You may fill out it280 form instantly in our online PDF editor. To make our tool better and easier to use, we constantly implement new features, taking into account feedback coming from our users. This is what you would need to do to get going:

Step 1: Open the PDF doc inside our tool by hitting the "Get Form Button" at the top of this webpage.

Step 2: This tool will let you customize almost all PDF files in many different ways. Modify it by adding customized text, correct what's already in the document, and place in a signature - all at your disposal!

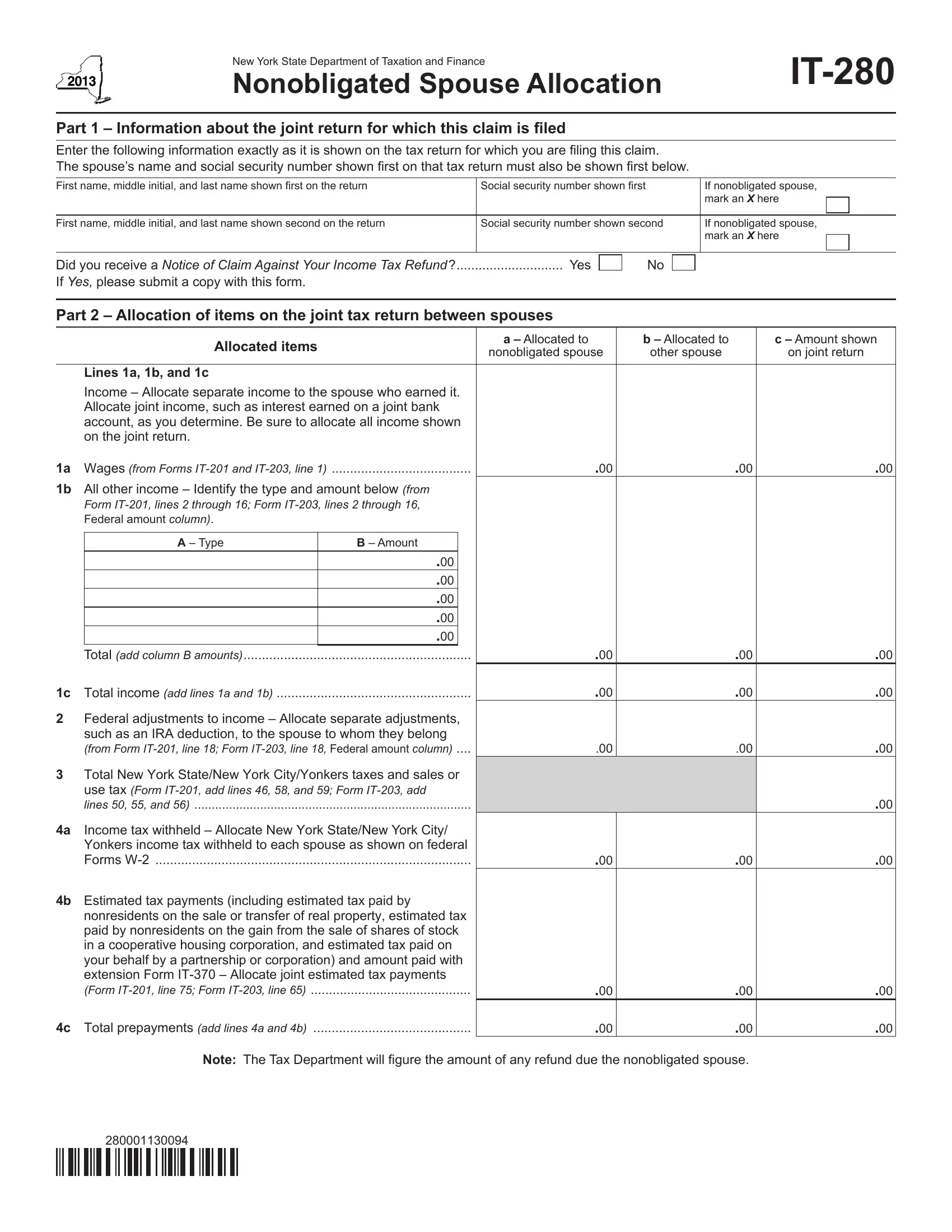

This PDF form will need specific data to be filled in, hence you should take some time to type in precisely what is expected:

