Should you want to fill out Form Lgt 140, it's not necessary to download any sort of software - simply try using our online PDF editor. Our team is devoted to giving you the absolute best experience with our tool by consistently presenting new features and upgrades. Our tool has become much more user-friendly with the latest updates! Now, editing PDF files is easier and faster than ever before. Here is what you'll have to do to begin:

Step 1: Simply click on the "Get Form Button" in the top section of this site to open our pdf file editor. This way, you'll find all that is required to work with your file.

Step 2: When you launch the tool, you will get the document all set to be filled out. Aside from filling in various blank fields, you may as well do other sorts of actions with the Document, including adding custom textual content, modifying the original textual content, adding illustrations or photos, signing the document, and more.

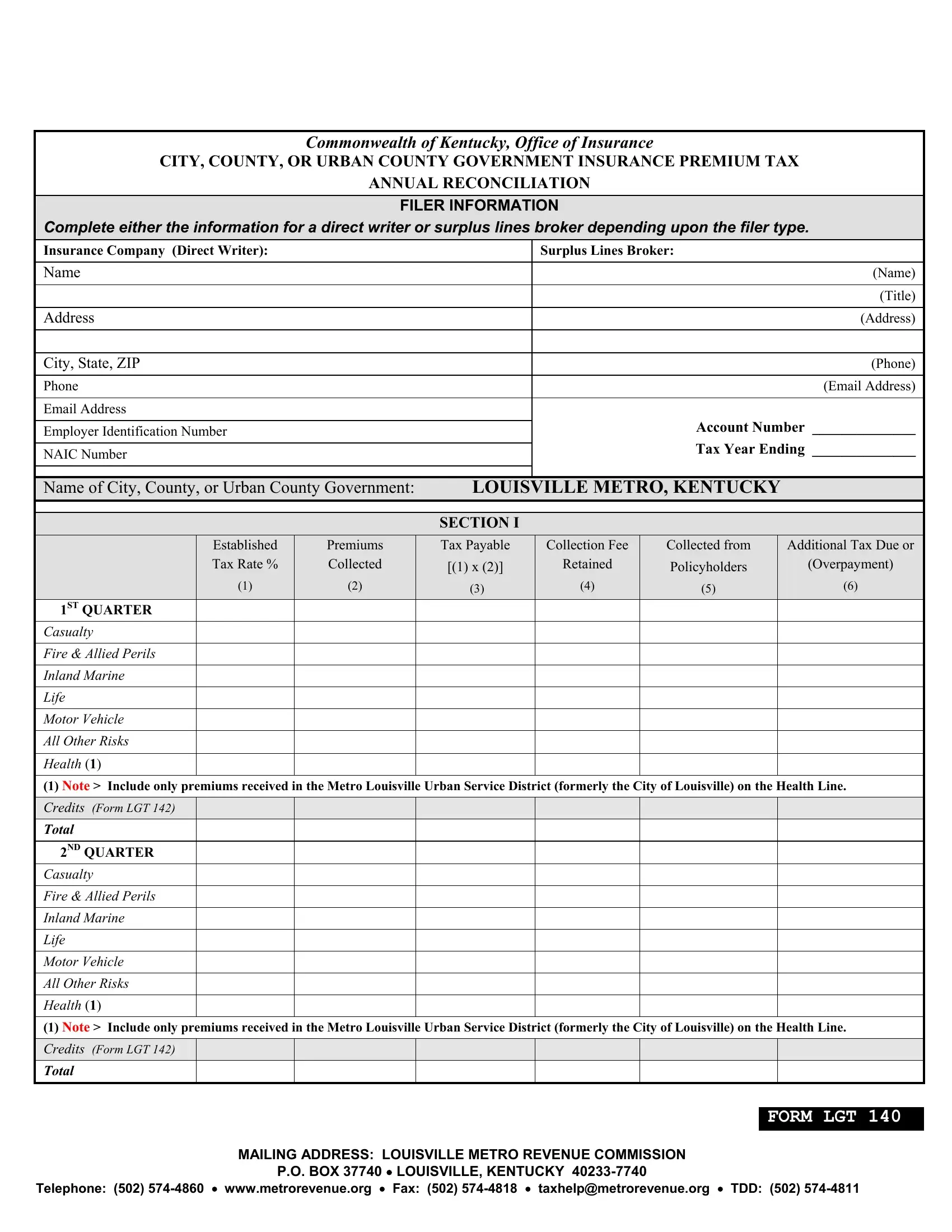

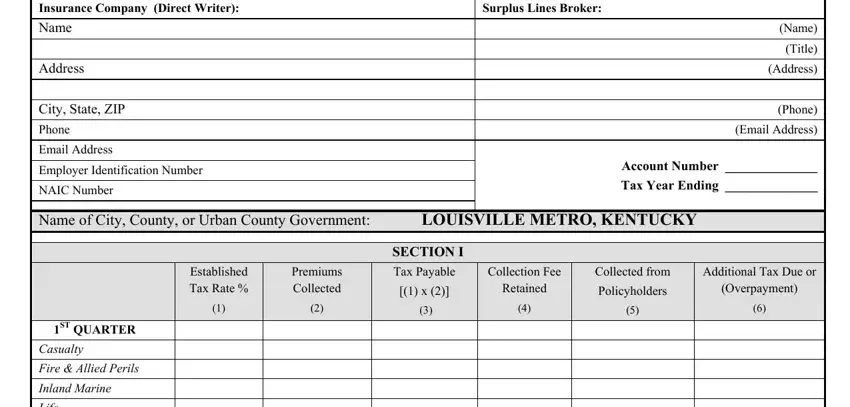

As for the blank fields of this particular PDF, here's what you should know:

1. Begin filling out your Form Lgt 140 with a number of essential blanks. Gather all of the important information and ensure absolutely nothing is left out!

