Working with PDF forms online is certainly simple with our PDF tool. You can fill out proforma here without trouble. To make our tool better and simpler to work with, we consistently develop new features, bearing in mind suggestions coming from our users. Getting underway is easy! Everything you need to do is take the following simple steps below:

Step 1: Open the PDF doc inside our tool by clicking the "Get Form Button" in the top part of this webpage.

Step 2: After you launch the editor, you will get the form made ready to be completed. Apart from filling in different fields, it's also possible to perform some other actions with the PDF, namely adding custom text, modifying the original text, adding graphics, affixing your signature to the form, and more.

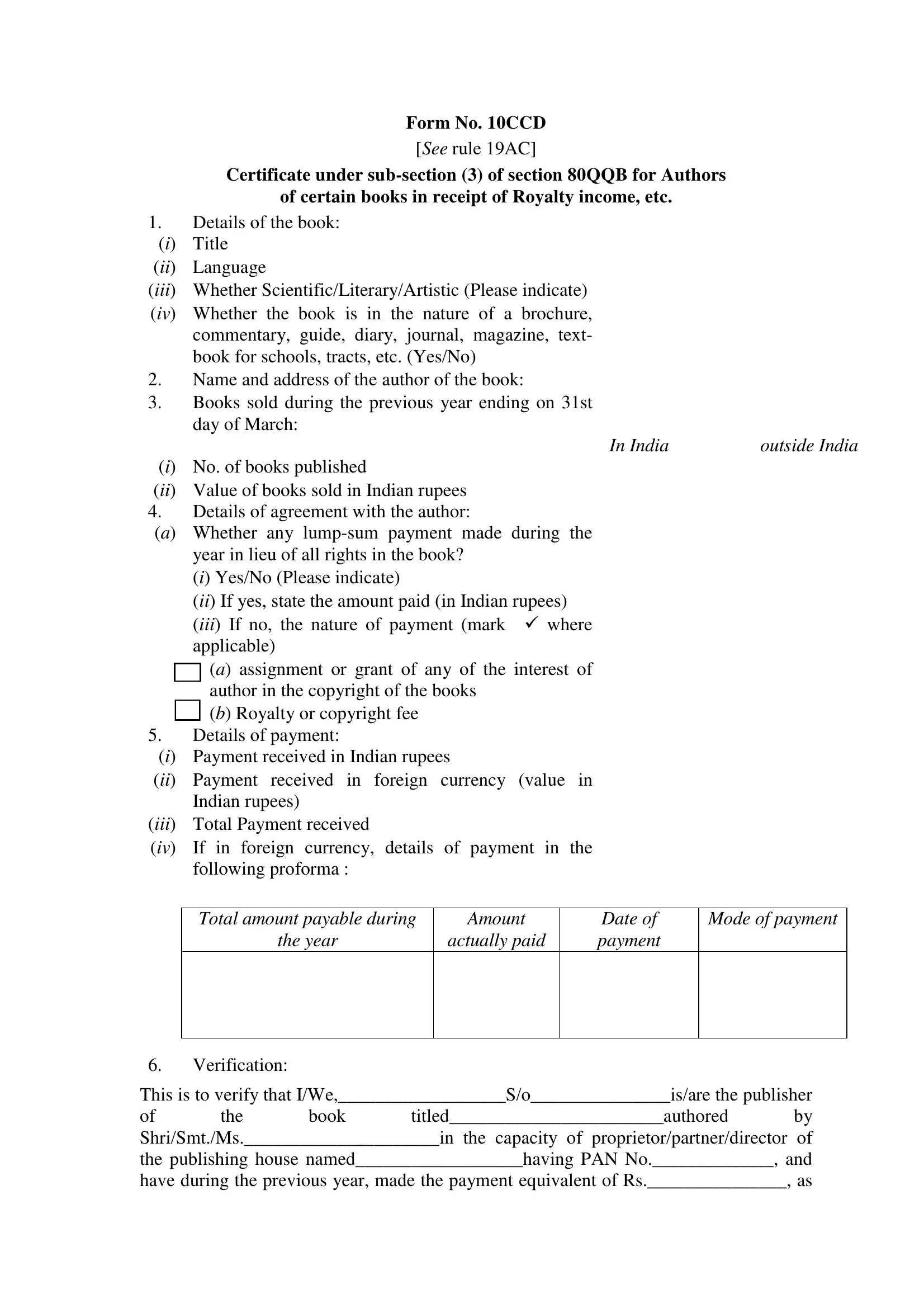

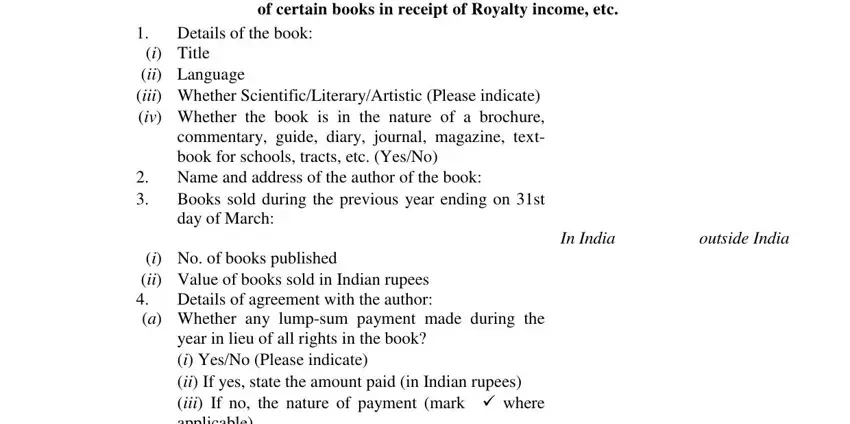

This PDF form will require specific data to be entered, hence you should definitely take whatever time to provide precisely what is expected:

