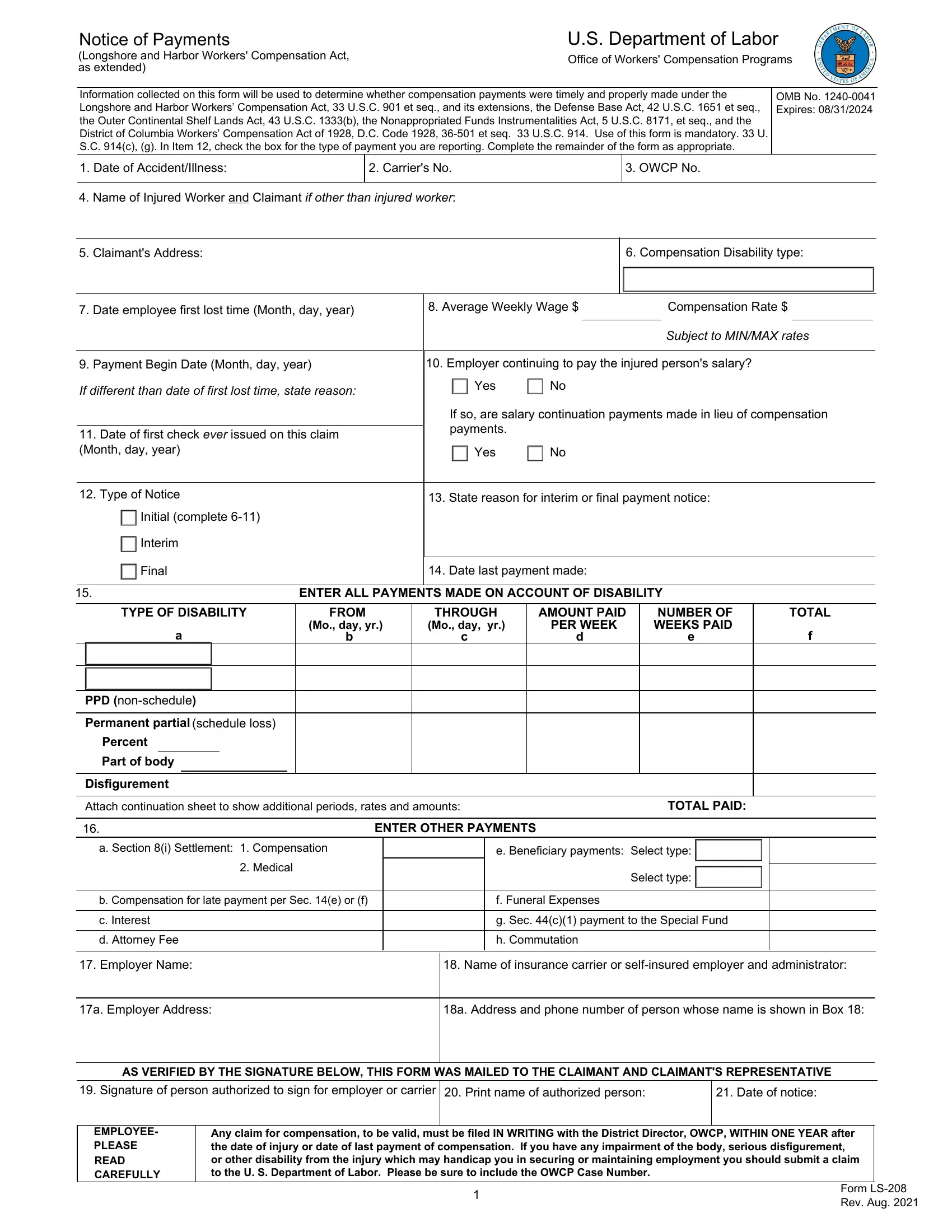

INSTRUCTIONS TO THE EMPLOYER/INSURANCE CARRIER

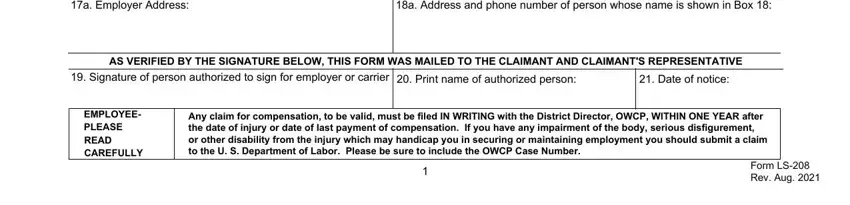

A COPY OF THE FORM MUST BE MAILED TO THE CLAIMANT AND THE CLAIMANT'S REPRESENTATIVE.

