The New York City Utility Excise Tax (NYC UXS) form serves a crucial role in the regulatory landscape of utility services in NYC, primarily targeting vendors not under the Department of Public Service's supervision. This comprehensive form covers the excise tax imposed on vendors offering various utility services such as gas, electricity, steam, water, refrigeration, and telecommunications, excluding limited fare omnibus companies from its purview. The reporting period is clearly demarcated, allowing for precise tax calculations based on gross operating income derived from sales and services without any deductions. Depending on the nature of the business—be it a corporation, partnership, or individual entity—vendors must indicate the appropriate business type while also highlighting specific details such as any changes in address or ownership, and the completion of either an initial, amended, or final return. The inclusion of schedules for computing gross operating income and subsequent taxes due underscores the meticulous financial accountability required from vendors. The form also facilitates deductions, such as the REAP and LMREAP credits, reflecting a layered approach to utility tax computation. Importantly, it incorporates sections for certifying taxpayer information and delineates the payment process, emphasizing electronic payment options for efficiency. By consolidating these varied components, the NYC UXS form epitomizes the city's effort to streamline tax collection from utility vendors, ensuring a structured approach to fiscal governance within this sector.

| Question | Answer |

|---|---|

| Form Name | Form Nyc Uxs |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | Fillable Online TM UXS RETURN OF EXCISE TAX BY VENDORS OF ... |

|

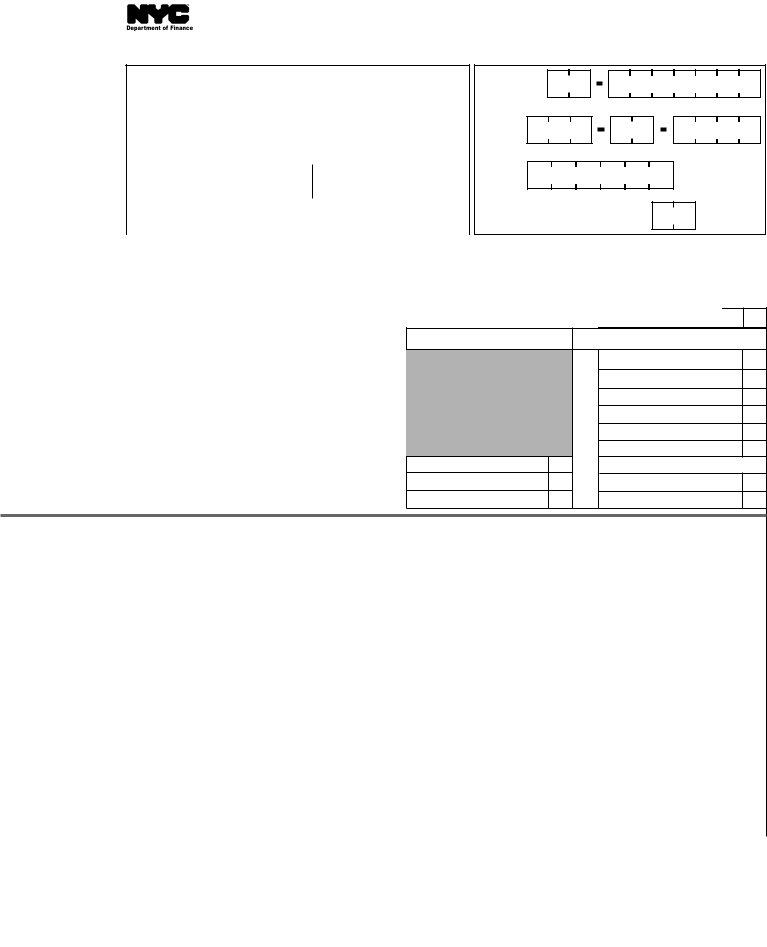

RETURN OF EXCISE TAX BY VENDORS OF UTILITY SERVICES |

||

|

FORUSEBYPERSONS(OTHERTHANALIMITEDFAREOMNIBUSCOMPANY)NOTSUBJECTTOTHESUPERVISION |

||

|

|

OFTHEDEPARTMENTOFPUBLICSERVICEWHOFURNISHORSELLUTILITYSERVICESOROPERATEOMNIBUSES |

|

|

|

|

|

|

Period beginning |

Period ending |

|

*70312291*

Name: |

Name |

n |

|

||

|

Change |

__________________________________________________________________________________________

In Care of:

