The IT-540 2D form embodies a crucial document for Louisiana residents during the tax filing season, delineating a comprehensive structure for tax calculations, declarations, and potential refunds. Designed for the 2013 tax year, it serves various filing statuses, including single, married filing jointly, married filing separately, head of household, and qualifying widow(er), ensuring a personalized approach to tax obligations. It succinctly captures taxpayer details such as Social Security numbers, dates of birth, and contact information, paving the way for an accurate tax filing process. Exemptions due to age, blindness, and dependents are accounted for, directly impacting the tax calculation. The form meticulously details the financial aspects, from adjusted gross income to itemized or standard deductions, thereby clarifying federal income adjustments relevant for state tax purposes. Both nonrefundable and refundable tax credits are distinguished, encompassing child care, education, and specific Louisiana tax credits, illustrating the state's approach to reduce the tax burden while incentivizing societal contributions. Furthermore, the form addresses payment contributions, overpayments, and the option to direct a portion of the refund to specific funds, emphasizing taxpayer autonomy and philanthropy. Finally, penalties for underpayment or late filings are also considered, encapsulating the comprehensive nature of tax obligations and the importance of timely and accurate submissions.

| Question | Answer |

|---|---|

| Form Name | IT-540-WEB Form |

| Form Length | 17 pages |

| Fillable? | Yes |

| Fillable fields | 382 |

| Avg. time to fill out | 26 min 54 sec |

| Other names | IT540 2D(2013) 2013 10 21 template it 540 online form |

2013 Louisiana Resident - 2d

DEV ID

Name

Change

Decedent

Filing

Spouse

Decedent

Amended

Return

NOL

Carryback

Taxpayer DOB

FiLinG status: Enter the appropriate number in the iling status box. It must agree with your federal return.

Spouse DOB

6eXeMPtions:

Taxpayer SSN

Spouse SSN

Telephone

Enter a “1” in box if single.

Enter a “2” in box if married iling jointly.

Enter a “3” in box if married iling separately.

Enter a “4” in box if head of household.

If the qualifying person is not your dependent, enter name here.

Enter a “5” in box if qualifying widow(er).

6A |

X Yourself |

65 or |

|

older |

|||

6B |

Spouse |

65 or |

|

older |

|||

|

|

Blind

Blind

Qualifying

Widow(er) Total of

6A & 6B

6C dePendents – Enter dependent information below. If you have more than 6 dependents, attach a statement to your return with the

required information. Enter the total number from Federal Form 1040A, Line 6c, or Federal Form 1040, Line 6c. |

|

6C |

||||||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

dependent First and Last name |

social security number |

|

Relationship to you |

Birth date (mm/dd/yyyy) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6D totaL eXeMPtions – Total of 6A, 6B, and 6C |

6d |

6459

Social Security Number

if you are not required to ile a federal return, indicate wages here.

Mark this box and enter zero “0” on Lines 7 through 16.

|

FEDERAL ADJUSTED GROSS INCOME – If your Federal Adjusted Gross |

From Louisiana |

|

7 |

Schedule E, |

||

Income is less than zero, enter “0.” |

|||

|

attached |

||

|

|

8A FEDERAL ITEMIZED DEDUCTIONS

8B FEDERAL STANDARD DEDUCTION

8C EXCESS FEDERAL ITEMIZED DEDUCTIONS – Subtract Line 8B from Line 8A.

9FEDERAL INCOME TAX – If your federal income tax has been decreased by a federal disaster credit allowed by IRS, complete Schedule H and mark box.

10YOUR LOUISIANA TAX TABLE INCOME – Subtract Lines 8C and 9 from Line 7. If less than zero, enter “0.”

