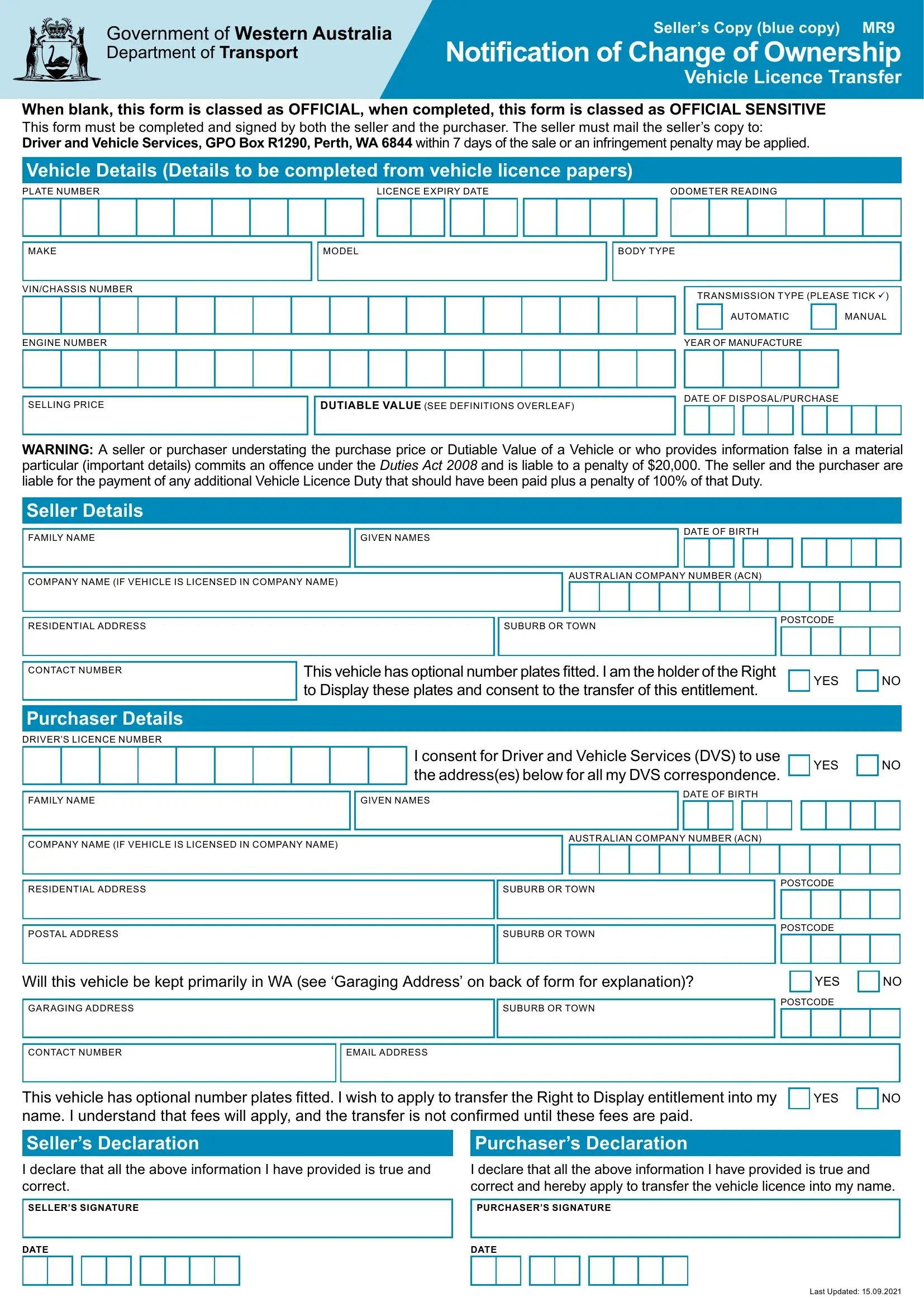

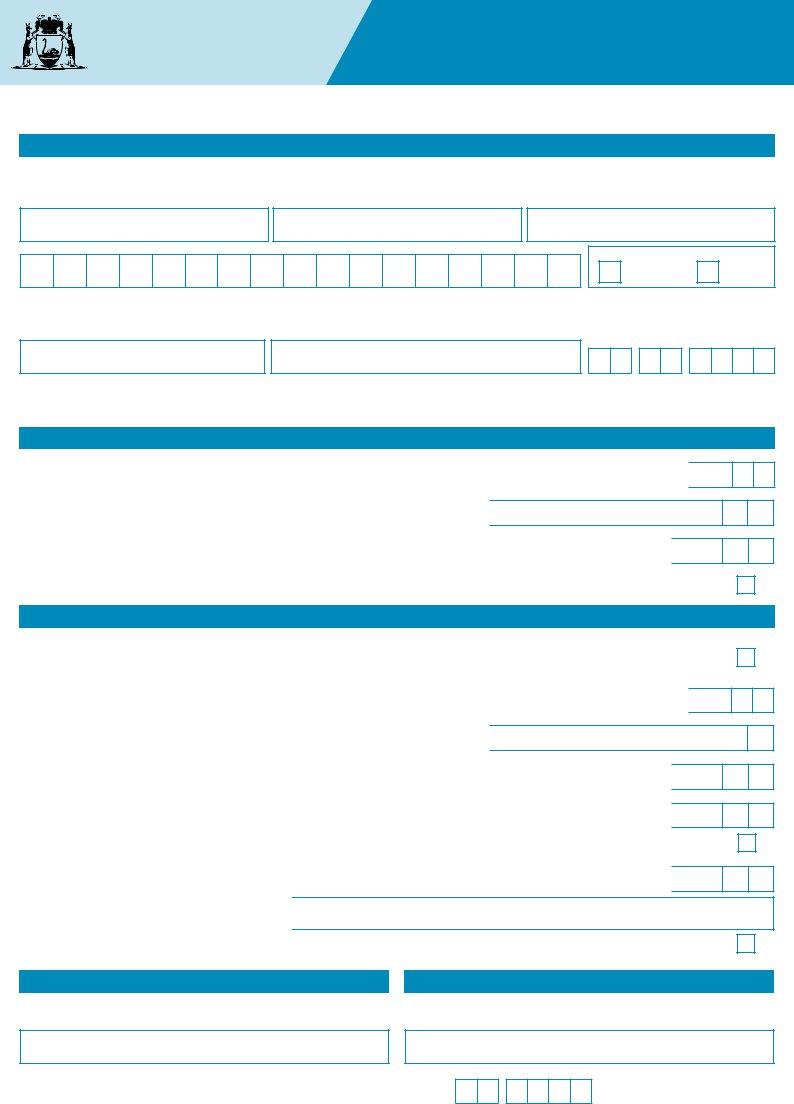

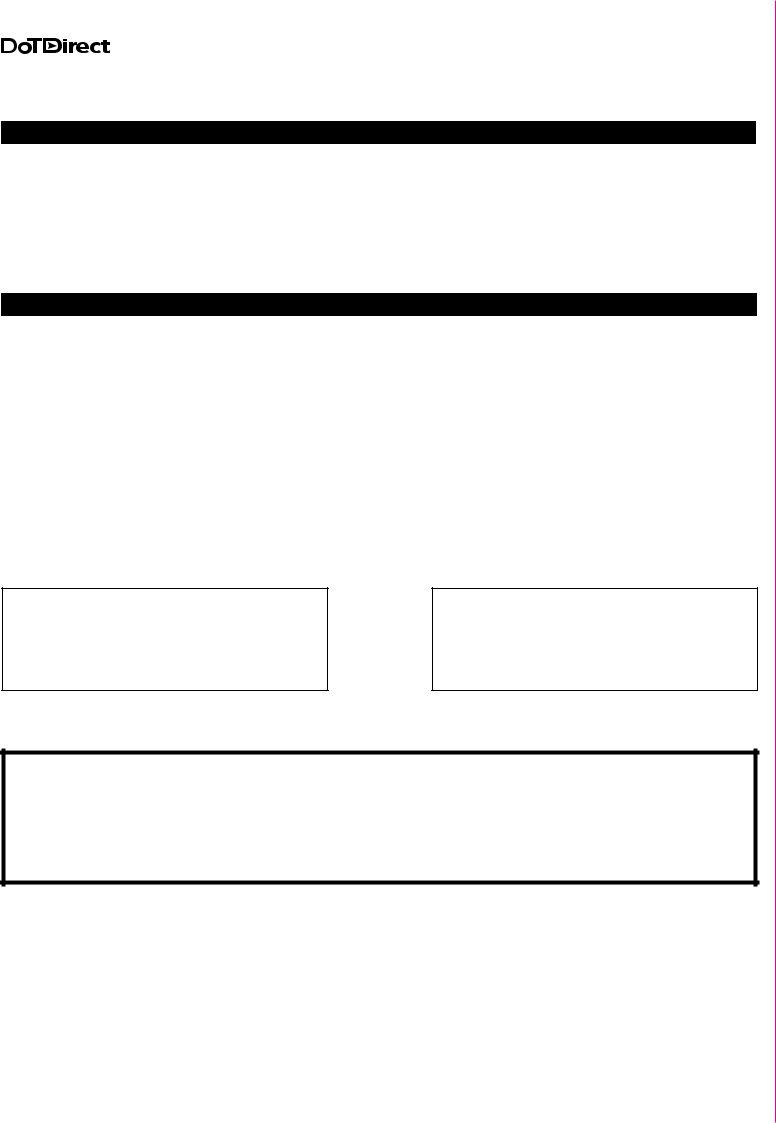

WHAT THE PURCHASER HAS TO DO

1.When purchasing a licensed vehicle you must complete this form together with the seller of the vehicle. The seller is required to give you (as the Purchaser) the Purchaser’s Copy (red copy) and the current licence papers. The purchaser must submit this copy either in person at a DVS Centre or agent, or by mail, within 14 days of purchasing the vehicle. Failing to do so may result in a penalty. Failure to pay the vehicle licence duty and transfer fee within 28 days of the invoice being issued may result in an infringement of $100. If you have not received an invoice within 14 days of submitting this form please contact DVS on 13 11 56.

2.Purchasers must provide proof of identity and age before a vehicle licence can be transferred. A vehicle licence can only be issued/transferred to:

•an individual (natural person) aged 18 years or older for a heavy vehicle (over 4500 kg mass rating for charging) or 16 years or older for any other vehicle;

•a corporate company or other incorporated body; or

