Dealing with PDF forms online can be surprisingly easy with our PDF editor. You can fill in 2015 here without trouble. To have our editor on the leading edge of convenience, we work to put into operation user-driven capabilities and enhancements on a regular basis. We are routinely looking for feedback - help us with revolutionizing PDF editing. Getting underway is simple! All you need to do is adhere to the following easy steps directly below:

Step 1: Hit the "Get Form" button above. It is going to open up our pdf tool so that you could begin filling out your form.

Step 2: When you launch the tool, you will notice the document made ready to be filled in. Aside from filling in different blanks, you may also do many other things with the PDF, that is adding your own text, changing the initial textual content, inserting images, placing your signature to the form, and much more.

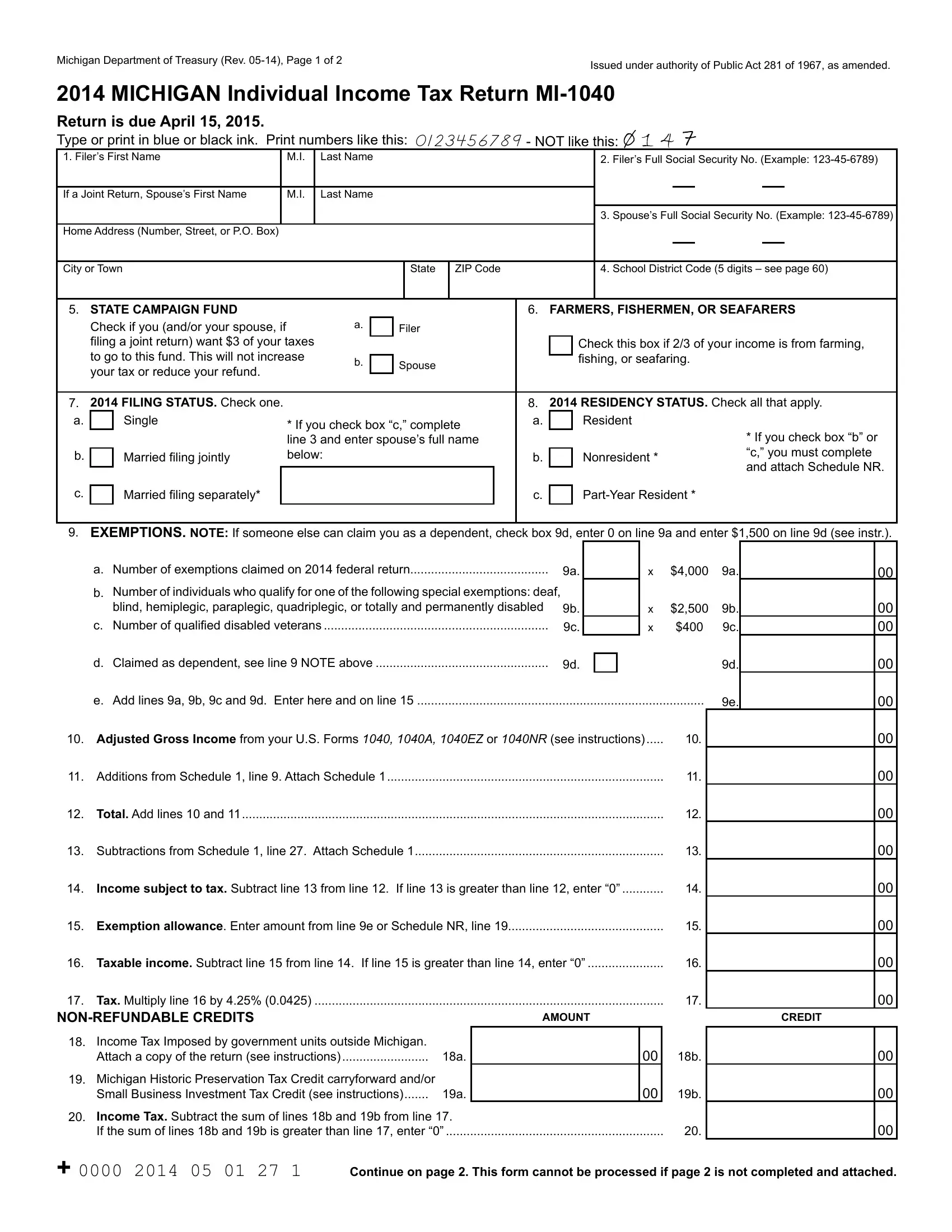

This PDF will need specific information to be entered, so you must take your time to type in what is expected:

