The IT-140 NRC form, significant for facilitating the Direct Deposit of Refunds, plays a critical role for nonresident composite income tax return filings in West Virginia. As the revised document for the year indicates (Revision 04-11), it caters to S Corporations, partnerships, estates, or trusts generating income within West Virginia boundaries. With specified periods for the tax year beginning and ending, it mandates a $50.00 processing fee for each return. It intricately details the taxation process, starting from the total West Virginia source income, through tax calculations at a 6.5% rate, to the declaration of overpayments or balance dues. Notably, the form ensures provisions for withholding tax information from West Virginia incomes, requiring an appended IT-140NRCW schedule for validation without necessarily attaching Schedule K-1(s) or WV/NRW-2s. These components point to a thoughtful structure aimed at easing the filing experience while assuring compliance and precision in tax remittance by nonresident entities. Beyond tax calculations and submissions, the form emphasizes the importance of accurate record-keeping and adherence to procedural mandates, including the election to file a composite return and the implications thereof, ensuring entities are well-versed with their obligations and the applicable filing options. This summary encapsulates the essence of the IT-140 NRC form as a vital document for nonresident income earners in West Virginia, highlighting its application process, requirements, and the critical role it serves in the tax submission framework.

| Question | Answer |

|---|---|

| Form Name | Form It 140 Nrc |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | 2010, VIRGINIA, IT-140NRC, nrc form fill up |

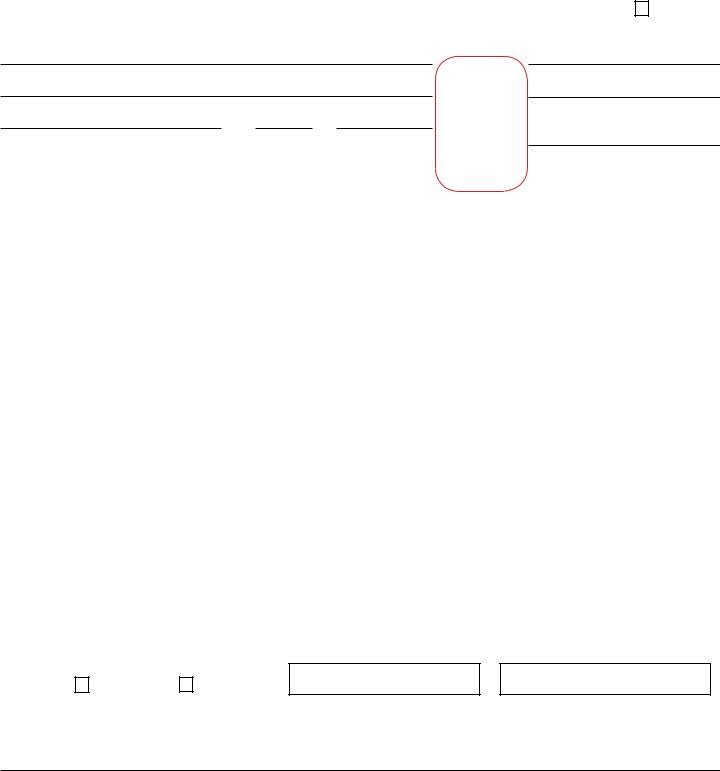

REV |

West Virginia Nonresident COMPOSITE Income Tax Return |

Period |

|

Period |

|

|

Beginning: |

|

Ending: |

|

|

|

|

Amended Return

Name of S Corporation, partnership, estate, or trust

Mailing Address

A processing fee of

$50.00

FEIN

Extended Due Date

|

|

|

City |

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

Entity Type |

|

|

S Corp. |

|

Partnership |

|

Estate or |

|

|

|

|

||||

|

|

|

|

|

|

|

Trust |

|

|

|

|

|

|

|

|

must be submitted |

|

with this return |

Telephone Number |

|

1. |

Total West Virginia Source Income as reported on S corporation, partnership, estate |