11YOUR LOUISIANA INCOME TAX

7

8a

8B

8C

9

10

11

nonReFundaBLe taX CRedits

12A FEDERAL CHILD CARE CREDIT

12B 2013 LOUISIANA NONREFUNDABLE CHILD CARE CREDIT

12C AMOUNT OF LOUISIANA NONREFUNDABLE CHILD CARE CREDIT CARRIED FORWARD FROM 2009 THROUGH 2012

12D 2013 LOUISIANA NONREFUNDABLE SCHOOL READINESS CREDIT

5 |

4 |

3 |

2 |

12E AMOUNT OF LOUISIANA NONREFUNDABLE SCHOOL READINESS CREDIT CARRIED FORWARD FROM 2009 THROUGH 2012

13 EDUCATION CREDIT

14OTHER NONREFUNDABLE TAX CREDITS – From Schedule G, Line 11

15TOTAL NONREFUNDABLE TAX CREDITS – Add Lines 12B through 14.

16ADJUSTED LOUISIANA INCOME TAX – Subtract Line 15 from Line 11. If the result is less than zero, or you are not required to ile a federal return, enter zero “0.”

17 CONSUMER USE TAX |

No use tax due. |

Amount from the Consumer Use |

|

Tax Worksheet, Line 2. |

|||

|

|

12a

12B

12C

12d

12e

13

14

15

16

17

18 TOTAL INCOME TAX AND CONSUMER USE TAX - Add Lines 16 and 17. |

18 |

|

6460

ReFundaBLe taX CRedits

19 2013 LOUISIANA REFUNDABLE CHILD CARE CREDIT

19A Enter the qualiied expense amount from the Refundable Child Care Credit Worksheet, Line 3.

19B Enter the amount from the Refundable Child Care Credit Worksheet, Line 6.

20 2013 LOUISIANA REFUNDABLE SCHOOL READINESS CREDIT

5 |

4 |

3 |

2 |

21 EARNED INCOME CREDIT

22 LOUISIANA CITIZENS INSURANCE CREDIT

23 OTHER REFUNDABLE TAX CREDITS – From Schedule F, Line 7

Social Security Number

19

19a

19B

20

21

22

23

PayMents

24aMount oF Louisiana taX WitHHeLd FoR 2013 – attach Forms

25AMOUNT OF CREDIT CARRIED FORWARD FROM 2012

26AMOUNT OF ESTIMATED PAYMENTS MADE FOR 2013

27AMOUNT PAID WITH EXTENSION REQUEST

28TOTAL REFUNDABLE TAX CREDITS AND PAYMENTS – Add Lines 19 and 20 through 27. Do not include amounts on Lines 19A and 19B.

29OVERPAYMENT – If Line 28 is greater than Line 18, subtract Line 18 from Line 28. Otherwise, enter zero “0” on Lines 29 through 35 and go to Line 36.

30UNDERPAYMENT PENALTY – If you are a farmer, check the box.

adJusted oveRPayMent – If Line 29 is greater than Line 30, subtract Line 30 from Line 29 and enter the

31result here. If Line 30 is greater than Line 29, enter zero “0” on Lines 31 through 35, subtract Line 29 from Line 30, and enter the balance on Line 36.

32TOTAL DONATIONS – From Schedule D, Line 26

24

25

26

27

28

29

30

31

32

ReFund due

33 SUBTOTAL – Subtract Line 32 from Line 31. This amount of overpayment is available for credit or refund.

34 AMOUNT OF LINE 33 TO BE CREDITED TO 2014 INCOME TAX |

|

CRedit |

||

AMOUNT TO BE REFUNDED – Subtract Line 34 from Line 33. |

|

|

||

35 Enter a “1” in box if you want to receive your refund on a MyRefund Card. |

ReFund |

|||

Enter a “2” in box if you want to receive your refund by paper check. |

|

|||

Enter a “3” in box if you want to receive your refund by direct deposit and complete |

|

|||

information below. If information is unreadable, you will receive your refund on a |

|

|||

MyRefund Card. |

|

|

|

|

if you do not make a refund selection, you will receive your refund on a MyRefund Card. |

|

|||

diReCt dePosit inFoRMation: |

|

|

||

|

|

|

Will this refund be forwarded to a inancial |

|

type: |

Checking |

Savings |

institution located outside the United States? |

|

Routing |

|

|

Account |

|

Number |

|

|

Number |

|

33

34

35

YesNo

6461

aMounts due Louisiana

36AMOUNT YOU OWE – If Line 18 is greater than Line 28, subtract Line 28 from Line 18 and enter the balance here.