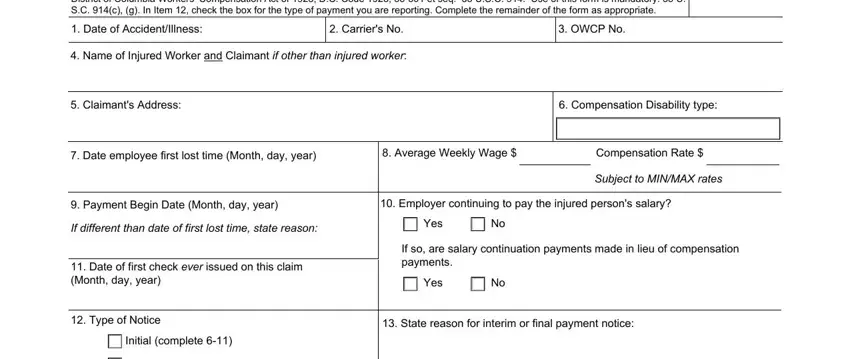

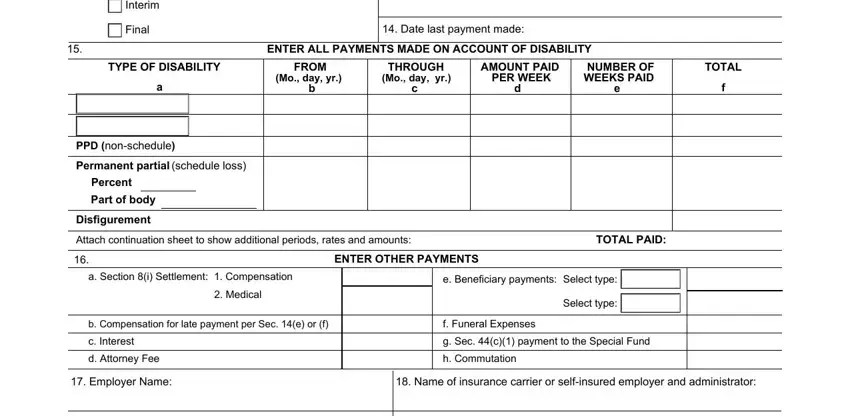

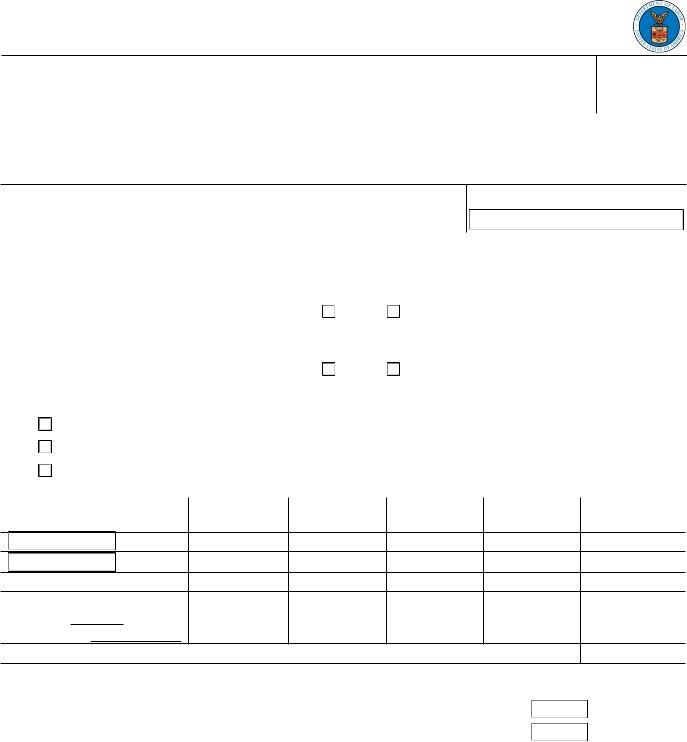

This form must be filed with the Department of Labor to report disability or death compensation payments, as well as other statutory payments, in three situations.