1 |

.00 |

|

or trust return |

||

|

|

||

2. |

Tax (line 1 multiplied by 6.5%) |

2 |

.00 |

|

|||

3. |

Composite Return Processing Fee |

3 |

50.00 |

|

|

|

|

4. |

Total Taxes and Fees Due (line 2 plus line 3) |

4 |

.00 |

|

|

|

|

5. |

West Virginia Income Withheld - You must complete the |

5 |

.00 |

|

Nonresident Composite Withholding Tax Schedule to support this amount. |

||

|

|

||

6. |

Estimated Tax Payments and payments made with extensions of time |

6 |

.00 |

|

|

|

|

|

|

|

|

7. |

Total amount from Credit Recap Schedule |

7 |

.00 |

|

|

|

|

8. |

Payment Made With Original Return (Amended Return Only) |

8 |

.00 |

|

|

|

|

9. Sum of Payments (add lines 5 through 8) |

9 |

.00 |

|

|

|

|

|

10. Overpayment previously refunded or credited (Amended Return Only) |

10 |

.00 |

|

|

|

|

|

11. Balance Due the State (subtract line 9 from line 4) |

11 |

.00 |

|

|

* * * Enclose pa ym e nt but do N OT at t a ch! |

||

|

|

||

12. Overpayment (subtract line 4 from line 9) |

12 |

.00 |

|

|

|

|

|

13. Credit to Next Year’s Estimated Tax |

13 |

.00 |

|

|

|

|

|

14. Refund (subtract line 13 from line 12) |

14 |

.00 |

|

|

|

|

|

CHECKING

SAVINGS

ROUTING NUMBERACCOUNT NUMBER

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowl- edge and belief it is true, correct, and complete. If prepared by a person other than the taxpayer, his certiication is based on all information of which he

has any knowledge.

Signature of partner, corporate oficer, trustee, executor, or administrator |

|

Title |

Date |

|

|

|

|

|

|

Signature of preparer other than above |

Date |

Address |

Title |

|

|

MAIL TO: |

|

Charleston, WV |

*p31201001w* |

|

|

|||

|

REFUND |

|

||

|

|

BALANCE DUE |

|

|

|

WV State Tax Department |

WV State Tax Department |

|

|

|

|

|||

Preparer’s EIN |

P.O. Box 1071 |

|

P.O. Box 3694 |

|

|

Charleston, WV |

|

|

|

1

INSTRUCTIONS WEST VIRGINIA COMPOSITE INCOME TAX RETURN

Nonresident individuals who are partners in a partnership, shareholders in a

A composite return is a return iled by a

included in the composite return.

The pass through entity iling a composite return is responsible for maintaining a list, which must set forth the name, address, taxpayer identiication number, and percent of ownership or interest in the

of those nonresident individuals included in the composite return. The list should NOT be submitted with the

composite return, but should be made available to the WV State Tax Department upon request.

There is no requirement that all nonresident distributees join in iling a composite return.

When determining the amount of tax due, West Virginia taxable income is determined as if there is only one taxpayer. No personal exemptions are allowed and tax must be calculated using the 6.5% rate of tax.

If claiming WV withholding transfer the information requested from Schedule

your return, we will send your 140NRC back to you as incomplete. Do not submit your Schedule

A composite return need not be signed by the individuals included in the return. It must be signed by a partner of the partnership, an oficer of the

The

on the return.

An election to ile a composite return does not prevent the nonresident from iling his or her separate nonresident

return, FORM

West Virginia source. If a separate return is iled, the nonresident must include in that return the West Virginia income the nonresident derives from the

his or her share of West Virginia income tax remitted with the composite return (Line 16 Credit Recap Schedule).

Payment of tax can be paid by check, certiied funds, or credit/debit card. If payment is by credit/debit card, call

Corporation, a private credit card payment services provider. A convenience fee of 2.5% will be charged to the

card by the provider. The State receives no part of the fee. Once the transaction is complete, a conirmation

number bill be given to show the payment was received.

Contact the Taxpayer Services Division at (304)

