When you need to fill out Form It 20, you don't need to install any kind of applications - just make use of our PDF tool. The tool is consistently improved by our staff, acquiring useful functions and growing to be much more convenient. To begin your journey, take these simple steps:

Step 1: Just click on the "Get Form Button" in the top section of this webpage to start up our pdf file editor. This way, you will find everything that is needed to fill out your document.

Step 2: Once you access the online editor, you will find the form prepared to be filled out. Other than filling in different blanks, you could also perform some other actions with the file, specifically writing custom textual content, changing the initial text, inserting graphics, signing the document, and a lot more.

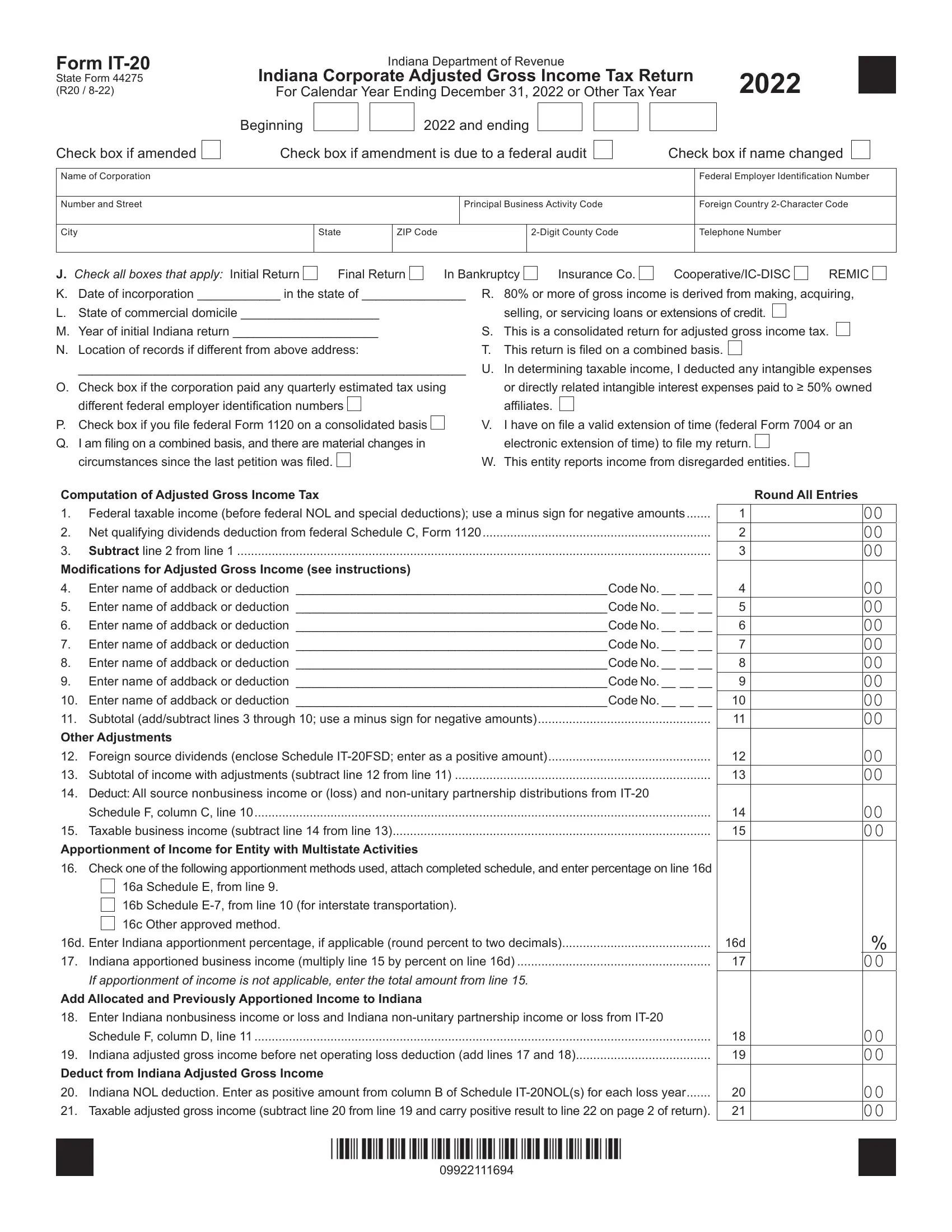

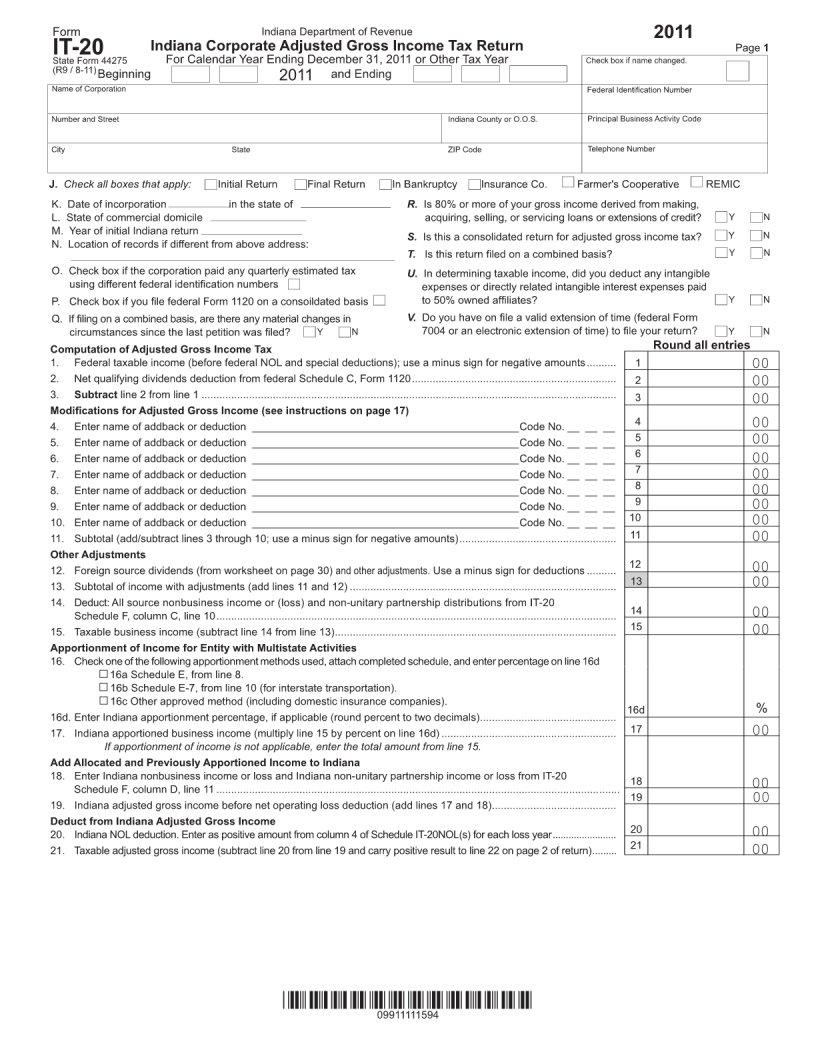

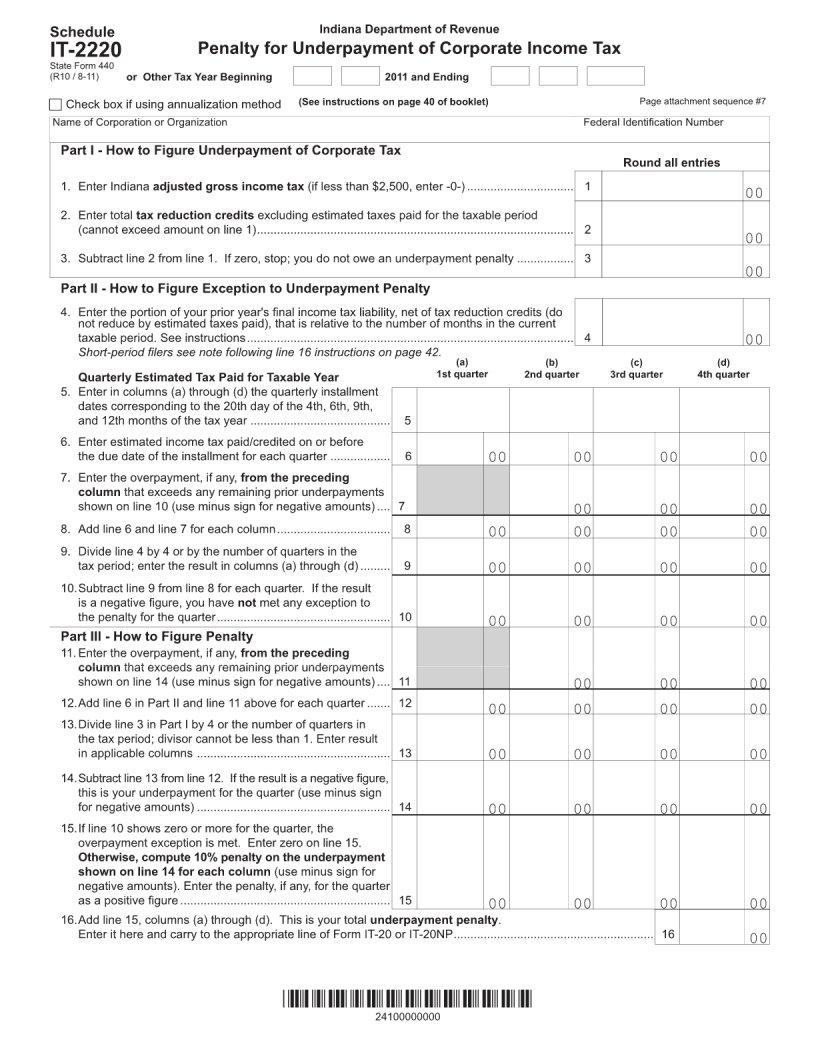

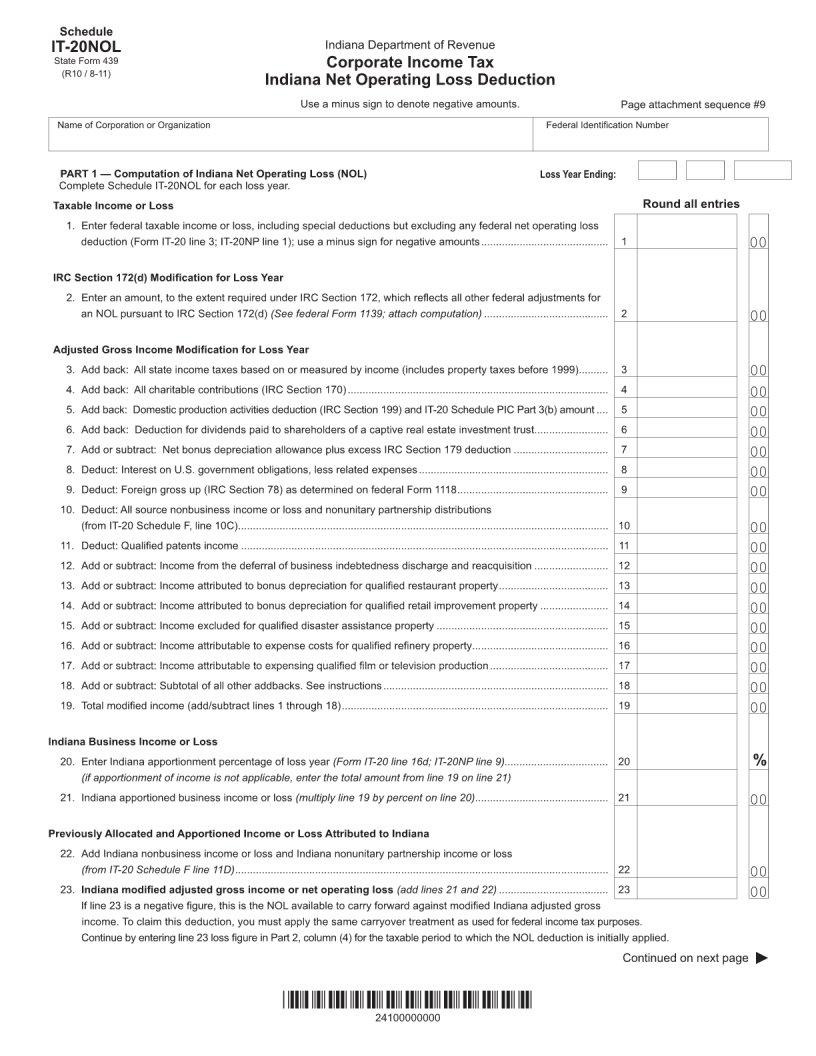