37additionaL donation to tHe MiLitaRy FaMiLy assistanCe Fund

38additionaL donation to tHe CoastaL PRoteCtion and RestoRation Fund

Social Security Number

36

37

38

39

additionaL donation to Louisiana CHaPteR oF tHe nationaL MuLtiPLe sCLeRosis soCiety Fund

39

40 additionaL donation to Louisiana Food Bank assoCiation

41additionaL donation to tHe snaP FRaud and aBuse deteCtion and PRevention Fund

42INTEREST

43DELINQUENT FILING PENALTY

44DELINQUENT PAYMENT PENALTY

45UNDERPAYMENT PENALTY – If you are a farmer, check the box.

46 BALANCE DUE LOUISIANA – Add Lines 36 through 45. |

Pay tHis aMount. |

40

41

42

43

44

45

46

do not send CasH.

Status

Contribution and Donation

I declare that I have examined this return, and to the best of my knowledge, it is true and complete. Declaration of paid preparer is based on all available information. If I made a contribution to the START Savings Program, I consent that my Social Security Number may be given to the Louisiana Office of Student Financial Assistance to properly identify the START Savings Program account holder. If married filing jointly, both Social Security Numbers may be submitted. I understand that by submitting this form I authorize the disburse- ment of individual income tax refunds through the method as described on Line 35.

Your Signature

Date

Signature of paid preparer other than taxpayer

Spouse’s Signature (If filing jointly, both must sign.)

Date

Telephone number of paid preparer

Date

Name |

Address |

|

|

||

|

|

|

|

|

Field |

|

|

|

|

|

|

individual income tax Return |

|

Flag |

|||

|

|||||

|

|

||||

Calendar year return due 5/15/2014 |

Mail to: |

||||

|

|

|

|

|

|

|

|

|

|

|

|

FoR oFFiCe use onLy |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

Social Security Number, PTIN, or |

|

|

|

|

|

|

|

|

|

|

|

|

Department of Revenue |

FEIN of paid preparer |

||||||||||

sPeC |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

Code |

6462

Social Security Number

sCHeduLe d – 2013 DONATION SCHEDULE

Individuals who ile an individual income tax return and have overpaid their tax may choose to donate all or part of their overpayment shown on Line 31 of Form

1adjusted overpayment - From

donations oF Line 1 |

|

||

2 |

the Military Family assistance |

2 |

|

Fund |

|||

|

|

||

3 |

Coastal Protection and |

3 |

|

Restoration Fund |

|||

|

|

||

4 |

snaP Fraud and abuse detection |

4 |

|

and Prevention Fund |

|||

|

|

||

5 |

The START Program |

5 |

|

6 |

Wildlife Habitat and Natural Heritage |

6 |

|

Trust Fund |

|||

|

|

||

7 |

Louisiana Cancer Trust Fund |

7 |

|

8 |

Louisiana Animal Welfare |

8 |

|

Commission |

|||

|

|

||

9 |

National Lung Cancer Partnership |

9 |

|

10 |

Louisiana Chapter of the National |

10 |

|

Multiple Sclerosis Society Fund |

|||

|

|

||

11 |

Louisiana Food Bank Association |

11 |

|

|

Louisiana Bicentennial Commission |

|

|

12 |

and Battle of New Orleans |

12 |

|

|

Bicentennial Commission |

|

|

13 |

13 |

||

Texas Gulf Coast and Louisiana |

|||

|

|

||

|

|

|

1 |

|

|

14 |

Louisiana Association of United |

14 |

|||

Ways/LA |

|||||

|

|

||||

15 |

Center of Excellence for Autism |

15 |

|||

Spectrum Disorder |

|||||

|

|

||||

16 |

Alliance for the Advancement of |

16 |

|||

End of Life Care |

|||||

|

|

||||

17 |

American Red Cross |

17 |

|||

18 |

New Opportunities Waiver Fund |

18 |

|||

19 |

Friends of Palmetto Island State |

19 |

|||

Park |

|||||

|

|

||||

20 |

Dreams Come True, Inc. |

20 |

|||

21 |

Louisiana Coalition Against |

21 |

|||

Domestic Violence, Inc. |

|||||

|

|

||||

22 |

Decorative Lighting on the |

22 |

|||

Crescent City Connection |

|||||

|

|

||||

23 |

Operation and Maintenance of |

23 |

|||

the New Orleans Ferries |

|||||

|

|

||||

24 |

Louisiana National Guard Honor |

24 |

|||

Guard for Military Funerals |

|||||

|

|

||||

25 |

Bastion Community of Resilience |

25 |

|||

26 |

TOTAL DONATIONS – Add Lines 2 through 25. This amount cannot be more than Line 1. Also, enter this |