1. The proforma usually requires particular information to be entered. Ensure the following blank fields are finalized:

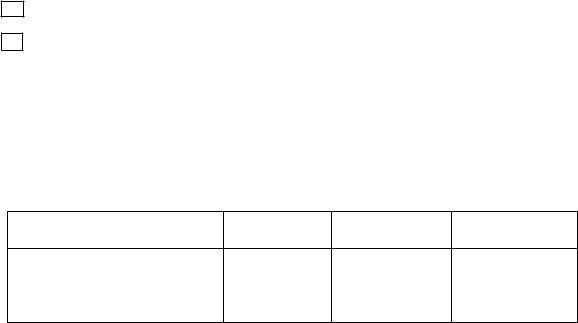

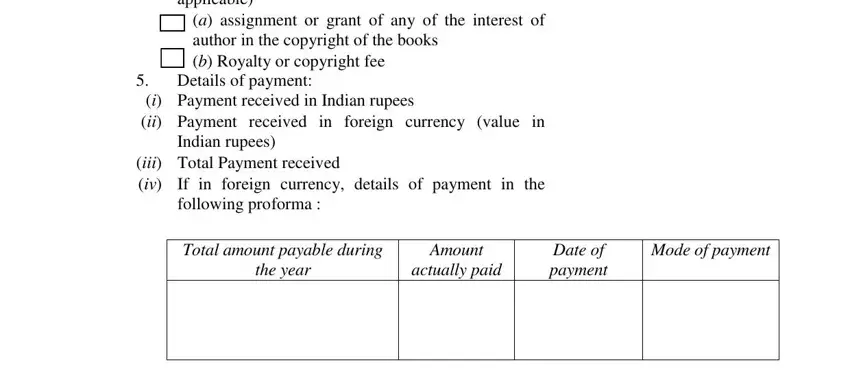

2. After the previous segment is completed, you're ready include the needed specifics in year in lieu of all rights in the, a assignment or grant of any of, Details of payment, i Payment received in Indian, Indian rupees, iii Total Payment received iv If, following proforma, Total amount payable during, Amount, the year, actually paid, Date of payment, and Mode of payment so you can go to the next part.

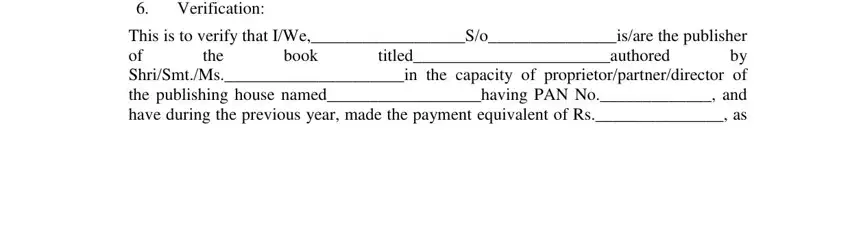

3. Within this step, have a look at Verification, the, This is to verify that IWeSoisare, titledauthored, book, and Printed from wwwtaxmanncom. All of these are required to be completed with utmost focus on detail.

As for Printed from wwwtaxmanncom and the, be sure you get them right in this current part. These two could be the key ones in the form.

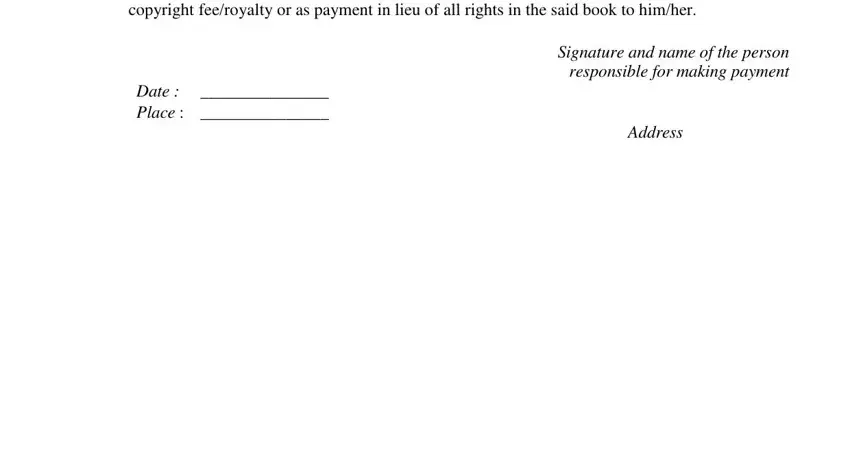

4. The form's fourth subsection comes with the following blank fields to consider: copyright feeroyalty or as payment, Signature and name of the person, Date Place, and Address.

Step 3: Make sure that the information is correct and click "Done" to progress further. Right after creating a7-day free trial account here, it will be possible to download proforma or send it via email right off. The PDF document will also be easily accessible in your personal account menu with your each edit. We do not share the details you use while completing documents at our site.