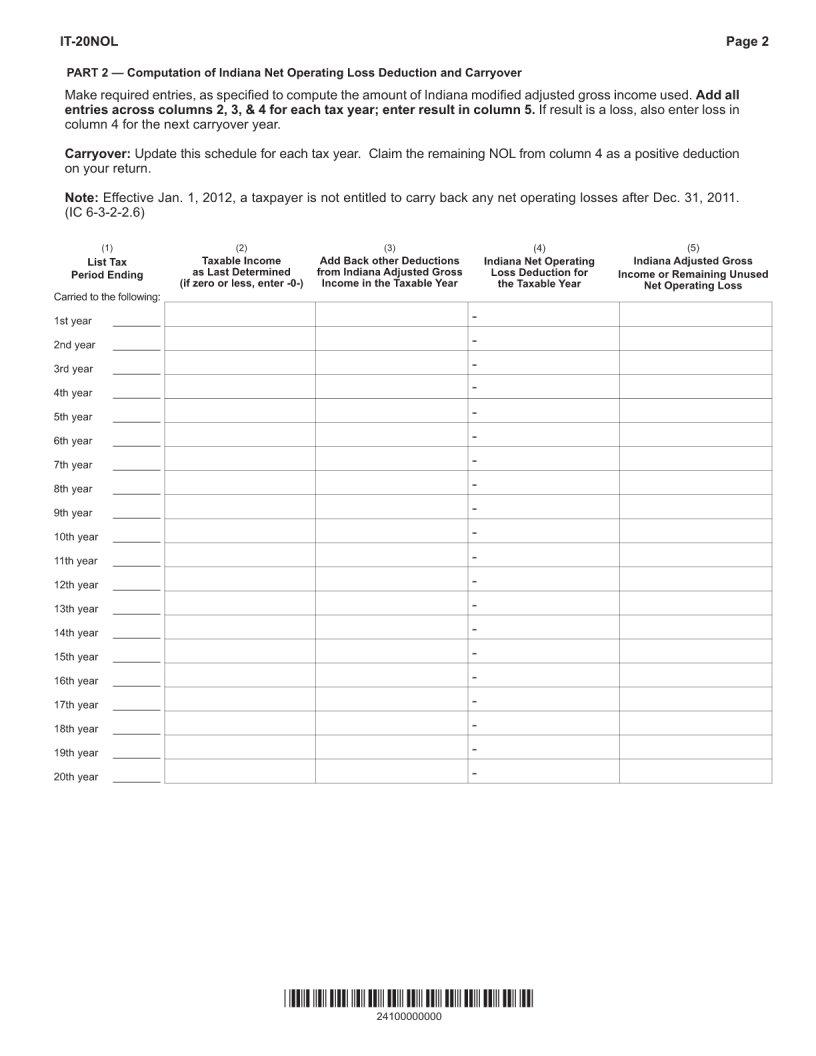

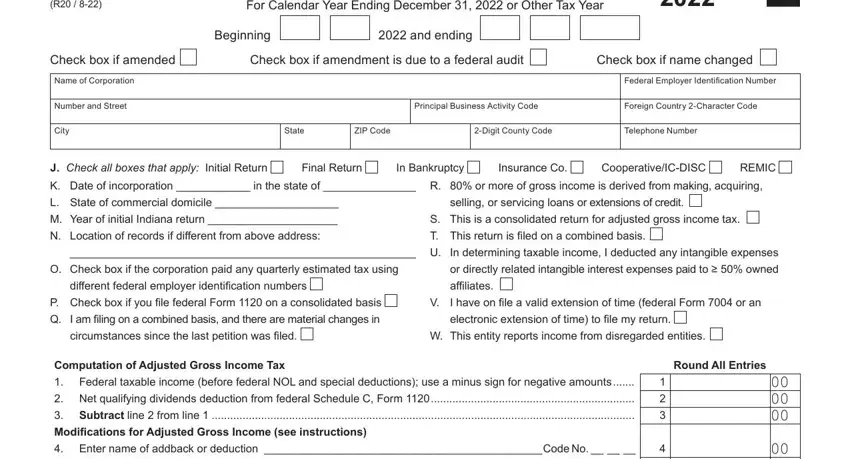

When it comes to fields of this particular form, here is what you need to know:

1. Fill out your Form It 20 with a selection of major fields. Get all of the important information and be sure there's nothing forgotten!