•any other body that is recognised as being a legal entity.

When a vehicle is jointly owned a Proof of Identity (VL186) form must be completed and signed by all owners nominating an owner/licence holder. Proof of Identity forms may be obtained online at www.transport.wa.gov.au/licensing

3.If you purchase a vehicle that is licensed at a concession rate and you are not eligible for a concession, the vehicle licence must be restored to full rates prior to using the vehicle or the vehicle licence will be deemed invalid. The continued use of the vehicle will be in contravention of the ROAD TRAFFIC (VEHICLES) ACT 2012.

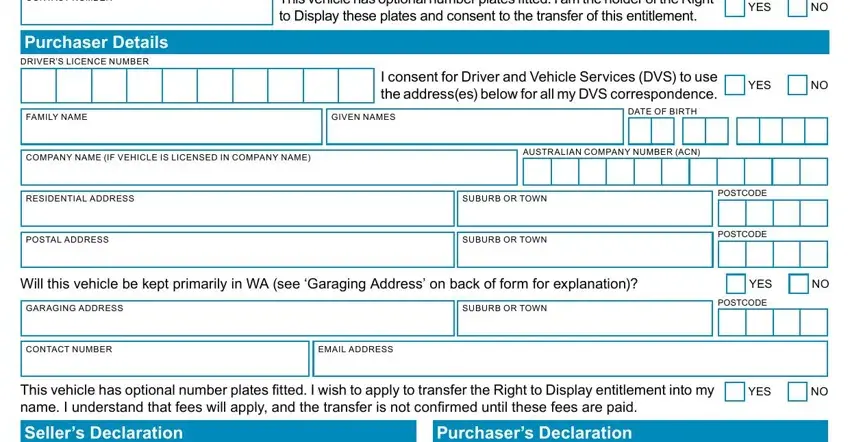

4.If you purchase a vehicle with optional plates and you intend to keep them, you must complete the relevant sections on this form. A plate transfer fee is

applicable. If you do not wish to transfer the optional plates into your name, the plates must be returned to your nearest DVS centre or regional agent. Note:

It is unlawful to display optional plates on a vehicle without a Right to Display and Trade certificate being granted by the Chief Executive Officer.

5. The invoice may be paid by BPAY (contact your bank or financial institution for further information), credit card using DVS’s Phonepay 1300 655 322, by mail (GPO Box R1290, PERTH, WA 6844), in person at any metropolitan Post Office, participating country Post Office, regional DVS agent or a DVS centre (cash, cheque or EFTPOS).

A vehicle can only be licensed in the name of an individual (natural person), corporate company, incorporated body or any other body that is recognised as a legal entity. If the vehicle is jointly owned, a VL186 form must be completed and signed nominating an owner/licence holder. Proof of Identity forms may be obtained online at www.transport.wa.gov.au/licensing

The information you supply on this form may be disclosed to other government agencies where provided for in legislation. The Chief Executive Officer of the Department of Transport also releases aggregated statistical information to third parties. However, your personal identifying information will not be released to these persons without your explicit consent.

DEFINITIONS - DUTIABLE VALUE

The term “dutiable value” is defined by Division 5 of the DUTIES ACT 2008. The following interpretation is provided as a guide only.