2

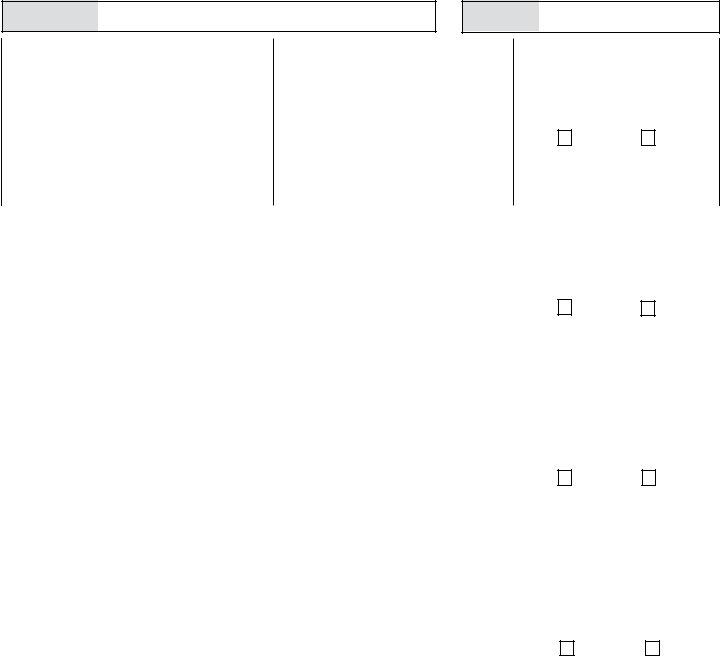

2010 West Virginia Non Resident Composite |

|

Withholding Tax Schedule |

|

|

|

Do NOT send

Enter WV withholding information below.

PRIMARY LAST NAME

SHOWN ON FORM

SOCIAL

SECURITY NUMBER

1 |

A - Employer or Payer Information |

B - Employee or Taxpayer Information |

C - WV Tax Withheld |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer or payer ID from |

|

|

|

|

Name |

WV WITHOLDING |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Check appropriate box. |

|||

|

Employer or payer name |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

Social Security Number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

Enter State Abbreviation |

||

|

|

|

|

|

|

|

|

|

|

|

Enter WV withholding only |

|||||

|

City, State, ZIP |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

Income Subject to WV WITHHOLDING |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

A - Employer or Payer Information |

|

|

|

B - Employee or Taxpayer Information |

|

|

C - WV Tax Withheld |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer or payer ID from |

|

|

|

|

Name |

|

WV WITHOLDING |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Check appropriate box. |

|||

|

Employer or payer name |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

Social Security Number |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter State Abbreviation |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Enter WV withholding only |

|||||

|

City, State, ZIP |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

Income Subject to WV WITHHOLDING |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

A - Employer or Payer Information |

|

|

|

B - Employee or Taxpayer Information |

|

|

C - WV Tax Withheld |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer or payer ID from |

|

|

|

|

Name |

|

WV WITHOLDING |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Check appropriate box. |

|||

|

Employer or payer name |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

Social Security Number |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter State Abbreviation |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Enter WV withholding only |

|||||

|

City, State, ZIP |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

Income Subject to WV WITHHOLDING |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

A - Employer or Payer Information |

|

|

|

B - Employee or Taxpayer Information |

|

|

C - WV Tax Withheld |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Employer or payer ID from |

|

|

|

|

Name |

|

WV WITHOLDING |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Check appropriate box. |

|||

|

Employer or payer name |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

Social Security Number |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter State Abbreviation |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Enter WV withholding only |

|||||

|

City, State, ZIP |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

Income Subject to WV WITHHOLDING |

|

|

|||||||||

Total WV tax withheld from column C above |

|

|

|

|

|

|

.00 |

|

||||||||

|

|

|

|

|

|

|||||||||||

If you have WV withholding on multiple pages, add the totals together and enter the GRAND total on line 5, Form

*p31201002w*

3

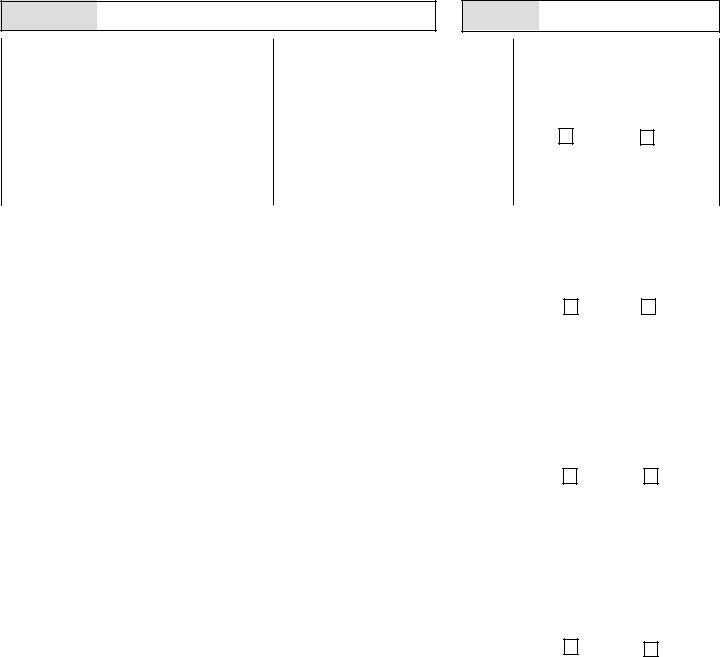

2010 West Virginia Non Resident Composite |

|

Withholding Tax Schedule |

|

|

|

Do NOT send

Enter WV withholding information below.