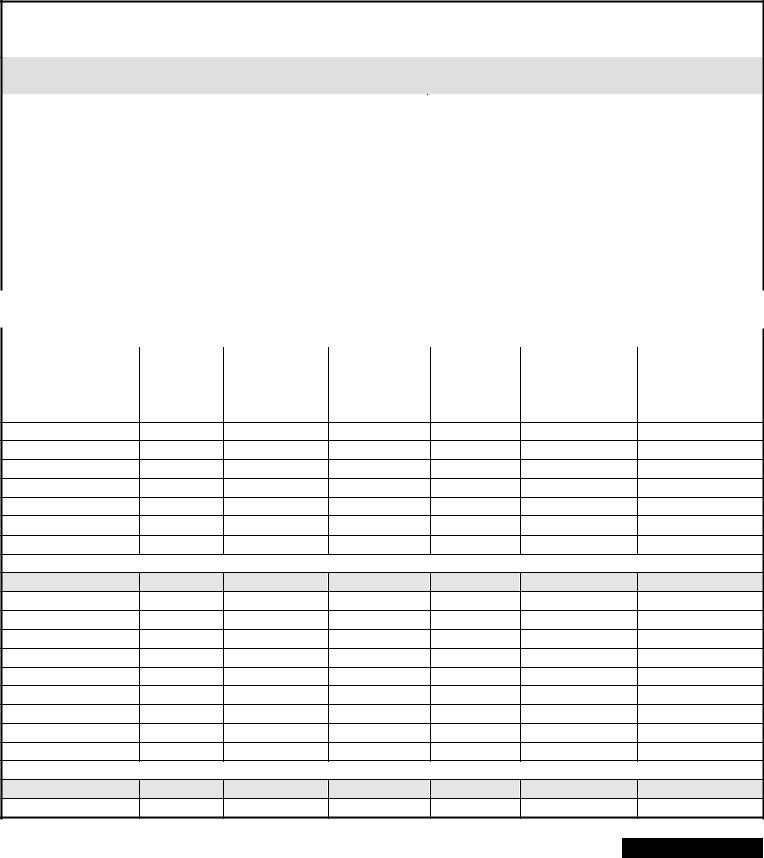

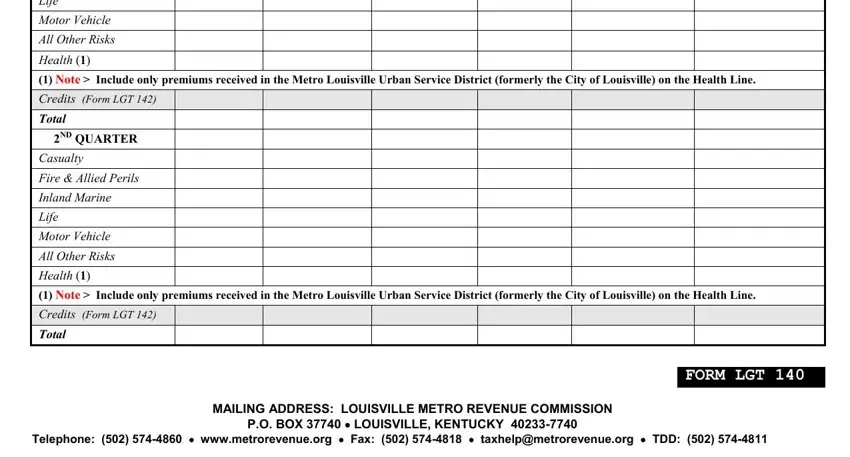

2. Your next stage would be to fill in these fields: Casualty Fire Allied Perils, ND QUARTER, Casualty Fire Allied Perils, FORM LGT, Telephone wwwmetrorevenueorg, MAILING ADDRESS LOUISVILLE METRO, and PO BOX LOUISVILLE KENTUCKY.

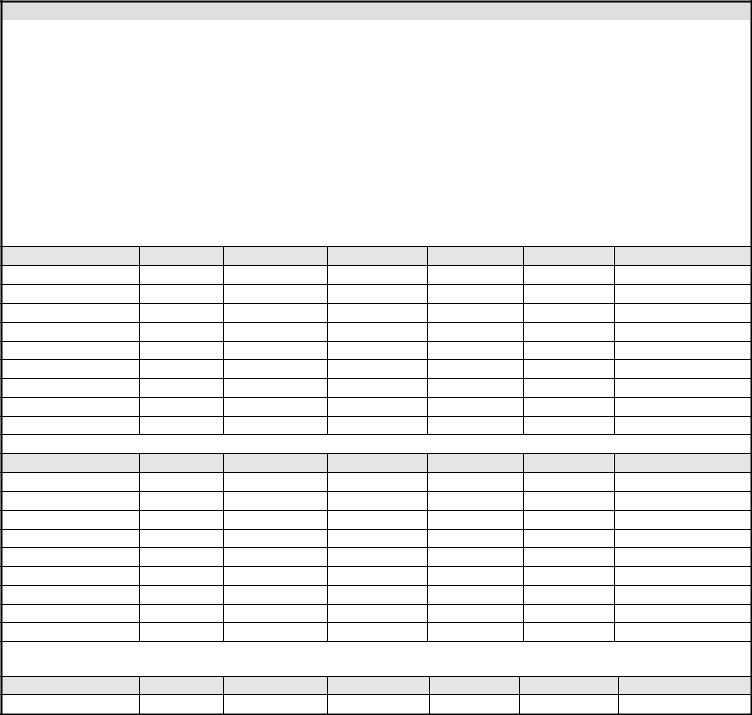

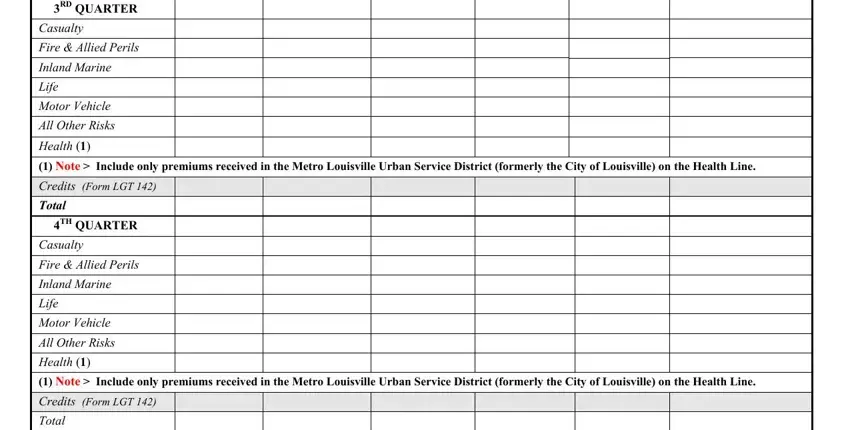

3. Your next stage is going to be hassle-free - fill out all the blanks in RD QUARTER, Casualty Fire Allied Perils, TH QUARTER, and Casualty Fire Allied Perils to complete this part.

Regarding Casualty Fire Allied Perils and Casualty Fire Allied Perils, be certain that you double-check them in this section. These two are surely the most significant ones in this document.