__________________________________________________________________________________________

Address (number and street): |

Address |

n |

|

||

|

Change |

__________________________________________________________________________________________

City and State: |

Zip: |

Country (if not US): |

__________________________________________________________________________________________ |

|

|

Business Telephone Number: |

Taxpayer’s Email Address |

|

|

|

|

EMPLOYER

IDENTIFICATION

NUMBER:

OR

SOCIAL

SECURITY

NUMBER:

FEDERAL

BUSINESS

CODE:

Check type of business entity: nCorporation nPartnership |

nIndividual |

nAmended return |

nInitial return: Date business began |

nFinal return: Date business ended |

|

|

(Check this box if you have ceased operations in NYC) |

|

SCHEDULE A Computation of Gross Operating Income (See instructions)

A. Payment |

..................................................Amount being paid electronically with this return |

A. |

|

|

|

|

|

Payment Amount

t GROSS OPERATING INCOME t (see instructions)

RECEIPTS FROM SALESAND SERVICES(withoutanydeductions)

1.Gas ·································································································································································· 1.

2.Electricity ·················································································································································· 2.

3.Steam ··························································································································································· 3.

4.Water ···························································································································································· 4.

5.Refrigeration ······································································································································· 5.

6.Telecommunications Services ························································································ 6.

7.Passenger revenue (omnibus operation) ························································· 7.

8.Miscellaneous (attach schedule) ················································································ 8.

9.TOTAL GROSS OPERATING INCOME ···························································· 9.

COLUMNA - TAXABLEAT 1.17%

1.

2.

3.

4.

5.

6.

7.

8.

9.

COLUMN B - TAXABLEAT 2.35%

t COMPUTATION OFAMOUNT DUE t

10. |

line 9, Column A X 1.17% ······································································································································································································· |

10. |

|

|

|

|||

11. |

line 9, Column B X 2.35% ······································································································································································································· |

11. |

|

|

|

|||

12. |

Add lines 10 and 11 ························································································································································································································ |

12. |

|

|

|

|||

13. |

Sales and use tax refunded ······································································································································································································ |

13. |

|

|

|

|||

14. |

TOTAL TAX (Add lines 12 and 13)················································································································································································· |

14. |

|

|

|

|||

15a. |

......REAP Credit (from |

15a. |

|

|

|

|

|

|

15b. |

...LMREAP Credit (from Form |

15b. |

|

|

|

|

|

|

15c. |

Credit for rebates and discounts of charges for energy users (attachschedule). |

15c. |

|

|

|

|

|

|

15d. |

Previous payment |

15d. |

|

|

|

|

|

|

16. |

TOTAL PAYMENTS AND CREDITS (add lines 15a through 15d) ························································································· |

16. |

|

|

|

|||

17. |

If line 14 is larger than line 16, enter balance due ··································································································································· |

17. |

|

|

|

|||

18. |

If line 14 is smaller than line 16, enter overpayment ···································································································································· |

18. |

|

|

|

|||

19. |

Amount of line 18 to be applied to: |

(a) Refund············································································································································ |

19a. |

|

|

|||

|

|

(b) Corporation Tax, or················································································································· |

19b. |

|

|

|||

|

|

(c) Unincorporated Business Tax ········································································· |

19c. |

|

|

|||

20. |

Interest (see instructions) ······································································································································································································ |

20. |

|

|

|

|||

21. |

Penalty (see instructions) ····································································································································································································· |

21. |

|

|

|

|||

22. |

TOTAL REMITTANCE DUE (line 17 plus lines 20 and 21)··········································································································· |

22. |

|

|

|

|||

CERTIFICATION OF t TAXPAYER t

I hereby certify that this return, including any accompanying schedules or statements, has been examined by me, and is, to the best of my knowledge and belief, true, correct and complete. |

|

Firm's Email Address: |

|||||||||||||||||||||||||||||||

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) .................YES |

n |

|

__________________________________________ |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Preparer's Social Security Number or PTIN |

|||||||||||||||||||||||

Signature of owner, partner |

or officer of corporation s |

Title s |

Date s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Preparer's signature s |

