You may complete it2104 1 form instantly in our online tool for PDF editing. We are devoted to making sure you have the absolute best experience with our editor by regularly introducing new features and enhancements. With these improvements, using our tool gets easier than ever before! If you are seeking to get started, here's what it's going to take:

Step 1: Open the PDF file inside our tool by pressing the "Get Form Button" above on this page.

Step 2: Once you start the editor, you will find the document made ready to be completed. In addition to filling in various blanks, you might also perform many other things with the form, namely writing custom text, changing the original textual content, inserting graphics, putting your signature on the document, and much more.

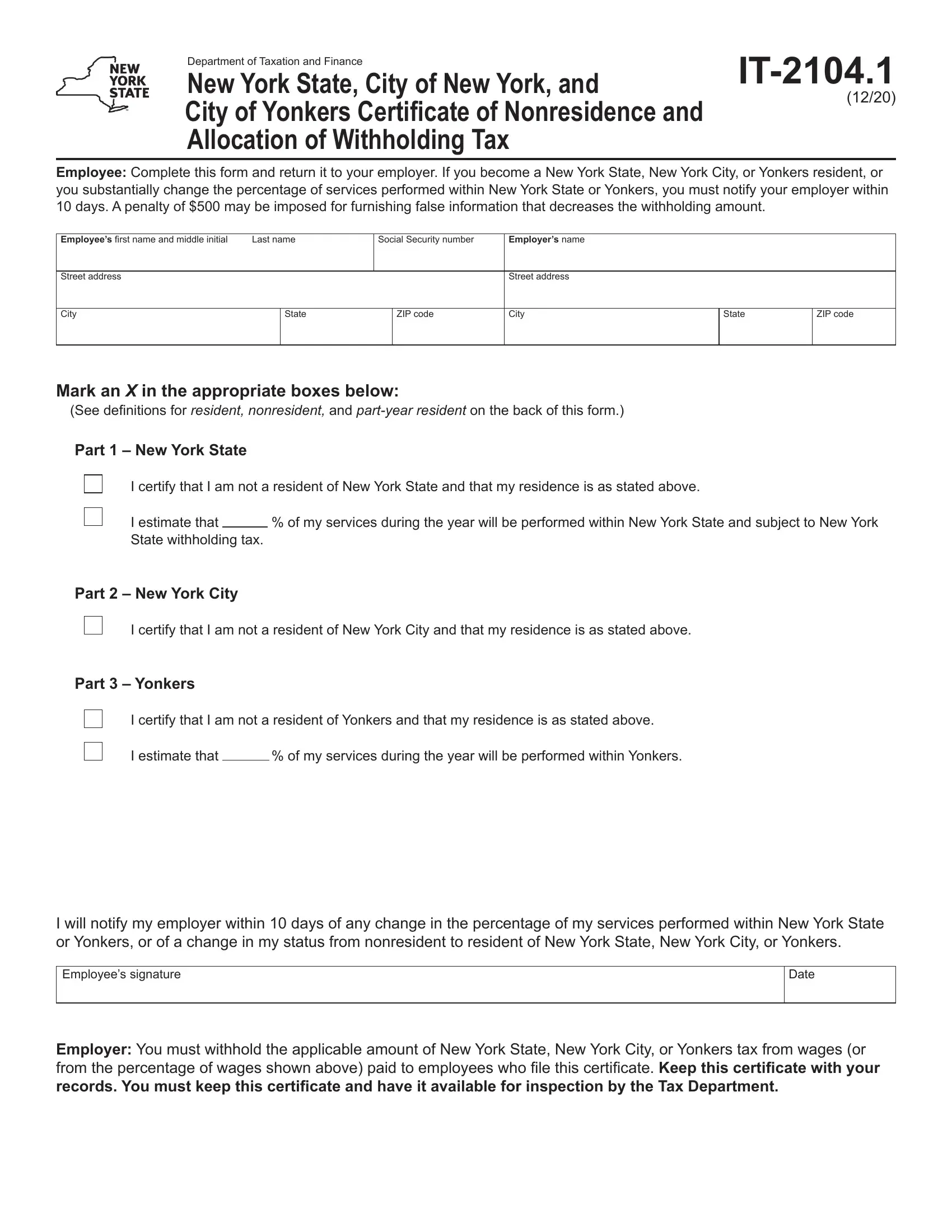

This PDF requires particular details to be entered, thus be certain to take your time to type in exactly what is required:

1. Start completing your it2104 1 form with a group of major fields. Consider all of the required information and ensure there is nothing omitted!

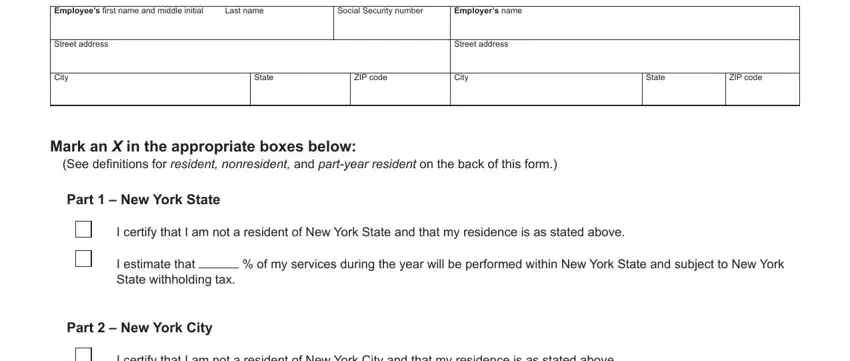

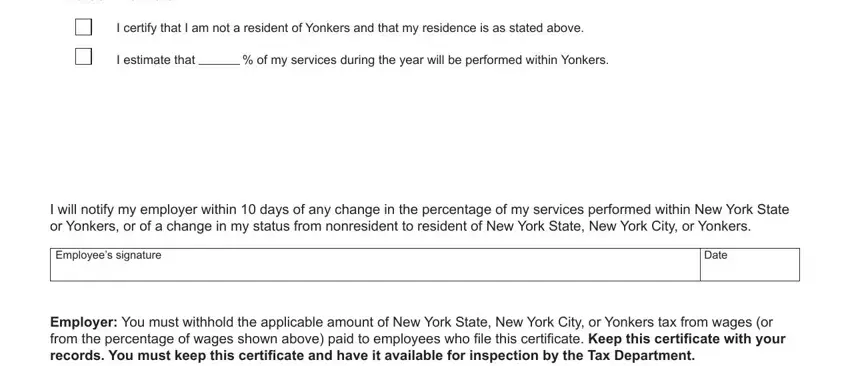

2. Right after filling out the last section, go on to the next part and fill out all required details in these fields - Part Yonkers, I certify that I am not a resident, I estimate that, of my services during the year, I will notify my employer within, Employees signature, Date, and Employer You must withhold the.

Be very mindful while filling out Date and Employer You must withhold the, because this is the part where most people make errors.

Step 3: As soon as you've glanced through the details in the fields, click on "Done" to conclude your FormsPal process. Sign up with us today and immediately gain access to it2104 1 form, set for download. Every last modification made is handily kept , letting you edit the file at a later stage anytime. We do not share any information you enter whenever working with documents at FormsPal.