Form Mi 1041D can be filled out online very easily. Simply make use of FormsPal PDF editing tool to accomplish the job fast. Our tool is consistently developing to grant the very best user experience possible, and that is thanks to our dedication to constant development and listening closely to customer feedback. Here is what you would have to do to get started:

Step 1: First, access the pdf editor by clicking the "Get Form Button" above on this page.

Step 2: Once you start the tool, you will get the form all set to be completed. Aside from filling in various blank fields, you could also perform other sorts of things with the form, specifically adding your own text, editing the original textual content, adding illustrations or photos, signing the document, and a lot more.

This PDF form will involve specific details; in order to guarantee accuracy and reliability, don't hesitate to take note of the following tips:

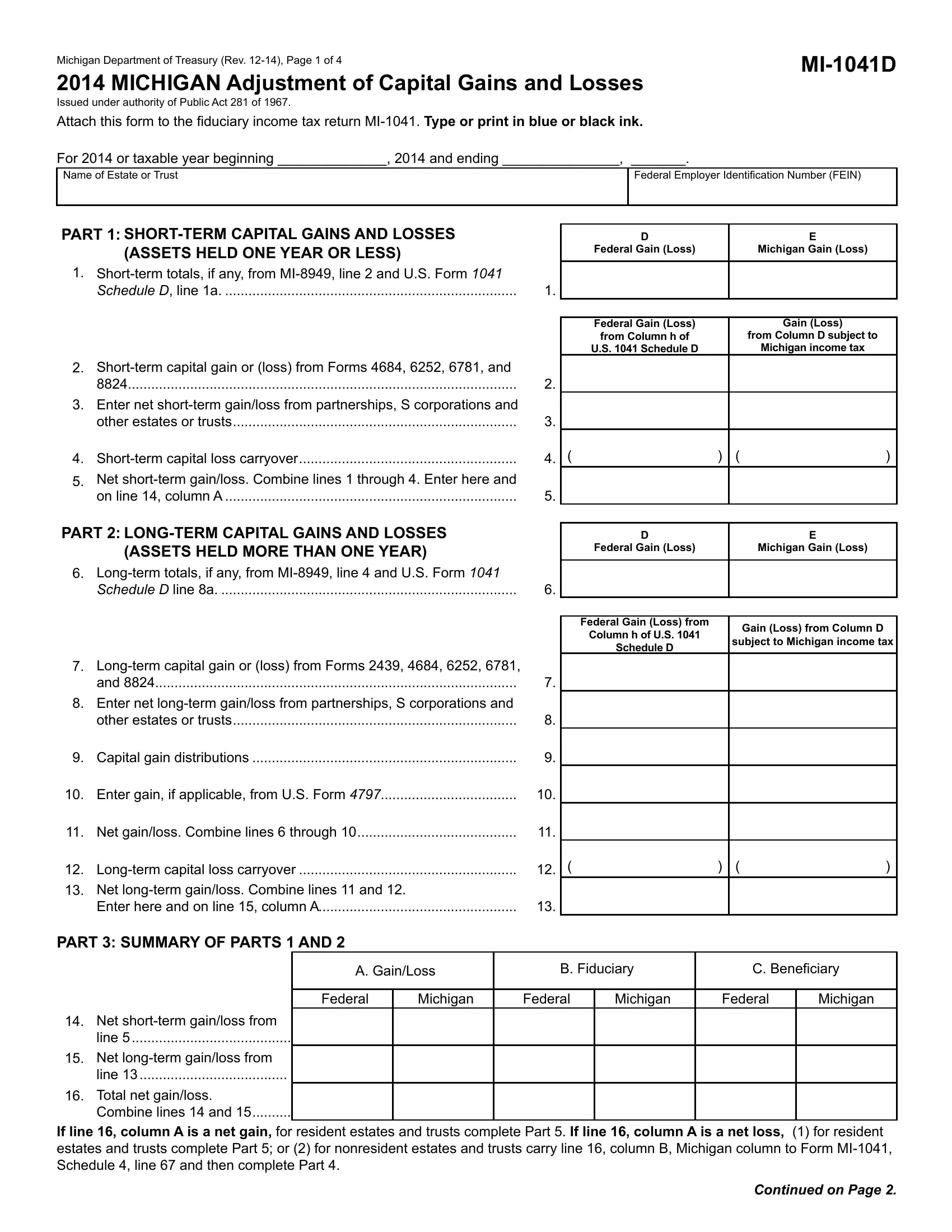

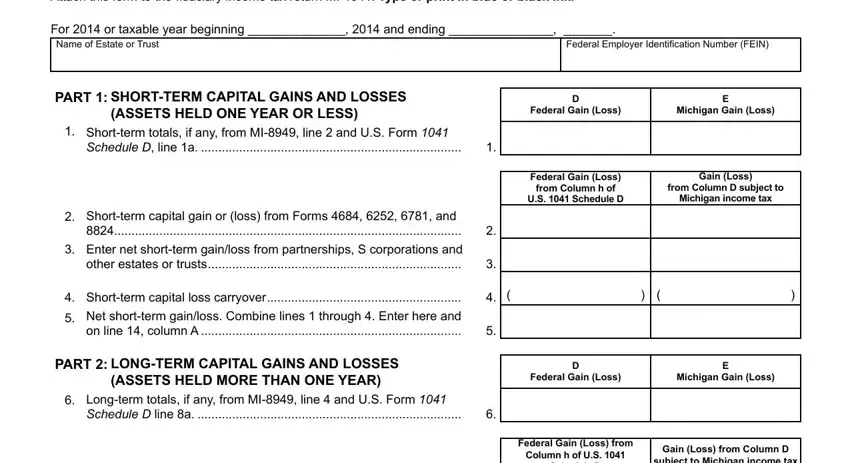

1. To begin with, when filling in the Form Mi 1041D, start with the page that includes the following fields:

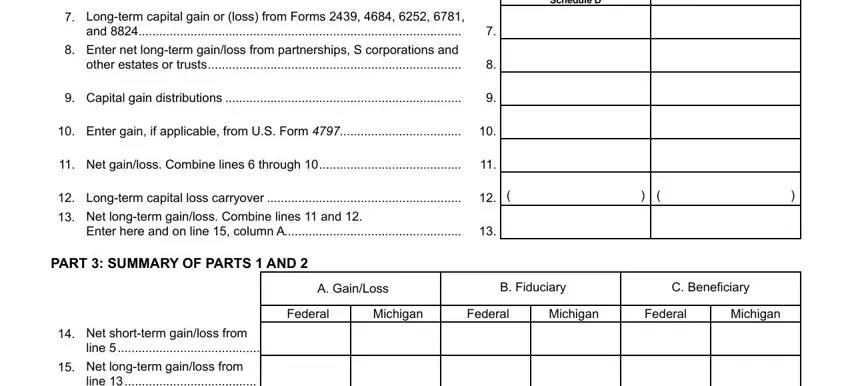

2. Once the previous part is done, go to type in the applicable information in all these: Schedule D, subject to Michigan income tax, Longterm capital gain or loss, and, Enter net longterm gainloss from, Capital gain distributions, Enter gain if applicable from US, Net gainloss Combine lines, Longterm capital loss carryover, Net longterm gainloss Combine, Enter here and on line column A, PART SUMMARY OF PARTS AND, A GainLoss, B Fiduciary, and C Beneiciary.

As to Longterm capital loss carryover and Capital gain distributions, be certain that you do everything properly here. These could be the key fields in the form.

