Our PDF editor was designed with the purpose of making it as simple and user-friendly as possible. These particular steps will help make filling in the form 941 worksheet 1 fast and simple.

Step 1: Choose the orange "Get Form Now" button on the following web page.

Step 2: As soon as you've entered the editing page form 941 worksheet 1, you should be able to discover all of the actions available for the document at the top menu.

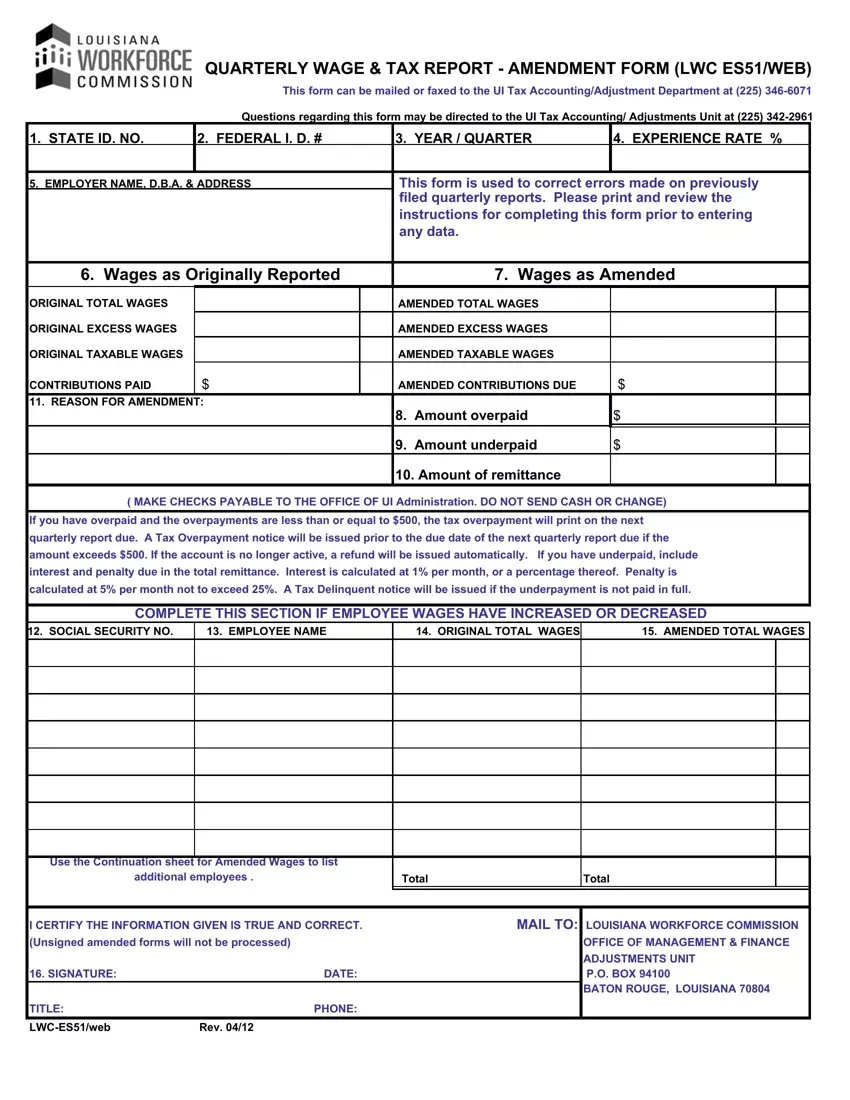

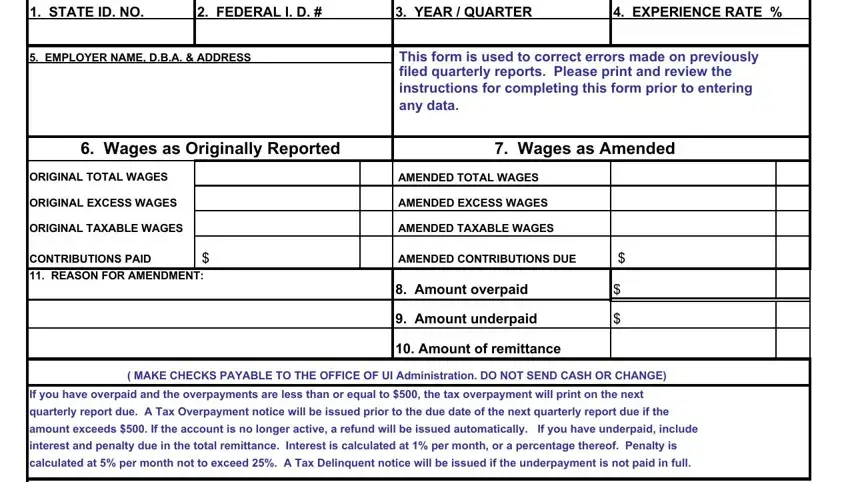

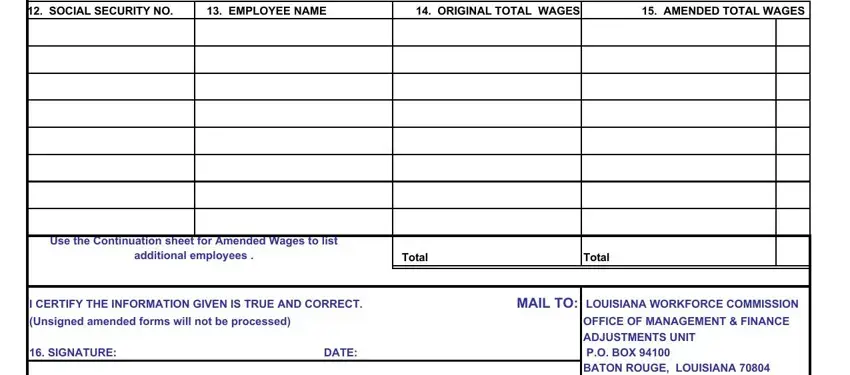

Fill out the form 941 worksheet 1 PDF and type in the information for each and every area:

In the COMPLETE THIS SECTION IF EMPLOYEE, SOCIAL SECURITY NO, EMPLOYEE NAME, ORIGINAL TOTAL WAGES, AMENDED TOTAL WAGES, Use the Continuation sheet for, Total, Total, I CERTIFY THE INFORMATION GIVEN IS, Unsigned amended forms will not be, SIGNATURE, DATE, MAIL TO LOUISIANA WORKFORCE, and OFFICE OF MANAGEMENT FINANCE box, note down your data.

The application will request information to quickly submit the segment TITLE, LWCESweb, Rev, and PHONE.

Step 3: As soon as you've hit the Done button, your document will be readily available transfer to any kind of device or email you indicate.

Step 4: Be sure to generate as many copies of the form as you can to avoid potential troubles.