tan application form download can be completed very easily. Simply use FormsPal PDF tool to complete the task in a timely fashion. The editor is continually improved by our team, getting new awesome functions and becoming a lot more versatile. By taking some simple steps, you can start your PDF editing:

Step 1: First, access the editor by pressing the "Get Form Button" above on this webpage.

Step 2: This tool gives you the capability to work with nearly all PDF files in various ways. Enhance it by writing any text, correct what is originally in the file, and put in a signature - all within a few mouse clicks!

It is straightforward to complete the document using out helpful tutorial! Here is what you should do:

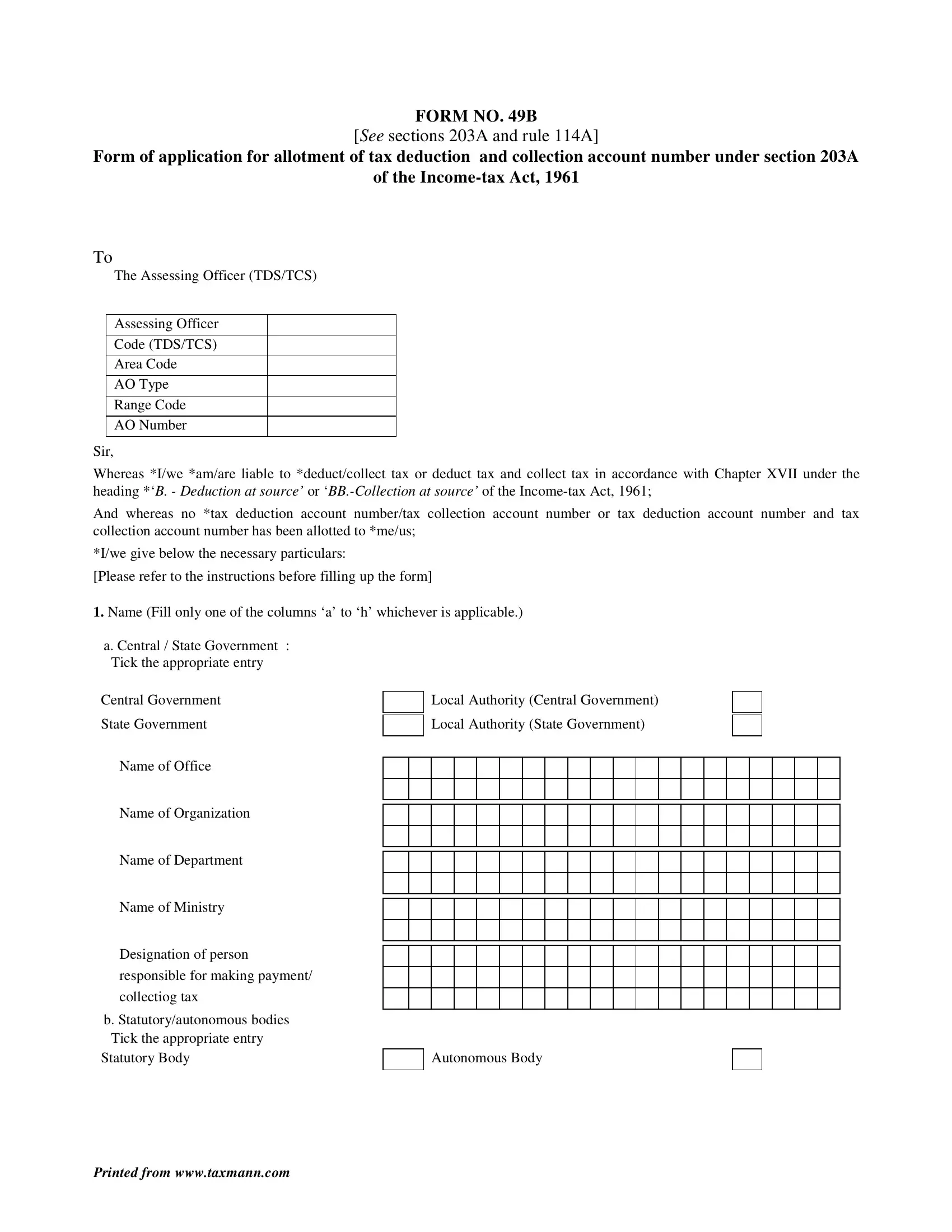

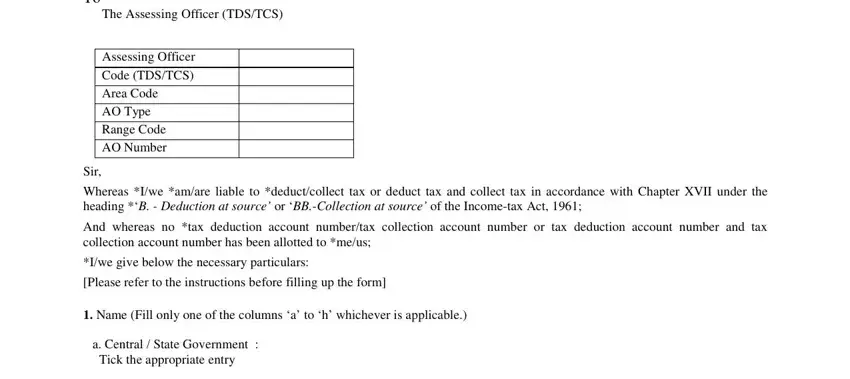

1. Start filling out the tan application form download with a selection of essential fields. Consider all the necessary information and ensure there's nothing forgotten!