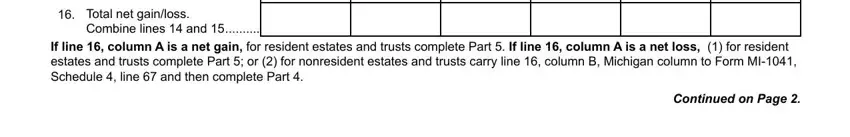

3. This next section is mostly about line, Total net gainloss, Combine lines and, If line column A is a net gain, and Continued on Page - complete each one of these blanks.

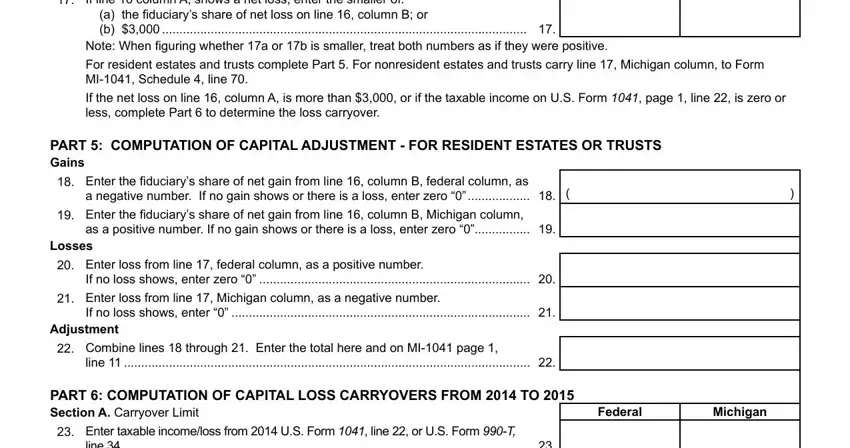

4. The form's fourth subsection comes with the following blank fields to focus on: If line column A shows a net loss, PART COMPUTATION OF CAPITAL, a negative number If no gain shows, Federal, Michigan, Enter the iduciarys share of net, as a positive number If no gain, Losses Enter loss from line, If no loss shows enter zero, Enter loss from line Michigan, If no loss shows enter, Adjustment Combine lines through, line, PART COMPUTATION OF CAPITAL LOSS, and line Enter the loss from line.

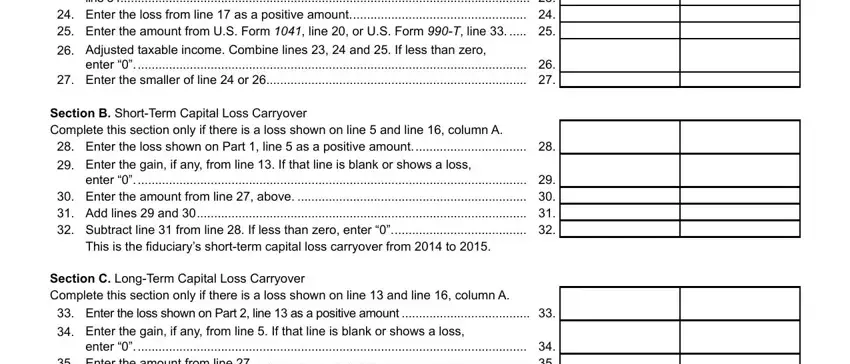

5. Lastly, this last subsection is what you will need to finish prior to closing the document. The blank fields you're looking at include the following: line Enter the loss from line, enter Enter the smaller of, Section B ShortTerm Capital Loss, Enter the loss shown on Part, Enter the gain if any from line, enter Enter the amount from, This is the iduciarys shortterm, Section C LongTerm Capital Loss, Enter the loss shown on Part, Enter the gain if any from line, and enter Enter the amount from.

Step 3: Before moving on, make certain that form fields are filled in the proper way. Once you think it's all good, click on “Done." Download the Form Mi 1041D the instant you subscribe to a free trial. Conveniently get access to the form inside your FormsPal account, with any modifications and changes conveniently saved! We do not share or sell the details that you type in whenever working with forms at FormsPal.