account page with all your modifications. Whenever you work with FormsPal, you can fill out documents without the need to worry about data breaches or records being shared. Our secure platform ensures that your personal details are stored safely.