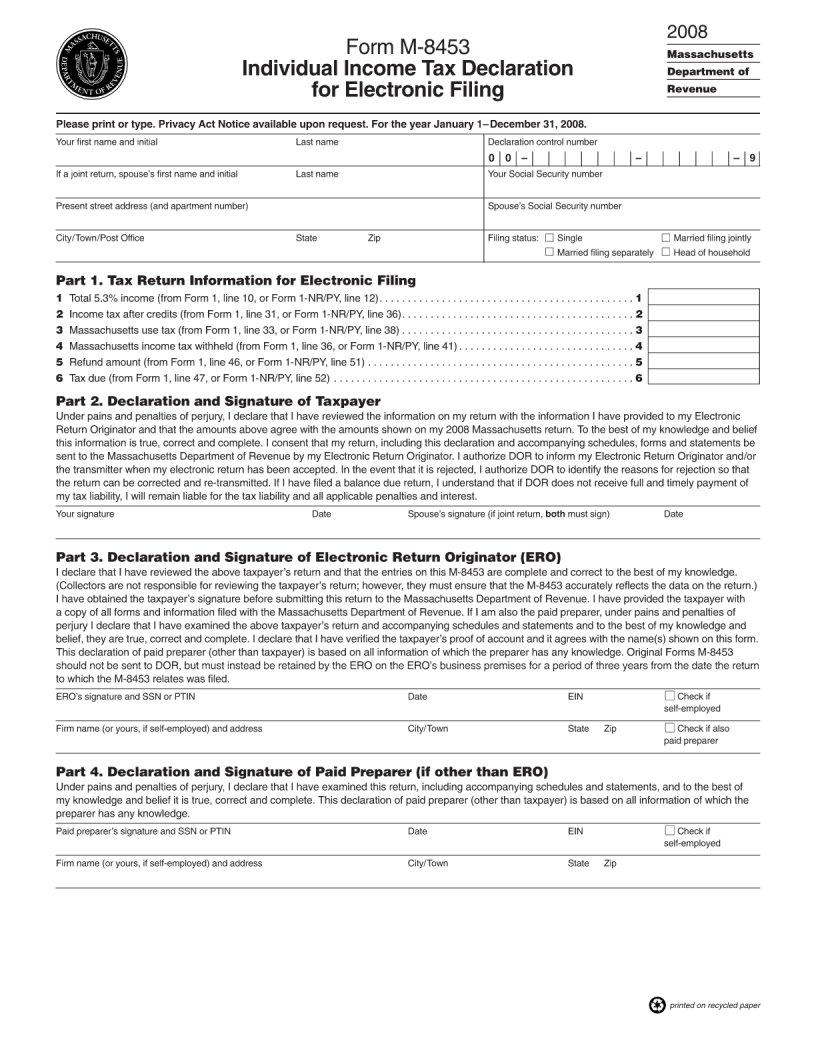

Filing taxes electronically has become the norm for millions of individuals, offering a convenient and streamlined way to manage one's financial obligations to the government. Central to this process is the M 8453 form, a document that plays a pivotal role in the electronic filing system. This form, officially known as the U.S. Individual Income Tax Transmittal for an IRS e-file Return, serves as a cover sheet for taxpayers who choose to file their taxes electronically but need to send certain paperwork to the IRS by mail. The necessity for this form arises in various circumstances, such as when documentation must accompany the tax return that cannot be electronically transmitted, including documents related to the adoption credit or the mortgage interest credit. It essentially bridges the gap between electronic filing and the traditional paper-based system, ensuring that the taxpayer's electronic submission is complete and accurate. As a vital component of the e-filing process, understanding the M 8453 form is crucial for taxpayers who are navigating the complexities of modern tax filing.

| Question | Answer |

|---|---|

| Form Name | Form M 8453 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | 2008, Originator, fillable form m 8453, PTIN |