1. You have to complete the 2015 correctly, therefore pay close attention when filling in the sections comprising these blank fields:

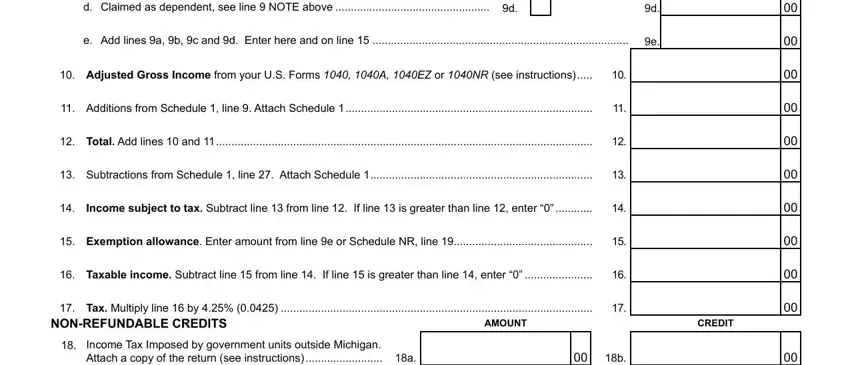

2. Soon after the last array of blanks is done, proceed to type in the relevant information in all these: d Claimed as dependent see line, e Add lines a b c and d Enter here, Adjusted Gross Income from your, Additions from Schedule line, Total Add lines and, Subtractions from Schedule line, Income subject to tax Subtract, Exemption allowance Enter amount, Taxable income Subtract line, Tax Multiply line by, NONREFUNDABLE CREDITS, AMOUNT, CREDIT, and Income Tax Imposed by government.

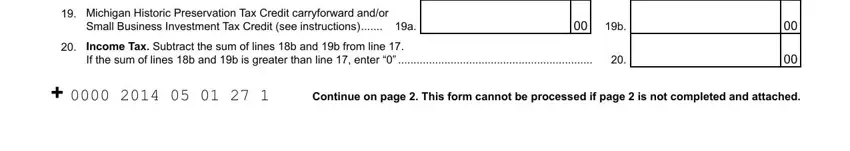

3. Completing Income Tax Imposed by government, Michigan Historic Preservation, Small Business Investment Tax, Income Tax Subtract the sum of, and Continue on page This form cannot is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