|

|

amount on Form |

26 |

||

|

6463

sCHeduLe e – 2013 ADJUSTMENTS TO INCOME

1FEDERAL ADJUSTED GROSS INCOME – Enter the amount from your Federal Form 1040EZ, Line 4, oR Federal Form 1040A, Line 21, oR Federal Form 1040, Line 37. Check box if amount is less than zero.

2INTEREST AND DIVIDEND INCOME FROM OTHER STATES AND THEIR POLITICAL SUBDIVISIONS

2A RECAPTURE OF START CONTRIBUTIONS

3TOTAL – Add Lines 1, 2, and 2A.

Social Security Number

1

2

2a

3

eXeMPt inCoMe – Enter on Lines 4A through 4H the amount of exempted income included in Line 1 above. Enter description and associated code, along with the dollar amount.

4A

4B

4C

4D

4E

4F

4G

4H

4I

4J

4K

5A

5B

5C

exempt income description |

Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

eXeMPt inCoMe BeFoRe aPPLiCaBLe FedeRaL taX – Add Lines 4A through 4H.

FEDERAL TAX APPLICABLE TO EXEMPT INCOME

EXEMPT INCOME – Subtract Line 4J from Line 4I.

LOUISIANA ADJUSTED GROSS INCOME BEFORE IRC 280C EXPENSE ADJUSTMENT – Subtract Line 4K from Line 3.

IRC 280C EXPENSE ADJUSTMENT

LOUISIANA ADJUSTED GROSS INCOME – Subtract Line 5B from Line 5A. Enter the result here and on Form

amount

4a

4B

4C

4d

4e

4F

4G

4H

4i

4J

4k

5a

5B

5C

description |

|

|

|

|

Code |

||||

Interest and Dividends on US Government Obligations |

01e |

||||||||

Louisiana State Employees’ Retirement Benefits (Date Retired) |

02e |

||||||||

Taxpayer |

|

|

Spouse |

|

|

|

|

||

Louisiana State Teachers’ Retirement Benefits (Date Retired) |

03e |

||||||||

Taxpayer |

|

|

Spouse |

|

|

|

|

||

Federal Retirement Benefits (Date Retired) |

04e |

||||||||

Taxpayer |

|

|

Spouse |

|

|

|

|

||

Other Retirement Benefits (Date Retired) |

05e |

||||||||

Provide name or statute: |

|

|

|

|

|

|

|

||

Taxpayer |

|

|

Spouse |

|

|

|

|

||

Annual Retirement Income Exemption for Taxpayers 65 or over |

06e |

||||||||

Provide name of pension or annuity: |

|

|

|

||||||

Taxable Amount of Social Security |

. ...................................................... |

|

|

|

07e |

||||

description |

Code |

Native American Income |

08e |

|

|

START Savings Program Contribution |

09e |

Military Pay Exclusion |

10e |

Road Home |

11e |

Recreation Volunteer |

13e |

Volunteer Firefighter |

14e |

Voluntary Retrofit Residential Structure |

16e |

Elementary and Secondary School Tuition |

17e |

Educational Expenses for |

18e |

Educational Expenses for Quality Public Education |

19e |

Capital Gain from Sale of Louisiana Business |

20e |

Other |

|

Identify: |

|

49e |

|

|

6464

Social Security Number

sCHeduLe F – 2013 REFUNDABLE TAX CREDITS

1Credit for amounts paid by certain military servicemembers for obtaining Louisiana Hunting and Fishing Licenses.

