Should you want to fill out massachusetts estate tax form m 792, you won't have to download and install any kind of applications - just give a try to our online tool. The editor is continually updated by our team, acquiring handy features and growing to be greater. Here is what you would need to do to begin:

Step 1: Click the "Get Form" button in the top area of this page to get into our PDF tool.

Step 2: This editor will let you customize most PDF forms in a range of ways. Improve it by adding customized text, correct original content, and put in a signature - all when it's needed!

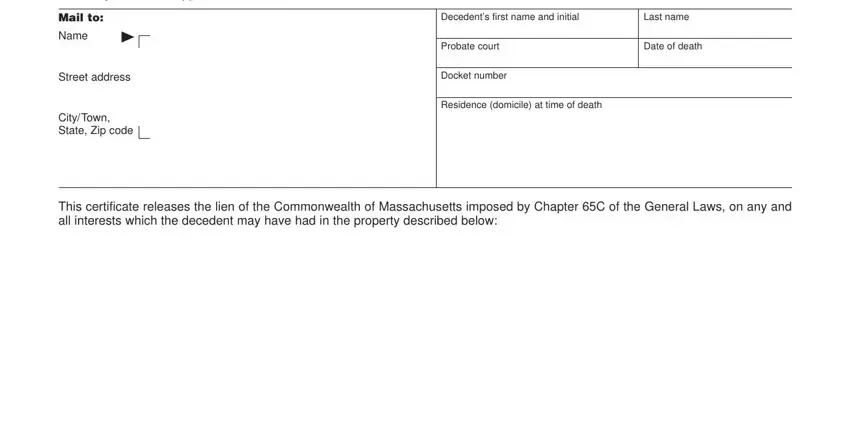

As for the blank fields of this particular document, here's what you should do:

1. It is critical to fill out the massachusetts estate tax form m 792 accurately, hence be attentive while working with the segments that contain these particular blanks:

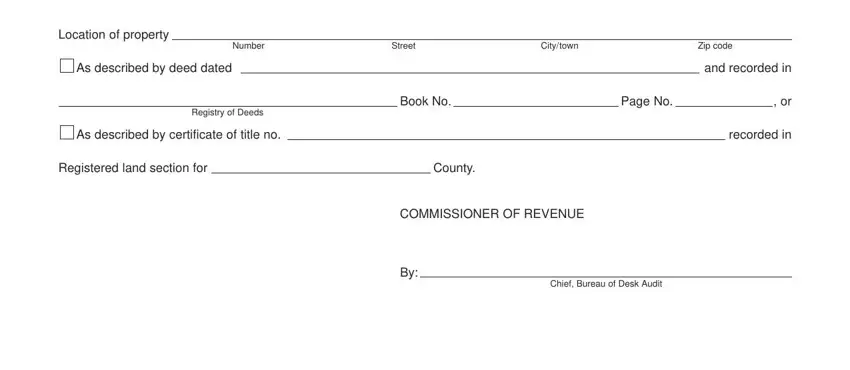

2. The subsequent stage is to complete these particular blank fields: Location of property, As described by deed dated, Registry of Deeds, As described by certificate of, Number, Street, Citytown, Zip code, Book No, Page No, and recorded in, recorded in, Registered land section for, County, and COMMISSIONER OF REVENUE.

People frequently make some mistakes when filling out and recorded in in this part. Don't forget to revise whatever you type in right here.

Step 3: Reread the information you've typed into the form fields and then press the "Done" button. Try a free trial account at FormsPal and gain instant access to massachusetts estate tax form m 792 - with all changes saved and accessible in your personal account. When you use FormsPal, you can certainly complete documents without having to get worried about database breaches or records being distributed. Our protected platform ensures that your personal details are kept safe.