When working in the online PDF editor by FormsPal, you are able to complete or modify Rev. 2020 here. The editor is constantly maintained by our team, acquiring additional features and becoming a lot more convenient. With just a few easy steps, it is possible to begin your PDF editing:

Step 1: Click the "Get Form" button at the top of this page to open our PDF editor.

Step 2: This tool provides you with the capability to customize the majority of PDF documents in a variety of ways. Improve it by writing customized text, correct existing content, and put in a signature - all at your fingertips!

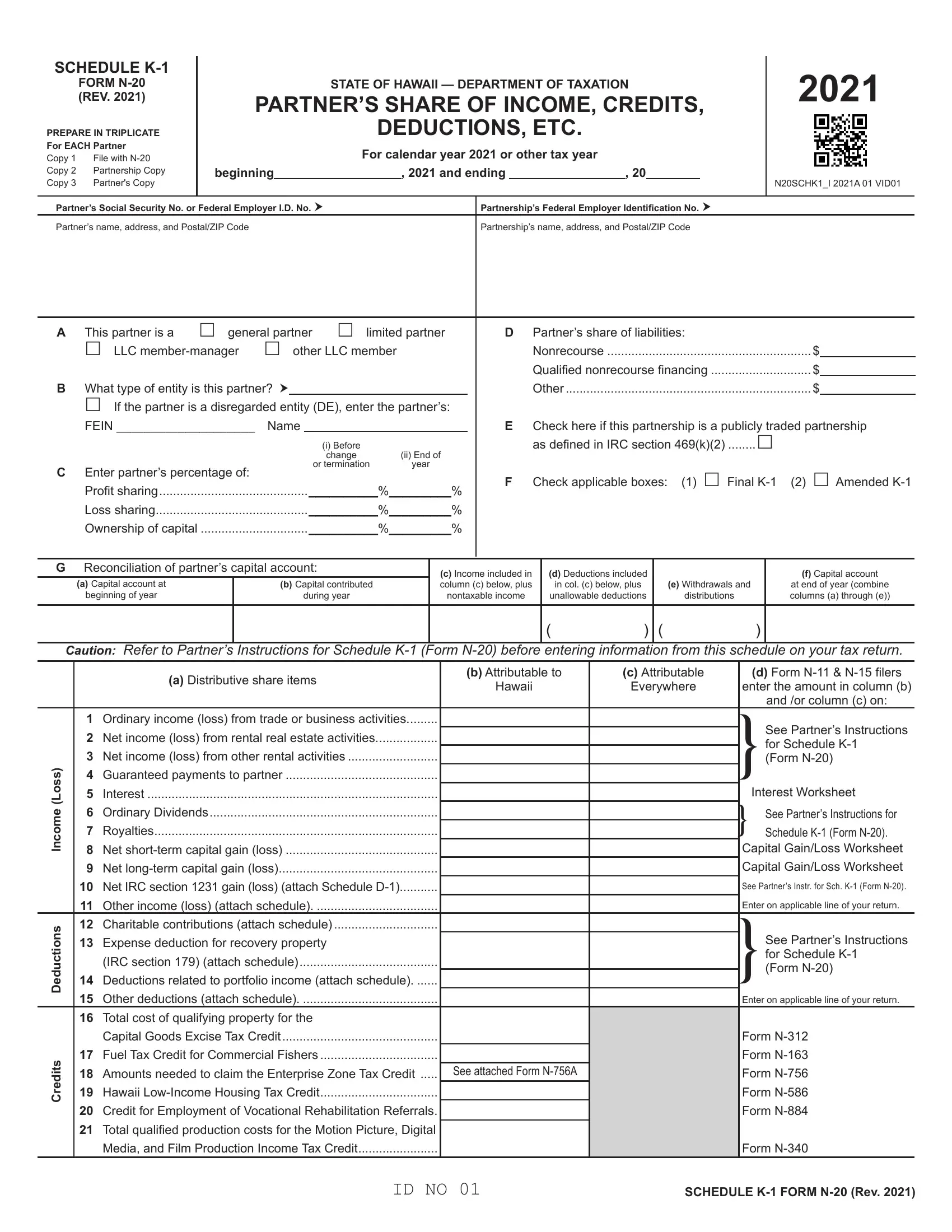

