itr v acknowledgement can be completed effortlessly. Just open FormsPal PDF editing tool to perform the job fast. In order to make our editor better and less complicated to utilize, we continuously design new features, with our users' feedback in mind. By taking several simple steps, you can begin your PDF journey:

Step 1: Simply hit the "Get Form Button" at the top of this site to launch our pdf form editing tool. This way, you will find all that is necessary to work with your file.

Step 2: Once you open the file editor, you will notice the document made ready to be filled out. Apart from filling in various fields, you may as well perform many other things with the PDF, such as writing your own text, changing the original text, adding graphics, placing your signature to the form, and much more.

It is an easy task to finish the pdf with our detailed guide! Here's what you need to do:

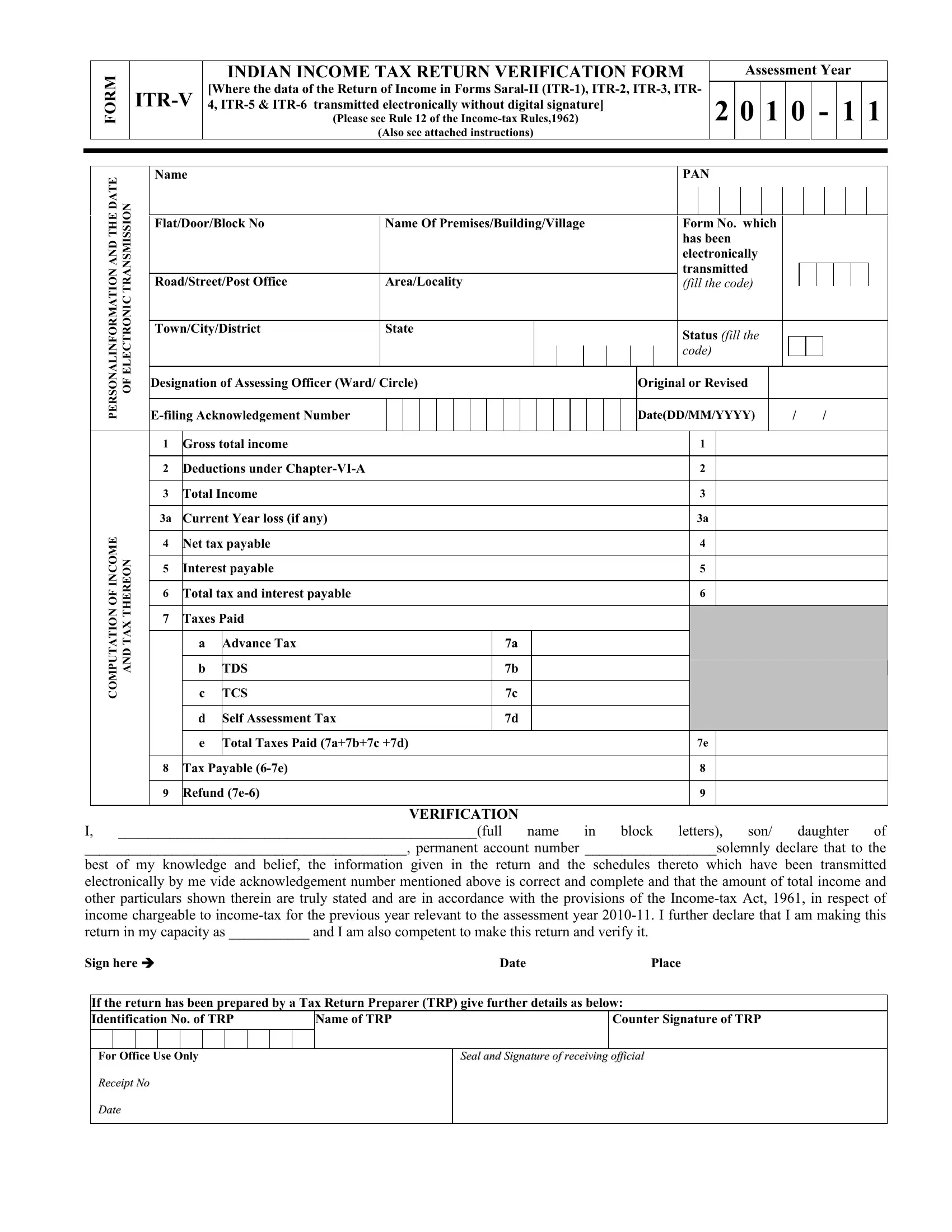

1. While filling in the itr v acknowledgement, be sure to include all essential blank fields in its relevant form section. It will help expedite the work, which allows your details to be processed without delay and correctly.

