In the business world, it is important to always be professional and up-to-date on the latest trends. Form Ph W3 is a great way to keep your professionalism in check, while also keeping your customer service skills sharp. This form allows you to gather feedback from customers after they have interacted with you or your company. Always be sure to review the information gathered from this form, in order to improve your customer service skills for future interactions. Thank you for reading!

| Question | Answer |

|---|---|

| Form Name | Form Ph W3 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | form ph w3, 2009, PH-941, city of port huron tax forms |

Form |

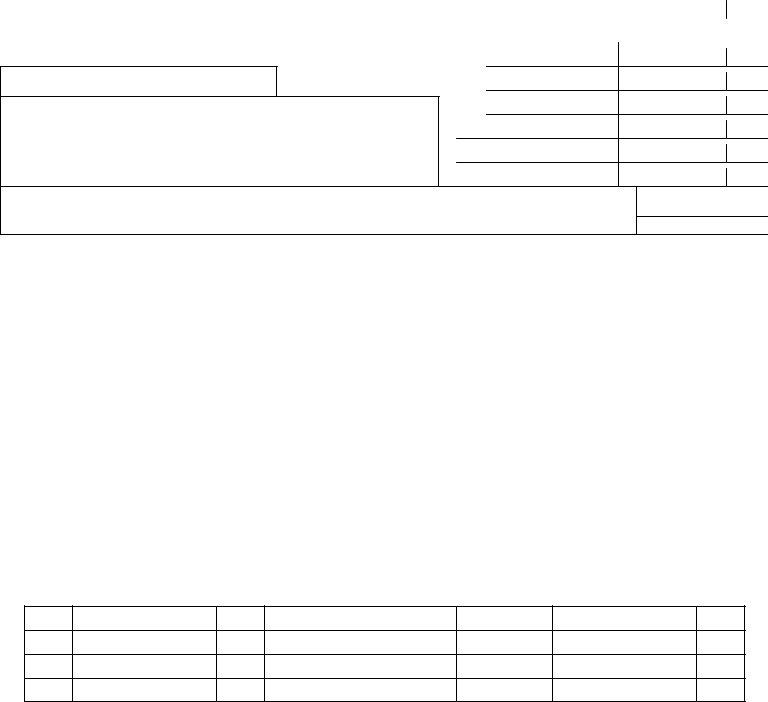

City of Port Huron Income Tax |

2009 |

|||

Reconciliation of Port Huron Income Tax Withheld |

|||||

|

|

|

|

||

Instructions are on the reverse side |

|

DUE FEBRUARY 28, 2010 |

|||

|

|

|

|

||

1. |

Total Port Huron tax withheld during the year, as shown on the enclosed withholding statements |

|

|

||

|

|

|

|

||

2. |

Total number of withholding statements |

|

|

||

|

|

|

|

|

|

3. Total Port Huron tax withheld, as paid with Forms

were filed monthly)

Federal Employer Identification Number

Employer name and address

3a. Quarter ended Mar 31

3b. Quarter ended Jun 30

3c. Quarter ended Sep 30

3d. Quarter ended Dec 31

4.Total withholding remitted

5.DIFFERENCE see instructions

Signature |

Title |

Date |

for city use

INSTRUCTIONS FOR FORM

1.By the last day of February following each calendar year, you must furnish to the city the following:

a)A completed copy of this form

b)An information return for each person who had income subject to city tax. The form must state the employee's name, social security number, address, compensation received and city tax withheld. The return must be a copy of the federal

2.Show the total Port Huron tax withheld (as reported on the enclosed forms

3. Mail this form, along with Forms |

Income Tax Division |

|

|

|

100 McMorran Boulevard |

|

|

Port Huron, MI 48060 |

Make checks payable to: Treasurer, City of Port Huron. |

Questions? please call (810) |

|

If you remitted the payments monthly, please list the amounts:

JAN

FEB

MAR

APR

MAY |

|

SEP |

JUN |

|

OCT |

JUL |

|

NOV |

AUG |

|

DEC |