(1)You must file this form the same day you make a first payment of compensation. 20 C.F.R. 702.234. Failure to do so may result in assessment of a penalty under 33 U.S.C. 930(b) and (e).

(2)You must file this form anytime you make an interim change in benefit payments. 20 C. F.R. 702.234. Failure to do so may result in assessment of a penalty under 33 U.S.C. 930(b) and (e) .

(3)You must file this form within 16 days of final payment of compensation. 33 U.S.C. 914(g), 20 C.F.R. 702.235. Failure to do so will result in assessment of a penalty in an amount established under 20 C.F.R. 702.236.

INSTRUCTIONS TO INJURED WORKER

A claim may be filed within one year after the injury or death (33 U.S.C. 913(a)). If compensation has been paid without an award, a claim may be filed within one year after the last payment. Time for filing a claim does not begin to run until the employee or beneficiary knows, or should have known by the exercise of reasonable diligence, of the relationship between the employment and the injury. In cases involving occupational disease which does not immediately result in death or disability, a claim may be filed within two years after the employee or claimant becomes aware, or in the exercise of reasonable diligence or by reason of medical advice should have been aware, of the relationship between the employment, the disease, and the death or disability.

To file a claim for compensation, complete and sign an LS-203, Employee's Claim for Compensation. The form can be provided by your servicing district office nearest you https://www.dol.gov/agencies/owcp/dlhwc/lscontac or you can obtain the form through our website: https://www.dol.gov/ agencies/owcp/dlhwc/lsforms

TO SUBMIT FORMS TO DEPARTMENT OF LABOR

Please be sure to include the OWCP Case Number and mail to the OWCP/DFELHWC Central Mail Receipt site at the following address: U. S. Department of Labor

Office of Workers' Compensation Programs

Division of Federal Employees Longshore and Harbor

400 West Bay Street, Suite 63A, Box 28

Jacksonville, FL 32202

Or upload the form directly to the case file using our Secure Electronic Access Portal (SEAPortal).

Access the SEAPortal directly at

https://seaportal.dol.gov/portal/?program_name=LS

PRIVACY ACT STATEMENT

The following information is provided in accordance with the Privacy Act of 1974, 5 USC 552a. (1) This collection of information is authorized under the Longshore and Harbor Workers' Compensation Act (LHWCA) and its extensions. (2) The information will be used to determine beginning and ending dates of compensation payments, types and amounts of compensation payments, and reasons for terminating compensation. (3) Completion of this form is MANDATORY. (4) Disclosures of this information may be made to: the claimant and his or her representative(s); the employer that employed the injured worker at the time of injury; the insurance carrier or other entity that secured the employer's compensation liability and their representative (s); the Department of Labor's Office of Administrative Law Judges, or other person, board or organization, authorized or required to render decisions on claims or other matters arising in connection with a claim; Federal, state and local agencies to determine whether benefits are being and have been paid properly and, where appropriate, to pursue salary/administrative offset and debt collection actions required or permitted by law; and other individuals, their representatives, and government agencies enforcing a legal obligation for alimony or child support. (5) An employer or insurance carrier's failure to timely provide the required information may result in penalties allowed by law. (6) This information is included in two Systems of Records, DOL/OWCP-3, 4, published at 81 Federal Register 25765, 25859-61 (April 29, 2016), or as updated and republished.

Public Burden Statement

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless such collection displays a valid OMB control number. The valid OMB control number for this information collection is 1240-0041. Public reporting burden for this collection of information is estimated to range between 5 and 15 minutes/hours per response, including time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. The obligation to respond to this collection is mandatory (5 U.S.C. 914(c)). Send comments regarding the burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to the U.S. Department of Labor, Office of Workers' Compensation Programs, 200 Constitution Avenue, N.W., Room S-3229, Washington, DC 20210. Note: Please do not return the completed LS-208 application to this address.