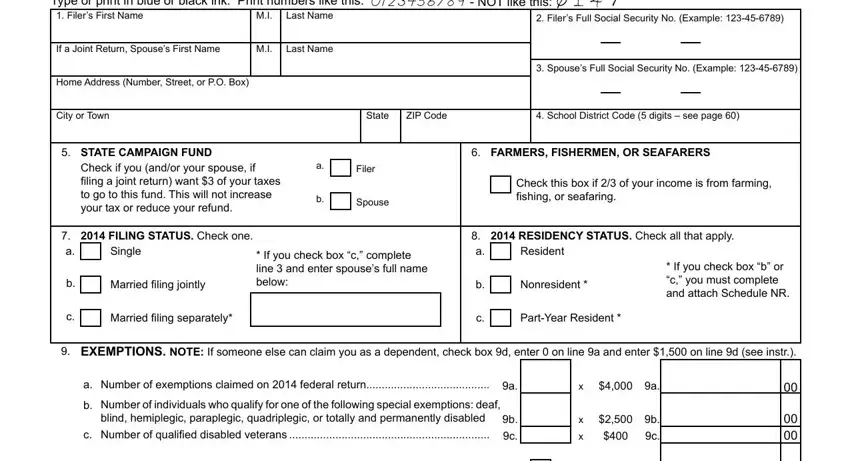

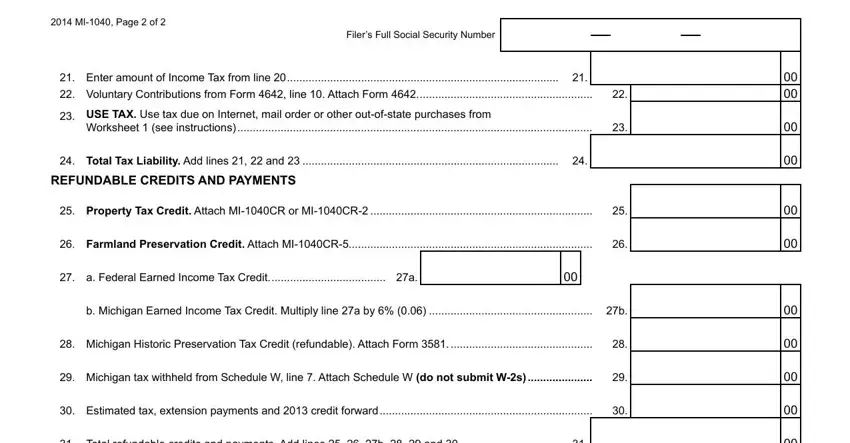

4. The subsequent paragraph will require your involvement in the following parts: MI Page of, Filers Full Social Security Number, Enter amount of Income Tax from, Voluntary Contributions from Form, USE TAX Use tax due on Internet, Worksheet see instructions, Total Tax Liability Add lines, REFUNDABLE CREDITS AND PAYMENTS, Property Tax Credit Attach MICR, Farmland Preservation Credit, a Federal Earned Income Tax, b Michigan Earned Income Tax, Michigan Historic Preservation, Michigan tax withheld from, and Estimated tax extension payments. Make certain you type in all requested information to go further.

It is easy to make an error when filling in the Michigan tax withheld from, hence ensure that you look again prior to deciding to send it in.

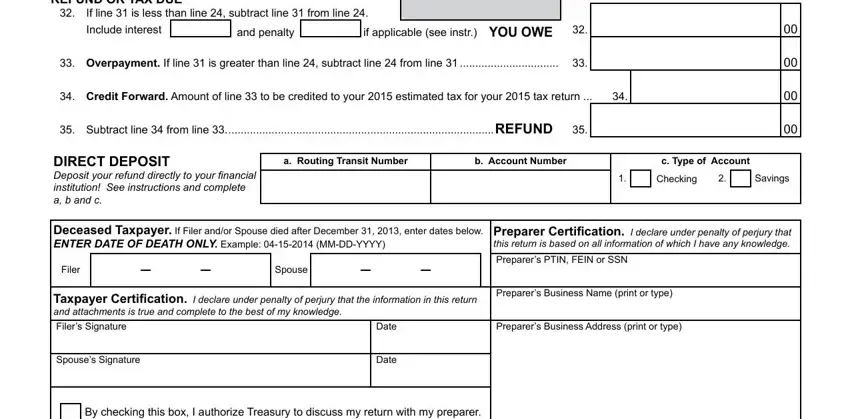

5. This pdf has to be finished by dealing with this area. Further there is an extensive list of blanks that need appropriate information to allow your document usage to be accomplished: REFUND OR TAX DUE, If line is less than line, Include interest, and penalty, if applicable see instr YOU OWE, Overpayment If line is greater, Credit Forward Amount of line to, Subtract line from line REFUND, DIRECT DEPOSIT Deposit your refund, a Routing Transit Number, b Account Number, c Type of Account, Checking, Savings, and Deceased Taxpayer If Filer andor.

Step 3: Look through everything you've inserted in the form fields and then click on the "Done" button. Join us now and immediately access 2015, set for downloading. Every last modification made is conveniently kept , which means you can customize the file later on as required. At FormsPal.com, we endeavor to make sure your details are kept protected.