Working with PDF files online is always super easy with our PDF tool. You can fill out Form Pc 584 here without trouble. To make our tool better and more convenient to utilize, we constantly develop new features, taking into account feedback coming from our users. With some basic steps, you'll be able to begin your PDF editing:

Step 1: Firstly, open the tool by clicking the "Get Form Button" at the top of this page.

Step 2: With the help of this online PDF file editor, you are able to accomplish more than simply fill in blank form fields. Express yourself and make your docs seem sublime with custom textual content added, or optimize the file's original content to excellence - all supported by the capability to insert just about any pictures and sign the file off.

It's an easy task to finish the form with this helpful tutorial! Here's what you must do:

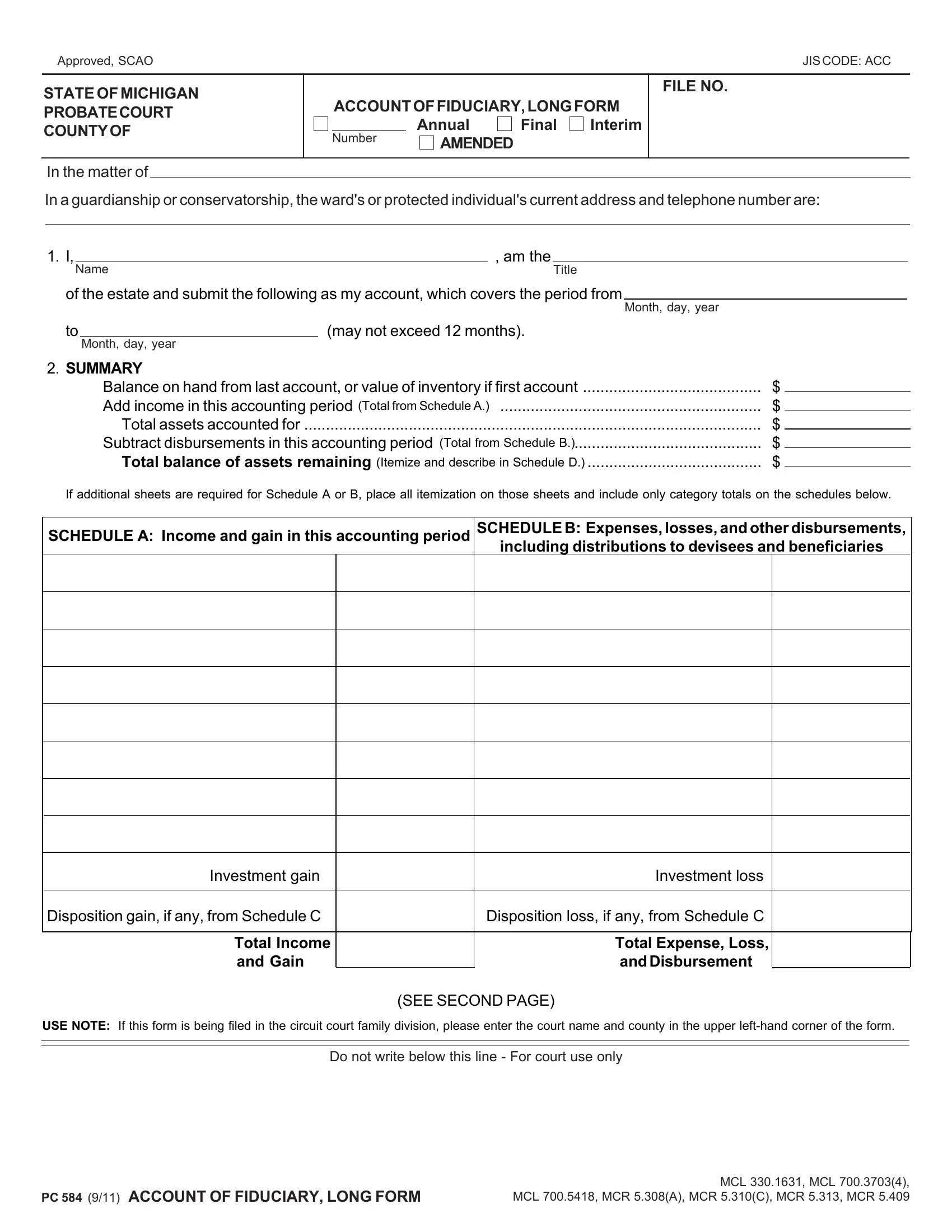

1. You will want to complete the Form Pc 584 properly, therefore pay close attention when filling in the sections including all of these blank fields:

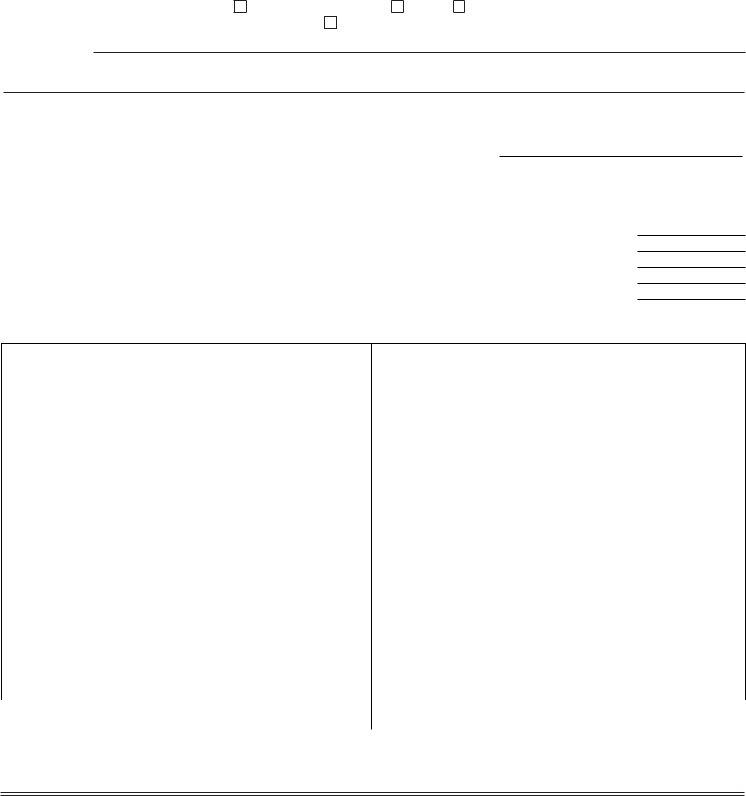

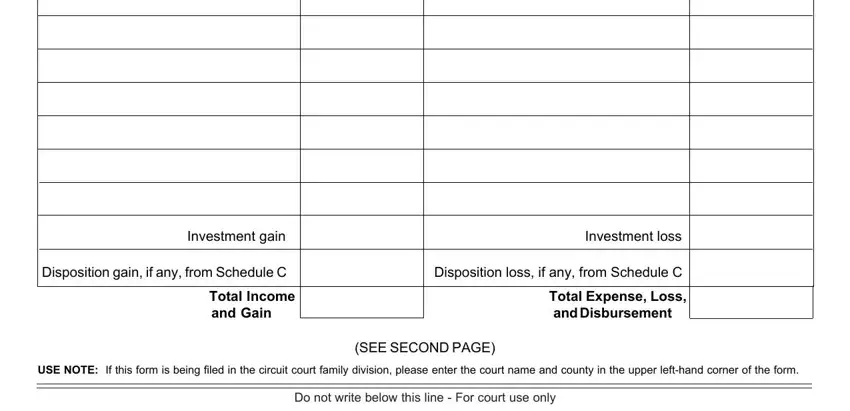

2. After this segment is completed, you're ready put in the necessary particulars in Investment gain, Investment loss, Disposition gain if any from, Disposition loss if any from, Total Income, and Gain, Total Expense Loss, and Disbursement, USE NOTE If this form is being, SEE SECOND PAGE, and Do not write below this line For allowing you to progress to the 3rd part.

Be extremely careful while filling in Total Expense Loss and and Gain, since this is where many people make some mistakes.