1A |

Yourself |

|

Date of Birth (MM/DD/YYYY) |

|

Driver’s License number |

|

|

|

|

|

|

|

|

|

|

|

|

|

or State Identiication |

|

1B |

Spouse |

|

Date of Birth (MM/DD/YYYY) |

|

Driver’s License number |

|

|

|

|

|

|

or State Identiication |

|

1C Dependents: List dependent names.

State of issue State of issue State of issue State of issue

Dependent name |

|

Date of Birth (MM/DD/YYYY) |

|

Dependent name |

|

Date of Birth (MM/DD/YYYY) |

|

|

|||

Dependent name |

|

Date of Birth (MM/DD/YYYY) |

|

|

|||

Dependent name |

|

Date of Birth (MM/DD/YYYY) |

|

|

|||

1D Enter the total amount of fees paid for Louisiana hunting and ishing licenses purchased for the listed individuals. |

1d |

||

additional Refundable Credits

Enter description and associated code, along with the dollar amount.

Credit description |

Code |

amount of Credit Claimed |

2

3

4

5

6

7OTHER REFUNDABLE TAX CREDITS – Add Lines 1D and 2 through 6. Enter the result here and on Form

2

3

4

5

6

7

sCHeduLe H – 2013 MODIFIED FEDERAL INCOME TAX DEDUCTION

1

Enter the amount of your federal income tax liability found on Federal Form 1040, Line 55, plus the tax amount from Federal Form 8960, Line 17.

1

2 Enter the amount of federal disaster credits allowed by IRS.

2

3 Add Line 1 and Line 2. Enter the result here and on Form |

3 |

6465

Social Security Number

sCHeduLe G – 2013 NONREFUNDABLE TAX CREDITS

1CREDIT FOR TAX LIABILITIES PAID TO OTHER STATES – A copy of the returns iled with the other states must be submitted with this schedule. Enter the amount of the income tax liability paid to other states. Round to the nearest dollar.

2CREDIT FOR CERTAIN DISABILITIES - Mark an “X” in the appropriate boxes. Only one credit is allowed per person.

1

Deaf |

Loss of |

Mentally |

|

Limb |

incapacitated |

||

|

2A Yourself

2B Spouse

2C Dependent *

*List dependent names here.

Blind

Enter the total number of qualifying

2D individuals. Only one credit is allowed per person.

2E Multiply Line 2D by $100.

2d

2e

3CREDIT FOR CONTRIBUTIONS TO EDUCATIONAL INSTITUTIONS

3A Enter the value of computer or other technological equipment donated. Attach Form

3a

3B Multiply Line 3A by 40 percent. Round to the nearest dollar. |

3B |

4CREDIT FOR CERTAIN FEDERAL TAX CREDITS

4A |

Enter the amount of eligible federal credits. |

4a |

4B |

Multiply Line 4A by 10 percent. Enter the result or $25, whichever is less. This credit is limited to $25. |

4B |

additional nonrefundable Credits

Enter credit description and associated code, along with the dollar amount of credit claimed.

Credit description

5

6

7

8

9

10

OTHER NONREFUNDABLE TAX CREDITS – Add Lines 1, 2E, 3B, 4B, and 5 through 10. Enter the

11 result here and on Form

Credit Code |

amount of Credit Claimed |

5

6

7

8

9

10

11

6466

2013 Louisiana school expense deduction Worksheet (For use with Form

Your Name

Your Social Security Number

i.This worksheet should be used to calculate the three School Expense Deductions listed below. Refer to Revenue Information Bulletin

1.elementary and secondary school tuition – R.S. 47:297.10 provides a deduction for amounts paid during the tax year for tuition and fees required for your dependent child’s enrollment in a nonpublic elementary or secondary school that complies with the criteria set forth in Brumfield v. Dodd and Section 501(c)(3) of the Internal Revenue Code or to any public elementary or secondary laboratory school that is operated by a public college or university. The school can verify that it complies with the criteria. The deduction is equal to the actual amount of tuition and fees paid per dependent, limited to $5,000. The tuition and fees that can be deducted include amounts paid for tuition, fees, uniforms, textbooks and other supplies required by the school.

