It is possible to work with new mexico weight distance tax return effectively with the help of our online tool for PDF editing. Our tool is consistently evolving to present the very best user experience attainable, and that's because of our dedication to continual development and listening closely to customer feedback. Should you be seeking to start, here is what it will require:

Step 1: Click on the "Get Form" button above. It is going to open up our pdf editor so that you can begin completing your form.

Step 2: As you access the file editor, you will find the form made ready to be completed. In addition to filling out different fields, you might also do several other actions with the file, specifically adding custom words, changing the original textual content, inserting illustrations or photos, affixing your signature to the form, and a lot more.

Completing this PDF demands thoroughness. Make sure that all necessary blank fields are completed accurately.

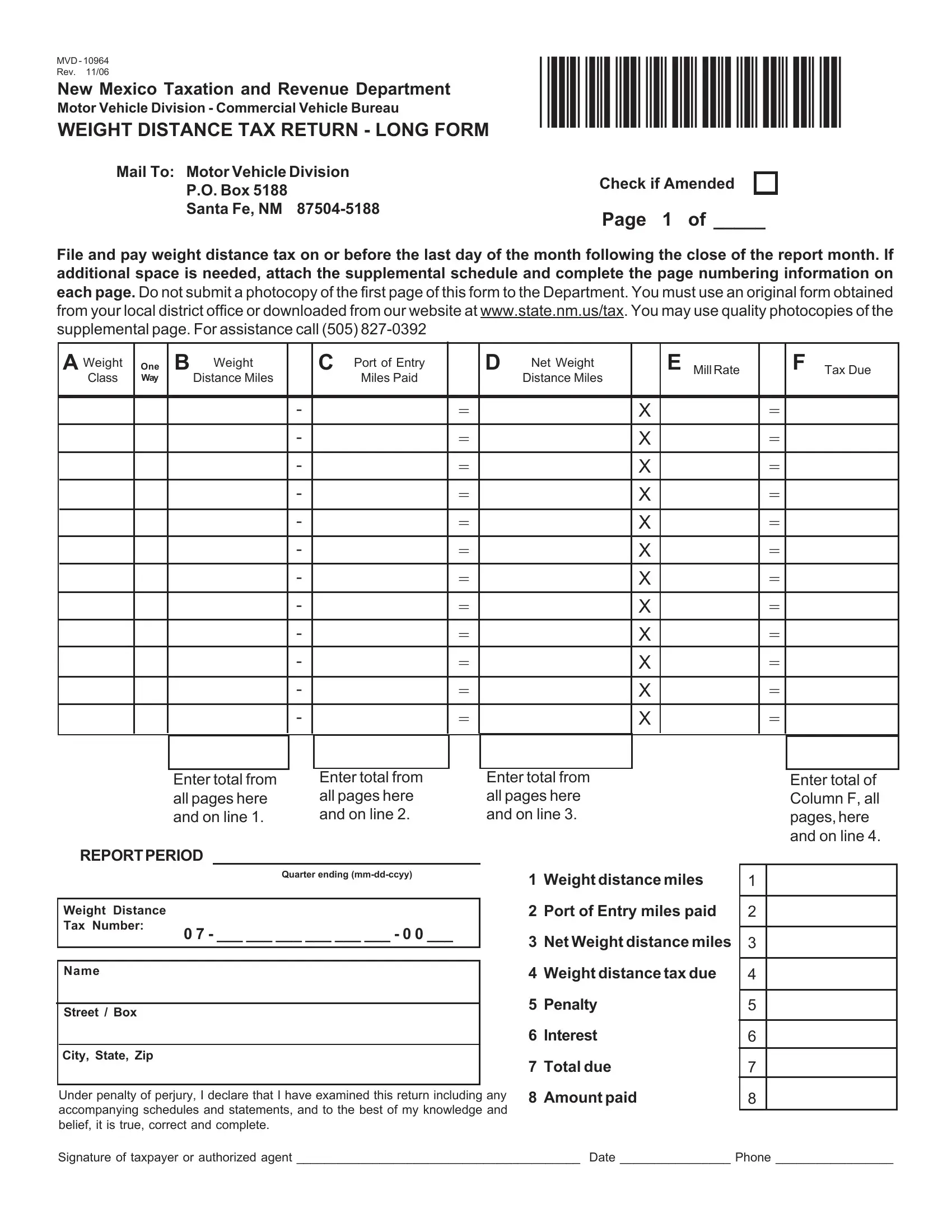

1. You should complete the new mexico weight distance tax return accurately, hence pay close attention while filling out the segments that contain all these fields:

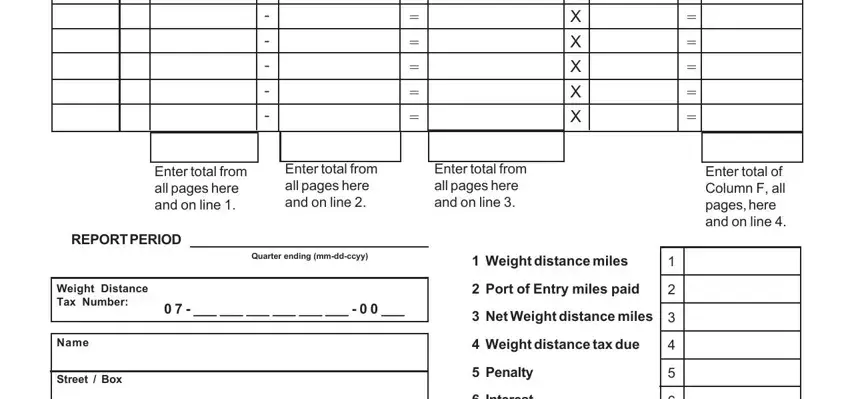

2. Once this part is completed, go on to enter the suitable information in all these - Enter total from all pages here, Enter total from all pages here, Enter total from all pages here, Enter total of Column F all pages, REPORT PERIOD, Quarter ending mmddccyy, Weight Distance Tax Number, Name, Street Box, Weight distance miles, Port of Entry miles paid, Net Weight distance miles, Weight distance tax due, Penalty, and Interest.