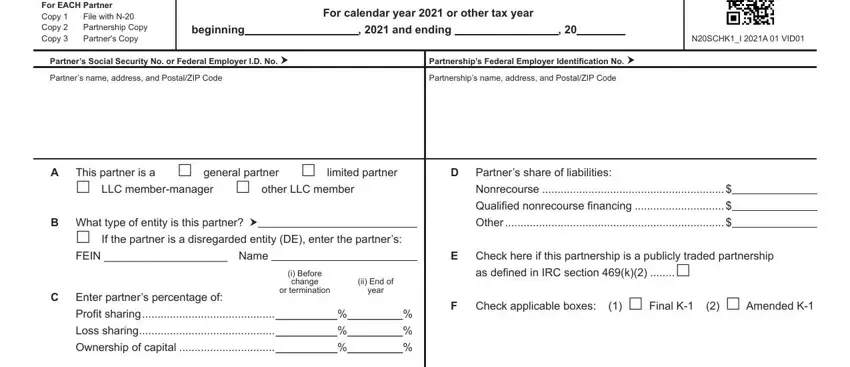

As a way to finalize this PDF document, make certain you enter the necessary details in every blank:

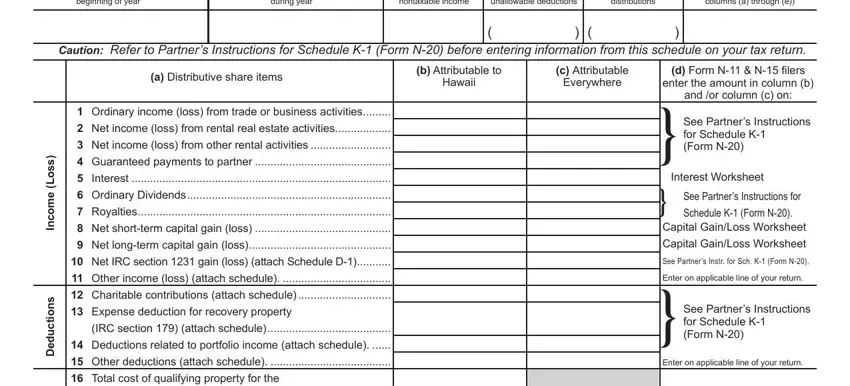

1. It is crucial to complete the Rev. 2020 correctly, so be mindful when working with the segments containing all of these blanks:

2. Your next step is to complete these blank fields: beginning of year, during year, nontaxable income, d Deductions included in col c, distributions, at end of year combine columns a, Caution Refer to Partners, b Attributable to, c Attributable, a Distributive share items, Hawaii, Everywhere, enter the amount in column b, s s o L, and e m o c n.

