By using the online PDF tool by FormsPal, you are able to fill out or edit ma va form 40 hbyet 2019 here and now. FormsPal team is continuously working to develop the editor and make it much faster for people with its multiple features. Bring your experience to a higher level with constantly improving and great opportunities available today! To get the ball rolling, take these simple steps:

Step 1: Hit the "Get Form" button above. It'll open up our editor so that you can begin filling in your form.

Step 2: When you start the PDF editor, you will find the document ready to be filled out. Other than filling in different blank fields, you may also perform various other things with the Document, specifically writing any words, changing the initial text, adding images, affixing your signature to the form, and much more.

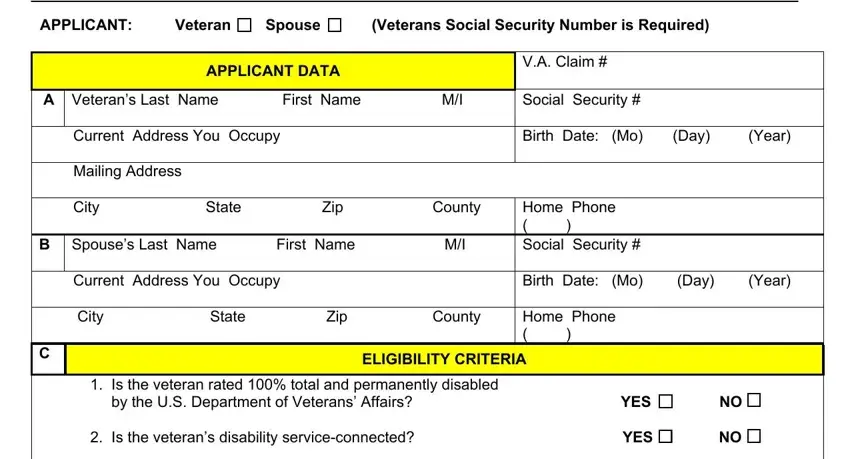

In an effort to complete this document, be certain to enter the right information in every blank:

1. You have to fill out the ma va form 40 hbyet 2019 properly, hence be mindful while filling out the sections containing these blank fields:

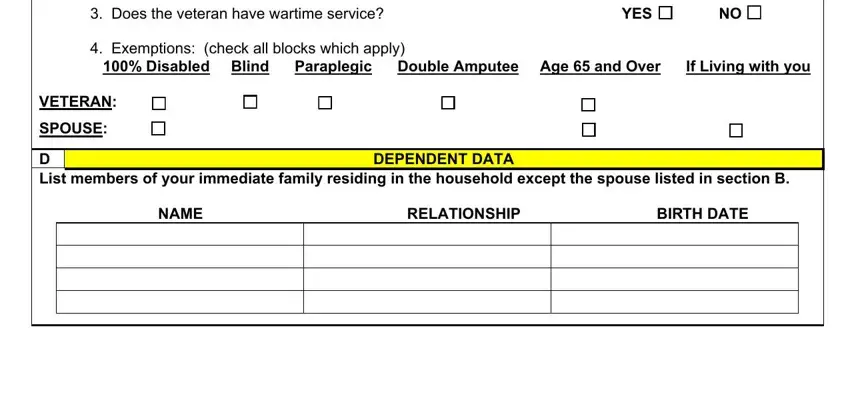

2. Once your current task is complete, take the next step – fill out all of these fields - Is the veteran rated total and, Exemptions check all blocks which, D List members of your immediate, and DEPENDENT DATA with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