2.educational expenses for

3.educational expenses for a Quality Public education – R.S. 47:297.12 provides a deduction for the fees or other amounts paid during the tax year for a quality education of a dependent child enrolled in a public elementary or secondary school, including Louisiana Department of Education approved charter schools. The deduction is equal to 50 percent of the amounts paid per dependent, limited to $5,000. The amounts that can be deducted include amounts paid for uniforms, textbooks and other supplies required by the school.

ii.On the chart below, list the name of each qualifying dependent and the name of the school the student attends. If the student is

|

|

|

deduction as described |

||||

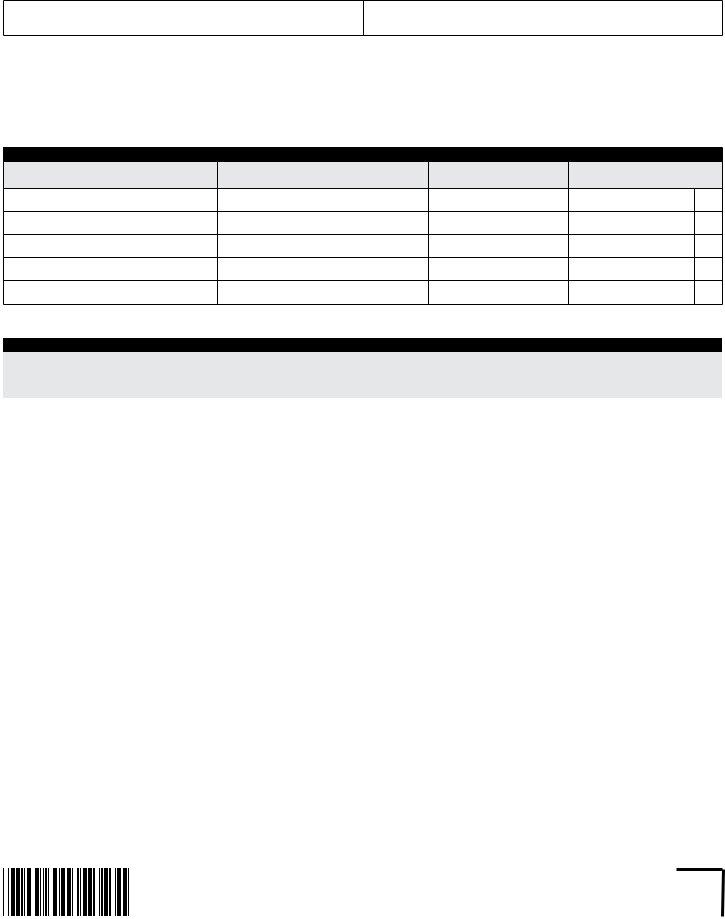

student |

name of Qualifying dependent |

name of school |

|

in section i |

|

||

|

|

|

|

|

|

|

|

|

|

|

1 |

|

2 |

|

3 |

|

|

|

|

|

|

|

|

a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

iii.Using the letters that correspond to each qualifying dependent listed in Section II, list the amount paid per student for each qualifying expense. For students attending a qualifying school, the expense must be for an item required by the school. Refer to the information in Section I to determine which expenses qualify for the deduction. Retain copies of cancelled checks, receipts and other documentation in order to support the amount of qualifying expenses. if you checked column 1 in section ii, skip the 50% calculation below; however, the deduction is still limited to $5,000.

Qualifying expense |

|

List the amount paid for each student as listed in Section II. |

|

||||

|

|

|

|

|

|

||

A |

B |

C |

D |

E |

F |

||

|

|||||||

|

|

|

|

|

|

|

|

Tuition and Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

School Uniforms |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Textbooks, or Other Instructional Materials |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (add amounts in each column) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If column 2 or 3 in Section II was checked, |

50% |

50% |

50% |

50% |

50% |

50% |

|

multiply by: |

|||||||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

deduction per student – Enter the result |

|

|

|

|

|

|

|

or $5,000 whichever is less. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

iv.Total the Deduction per Student in Section III, based on the deduction for which the students qualiied as marked in boxes 1, 2, or 3 in Section II.