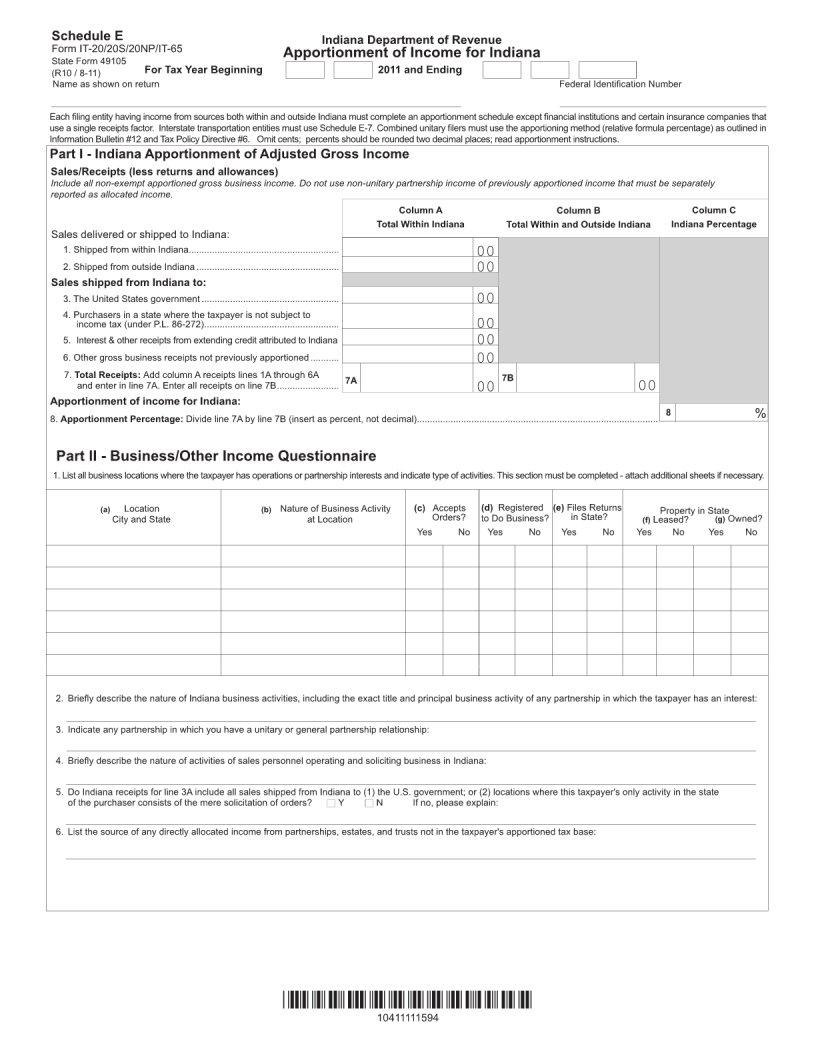

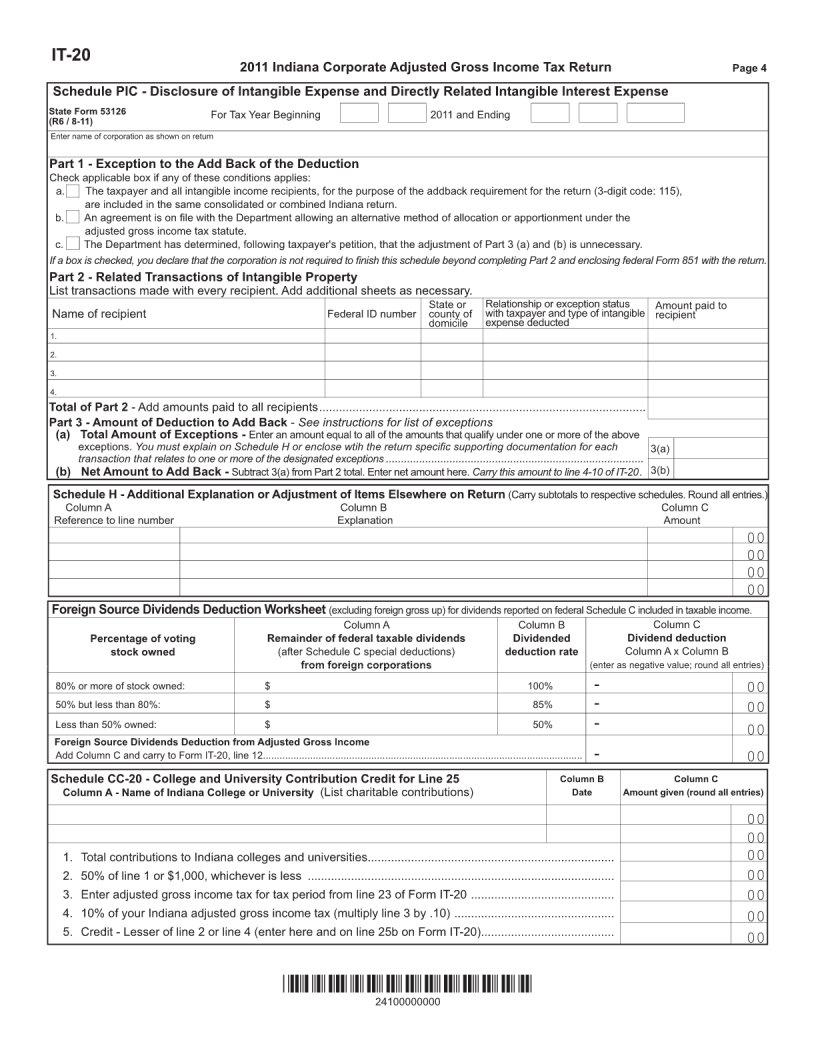

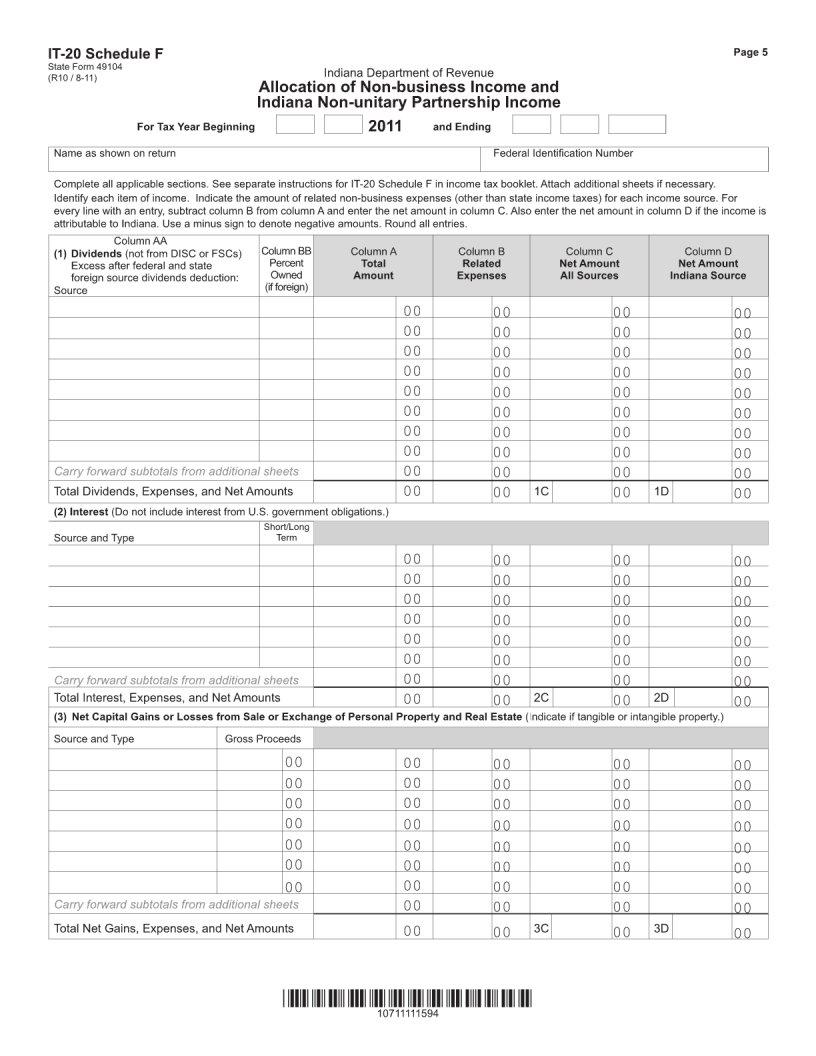

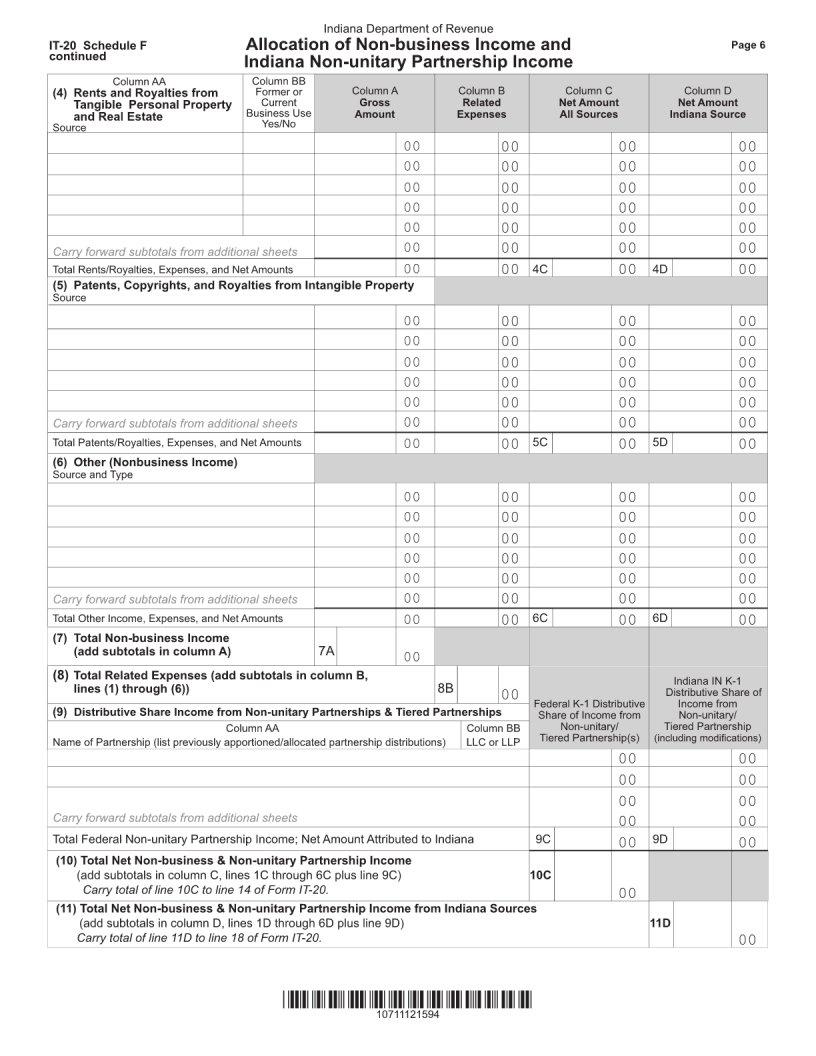

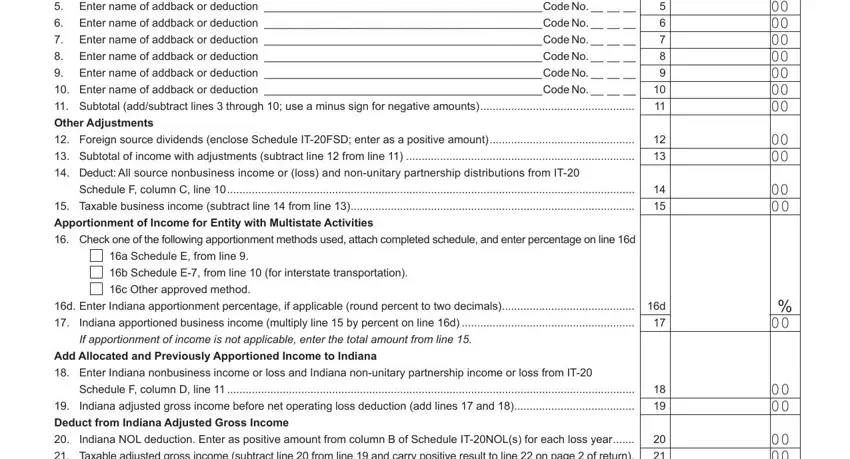

2. The third stage is usually to complete these particular blank fields: Enter name of addback or, Enter name of addback or, Enter name of addback or, Enter name of addback or, Enter name of addback or, Enter name of addback or, Subtotal addsubtract lines, Other Adjustments, Foreign source dividends enclose, Subtotal of income with, Schedule F column C line, Taxable business income subtract, Apportionment of Income for Entity, Check one of the following, and a Schedule E from line.

