In the realm of workers' compensation in Pennsylvania, the LIBC-513 form plays a pivotal role for corporate executives. Designed by the Commonwealth of Pennsylvania Department of Labor & Industry's Bureau of Workers’ Compensation, this document caters specifically to executive officers seeking exemption from the Pennsylvania Workers’ Compensation Act. The form serves as a formal declaration by these executives, stating their voluntary decision to forego the rights and benefits typically afforded under the Act. What makes the LIBC-513 unique is its requirement for each executive officer with an ownership interest in the corporation to complete and submit an original declaration, ensuring that the total ownership interest declared equals 100%. The form is precise in its structure, offering options for executives of Subchapter S corporations, those with at least a 5% ownership interest in Subchapter C corporations, and officers serving nonprofit corporations without remuneration. Filled with meticulous instructions for both typed and handwritten submissions, the LIBC-513 form emphasizes clarity and accuracy, from the use of black ink to the specific ways of entering names, dates, and telephone numbers. This careful approach ensures that the Bureau of Workers Compensation can efficiently process and machine-read the form, highlighting the form's significance in maintaining clear and accountable declarations by corporate executives regarding their workers' compensation status. Furthermore, the LIBC-513 includes stern reminders about the legal implications of providing false information, underscoring the seriousness with which the Commonwealth views these declarations.

| Question | Answer |

|---|---|

| Form Name | Form Libc 513 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | libc 513, uppercase, 1971, Cameron |

Commonwealth of Pennsylvania

Department of Labor & Industry

Bureau of Workers’ Compensation

COMPLIANCE SECTION

1171 S. Cameron Street, Room 103

Harrisburg PA

EXECUTIVE OFFICER’S DECLARATION

INSTRUCTIONS: Each executive officer having an ownership interest in a corporation seeking exemption must complete an original Declaration for submission with the Corporation’s Application for Executive Officer Exception. The total ownership interest of all Declarations combined must equal 100%. See the Form Completion Hints on the reverse side for additional information and the Application for Executive Officer Exception for filing instructions.

I, the below named Executive Officer, do hereby knowingly and voluntarily elect not to be an employee of the below named corporation for purposes of the Pennsylvania Workers’ Compensation Act, and waive any and all benefits and rights to which I might be entitled under the Pennsylvania Workers Compensation Act (77 P.S. §1, et seq.).

I do hereby state and affirm that I am an executive officer who: (check only one box)

Has an ownership interest in a Subchapter S corporation as defined by the Federal Tax Reform Code of 1971.

Has at least 5% ownership interest in a Subchapter C corporation as defined by the Federal Tax Reform Code of 1971. Serves voluntarily and without remuneration for a nonprofit corporation

I, the undersigned, verify that the facts set forth in this Executive Officer’s Declaration are true and correct to the best of my knowledge, information and belief. This verification is made subject to the penalties of 18 Pa.C.S. § 4904, relating to unsworn falsification to authorities.

Month Day Year

Signature of Executive Officer |

|

Date |

Corporation’s Full Legal Name

Title of Executive Officer

First Name

-

-

Middle Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

513 |

|

0705 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Suffix (ex: Jr.) |

|

Social Security Number |

|

|

|

|

|

|

|

Percentage of Ownership |

Telephone |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (Business or residence address acceptable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

Zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

-

For Bureau Use ONLY….

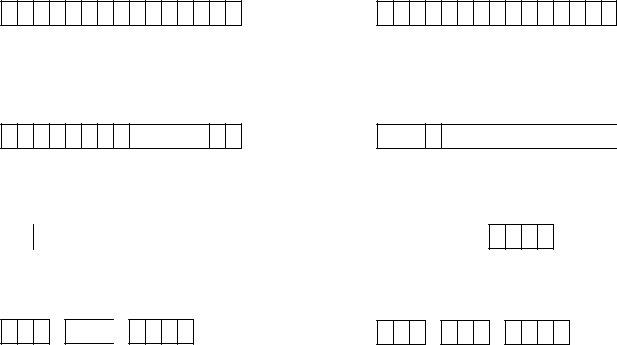

FORM COMPLETION HINTS

In General:

This form will be

Where to Type:

When typing a form, begin in the left most box of each set of red boxes. Use normal spacing (do not put one letter per box) staying within the range of boxes. Avoid typing in the margins. Use black ink only. For example:

First Name

JOHNATHAN

Last Name

JONES

Where to Handwrite:

When completing a form by hand, print clearly, using uppercase letters, in black ink only, placing one letter or numeral within each box. For example:

First Name

J O HN A T H A N

Dates:

Enter all dates as MMDDYYYY. For example:

Last Name

J ON E S

Month |

Day |

Year |

Month |

Day |

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

04272005 |

|

|

|

|

|

|

|

OR |

0 |

4 |

|

2 |

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Numbers:

The first three digits are the area code. No need for parenthesis. For example:

2 0 0 5

Telephone

7175553894

OR

Telephone

7 1 7

5 5 5

3 8 9 4

Auxiliary aids and services are available upon request to individuals with disabilities.

Equal Opportunity Employer/Program