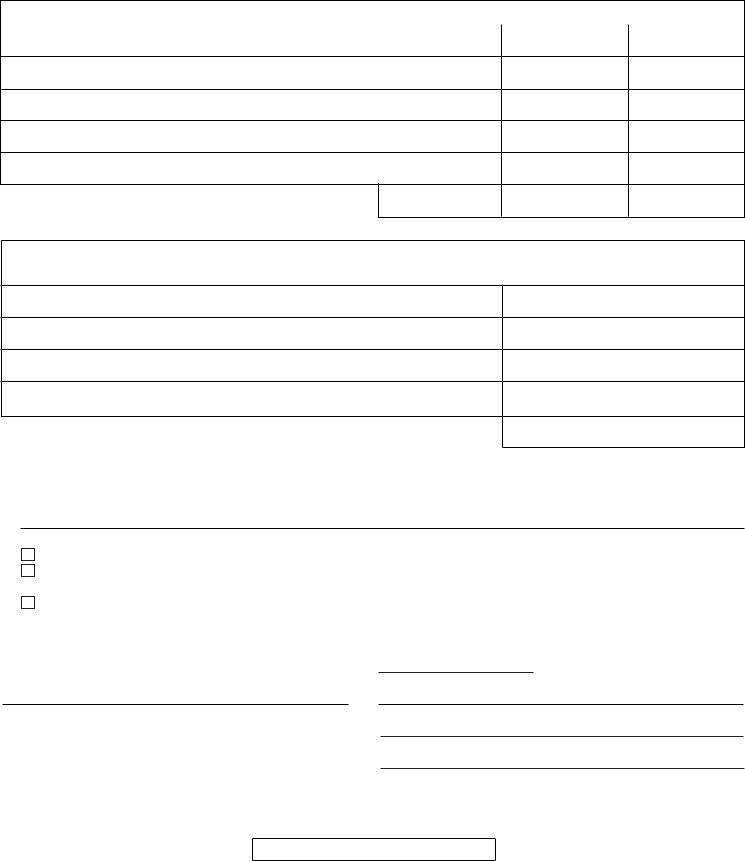

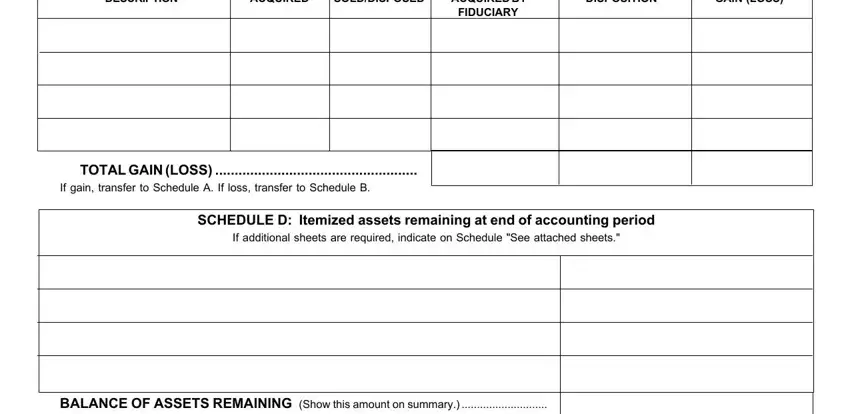

3. The third step is generally easy - complete all the empty fields in DESCRIPTION, DATE ACQUIRED SOLDDISPOSED, VALUE AT TIME PROCEEDS OF SALE, DISPOSITION, GAIN LOSS, FIDUCIARY, TOTAL GAIN LOSS, If gain transfer to Schedule A If, SCHEDULE D Itemized assets, If additional sheets are required, and BALANCE OF ASSETS REMAINING Show in order to finish this part.

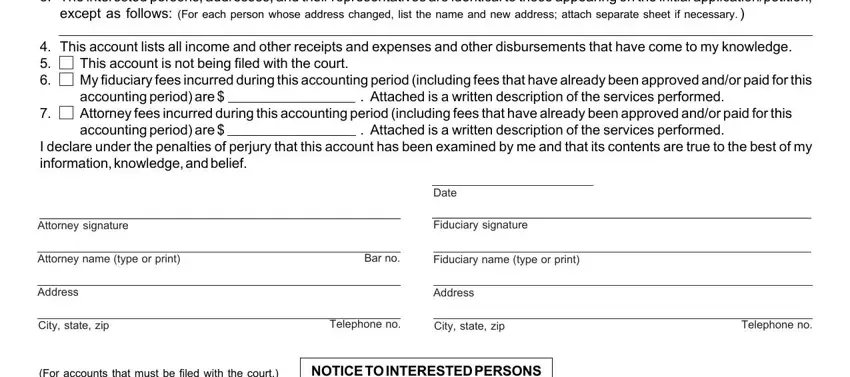

4. To go onward, this next step requires typing in a handful of form blanks. Included in these are The interested persons addresses, except as follows For each person, This account lists all income and, This account is not being filed, Attached is a written description, Attached is a written description, I declare under the penalties of, Attorney signature, Date, Fiduciary signature, Attorney name type or print, Bar no, Fiduciary name type or print, Address, and City state zip, which you'll find key to carrying on with this document.

Step 3: Ensure the details are accurate and then press "Done" to complete the process. Create a 7-day free trial plan at FormsPal and gain instant access to Form Pc 584 - download, email, or edit inside your FormsPal cabinet. If you use FormsPal, you can fill out documents without worrying about database incidents or entries getting distributed. Our secure software helps to ensure that your personal details are kept safe.