In case you intend to fill out visa 48r australia, you won't need to install any kind of software - simply give a try to our PDF tool. Our team is always endeavoring to enhance the editor and ensure it is even better for people with its extensive functions. Bring your experience one stage further with continuously growing and interesting options we offer! In case you are seeking to get started, here's what it will require:

Step 1: Press the "Get Form" button above. It is going to open up our editor so that you can start filling out your form.

Step 2: After you open the tool, you'll notice the form made ready to be filled out. Besides filling out different blanks, you may also perform other sorts of actions with the form, namely writing custom text, editing the initial text, inserting illustrations or photos, putting your signature on the PDF, and much more.

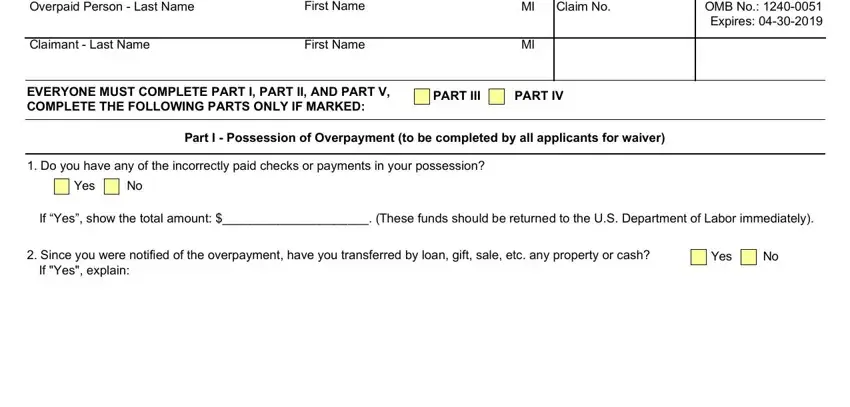

When it comes to fields of this specific document, here's what you should consider:

1. The visa 48r australia usually requires specific information to be inserted. Ensure that the following blank fields are finalized:

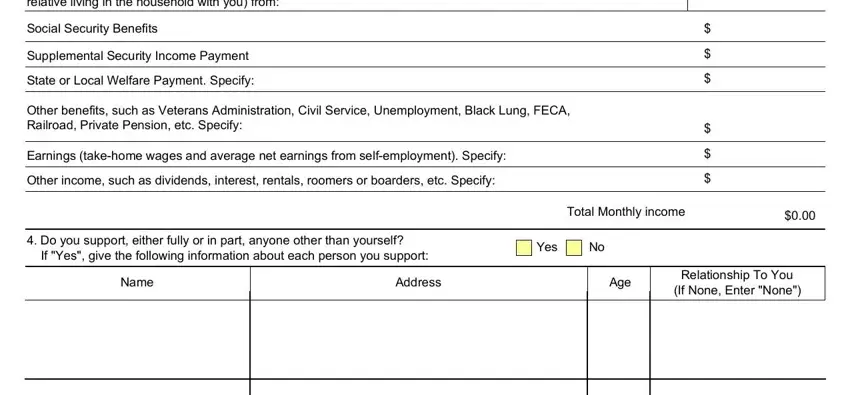

2. Soon after completing the previous step, go on to the subsequent part and fill out the necessary details in all these blank fields - To be completed by the person for, Social Security Benefits, Supplemental Security Income, Other benefits such as Veterans, Earnings takehome wages and, Do you support either fully or in, If Yes give the following, Yes, Name, Address, Age, Relationship To You If None Enter, and Total Monthly income.

