If you are a Massachusetts taxpayer who received health insurance coverage through an Affordable Care Act (ACA) Marketplace plan in 2018, you will likely receive a Form 1099-HC from the marketplace. This form reports the amount of advance premium tax credit (APTC) that was paid to your insurance carrier on your behalf during 2018. The APTC is used to lower the cost of premiums for eligible taxpayers. If you received an APTC, it is important to understand how this amount will impact your federal and state income tax returns. The ACA requires individuals who have minimum essential coverage, including those who receive APTCs, to report their coverage on their federal income tax return. For more information about reporting health care coverage on your tax return, visit IRS.gov/aca . You can also contact the IRS helpline at 1-800-829-1040 with questions about filing your return. Thank you for reading our blog post! Stay tuned for more informative content from our team here at Rotenber

| Question | Answer |

|---|---|

| Form Name | Form Ma 1099 Hc |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | www.mass.govservice-details1095-b-and-1099-hc1095-B and 1099-HC tax formMass.gov |

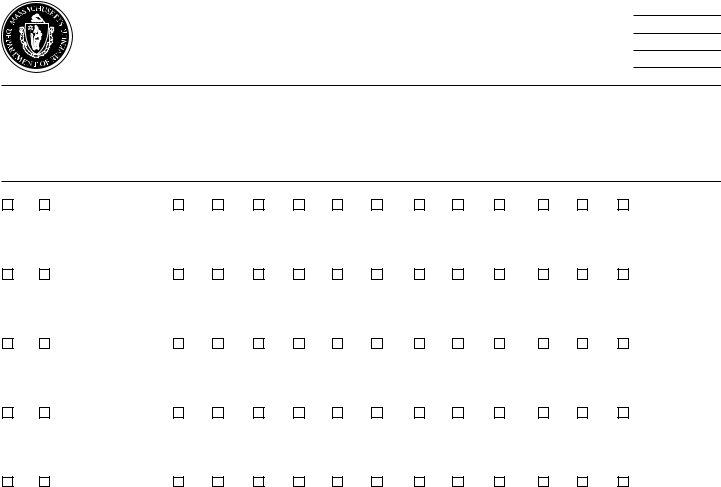

Form MA

IndividualMandate

MassachusettsHealthCareCoverage

2020

Massachusetts

Department of

Revenue

1. |

Name of insurance company or administrator |

|

|

2. |

FID number of insurance co. or administrator |

|

|

|

|

|

|

|

|

3. |

Name of subscriber |

4. |

Date of birth |

5. |

Subscriber number |

|

|

|

|

|

|

|

|

6. |

Street address |

7. |

City/Town |

8. |

State |

9.Zip |

If No, check months with minimum creditable coverage: |

|

|

|

|

|

Corrected: |

||||||||

Yes |

No |

|

Jan. |

Feb. |

Mar. |

Apr. |

May |

June |

July |

Aug. |

Sept. |

Oct. |

Nov. |

Dec. |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||

a.Name of dependent |

Date of birth |

|

Subscriber number |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||||

If No, check months with minimum creditable coverage: |

|

|

|

|

|

Corrected: |

||||||||

Yes |

No |

|

Jan. |

Feb. |

Mar. |

Apr. |

May |

June |

July |

Aug. |

Sept. |

Oct. |

Nov. |

Dec. |

|

|

|

|

|

|

|

|

|

|

|

||||

b.Name of dependent |

Date of birth |

|

Subscriber number |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||||

If No, check months with minimum creditable coverage: |

|

|

|

|

|

Corrected: |

||||||||

Yes |

No |

|

Jan. |

Feb. |

Mar. |

Apr. |

May |

June |

July |

Aug. |

Sept. |

Oct. |

Nov. |

Dec. |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||

c.Name of dependent |

Date of birth |

|

Subscriber number |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||||

If No, check months with minimum creditable coverage: |

|

|

|

|

|

Corrected: |

||||||||

Yes |

No |

|

Jan. |

Feb. |

Mar. |

Apr. |

May |

June |

July |

Aug. |

Sept. |

Oct. |

Nov. |

Dec. |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||

d.Name of dependent |

Date of birth |

|

Subscriber number |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||||

If No, check months with minimum creditable coverage: |

|

|

|

|

|

Corrected: |

||||||||

Yes |

No |

|

Jan. |

Feb. |

Mar. |

Apr. |

May |

June |

July |

Aug. |

Sept. |

Oct. |

Nov. |

Dec. |