Enter the elementary and secondary school tuition deduction here and on |

$ |

|

|

Enter the educational expenses for |

$ |

|

|

Enter the educational expenses for a Quality Public education deduction here and on |

$ |

|

|

6407

2013 Louisiana Refundable Child Care Credit Worksheet (For use with Form

Your Name

Social Security Number

your Federal adjusted Gross income must be $25,000 or less in order to complete this form.

1.Care Provider information schedule – Complete columns A through D for each person or organization that provided care to your child. You may use Federal Form

Care Provider information schedule

a |

B |

C |

d |

|

Care provider’s name |

Address (number, street, apartment |

Identifying number |

Amount paid |

|

number, city, state, and ZIP) |

(SSN or EIN) |

(See instructions.) |

||

|

.00

.00

.00

.00

.00

2.For each child under age 13, enter their name in column E, their Social Security Number in column F, and the amount of Qualiied Expenses you incurred and paid in 2013 in column G.

|

|

|

e |

|

F |

|

|

G |

|||

|

|

|

Qualifying person’s name |

|

Qualifying person’s |

Qualiied expenses you |

|||||

|

|

|

|

|

|

incurred and paid in 2013 for |

|||||

|

|

First |

|

|

Last |

Social Security Number |

|||||

|

|

|

|

the person listed in column (E) |

|||||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Add the amounts in column G, Line 2. Do not enter more than $3,000 for one qualifying person or |

3 |

|

|

|

||||||

$6,000 for two or more persons. Enter this amount here and on Form |

|

|

.00 |

||||||||

|

|

|

|

||||||||

4 |

Enter your earned income. |

|

|

|

4 |

|

|

.00 |

|||

5 |

If married iling jointly, enter your spouse’s earned income (if your spouse was a student or was |

5 |

|

|

|

||||||

disabled, see IRS Publication 503). All other iling statuses, enter the amount from Line 4. |

|

|

.00 |

||||||||

|

|

|

|

||||||||

6 |

Enter the smallest of Lines 3, 4, or 5. Enter this amount on Form |

6 |

|

|

.00 |

||||||

7 |

Enter your Federal Adjusted Gross Income from Form |

7 |

|

|

.00 |

||||||

|

Enter on Line 8 the decimal amount shown below that applies to the amount on Line 7. |

|

|

|

|

||||||

|

|

if Line 7 is: |

over |

but not over |

decimal amount |

|

|

|

|

||

|

|

|

$0 |

|

$15,000 |

.35 |

|

|

|

|

|

8 |

|

|

$15,000 |

|

$17,000 |

.34 |

|

8 |

|

X . _______ |

|

|

|

|

$17,000 |

|

$19,000 |

.33 |

|

|

|

|

|

|

|

|

$19,000 |

|

$21,000 |

.32 |

|

|

|

|

|

|

|

|

$21,000 |

|

$23,000 |

.31 |

|

|

|

|

|

|

|

|

$23,000 |

|

$25,000 |

.30 |

|

|

|

|

|

9 |

Multiply Line 6 by the decimal amount on Line 8. |

|

|

|

9 |

|

|

.00 |

|||

10 |

Multiply Line 9 by 50 percent and enter this amount on Line 11. |

|

|

10 |

|

X .50 |

|||||

11 |

Enter this amount on Form |

|

|

|

11 |

|

|

.00 |

|||

6411

2013 Louisiana Refundable school Readiness Credit Worksheet (For use with Form

Your Name

Social Security Number

R.S. 47:6104 provides a School Readiness Credit in addition to the credit for child care expenses as provided under R.S. 47:297.4. To qualify for this credit, the taxpayer must have Federal Adjusted Gross Income of $25,000 or less and must have incurred child care expenses for a qualiied dependent under age six who attended a child care facility that is participating in the Quality Start Rating program administered by the Louisiana Department of Children and Family Services. The qualifying child care facility must have provided the taxpayer with Form

Complete this worksheet only if you claimed a Louisiana Refundable Child Care Credit on Form it

