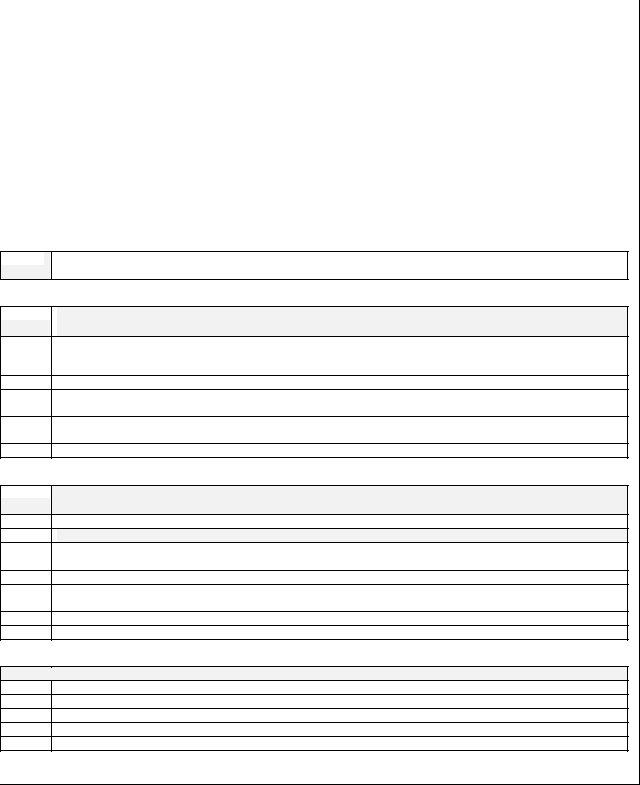

Navigating the intricacies of tax obligations is a crucial aspect for beer importers in Washington State, and the LIQ-788 form is a central piece in this puzzle. Officially issued by the Washington State Liquor Control Board, this document is tailored specifically for Washington beer importers, providing a detailed framework for reporting taxes attributable to their operations. Given its revision in June 2010, the form captures essential data, including licensee information, details of beer purchases, non-taxable shipments, and even samples used within a specific reporting month. As a monthly obligation, regardless of business activity levels, the form's timely submission - on or before the 20th of the following month - is mandatory to avoid penalties. With its parts meticulously designed to calculate taxes due on both purchases and samples, along with delineating late reporting penalties and any applicable credits or balances due, adherence to the LIQ-788 form’s directives ensures compliance with state regulations while aiding in the smooth operation of the beer importation sector.

| Question | Answer |

|---|---|

| Form Name | Form Liq 788 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Liq 788 liqwagov form |

|

|

WASHINGTON STATE LIQUOR CONTROL BOARD |

|

WASH BEER IMPORTERS SUMMARY TAX REPORT |

|||

|

|

3000 PACIFIC AVE SE |

PO BOX 43085 |

|

|

FORM |

|

|

|

OLYMPIA WA |

|

|

(REVISED 06/10) |

||

|

|

|

|

|

|||

|

License Number |

|

|

|

|

|

|

|

|

|

|

|

MONTH |

If Revised Report |

|

|

License Name |

|

|

|

|

|

(check box) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Location Address |

