With the online PDF tool by FormsPal, you can easily fill in or edit m4 form 2021 right here and now. The tool is constantly updated by our staff, acquiring handy features and becoming better. All it takes is a few easy steps:

Step 1: Hit the "Get Form" button in the top area of this webpage to open our tool.

Step 2: As you access the editor, you'll see the document all set to be filled out. Apart from filling out different fields, you could also do other things with the PDF, specifically putting on your own textual content, modifying the initial textual content, adding images, putting your signature on the document, and a lot more.

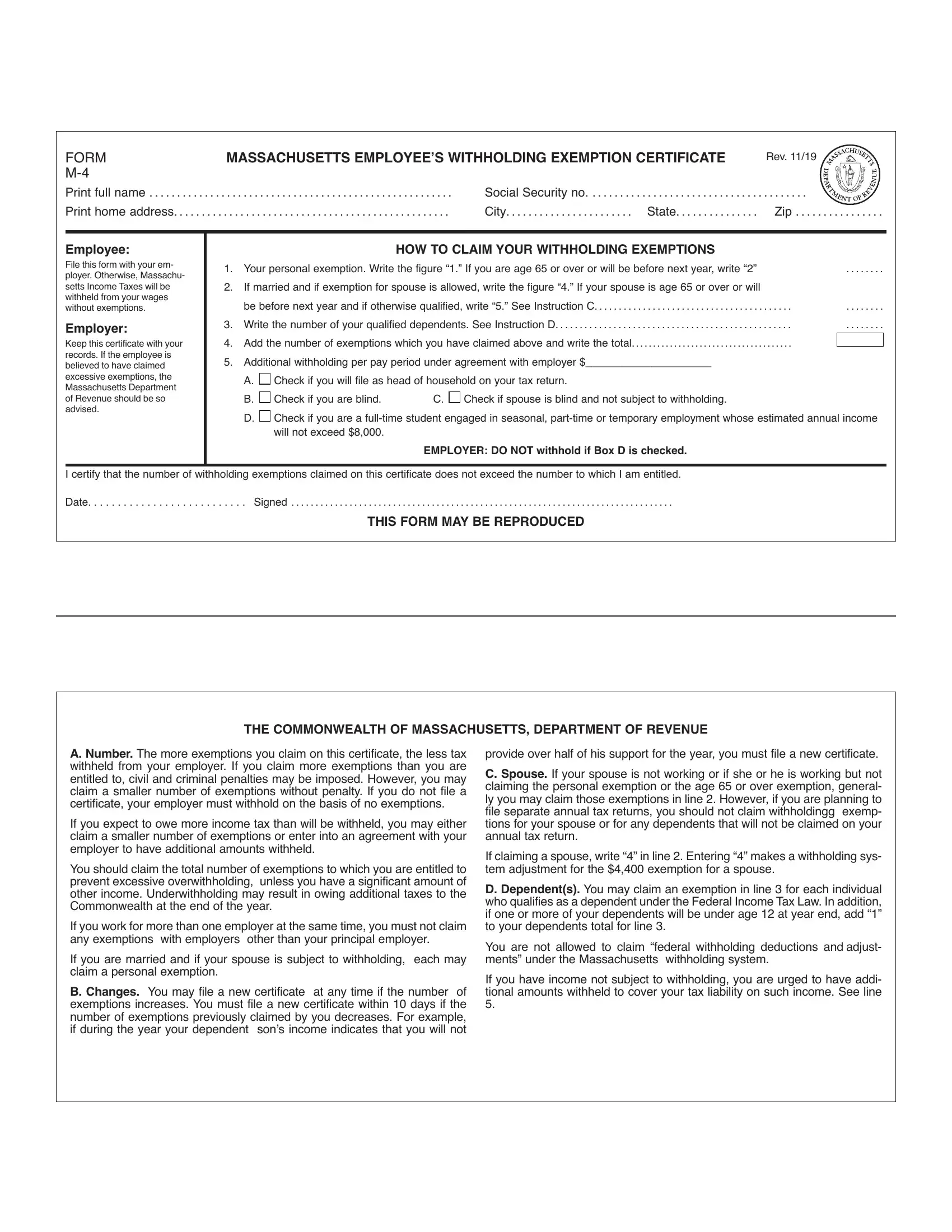

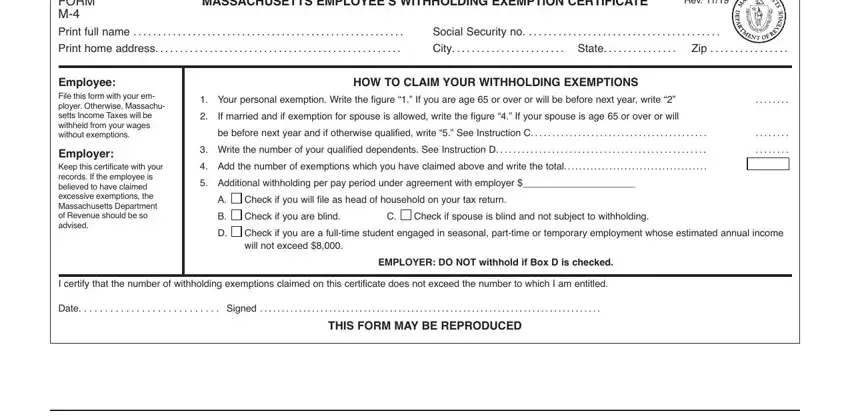

This PDF form will require particular data to be filled out, so you must take some time to type in exactly what is asked:

1. To begin with, once completing the m4 form 2021, start with the form section that features the next fields:

Step 3: Check that the details are accurate and press "Done" to complete the project. Right after getting afree trial account at FormsPal, it will be possible to download m4 form 2021 or send it via email promptly. The PDF document will also be accessible through your personal account page with your every single change. FormsPal ensures your information privacy via a secure method that in no way saves or distributes any kind of private information used in the file. You can relax knowing your paperwork are kept protected every time you use our editor!