Handling PDF files online is always surprisingly easy with this PDF editor. You can fill out new york ls 59 here and try out several other options available. Our professional team is continuously endeavoring to develop the editor and help it become even easier for users with its multiple functions. Bring your experience one stage further with continuously improving and great options available today! Here's what you'd need to do to start:

Step 1: First of all, open the pdf editor by pressing the "Get Form Button" at the top of this page.

Step 2: Using this online PDF tool, it's possible to do more than simply fill out blanks. Edit away and make your docs seem faultless with custom text added, or fine-tune the original input to perfection - all accompanied by the capability to incorporate almost any pictures and sign the file off.

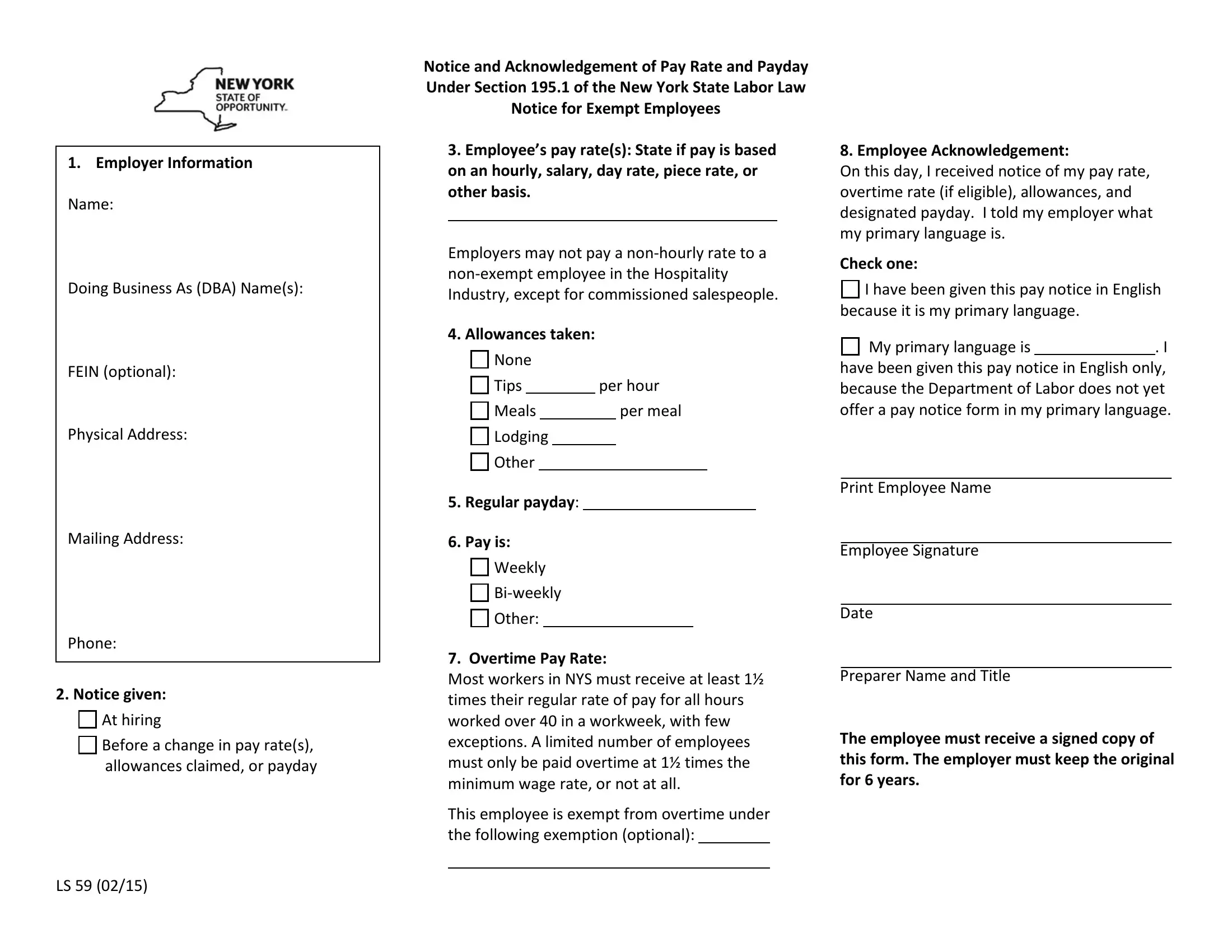

This PDF form will need particular details to be filled out, thus make sure to take whatever time to fill in exactly what is expected:

1. First, while filling out the new york ls 59, begin with the section that has the following blank fields:

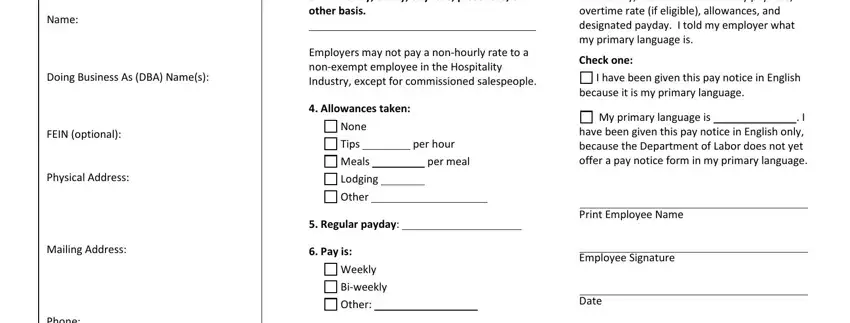

2. Once your current task is complete, take the next step – fill out all of these fields - Notice given, At hiring, Before a change in pay rates, Overtime Pay Rate Most workers in, This employee is exempt from, and Print Employee Name Employee with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It is possible to get it wrong while filling in your Print Employee Name Employee, therefore be sure you take a second look before you decide to send it in.

Step 3: Be certain that the details are accurate and click on "Done" to progress further. Join FormsPal right now and easily gain access to new york ls 59, available for downloading. Every change made is conveniently kept , making it possible to customize the file later if required. FormsPal guarantees protected document completion with no personal data recording or any type of sharing. Be assured that your details are secure here!