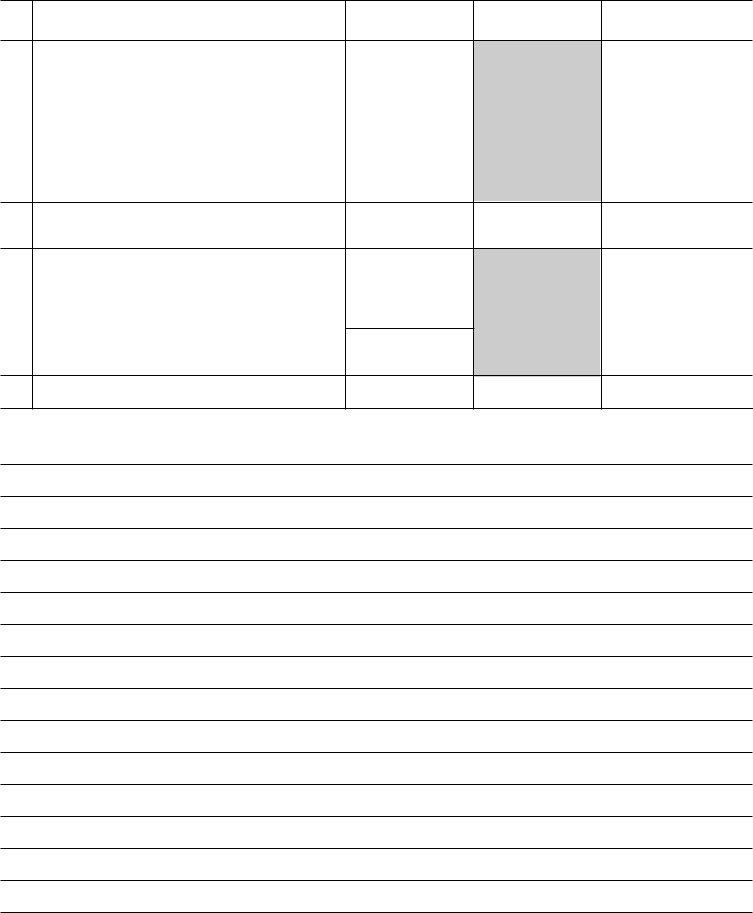

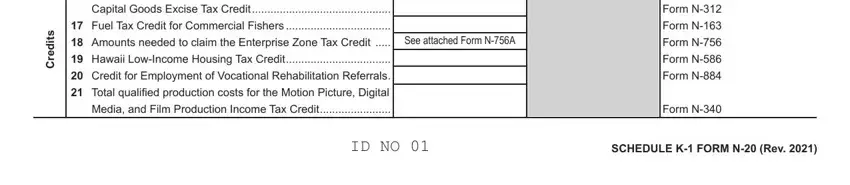

3. This next section is focused on s t i d e r C, Capital Goods Excise Tax Credit, Fuel Tax Credit for Commercial, Amounts needed to claim the, See attached Form NA, Hawaii LowIncome Housing Tax, Form N Form N Form N Form N Form N, Form N, ID NO, and SCHEDULE K FORM N Rev - type in each of these blank fields.

Always be extremely mindful when filling out SCHEDULE K FORM N Rev and ID NO, as this is the section in which a lot of people make mistakes.

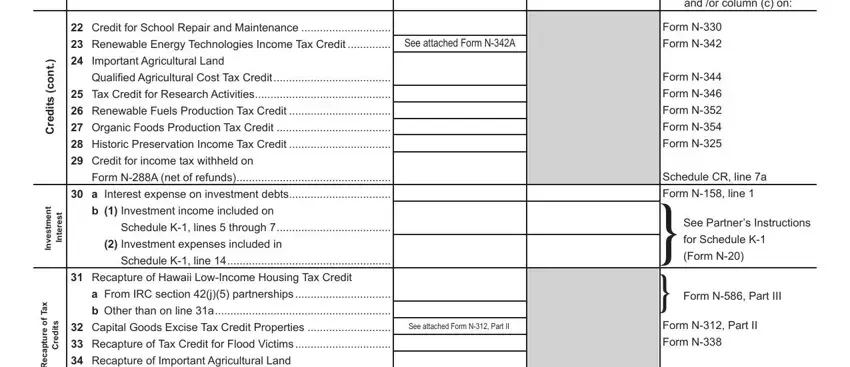

4. Completing Credit for School Repair and, Renewable Energy Technologies, See attached Form NA, and or column c on, Form N, Form N, Form N, Form N, Form N, Form N, Form N, Schedule CR line a, Form N line, for Schedule K, and See Partners Instructions Form N is key in this next part - you should definitely invest some time and fill out each field!

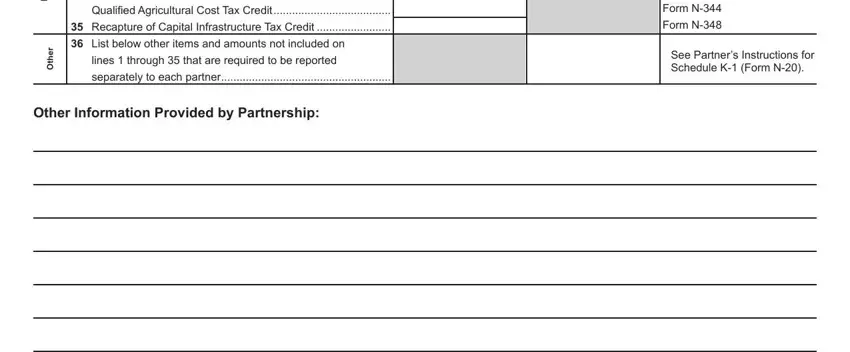

5. As you come near to the last sections of your document, you'll find just a few extra requirements that should be fulfilled. Specifically, x a T f o e r u t p a c e R, r e h t O, Recapture of Important, Qualified Agricultural Cost Tax, List below other items and, lines through that are required, separately to each partner, Form N, Form N, See Partners Instructions for, and Other Information Provided by must be filled in.

Step 3: Before finishing this file, make sure that all blanks were filled out the right way. The moment you believe it's all fine, press “Done." Join FormsPal now and easily get Rev. 2020, available for download. All adjustments made by you are preserved , which enables you to modify the pdf later if necessary. FormsPal offers safe document completion with no personal information recording or sharing. Rest assured that your information is secure here!