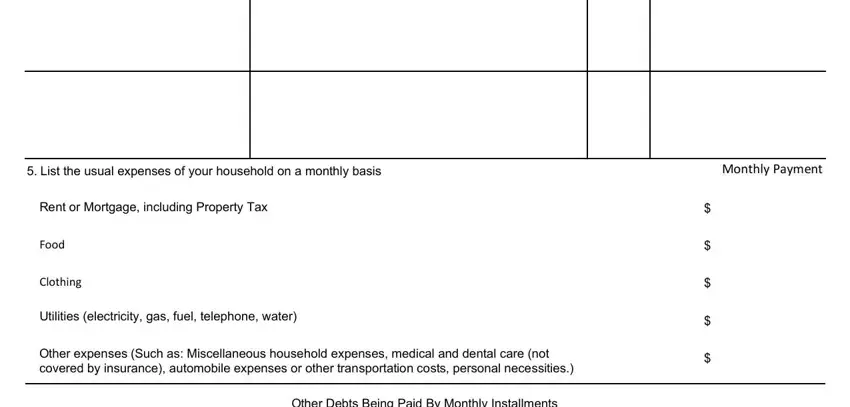

3. This next part is going to be straightforward - fill in all of the form fields in List the usual expenses of your, Monthly Payment, Rent or Mortgage including, Food, Clothing, Utilities electricity gas fuel, Other expenses Such as, and Other Debts Being Paid By Monthly to conclude this part.

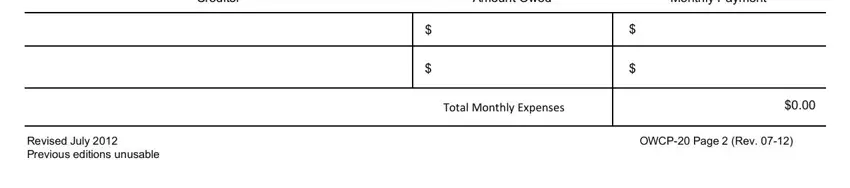

4. To move onward, your next section involves filling in a few blanks. Examples of these are Creditor, Amount Owed, Monthly Payment, Total Monthly Expenses, OWCP Page Rev, and Revised July Previous editions, which you'll find key to carrying on with this particular form.

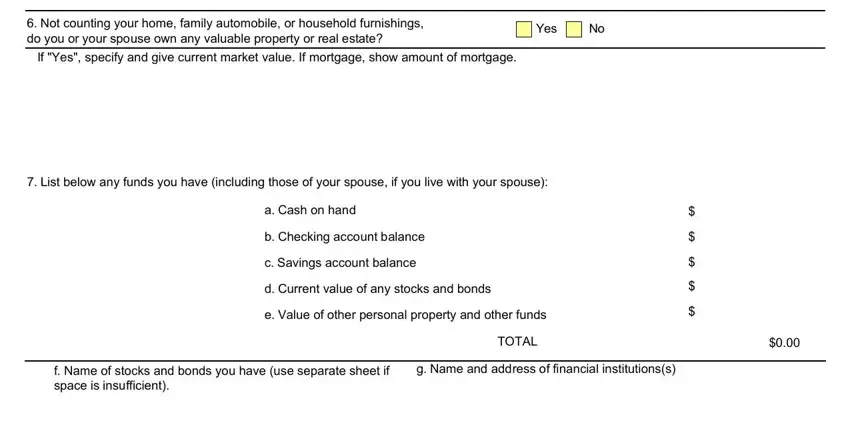

5. While you approach the end of the file, you'll notice several more requirements that need to be satisfied. Particularly, Not counting your home family, If Yes specify and give current, Yes, List below any funds you have, a Cash on hand, b Checking account balance, c Savings account balance, d Current value of any stocks and, e Value of other personal property, f Name of stocks and bonds you, g Name and address of financial, and TOTAL should all be filled in.

As for d Current value of any stocks and and Yes, make sure you review things here. Those two are considered the key fields in this form.

Step 3: When you have glanced through the information in the document, press "Done" to conclude your form at FormsPal. Get hold of your visa 48r australia when you register at FormsPal for a 7-day free trial. Immediately get access to the pdf file inside your FormsPal account page, along with any modifications and changes automatically synced! FormsPal guarantees your information privacy with a protected method that never saves or distributes any personal data involved. Feel safe knowing your paperwork are kept confidential each time you work with our service!