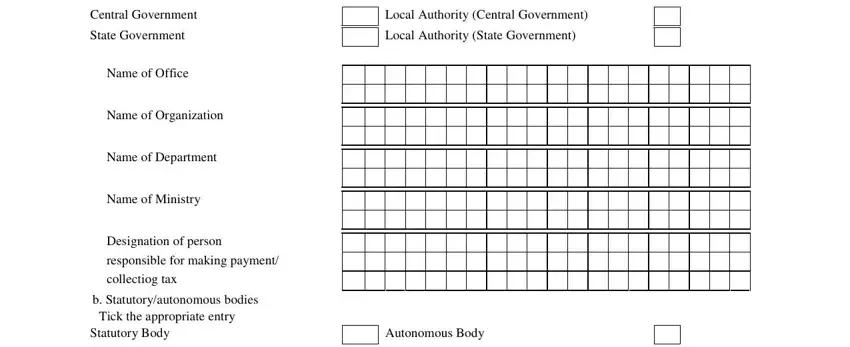

2. The next step is to fill out the following blank fields: Central Government, State Government, Name of Office, Name of Organization, Name of Department, Name of Ministry, Designation of person, responsible for making payment, collectiog tax, b Statutoryautonomous bodies Tick, Local Authority Central Government, Local Authority State Government, and Autonomous Body.

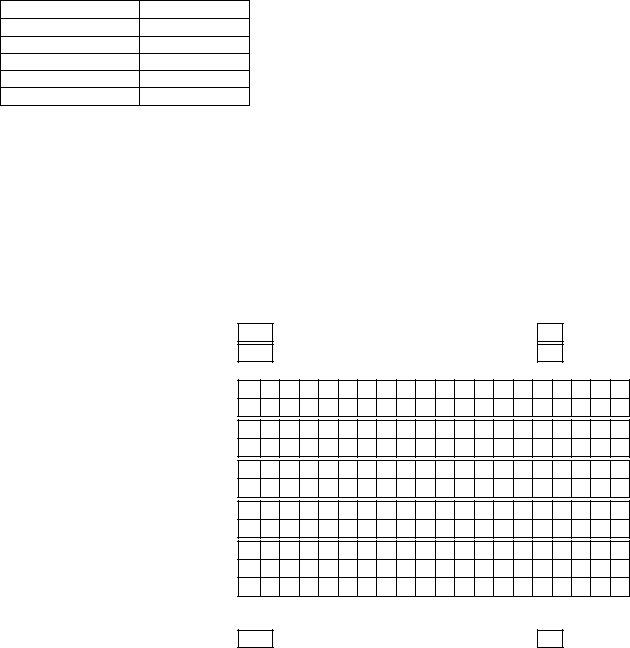

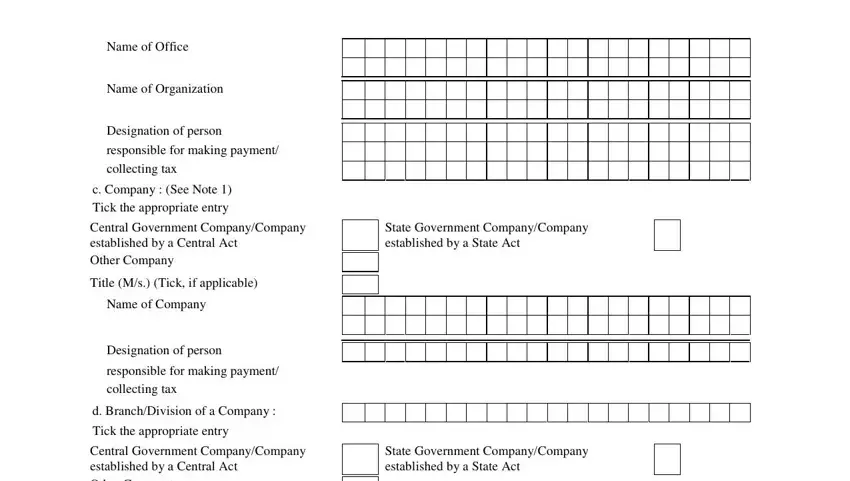

3. Completing Name of Office, Name of Organization, Designation of person, responsible for making payment, collecting tax, c Company See Note, Tick the appropriate entry, Central Government CompanyCompany, Other Company, Title Ms Tick if applicable, Name of Company, Designation of person, responsible for making payment, collecting tax, and d BranchDivision of a Company is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