Preparer’s printed name s |

Date s |

|

Check if self- |

Firm's Employer Identification Number |

||||||||||||||||||||||||||||

|

|

|

|

|

employed ✔ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

n |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Firm's name s |

Address s |

|

Zip Code s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

70312291 |

SEE PAGE 2 FOR MAILING AND PAYMENT INFORMATION |

Form |

Page 2 |

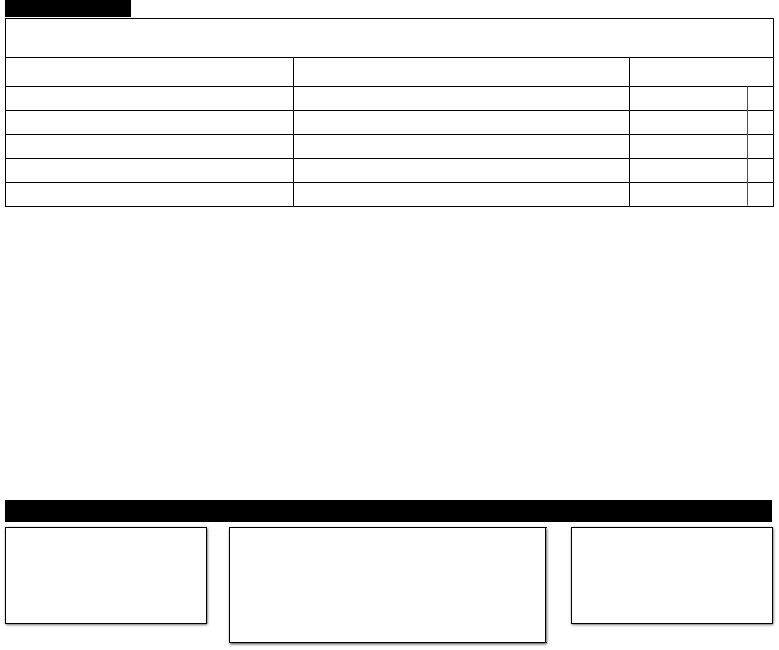

SCHEDULE B

Enter below the names and addresses of all locations where the taxpayer conducts business covered by this return and the amount of gross operating income applicable to each location. Attach rider if additional space is needed.

NAME

ADDRESS

GROSS OPERATING

INCOME

ADDITIONALINFORMATION REQUIRED

A.State kind and nature of business__________________________________________________________________________________________________

B.Telephone number (_______) ________ - __________________

C.If a corporation, in what state did you incorporate? _____________________________________

D. Does this return cover business at more than one location? |

......................nYES nNO (IF YES, YOU MUST COMPLETE SCHEDULE B ABOVE) |

E.The books of the taxpayer are in the care of: _________________________________________________________________________________________

|

Name s |

Address s |

Telephone s |

|

F. |

Does this taxpayer pay rent greater than $200,000 for any premises in NYC in the borough of Manhattan south of |

|

|

|

|

96th Street for the purpose of carrying on any trade, business, profession, vocation or commercial activity? |

nYES |

nNO |

|

G. If "YES", were all required Commercial Rent Tax Returns filed? |

.................................................................................................................................................................................... |

nYES |

nNO |

|

Please enter Employer Identification Number which was used on the Commercial Rent Tax Return:___________________________

ALLRETURNSEXCEPTREFUNDRETURNS

NYC DEPARTMENT OF FINANCE

UTILITY TAX

P.O. BOX 5564

BINGHAMTON, NY

MAILING INSTRUCTIONS

REMITTANCES

PAY ONLINE WITH FORM

AT NYC.GOV/ESERVICES

OR

NYC DEPARTMENT OF FINANCE

P.O. BOX 3933

NEW YORK, NY

RETURNSCLAIMINGREFUNDS

NYC DEPARTMENT OF FINANCE

UTILITY TAX

P.O. BOX 5563

BINGHAMTON, NY

*70322291*

70322291

NEW YORK CITY DEPARTMENT OF FINANCE

Instructions for Form

Payments may be made on the NYC Department of Finance website at nyc.gov/eservices, or via check or money order. If paying with check or money order, do not include these payments with your NewYork Cityreturn. Checks and money orders must be accompanied by

GENERAL INFORMATION

HIGHLIGHTS OFLEGISLATION

For tax periods beginning on or after January 1, 2009, Utility Tax re- funds may be claimed up to three years from the time the return is filed or two years from the time the tax is paid, the same as the period apply- ing to refunds of General Corporation Tax, Business Corporation Tax, the Unincorporated Business Tax, and the Bank Tax. Administrative Code section