PRIMARY LAST NAME

SHOWN ON FORM

SOCIAL

SECURITY NUMBER

1 |

A - Employer or Payer Information |

B - Employee or Taxpayer Information |

C - WV Tax Withheld |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer or payer ID from |

|

|

|

|

Name |

WV WITHOLDING |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Check appropriate box. |

|||

|

Employer or payer name |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

Social Security Number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter State Abbreviation |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Enter WV withholding only |

|||||

|

City, State, ZIP |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

Income Subject to WV WITHHOLDING |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

A - Employer or Payer Information |

|

|

|

B - Employee or Taxpayer Information |

|

|

C - WV Tax Withheld |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer or payer ID from |

|

|

|

|

Name |

|

WV WITHOLDING |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Check appropriate box. |

|||

|

Employer or payer name |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

Social Security Number |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

Enter State Abbreviation |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Enter WV withholding only |

|||||

|

City, State, ZIP |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

Income Subject to WV WITHHOLDING |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

A - Employer or Payer Information |

|

|

|

B - Employee or Taxpayer Information |

|

|

C - WV Tax Withheld |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer or payer ID from |

|

|

|

|

Name |

|

WV WITHOLDING |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Check appropriate box. |

|||

|

Employer or payer name |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

Social Security Number |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

Enter State Abbreviation |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Enter WV withholding only |

|||||

|

City, State, ZIP |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

Income Subject to WV WITHHOLDING |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

A - Employer or Payer Information |

|

|

|

B - Employee or Taxpayer Information |

|

|

C - WV Tax Withheld |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Employer or payer ID from |

|

|

|

|

Name |

|

WV WITHOLDING |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Check appropriate box. |

|||

|

Employer or payer name |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

Social Security Number |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter State Abbreviation |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Enter WV withholding only |

|||||

|

City, State, ZIP |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

Income Subject to WV WITHHOLDING |

|

|

|||||||||

Total WV tax withheld from column C above |

|

|

|

|

|

|

.00 |

|

||||||||

|

|

|

|

|

|

|||||||||||

If you have WV withholding on multiple pages, add the totals together and enter the GRAND total on line 5, Form

4*p31201002w*

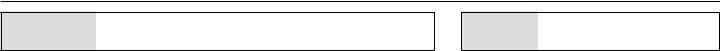

RECAP

2010 West Virginia NRC Tax Credit Recap Schedule

PRIMARY LAST

NAME SHOWN ON FORM

SOCIAL

SECURITY

NUMBER

This form is used to summarize the tax credit(s) that you may claim against your tax. In addition to completing this summary form, each tax credit has a schedule or form that is used to determine the amount of credit that can be claimed. Both this summary form and the appropriate credit calculation schedule(s) or form(s) MUST BE ENCLOSED with your return. Note:

If you are claiming Schedule E credit(s), the other state(s) tax return is no longer required to be enclosed for each Schedule E credit claimed. You MUST maintain a copy of the other state(s) return in your iles.

|

|

TAX CREDIT |

SCHEDULE |

APPLICABLE CREDIT |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Credit for income paid to another state (enter state postal |

E |

1 |

.00 |

||||||||||

|

abbreviation) |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

For What States? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Business Investment and Jobs Expansion Credit |

2 |

.00 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

General Economic Opportunity Tax Credit |

3 |

.00 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Strategic Research and Development Tax Credit |

4 |

.00 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

5 |

.00 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

West Virginia Agricultural Equipment Credit |

6 |

.00 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

West Virginia Military Incentive Credit |

J |

7 |

.00 |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

West Virginia Capital Company Credit |

CCP |

8 |

.00 |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

9 |

.00 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

Neighborhood Investment Program Credit |

10 |

.00 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

Historic Rehabilitated Buildings Investment Credit |

RBIC |

11 |

.00 |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

Qualiied Rehabilitated Buildings Investment Credit |

12 |

.00 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

West Virginia Film Industry Investment Tax Credit |

13 |

.00 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Apprenticeship Training Tax Credit |

14 |

.00 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

Solar Energy Tax Credit |

WV/SETC |

15 |

.00 |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

Non Resident Withholding paid on PTE (passthrough) |

|

16 |

.00 |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

TOTAL CREDITS |

|

17 |

.00 |

||||||||||

|

on form |

|

||||||||||||

|

|

|

||||||||||||

*p31201003W*

5