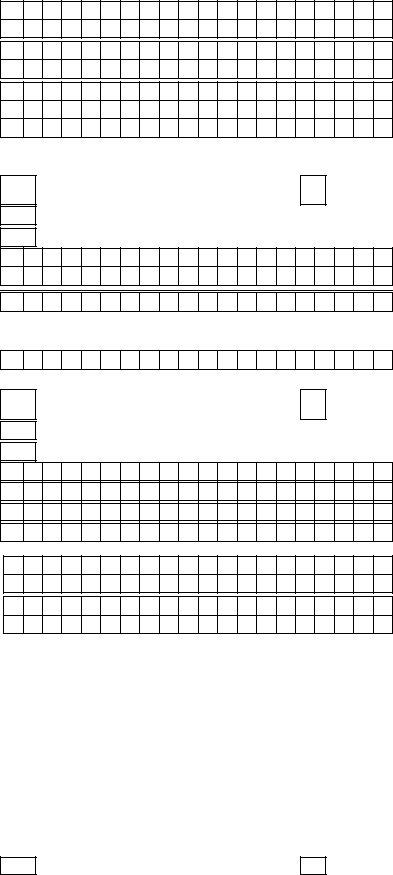

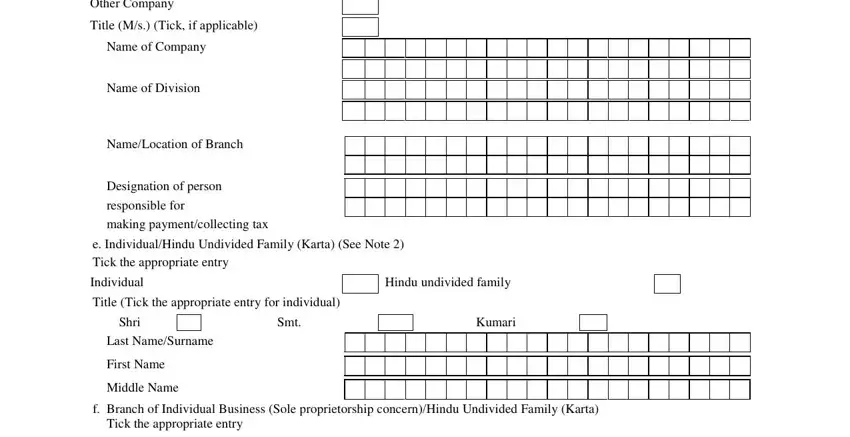

4. The following subsection will require your attention in the following parts: Other Company, Title Ms Tick if applicable, Name of Company, Name of Division, NameLocation of Branch, Designation of person, responsible for, making paymentcollecting tax, Hindu undivided family, e IndividualHindu Undivided Family, Individual, Title Tick the appropriate entry, Shri, Smt, and Last NameSurname. Be sure that you provide all required details to go further.

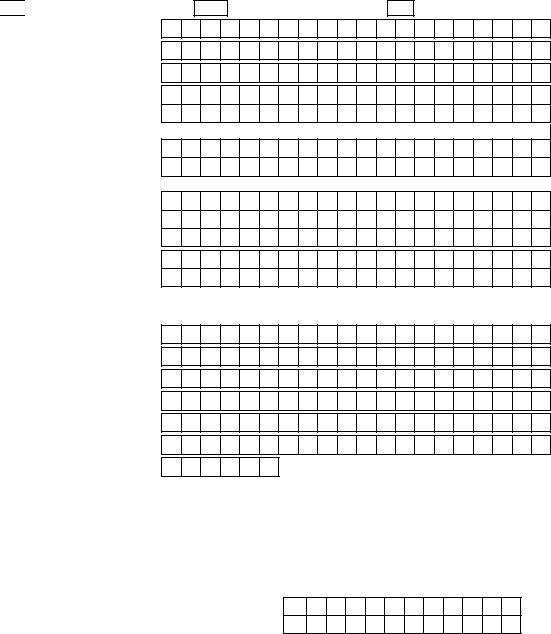

5. To finish your document, this final part features a number of additional blanks. Entering Branch of individual business, Branch of Hindu undivided family, and Printed from wwwtaxmanncom should conclude everything and you'll be done in a tick!

It is possible to get it wrong when completing your Branch of Hindu undivided family, therefore be sure you go through it again before you'll send it in.

Step 3: Spell-check the details you've entered into the blanks and then press the "Done" button. Get the tan application form download as soon as you register online for a 7-day free trial. Instantly use the pdf inside your personal cabinet, with any modifications and changes automatically kept! FormsPal is invested in the privacy of our users; we make certain that all information handled by our editor is secure.