|

|

|

|

|

|

|

|

|

|

|

YEAR |

|

|

|

City, State & Zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART 1: |

PURCHASES REPORT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL BARRELS |

TOTAL BARRELS |

|

|

|

|

|

|

@ $23.580 |

@ $4.782 |

|

|

Parts 1 and 2 are |

|

(1) |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

PART 2: |

ONE LINE PER DISTRIBUTOR FOR REPORTING MONTH |

|

|

|

||

|

(2) |

(3) |

|

|

|

(4) |

(5) |

|

DISTRIBUTOR'S |

SOLD TO |

|

TOTAL BARRELS |

TOTAL BARRELS |

||

|

WSLCB LICENSE NO. |

DISTRIBUTOR'S NAME |

|

CITY |

|

@ $23.580 |

@ $4.782 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS FOR PART 2 |

(6) |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART 3: |

IMPORTERS REPORT OF ALL SAMPLES USED |

|

|

|

||

|

|

|

|

|

|

||

|

|

(does not include those shipped to Distributors where Distributor pays tax) |

|

|

TOTAL BARRELS |

TOTAL BARRELS |

|

|

|

|

|

|

|

@ $23.580 |

@ $4.782 |

|

|

(Taxes are owed on Samples only) |

|

|

|

|

|

|

|

|

(7) |

|

|

||

|

|

|

|

|

|

Box (7) Col (4) X $23.580 = (8) |

Box (7) Col (5) X $4.782 = (8) |

|

|

|

|

|

|

|

|

|

|

Certified True and Correct Under Penalty of Perjury |

|

(8) |

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Person |

|

|

|

(9) |

Taxes Due Current Month |

|

|

Completing Form |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PENALTIES for late reporting |

|

|

Printed Name |

|

|

|

(10) |

2% per month of amounts on |

|

|

|

|

|

|

|

line (9) |

|

|

Date |

|

|

|

(11) |

Prior Credit or Balance Due |

|

|

|

|

|

(if any) |

|

||

|

|

|

|

|

|

|

|

|

Telephone No |

|

|

|

(12) |

TOTAL DUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WSLCB USE ONLY |

|

|

WSLCB USE ONLY |

||

|

Payee Number |

|

|

|

|

Amount Received |

|

|

|

|

|

|

|

|

|

|

Refund Amount |

|

|

|

|

Office Audit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postmark Date |

|

Instructions for Completing

WASH BEER IMPORTERS SUMMARY TAX REPORT

This report must be filed every month INCLUDING MONTHS WHEN THERE IS NO ACTIVITY. Reports must be postmarked on or before the 20th of the following month. When the 20th falls on a Saturday, Sunday, or a legal holiday, the filing must be postmarked by the U.S. Postal Service no later than the next postal business day.

Licensee Number: |

Enter your Washington State Liquor Control Board (WSLCB) 6 digit licensee number. |

Licensee Name: |

Trade Name per license number entered. |

Location Address: |

Location address per license number entered. |

City, State, Zip: |

City, State, and Zip Code per license number entered. |

MONTH: |

Enter month reported. |

YEAR: |

Enter year reported. |

|

Please complete the numbered fields as follows: (round to two decimal places) |

Part 1

(1)In the first cell, enter the total amount of beer purchased at the taxable rate of $23.580 per barrel. In the second cell, enter the total amount of beer purchased at the taxable rate of $4.782 per barrel.

Part 2

(2)Enter the

Licensee Lists and Forms may be found on the website at: http://www.liq.wa.gov/publications/WineandBeer.aspx

(3)Enter the trade name and city location of the receiving distributor in Washington State.

(4)Enter the Total Barrels of Beer sold at the taxable rate of $23.580 per barrel for the reporting month. Use only one line per distributor.

(5)Enter the Total Barrels of Beer sold at the taxable rate of $4.782 per barrel for the reporting month. Use only one line per distributor.

(6)Enter the total barrels sold to Washington Distributors from columns 4 and 5 for the month. (Barrel = 31 gallons).

Part 3 TAXABLE SHIPMENTS

(does not include those shipped to Distributors where the distributor pays the tax)

(7)Enter the Total Barrels of beer used as samples under the correct tax rate for the reporting month.

Calculating Taxes, Penalties and any Adjustments.

(8)Calculate line 7, first cell multiplied by $23.580 ( tax rate per barrel). Calculate line 7, second cell multiplied by $4.782 (tax rate per barrel).

(9)Calculate the Current Taxes Due for the two columns in line 8 on line 9 .

(10)Enter the amount of penalties if reporting late. (Reports are due the 20th of the following month and penalties accumulate at 2% per month of the total tax due on line 9).

(11)Enter the amount of an existing credit as a negative number. Indicate a balance due as a positive number.

(12)Enter the total due from entries in box 9, 10, and 11.

Certified True and Correct Under Penalty of Perjury

Signature of Person Completing Form.

Enter printed Name of person who completed the form

Enter the date form completed

Enter the telephone number of person who completed the form

Enter the

LIQ

REVISED 06/10