In case you would like to fill out Form M1W, you won't have to download any sort of software - simply try using our online tool. In order to make our editor better and more convenient to use, we consistently work on new features, taking into consideration suggestions from our users. This is what you will need to do to get started:

Step 1: Press the "Get Form" button in the top part of this page to access our PDF editor.

Step 2: The editor enables you to modify your PDF file in various ways. Transform it with customized text, correct what is already in the PDF, and include a signature - all when you need it!

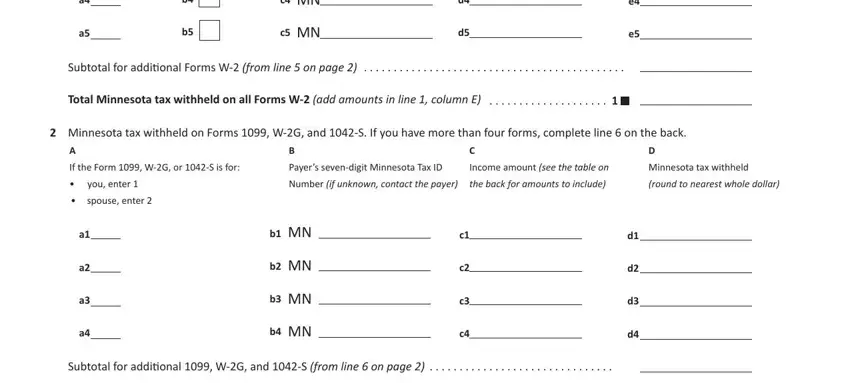

This PDF form will require some specific details; to guarantee accuracy, please make sure to take note of the guidelines further down:

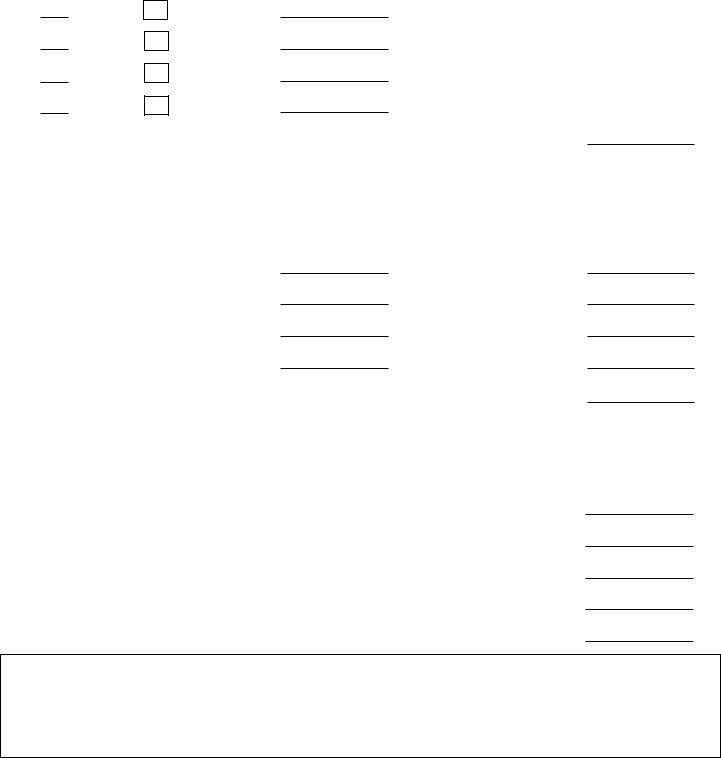

1. It is crucial to complete the Form M1W properly, so pay close attention while filling out the sections that contain all these blank fields:

