Form Mi 1045 can be completed online very easily. Simply make use of FormsPal PDF editing tool to get the job done without delay. To have our editor on the cutting edge of efficiency, we aim to integrate user-oriented features and enhancements on a regular basis. We are routinely pleased to receive suggestions - join us in revolutionizing PDF editing. To get the ball rolling, consider these easy steps:

Step 1: Hit the "Get Form" button at the top of this webpage to get into our PDF editor.

Step 2: As soon as you start the PDF editor, you will find the form ready to be filled out. Besides filling in different blank fields, you could also do various other things with the form, that is putting on custom words, editing the initial textual content, adding graphics, putting your signature on the PDF, and more.

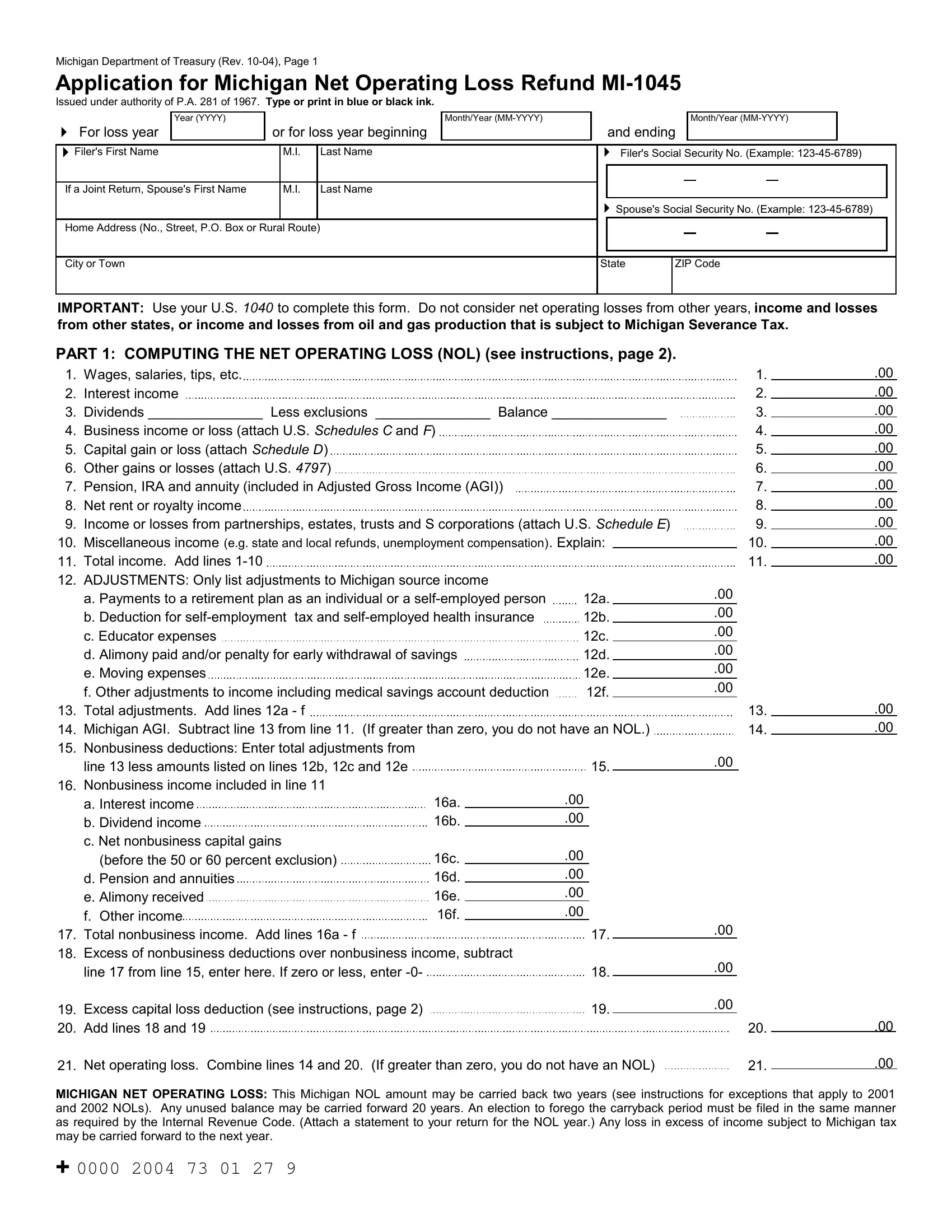

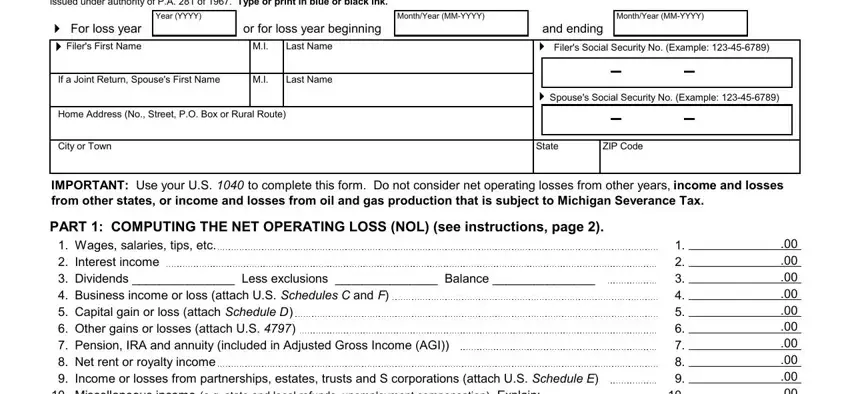

With regards to the blank fields of this precise form, here is what you should do:

1. Fill out the Form Mi 1045 with a group of major blank fields. Gather all of the information you need and make sure nothing is neglected!