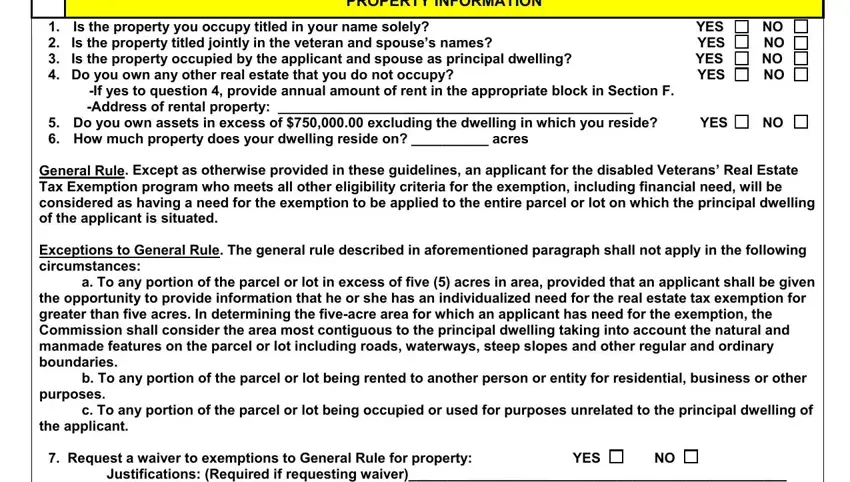

3. This subsequent segment should be relatively easy, PROPERTY INFORMATION, Is the property you occupy titled, Address of rental property Do, General Rule Except as otherwise, a To any portion of the parcel or, the opportunity to provide, b To any portion of the parcel or, purposes, c To any portion of the parcel or, the applicant, Request a waiver to exemptions to, and Justifications Required if - all of these form fields must be completed here.

Be extremely mindful when filling out Justifications Required if and the opportunity to provide, because this is the part in which many people make errors.

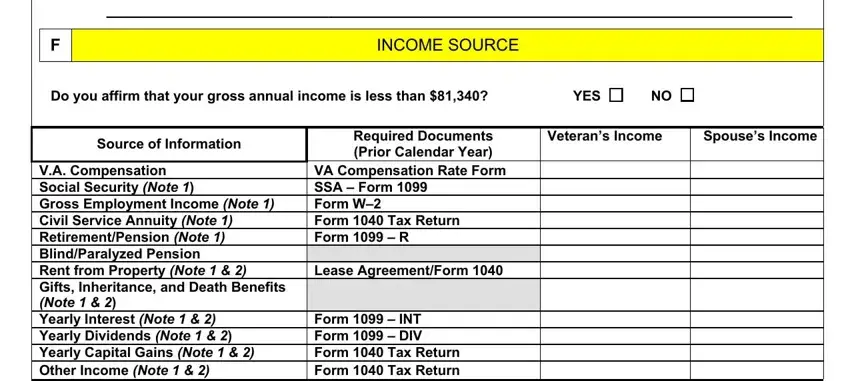

4. It is time to complete this fourth form section! In this case you will get all these Justifications Required if, INCOME SOURCE, Do you affirm that your gross, Source of Information, VA Compensation Social Security, Required Documents Prior Calendar, VA Compensation Rate Form SSA, Form INT Form DIV Form Tax, Veterans Income, and Spouses Income fields to fill in.

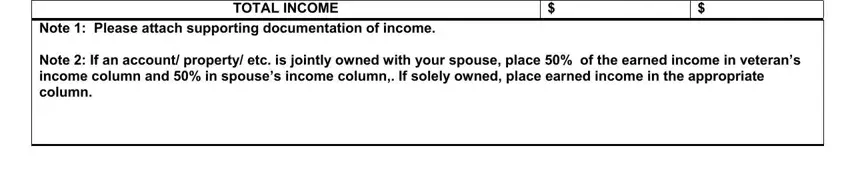

5. Since you draw near to the finalization of your file, you'll find a few more requirements that have to be satisfied. Notably, TOTAL INCOME, and Note Please attach supporting should be filled out.

Step 3: Before moving on, make sure that form fields are filled in the proper way. When you confirm that it's fine, press “Done." After setting up afree trial account here, you'll be able to download ma va form 40 hbyet 2019 or send it via email promptly. The PDF form will also be available in your personal account page with your modifications. We do not share the information that you enter when filling out documents at our site.