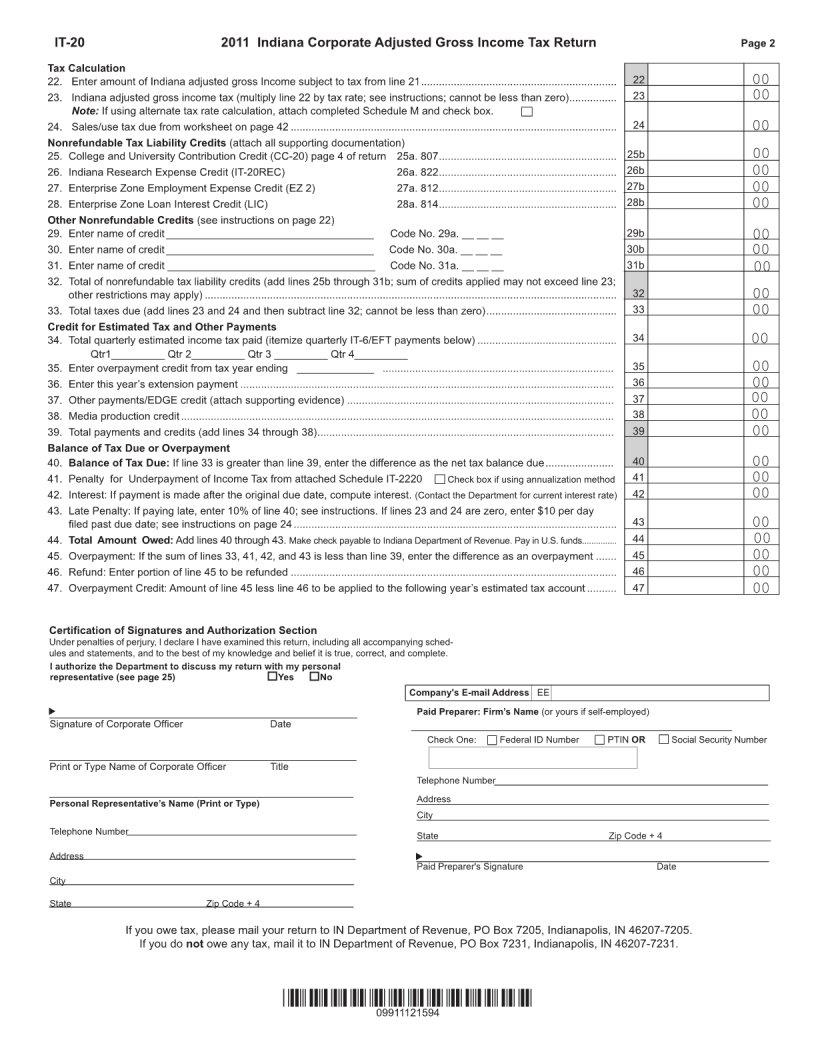

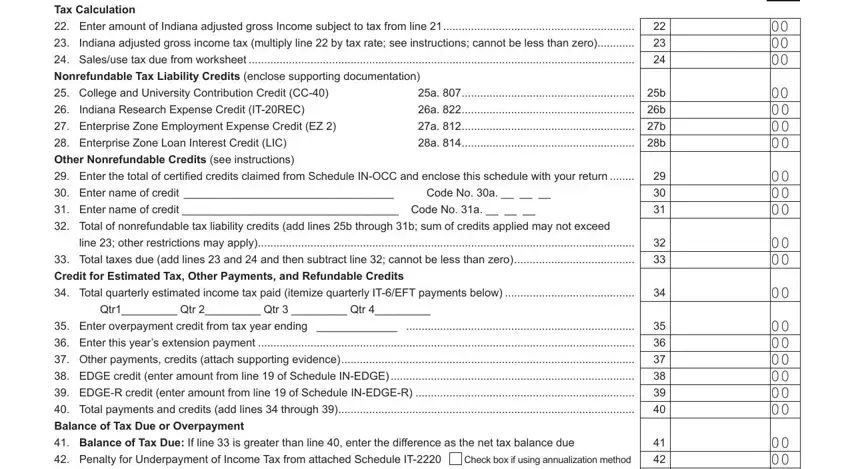

3. This next portion will be focused on Tax Calculation, Enter amount of Indiana adjusted, Indiana adjusted gross income tax, Salesuse tax due from worksheet, Nonrefundable Tax Liability, College and University, Indiana Research Expense Credit, Enterprise Zone Employment, Enterprise Zone Loan Interest, Other Nonrefundable Credits see, Code No a, Enter name of credit Code No a, Total of nonrefundable tax, line other restrictions may apply, and Total taxes due add lines and - fill in all these fields.

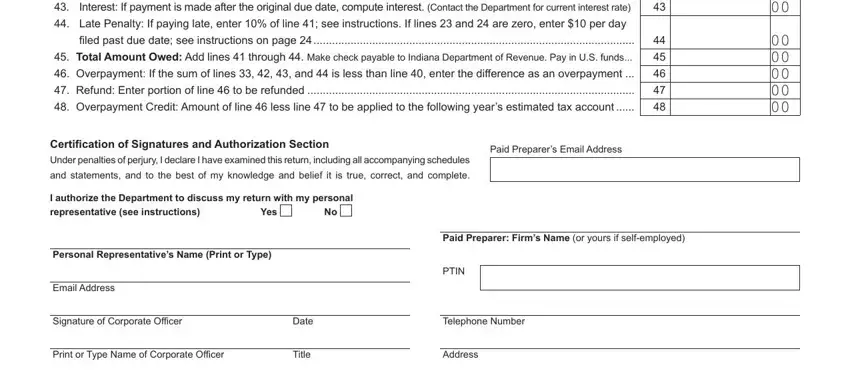

4. This next section requires some additional information. Ensure you complete all the necessary fields - Balance of Tax Due or Overpayment, filed past due date see, Certification of Signatures and, and statements and to the best of, Paid Preparers Email Address, I authorize the Department to, Yes, Paid Preparer Firms Name or yours, Personal Representatives Name, Email Address, Signature of Corporate Officer, Print or Type Name of Corporate, Date, Title, and PTIN - to proceed further in your process!

Always be very attentive while completing Signature of Corporate Officer and Title, as this is where many people make some mistakes.

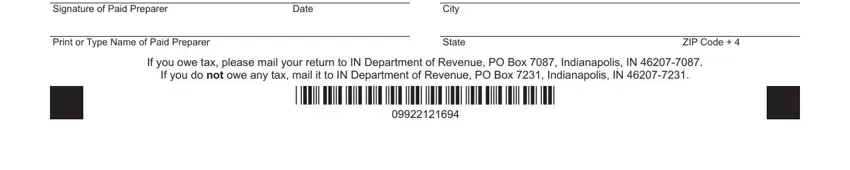

5. This very last step to conclude this PDF form is essential. You need to fill in the required form fields, such as Signature of Paid Preparer, Print or Type Name of Paid Preparer, Date, City, State, ZIP Code, If you owe tax please mail your, and If you do not owe any tax mail it, before submitting. If not, it might lead to an incomplete and possibly invalid paper!

Step 3: Right after you've reviewed the details you filled in, just click "Done" to complete your form at FormsPal. Make a 7-day free trial subscription with us and get direct access to Form It 20 - download or modify from your FormsPal account page. FormsPal is focused on the privacy of our users; we ensure that all information entered into our editor continues to be confidential.