Beginning January 1, 2006, metered sales of energy to tenants of cer- tain cooperative housing corporations are exempted from the City util- ity tax. The exemption applies to cooperative corporations with at least 1,500 apartments that own or operate a cogeneration facility that was in place before January 1, 2004 (or that replaces such a facility), and that make metered sales of the energy produced for the development’s ten- ants or occupants. See Ad. Code

ForinformationconcerningtheRelocationEmploymentAssistanceProgram (REAP)seetheDepartmentofFinancewebsiteat:

Effective for tax periods beginning on and afterAugust 1, 2002, entities that receive eighty percent or more of their gross receipts from charges for the provision of mobile telecommunications services to customers will be taxed as if they were regulated utilities for purposes of the New York City Utility Tax, General Corporation Tax, Business Corporation Tax,Banking CorporationTax and Unincorporated BusinessTax. Thus, such entities will be subject to only the NewYork City Utility Tax. The amount of gross income subject to tax has been amended to conform to the Federal Mobile Telecommunications Sourcing Act of 2000. In ad- dition, if any such entity is a partnership, its partners will not be subject to the New York City Utility Tax on their distributive share of the in- comeofanysuchentity. Finally,fortaxyearsbeginningonandafterAu- gust 1, 2002, partners in any such entity will not be subject to General Corporation Tax, Business Corporation Tax, Banking Corporation Tax orUnincorporatedBusinessTaxontheirdistributiveshareoftheincome of any such entity. Laws of New York of 2002, Chapter 93, Part C and Laws of New York of 2015, Chapter 60, Part D.

NOTE:TherehavebeensubstantialchangestotheEnergyCostSavings Program. For information, call 311 or, if outside New York City, 212-

Taxpayers first becoming subject to the utility tax must file monthly re- turns for every month of the calendar year in which they first become subject to tax.

SpecialConditionCodes

Check the Finance website for applicable special condition codes. If ap- plicable, enter the two character code in the box provided on the form.

GENERALDEFINITIONS

1.“Grossoperatingincome”includes (1) receipts from furnishing or sell- ing gas, electricity, steam, water or refrigeration, or furnishing or selling gas, electric, steam, water, refrigeration or telecommunications services,

(2)receipts from omnibus services (except limited fare omnibus compa- nies,seeItem3),whetherornotaprofitisrealized,withoutdeductionfor any cost, expense or discount paid or 3) for tax periods beginning on or afterAugust 1, 2002, 84 percent of ALLcharges for mobile telecommu- nicationsservicestocustomerswheretheplaceofprimaryuseofthecus- tomerisintheCity. Suchreceiptsaredeemedtobederivedfrombusiness

2.“Vendor of Utility Services” Every person (1) not subject to the supervisionoftheNewYorkStateDepartmentofPublicServicewho furnishes or sells gas, electricity, steam, water or refrigeration or fur- nishes or sells gas, electric, steam, water, refrigeration or telecommuni- cations services, or (2) who operates omnibuses (including school buses), whether or not the operation is on the public streets and re- gardlessofwhetherthefurnishing,sellingoroperationconstitutesthe mainactivityoftheperson. Effectivefortaxperiodsbeginningonand after August 1, 2002, entities that receive eighty percent or more of theirgrossreceiptsfromchargesfortheprovisionofmobiletelecom- munications services to customers will be taxed as if they were sub- jecttothesupervisionoftheDepartmentofPublicServiceoftheState ofNewYorkandwillNOTbeconsideredvendorsofutilityservices.

3.“Limited Fare Omnibus Companies” Omnibus companies fran- chised by the City whose principal source of revenue is from trans- porting passengers daily within the City over fixed routes at fares no higher than those charged by the New York City Transit Authority. Limited fare omnibus companies are required to file

If you received a refund in the current period of any sales and use taxes forwhichyouclaimedacreditinapriorperiod,entertheamountofsuch refund on line 13.

