The City of Port Huron, maintaining its diligence in financial oversight, mandates the timely submission of the PH-W3 form, a crucial document representing the reconciliation of Port Huron income tax withheld for the year 2009, with a strict deadline set on February 28, 2010. This elaborate form is designed to synchronize the total Port Huron tax withheld, as evidenced on individual W-2 forms, against the aggregate sums remitted to the city, recorded meticulously through quarterly details on Forms PH-941. Employers are tasked with summarizing the year's withholding, alongside furnishing an information return for each taxpayer under their employ, detailing earnings and withholdings subjected to city tax. The PH-W3 form serves not just as a financial summary but also as a regulatory compliance tool, ensuring that employers accurately report and remit due taxes to the city. Any discrepancies identified, notably underpayments exceeding one dollar, necessitate correction through this form, with overpayments due for verification and potential refund by the city. The structured format, including provisions for filing via magnetic media, underscores the city's commitment to efficient processing and verification, fostering timely compliance and financial transparency.

| Question | Answer |

|---|---|

| Form Name | Form Ph W3 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | form ph w3, 2009, PH-941, city of port huron tax forms |

Form |

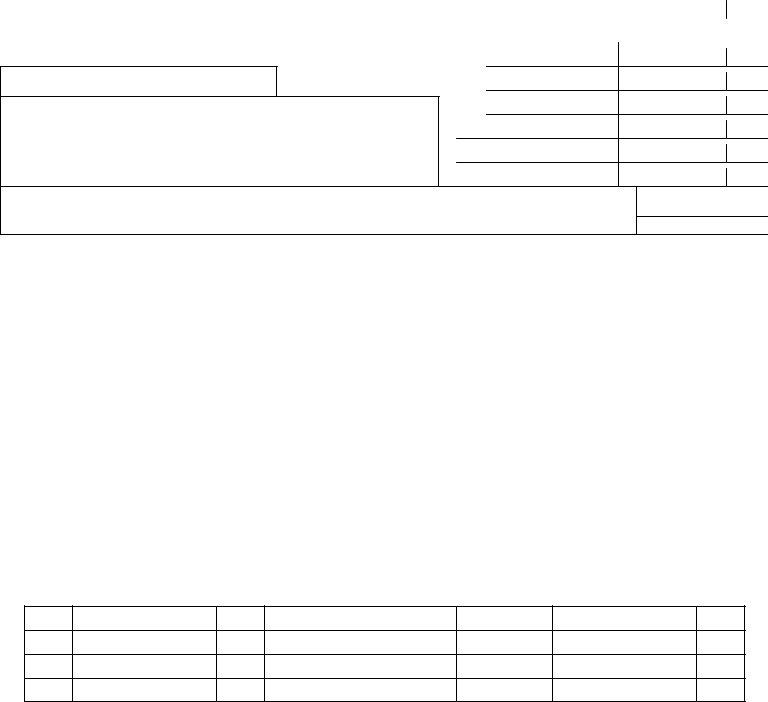

City of Port Huron Income Tax |

2009 |

|||

Reconciliation of Port Huron Income Tax Withheld |

|||||

|

|

|

|

||

Instructions are on the reverse side |

|

DUE FEBRUARY 28, 2010 |

|||

|

|

|

|

||

1. |

Total Port Huron tax withheld during the year, as shown on the enclosed withholding statements |

|

|

||

|

|

|

|

||

2. |

Total number of withholding statements |

|

|

||

|

|

|

|

|

|

3. Total Port Huron tax withheld, as paid with Forms

were filed monthly)

Federal Employer Identification Number

Employer name and address

3a. Quarter ended Mar 31

3b. Quarter ended Jun 30

3c. Quarter ended Sep 30

3d. Quarter ended Dec 31

4.Total withholding remitted

5.DIFFERENCE see instructions

Signature |

Title |

Date |

for city use

INSTRUCTIONS FOR FORM

1.By the last day of February following each calendar year, you must furnish to the city the following:

a)A completed copy of this form

b)An information return for each person who had income subject to city tax. The form must state the employee's name, social security number, address, compensation received and city tax withheld. The return must be a copy of the federal

2.Show the total Port Huron tax withheld (as reported on the enclosed forms

3. Mail this form, along with Forms |

Income Tax Division |

|

|

|

100 McMorran Boulevard |

|

|

Port Huron, MI 48060 |

Make checks payable to: Treasurer, City of Port Huron. |

Questions? please call (810) |

|

If you remitted the payments monthly, please list the amounts:

JAN

FEB

MAR

APR

MAY |

|

SEP |

JUN |

|

OCT |

JUL |

|

NOV |

AUG |

|

DEC |