1.Enter the amount of 2013 Louisiana Refundable Child Care Credit on

the Louisiana Refundable Child Care Credit Worksheet, Line 11 |

1 |

|

. 00 |

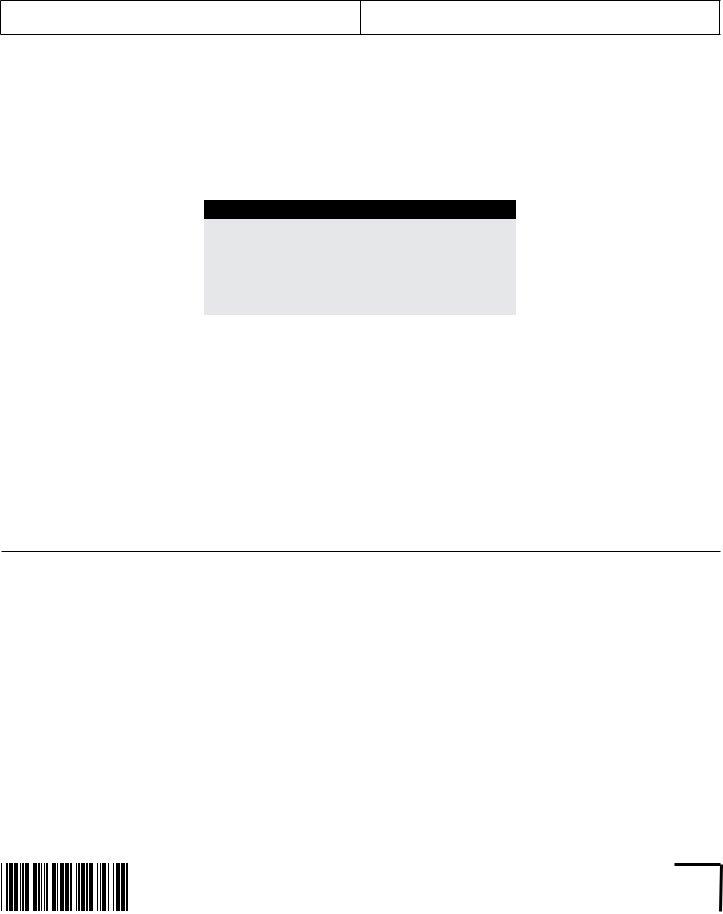

Using the Star Rating of the child care facility that your qualiied dependent attended during 2013, shown on Form

a Quality Rating |

B Percentages for star Rating |

|

|

Five Star |

200% (2.0) |

|

|

Four Star |

150% (1.5) |

|

|

Three Star |

100% (1.0) |

|

|

Two Star |

50% (.50) |

|

|

One Star |

0% (.00) |

|

|

2.Enter the number of your qualiied dependents under age six who attended a:

|

Five Star Facility |

________ |

and multiply the number by 2.0 |

(i) __________ . ______ |

|

Four Star Facility |

________ |

and multiply the number by 1.5 |

(ii) __________ . ______ |

|

Three Star Facility |

________ |

and multiply the number by 1.0 |

(iii) __________ . ______ |

|

Two Star Facility |

________ |

and multiply the number by .50 |

(iv) __________ . ______ |

3 |

Add lines (i) through (iv) and enter the result. Be sure to include the decimal |

. . . . . . . . . . . 3 __________ . ______ |

||

4Multiply Line 1 by the total on Line 3. If the number results in a decimal, round to the nearest dollar

and enter the result here and on Form

On Form

2013 Louisiana earned income Credit Worksheet

R.S. 47:297.8 allows a refundable credit for resident individuals who claimed and received a Federal Earned Income Credit (EIC). The Federal EIC is available for certain individuals who work, have a valid Social Security Number, and have a qualifying child, or are between ages 25 and 64. These individuals cannot be a qualifying child or dependent of another person.

Complete only if you claimed a Federal earned income Credit (eiC)

1Federal Earned Income Credit – Enter the amount from Federal Form 1040EZ,

|

Line 8a, OR Federal Form 1040A, Line 38a, OR Federal Form 1040, Line 64a |

1 |

|

. 00 |

2 |

Multiply Line 1 above by 3.5 percent, round to the nearest dollar, and enter the result on Line 3 |

2 |

X .035 |

|

3 |

Enter this amount on Form |

3 |

|

. 00 |

6412