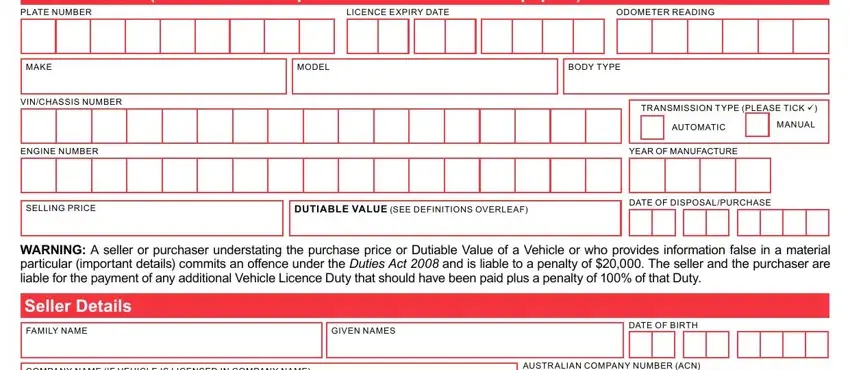

New Vehicle: For a new vehicle (which includes a demonstration model that has been used for that purpose for not more than 2 months) that is a motor car, motor wagon or motorcycle, the list price (see definition below), plus the price fixed by the manufacturer, importer or principle distributor as the additional retail selling price in Western Australia for a particular kind of transmission or engine fitted to the vehicle that is not standard in a vehicle of that make and model (for example, the set fee to upgrade a manual transmission to automatic, or to include a V8 or turbocharged engine).

Used Vehicle: In relation to used vehicles - the amount for which the vehicle might reasonably be sold, free of encumbrance, in the open market. Where the dutiable value or purchase price of a vehicle has been incorrectly stated the matter will be referred to RevenueWA for investigation and possible prosecution.

List Price means the price that has been fixed by the manufacturer, importer or principle distributor as the retail selling price of that vehicle in Western Australia.

NOTE: Vehicles which are transferred for no monetary gain need to have an amount provided for which the vehicle might reasonably be sold, free of encumbrances in the open market. i.e. its dutiable value.

VEHICLE LICENCE DUTY EXEMPTION ON THE TRANSFER OF A VEHICLE LICENCE BETWEEN SPOUSES/DEFACTOS

There is a provision for an exemption from vehicle licence duty, upon the transfer of a vehicle licence between spouses or de facto partners of at least two years. The Application for Duty Exemption - Transfer of a vehicle licence between two spouses or de facto partners (FDA45) form, which is available for download from www.wa.gov.au must be presented to a Driver and Vehicle Services Centre, regional Department of Transport office or participating DVS agent.

For further information visit www.transport.wa.gov.au/licensing or call DVS on 13 11 56.

PENSIONER CONCESSION CARD ENQUIRIES

If you are the holder of a Pension Concession card issued by Centrelink or Department of Veterans’ Affairs or a WA Senior’s Card and a Commonwealth Senior’s Health Card holder, you may be eligible for a concession on your vehicle or driver’s licence. For further information please call DVS on 13 11 56.

GARAGING ADDRESS (BASE OF OPERATION)

In accordance with section 5(3)(d) of the ROAD TRAFFIC (VEHICLES) ACT 2012, vehicles cannot be licenced in Western Australia if they are garaged in another state or territory. You may be required to provide documentary proof of this.

DOES THE VEHICLE HAVE MONEY OWING ON IT OR IS IT LISTED ON THE WRITTEN-OFF VEHICLE REGISTER?

The Personal Property Securities Register (the PPSR) is the register where details of security interests in personal property can be registered and searched. To make a PPSR enquiry, you will only need to provide the chassis or Vehicle Identification Number (VIN). Note there will be no provision for searching or registering an interest by plate or engine number on the PPS Register. Visit www.ppsr.gov.au for an online search or call 1300 007 777.

WARNING: Restrictions on vehicle transfers

There may be sanctions applied by the Department of the Attorney General in respect of unpaid fines that prevent the grant, renewal or transfer of a vehicle licence. Until such time the sanction has been removed, the vehicle is considered unlicensed and continued use of the vehicle will be in contravention of the ROAD

TRAFFIC (VEHICLES) ACT 2012.

Before considering the sale or purchase of a vehicle, the vehicle licence status may be checked at www.transport.wa.gov.au.

Vehicle owners that might have outstanding infringement notices or court fines may contact the Fines Enforcement Registry on 1300 650 235 to enquire if their unpaid fines have led to a suspension of the vehicle licence.