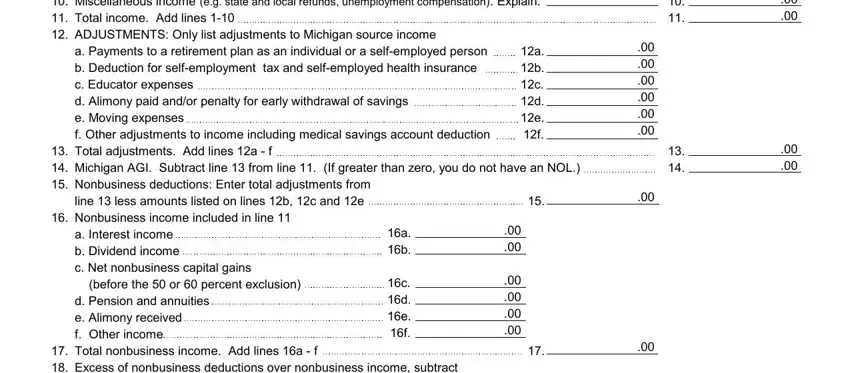

2. Immediately after this section is done, go to type in the suitable details in these - Wages salaries tips etc Interest, a b c d e f, c d e f, and a b.

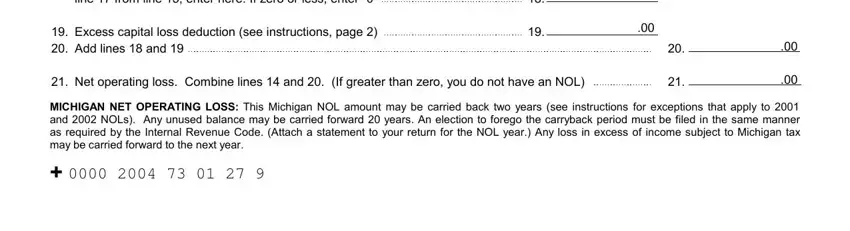

3. This next step is straightforward - fill out every one of the empty fields in Wages salaries tips etc Interest, Excess capital loss deduction see, Net operating loss Combine lines, and MICHIGAN NET OPERATING LOSS This in order to complete this process.

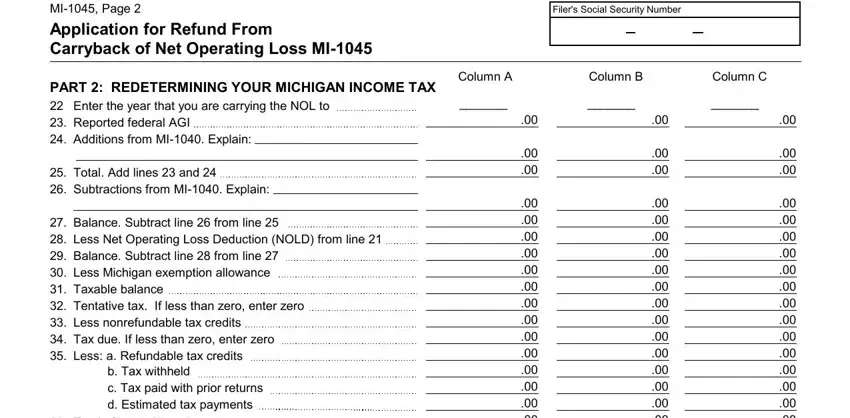

4. Filling in MI Page Application for Refund, PART REDETERMINING YOUR MICHIGAN, Enter the year that you are, Total Add lines and Subtractions, Balance Subtract line from line, b Tax withheld c Tax paid with, Total of items a d Tax previously, Filers Social Security Number, Column A, Column B, and Column C is key in this fourth form section - don't forget to don't hurry and be mindful with each and every empty field!

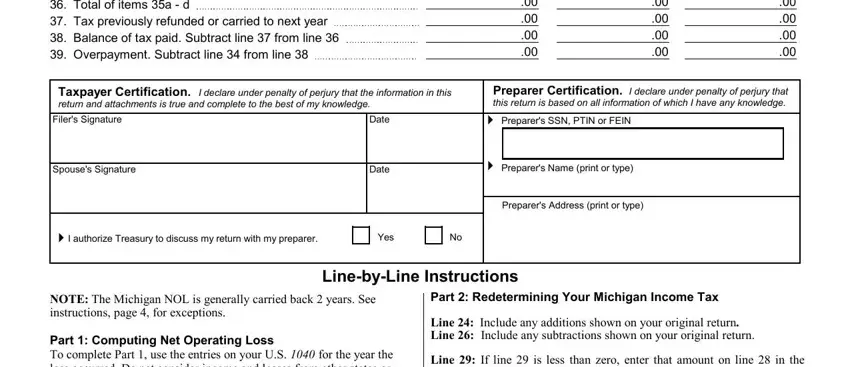

5. When you approach the conclusion of your file, you will find just a few more points to do. In particular, Total of items a d Tax previously, Taxpayer Certification I declare, Filers Signature, Spouses Signature, Date, Date, Preparer Certification I declare, Preparers SSN PTIN or FEIN, Preparers Name print or type, Preparers Address print or type, I authorize Treasury to discuss my, Yes, LinebyLine Instructions, NOTE The Michigan NOL is generally, and Part Computing Net Operating Loss must all be filled out.

It's simple to make an error when filling in the Preparers SSN PTIN or FEIN, and so be sure to take another look before you send it in.

Step 3: Before moving forward, ensure that form fields were filled in properly. When you establish that it's good, click “Done." After setting up afree trial account here, you'll be able to download Form Mi 1045 or send it via email at once. The PDF file will also be available in your personal account page with your each and every edit. FormsPal offers secure form editor with no personal data record-keeping or distributing. Feel at ease knowing that your details are secure with us!