1. The it280 form will require specific information to be entered. Ensure the next fields are filled out:

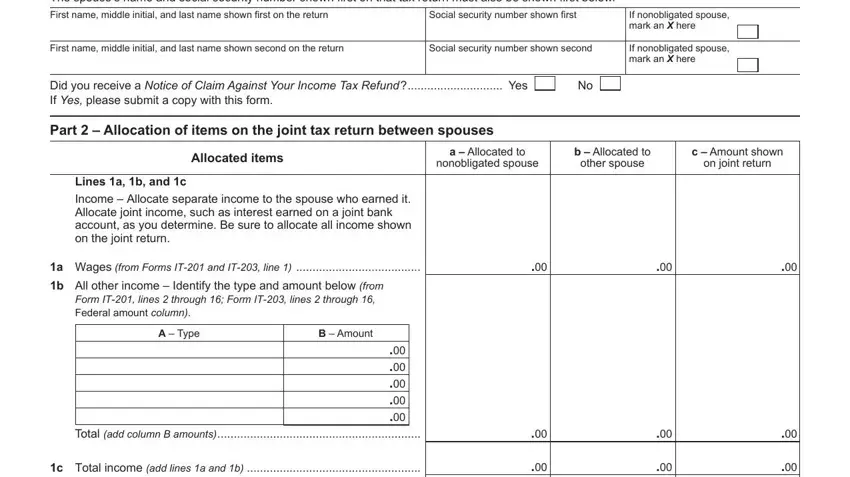

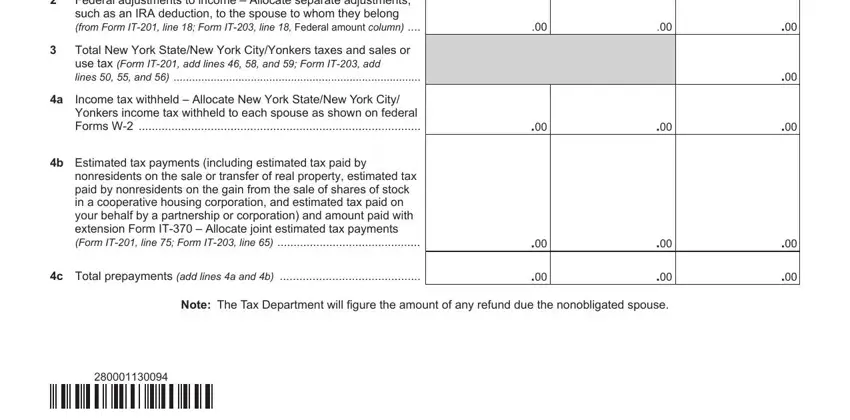

2. Once your current task is complete, take the next step – fill out all of these fields - c Total income add lines a and b, such as an IRA deduction to the, Total New York StateNew York, use tax Form IT add lines and, Yonkers income tax withheld to, b Estimated tax payments including, nonresidents on the sale or, c Total prepayments add lines a, and Note The Tax Department will igure with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

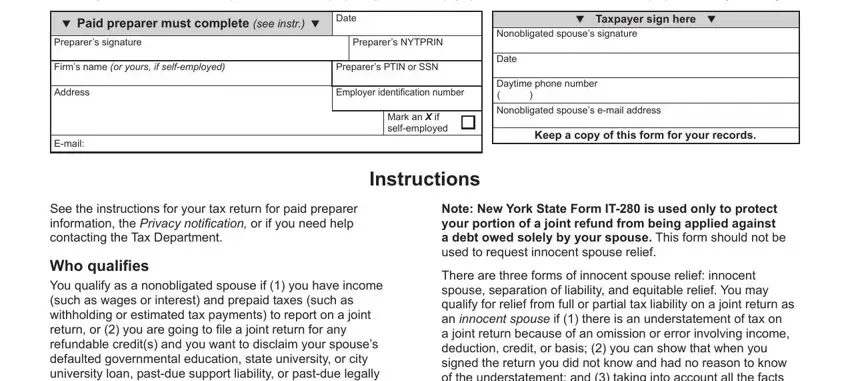

3. This third part is considered relatively straightforward, Under penalties of perjury I, Paid preparer must complete see, Date, Preparers signature, Firms name or yours if selfemployed, Address, Email, Preparers NYTPRIN, Preparers PTIN or SSN, Employer identiication number, Mark an X if selfemployed, Instructions, Taxpayer sign here, Nonobligated spouses signature, and Date - these empty fields has to be completed here.

As for Address and Paid preparer must complete see, make sure you take a second look in this section. Those two are the most significant ones in this file.

Step 3: When you've glanced through the details in the fields, simply click "Done" to complete your form at FormsPal. Go for a 7-day free trial subscription with us and obtain immediate access to it280 form - download, email, or change in your personal account. FormsPal offers risk-free form tools devoid of personal data recording or sharing. Rest assured that your information is safe with us!