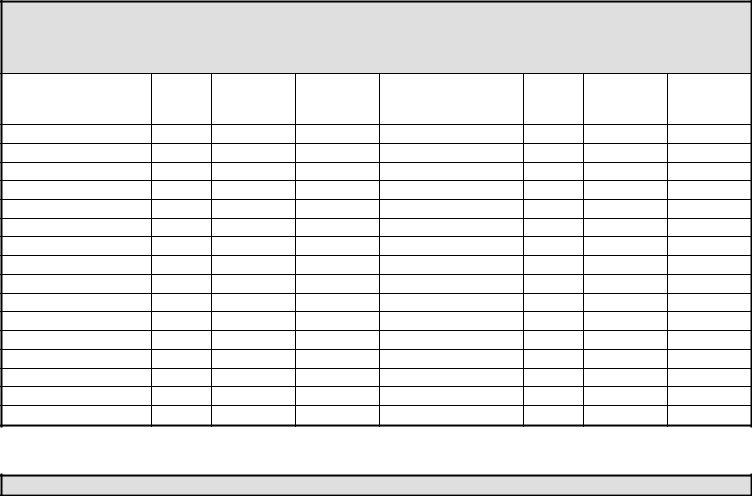

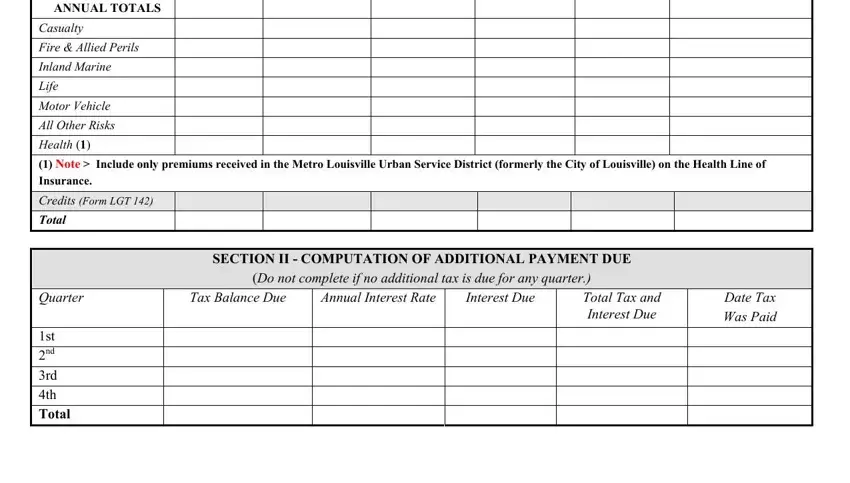

4. This fourth paragraph comes next with these particular fields to fill out: ANNUAL TOTALS, Casualty Fire Allied Perils, SECTION II COMPUTATION OF, Do not complete if no additional, Quarter, Tax Balance Due, Annual Interest Rate, Interest Due, Total Tax and Interest Due, Date Tax Was Paid, and st nd rd th Total.

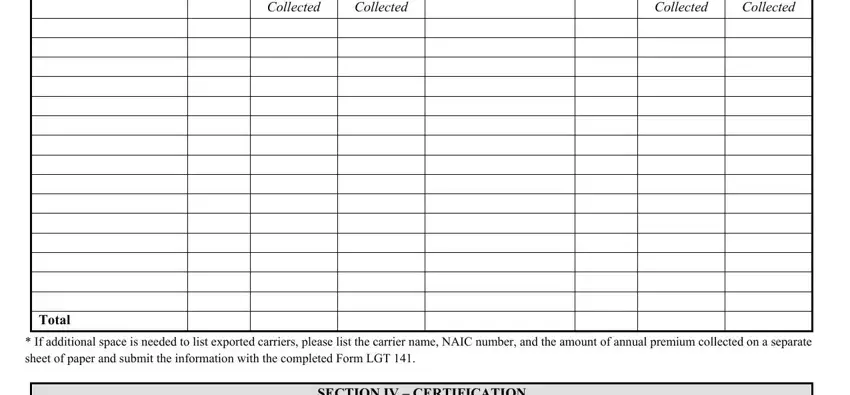

5. When you draw near to the finalization of this document, you'll notice a couple extra requirements that have to be fulfilled. In particular, Annual Premium Collected, Collected, Annual Premium Collected, Collected, Total, If additional space is needed to, and SECTION IV CERTIFICATION must all be filled out.

Step 3: Always make sure that the information is correct and then just click "Done" to complete the task. Sign up with us today and immediately gain access to Form Lgt 140, set for download. All alterations made by you are saved , so that you can customize the document later when necessary. FormsPal provides secure document completion without personal data record-keeping or sharing. Feel safe knowing that your data is in good hands here!