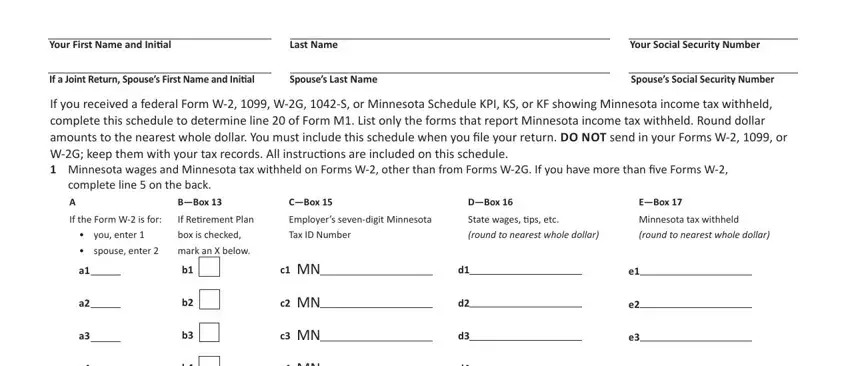

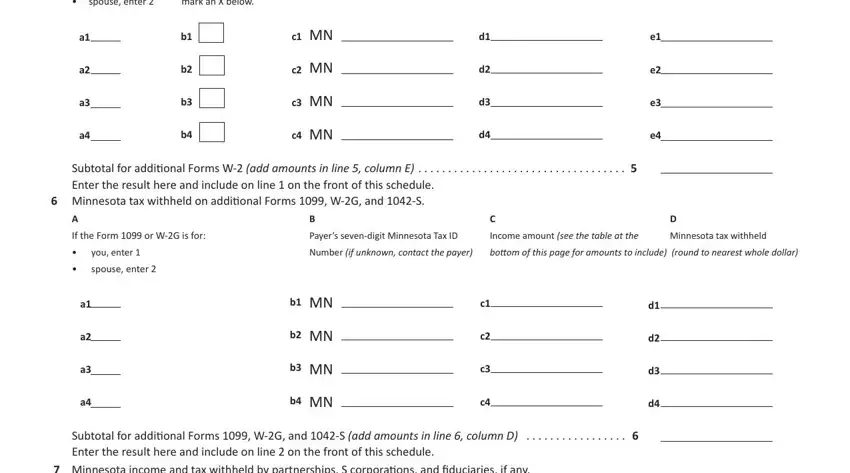

2. Soon after the last section is done, go to enter the suitable details in these - c MN, c MN, Subtotal for additional Forms W, Total Minnesota tax withheld on, Minnesota tax withheld on Forms, A If the Form WG or S is for, you enter, B Payers sevendigit Minnesota Tax, C Income amount see the table on, Minnesota tax withheld, round to nearest whole dollar, spouse enter, b MN, b MN, and b MN.

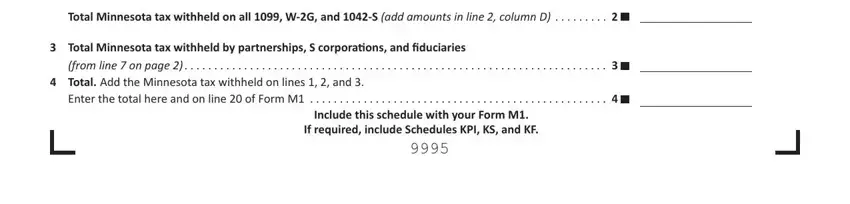

3. This next step is usually easy - complete all the empty fields in Total Minnesota tax withheld on, Total Minnesota tax withheld by, from line on page, Total Add the Minnesota tax, Enter the total here and on line, and Include this schedule with your to conclude this segment.

4. Completing spouse enter, mark an X below, c MN, c MN, c MN, c MN, Subtotal for additional Forms W, Minnesota tax withheld on, If the Form or WG is for, you enter, spouse enter, B Payers sevendigit Minnesota Tax, C Income amount see the table at, Minnesota tax withheld, and b MN is key in this next step - ensure that you take your time and fill in each and every blank area!

It is easy to make a mistake while filling out your B Payers sevendigit Minnesota Tax, consequently be sure to look again before you'll submit it.

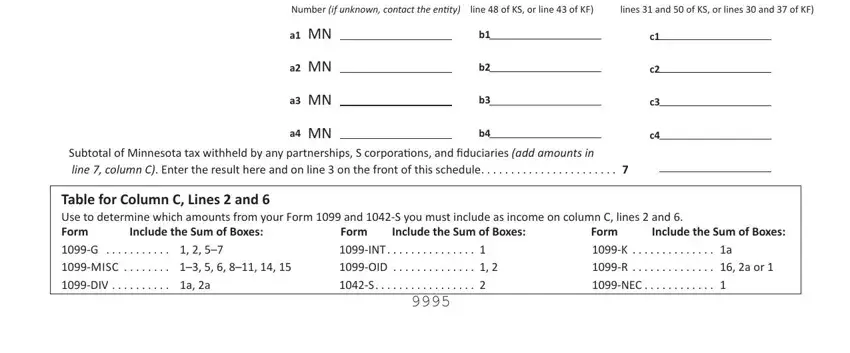

5. Now, the following final subsection is precisely what you will need to wrap up before closing the document. The blank fields here include the following: A Entitys sevendigit Minnesota Tax, BMinnesota Income Amount from line, CMinnesota Tax Withheld the sum of, a MN, a MN, a MN, a MN, Subtotal of Minnesota tax withheld, Table for Column C Lines and Use, Form INT OID, a a, Form K a R, Include the Sum of Boxes, Include the Sum of Boxes, and Include the Sum of Boxes.

Step 3: Before finalizing your document, ensure that all form fields were filled out correctly. When you’re satisfied with it, click “Done." Make a 7-day free trial option with us and gain instant access to Form M1W - with all transformations saved and accessible inside your personal account page. With FormsPal, you can complete forms without stressing about personal data leaks or entries being distributed. Our secure software makes sure that your personal information is maintained safely.