Those who use this PDF generally get some things incorrect while completing Enter total from all pages here in this part. You should definitely revise whatever you type in right here.

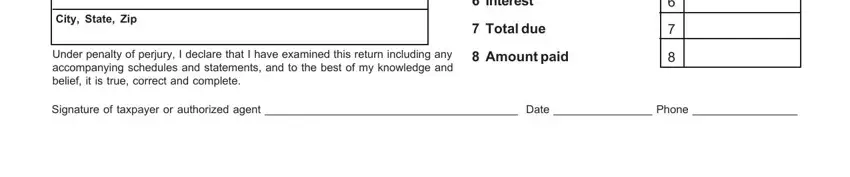

3. Within this stage, take a look at City State Zip, Under penalty of perjury I declare, Interest, Total due, Amount paid, and Signature of taxpayer or. All these will have to be completed with utmost precision.

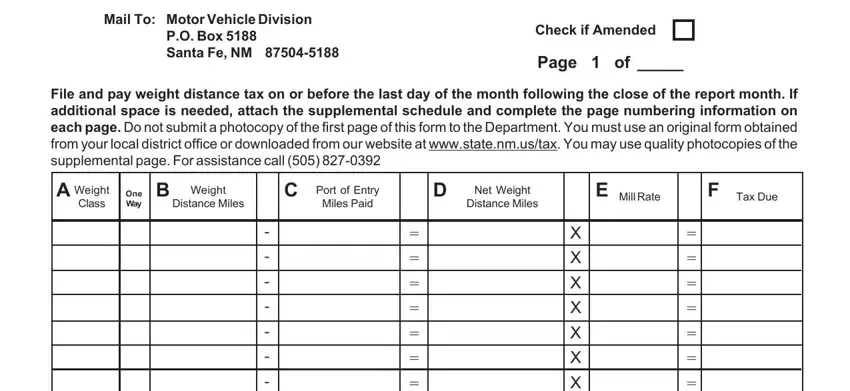

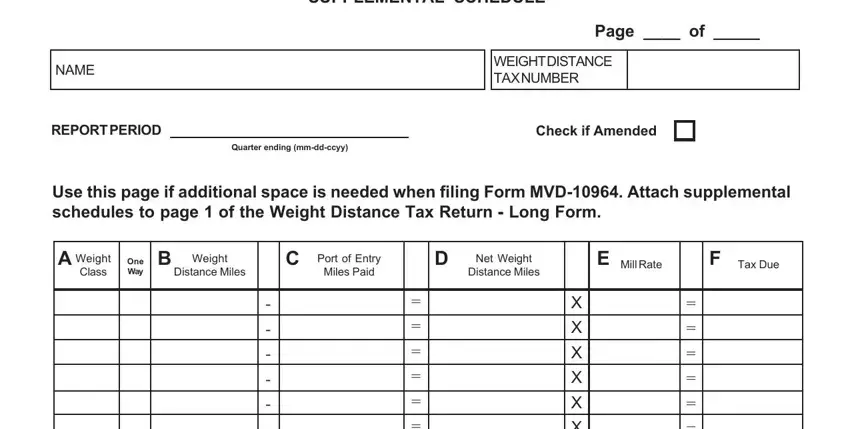

4. The subsequent part will require your information in the subsequent areas: NAME, SUPPLEMENTAL SCHEDULE, Page of, WEIGHT DISTANCE TAX NUMBER, REPORT PERIOD, Check if Amended, Quarter ending mmddccyy, Use this page if additional space, Weight Class, One Way, Weight, Distance Miles, Port of Entry, Miles Paid, and Net Weight. Make certain you fill out all of the required details to move onward.

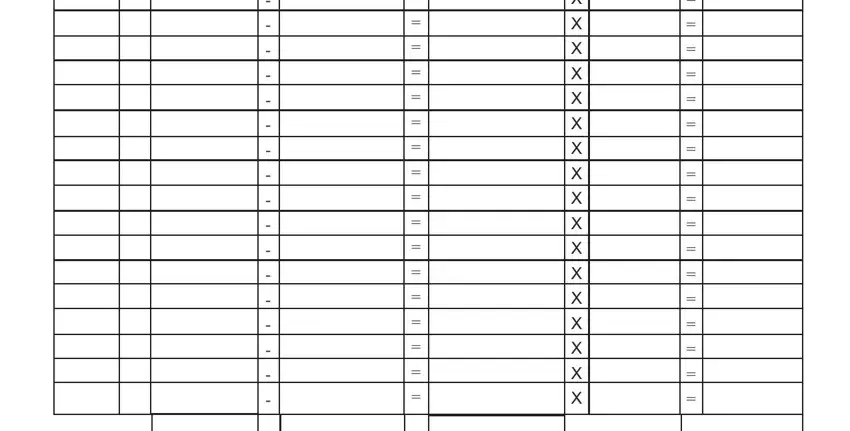

5. The pdf must be finalized by dealing with this segment. Below there is an extensive set of fields that require specific information for your document usage to be accomplished: .

Step 3: Confirm that your information is right and then press "Done" to finish the process. Join FormsPal right now and immediately gain access to new mexico weight distance tax return, prepared for downloading. All modifications you make are preserved , meaning you can customize the form later on if needed. We do not share or sell any details you use while filling out documents at FormsPal.