metropolitan commuter transportation district zip codes can be completed without difficulty. Just try FormsPal PDF editor to finish the job right away. To maintain our editor on the cutting edge of efficiency, we work to adopt user-oriented features and enhancements on a regular basis. We are always looking for feedback - help us with revampimg PDF editing. Should you be looking to begin, here's what it will take:

Step 1: First of all, open the tool by pressing the "Get Form Button" in the top section of this webpage.

Step 2: The tool provides the opportunity to work with your PDF document in a range of ways. Change it by writing any text, adjust existing content, and include a signature - all within a couple of mouse clicks!

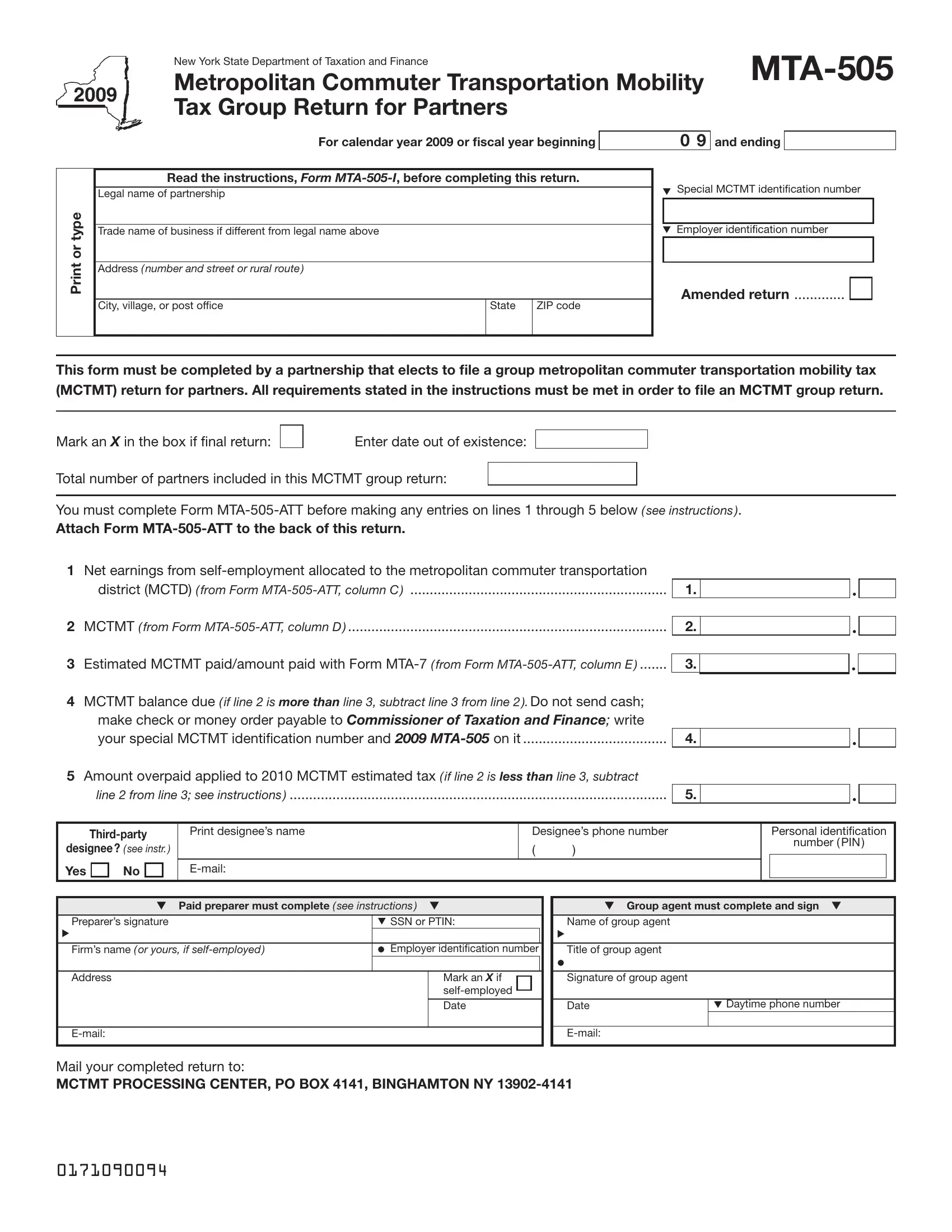

This form requires specific details to be typed in, thus be sure to take whatever time to provide precisely what is required:

