Dealing with PDF documents online is a breeze using our PDF tool. Anyone can fill in Form It 205 V here painlessly. The tool is continually improved by us, receiving new features and growing to be greater. By taking several basic steps, you can begin your PDF editing:

Step 1: Open the PDF form inside our tool by hitting the "Get Form Button" at the top of this webpage.

Step 2: With this advanced PDF file editor, you're able to accomplish more than simply fill out blank form fields. Edit away and make your forms look perfect with custom text put in, or tweak the file's original input to excellence - all comes with the capability to incorporate almost any photos and sign the PDF off.

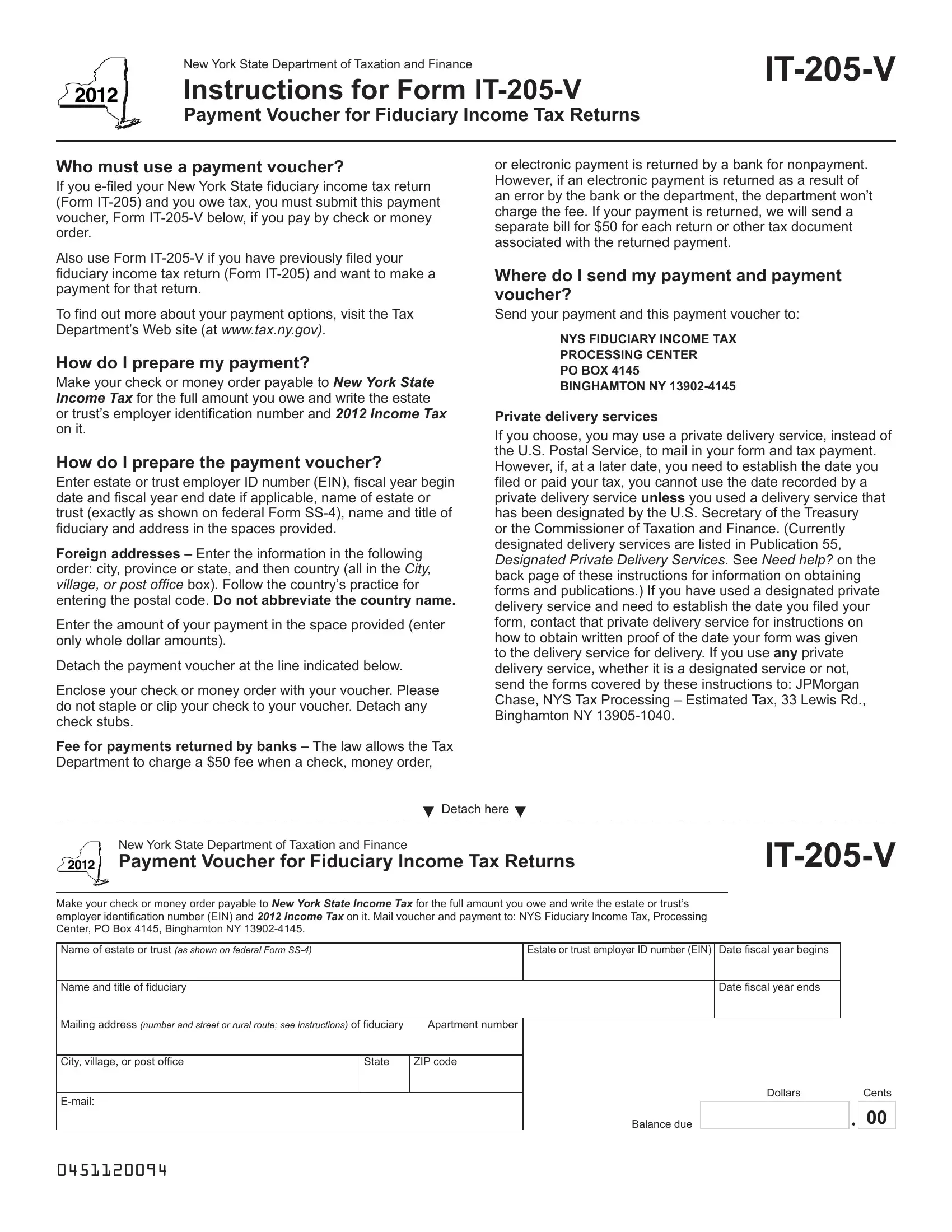

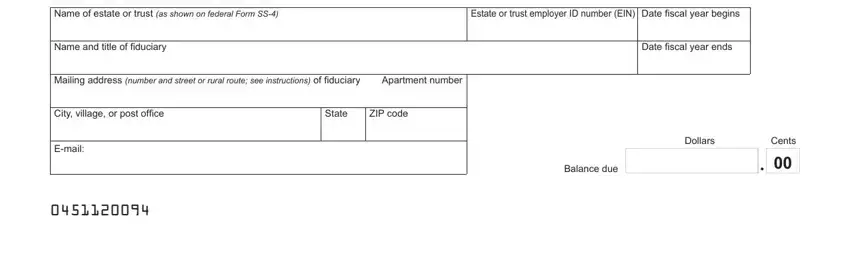

This PDF form will require particular information to be typed in, so you need to take your time to fill in exactly what is asked:

1. Firstly, when completing the Form It 205 V, start with the section that contains the subsequent blanks:

Step 3: Prior to getting to the next stage, check that blanks are filled in the correct way. Once you are satisfied with it, press “Done." Right after getting afree trial account with us, you will be able to download Form It 205 V or email it directly. The form will also be available in your personal cabinet with your modifications. Here at FormsPal.com, we do our utmost to ensure that your details are kept private.