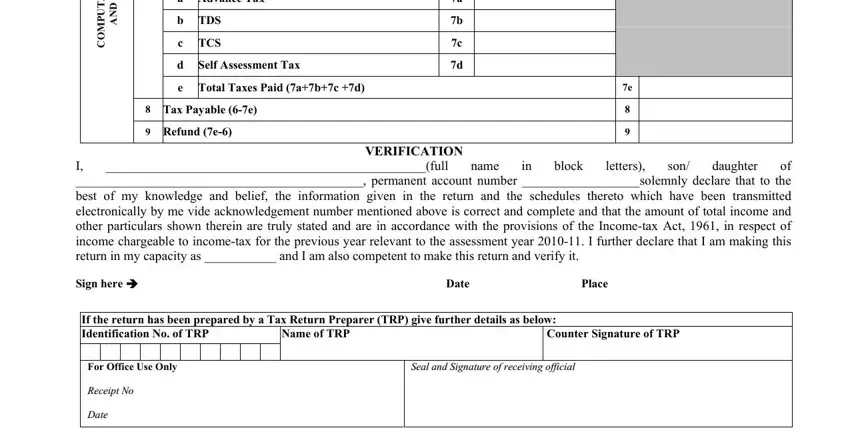

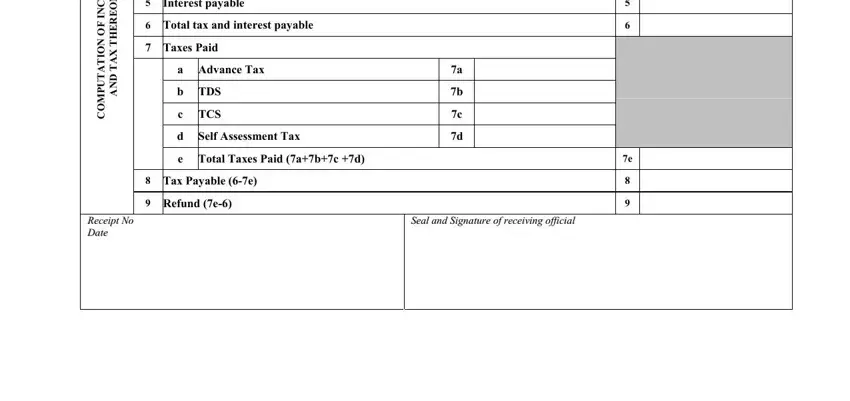

2. Once your current task is complete, take the next step – fill out all of these fields - E M O C N I F O N O I T A T U P M, N O E R E H T X A T D N A, a Advance Tax, b TDS, c TCS, d Self Assessment Tax, e Total Taxes Paid abc d, Tax Payable e, Refund e, VERIFICATION, full, of I permanent account number, daughter, letters, and Place with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Be really mindful while filling in Place and VERIFICATION, as this is the part where most users make a few mistakes.

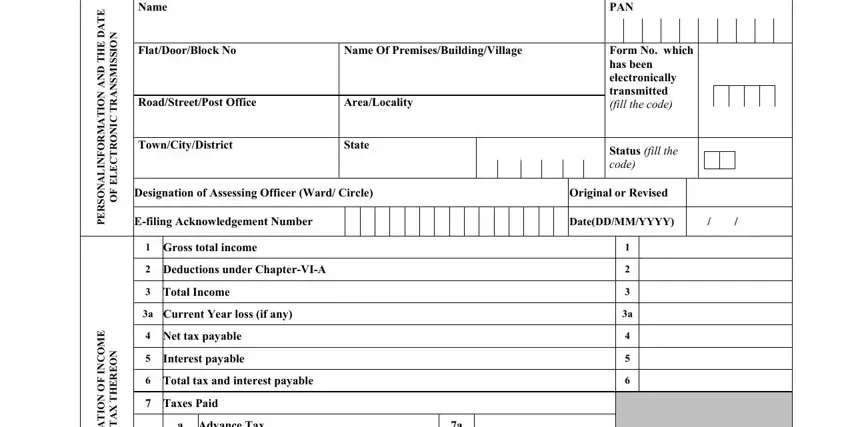

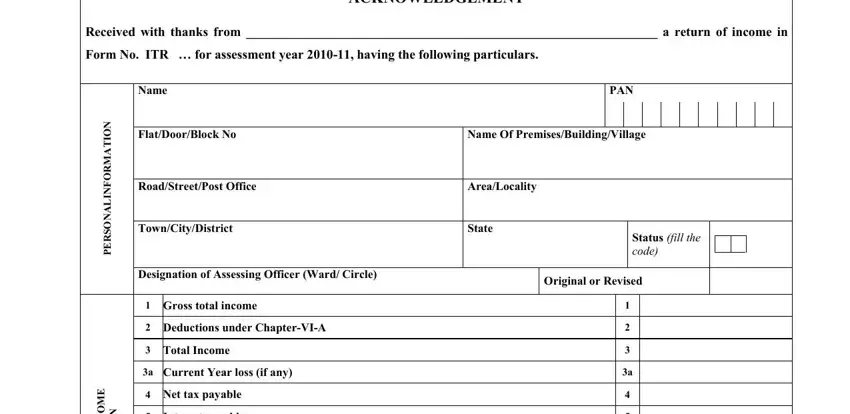

3. In this stage, review ACKNOWLEDGEMENT, Received with thanks from a, Form No ITR for assessment year, Name, PAN, FlatDoorBlock No, Name Of PremisesBuildingVillage, RoadStreetPost Office, AreaLocality, TownCityDistrict, State, Status fill the code, Designation of Assessing Officer, Original or Revised, and N O. Every one of these have to be completed with utmost focus on detail.

4. Completing E M O C N I F O N O I T A T U P M, N O E R E H T X A T D N A, Interest payable, Total tax and interest payable, Taxes Paid, a Advance Tax, b TDS, c TCS, d Self Assessment Tax, e Total Taxes Paid abc d, Tax Payable e, Refund e, RReecceeiipptt NNoo DDaattee, and SSeeaall aanndd SSiiggnnaattuurree is key in the fourth step - be sure to spend some time and be mindful with each blank!

Step 3: Prior to moving forward, check that form fields have been filled out the proper way. When you establish that it is correct, press “Done." Grab the itr v acknowledgement when you subscribe to a free trial. Conveniently get access to the pdf form within your FormsPal cabinet, with any modifications and changes conveniently preserved! We don't sell or share any details you use while working with forms at FormsPal.