Enter on this line the credit against the Utility Tax for the relocation and employment assistance program. (Attach Form

Enter on this line the credit against the Utility Tax for the new Lower Manhattanrelocationandemploymentassistanceprogram. (AttachForm

IMPOSITION/BASIS/RATE OFTAX

Thetaxisimposedoneveryvendorofutilityservicesfortheprivilegeof

Form |

Page 2 |

|

|

exercising a franchise or franchises, holding property or doing business in NewYork City.

A vendor of utility services is taxable on gross operating income as de- fined above. The following chart provides the rates.

CLASS t |

RATE t |

lVendors of utility services other than

omnibus operators...................................................................2.35% of gross operating income

lOmnibus operators not subject to

Department of Public Service supervision ...............1.17% of gross operating income

INTEREST

If the tax is not paid on or before the due date, interest must be paid on the amount of the underpayment from the due date to the date paid. For information as to the applicable rate of interest visit the Finance website at nyc.gov/finance or call 311. Interest amounting to less than $1 need not be paid.

PENALTIES

a)A late filing penalty is assessed if you fail to file this form when due, unless the failure is due to reasonable cause. For every month or partial month that this form is late, add to the tax (less any pay- ments made on or before the due date) 5%, up to a total of 25%.

b)If this form is filed more than 60 days late, the above late filing penalty cannot be less than the lesser of (1) $100 or (2) 100% of the amount required to be shown on the form (less any payments made by the due date or credits claimed on the return).

c)Alatepaymentpenaltyisassessedifyoufailtopaythetaxshownon this form by the prescribed filing date, unless the failure is due to rea- sonable cause. For every month or partial month that your payment is late,addtothetax(lessanypaymentsmade)1/2%,uptoatotalof25%.

d)The total of the additional charges in a and c may not exceed 5% for any one month except as provided for in b.

e)Additionalpenaltiesmaybeimposedonanyunderpaymentofthetax.

If you claim not to be liable for these additional charges, attach a state- ment to your return explaining the delay in filing, payment or both.

FILINGARETURNAND PAYMENTOFTAX

Returns are due on or before the 25th day of each month, if filing on a monthly basis, covering gross operating income for the preceding calen- dar month. However, if the tax liability is less than $100,000 for the pre- cedingcalendaryear,determinedonanannualorannualizedbasis,returns are due for the current tax year on a

Payment must be made in U.S. dollars, drawn on a U.S. bank. Checks drawn on foreign banks will be rejected and returned. Make remittance payable to the order of: NYC DEPARTMENT OF FINANCE.

SIGNATURE

This report must be signed by an officer authorized to certify that the statements contained herein are true. If the taxpayer is a partnership or anotherunincorporatedentity,thisreturnmustbesignedbyapersonduly authorized to act on behalf of the taxpayer.

For further information, call 311. If calling from outside the five bor- oughs, call

PreparerAuthorization: If you want to allow the Department of Fi- nance to discuss your return with the paid preparer who signed it, you must check the "yes" box in the signature area of the return.This author- izationappliesonlytotheindividualwhosesignatureappearsinthe"Pre- parer's Use Only" section of your return. It does not apply to the firm, if any, shown in that section. By checking the "Yes" box, you are author- izing the Department of Finance to call the preparer to answer any ques- tions that may arise during the processing of your return. Also, you are authorizing the preparer to:

lGive the Department any information missing from your return,

lCall the Department for information about the processing of your return or the status of your refund or payment(s), and

lRespondtocertainnoticesthatyouhavesharedwiththepreparer about math errors, offsets, and return preparation. The notices will notbe sent to the preparer.

Youarenotauthorizingthe preparer to receive any refund check, bind you to anything (including any additional tax liability), or otherwise rep- resent you before the Department. The authorization cannot be revoked, however, the authorization will automatically expire twelve (12) months aftertheduedate(withoutregardtoanyextensions)forfilingthisreturn.

Failuretochecktheboxwillbedeemedadenialofauthority.

MAILING INSTRUCTIONS

All returns, except refund returns:

NYC Department of Finance

UtilityTax

P.O. Box 5564

Binghamton,

Remittances - Pay online with Form

NYC Department of Finance

P.O. Box 3933

NewYork, NY

Returns claiming refunds:

NYC Department of Finance

UtilityTax

P.O. Box 5563

Binghamton,

TOAVOID THE IMPOSITION OFPENALTIES,youramountofthetaxduemustbe

paid in full and this return must be filed and postmarked within 25 days aftertheendoftheperiodcoveredbythereturn.