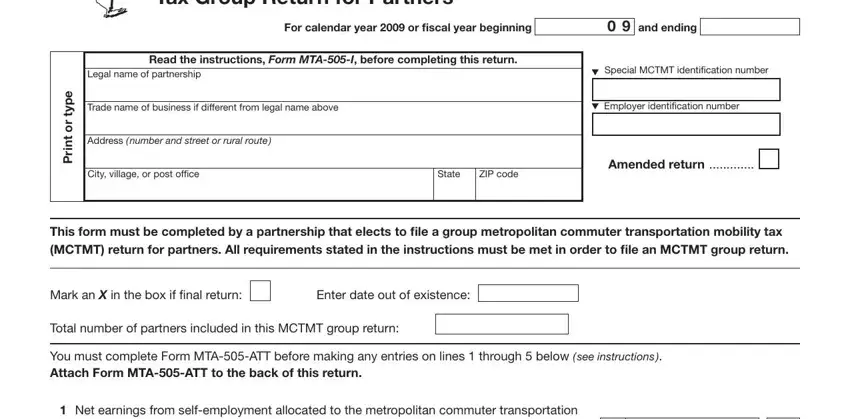

1. Fill out your metropolitan commuter transportation district zip codes with a selection of major blanks. Consider all of the required information and make sure there's nothing forgotten!

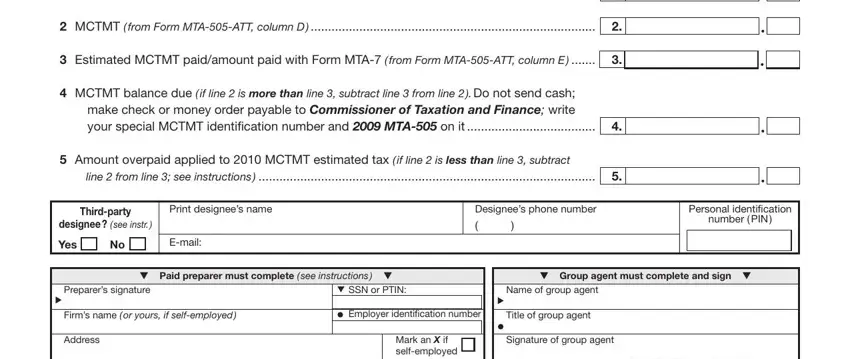

2. Just after finishing the previous part, go on to the subsequent step and fill in all required particulars in all these blanks - Net earnings from selfemployment, district MCTD from Form MTAATT, MCTMT from Form MTAATT column D, Estimated MCTMT paidamount paid, MCTMT balance due if line is, Amount overpaid applied to MCTMT, line from line see instructions, Thirdparty, designee see instr, Print designees name, Yes, Email, Designees phone number, Personal identiication, and number PIN.

3. This next part focuses on Email, Date, Date, Email, Daytime phone number, and Mail your completed return to - type in all of these blanks.

It is possible to get it wrong when filling in the Email, therefore be sure to reread it before you'll submit it.

Step 3: Before finalizing this form, you should make sure that all blank fields have been filled out the proper way. When you determine that it's correct, press “Done." Get the metropolitan commuter transportation district zip codes when you register at FormsPal for a free trial. Readily view the form in your FormsPal account, along with any edits and changes being automatically kept! We do not sell or share the details you type in when dealing with forms at FormsPal.