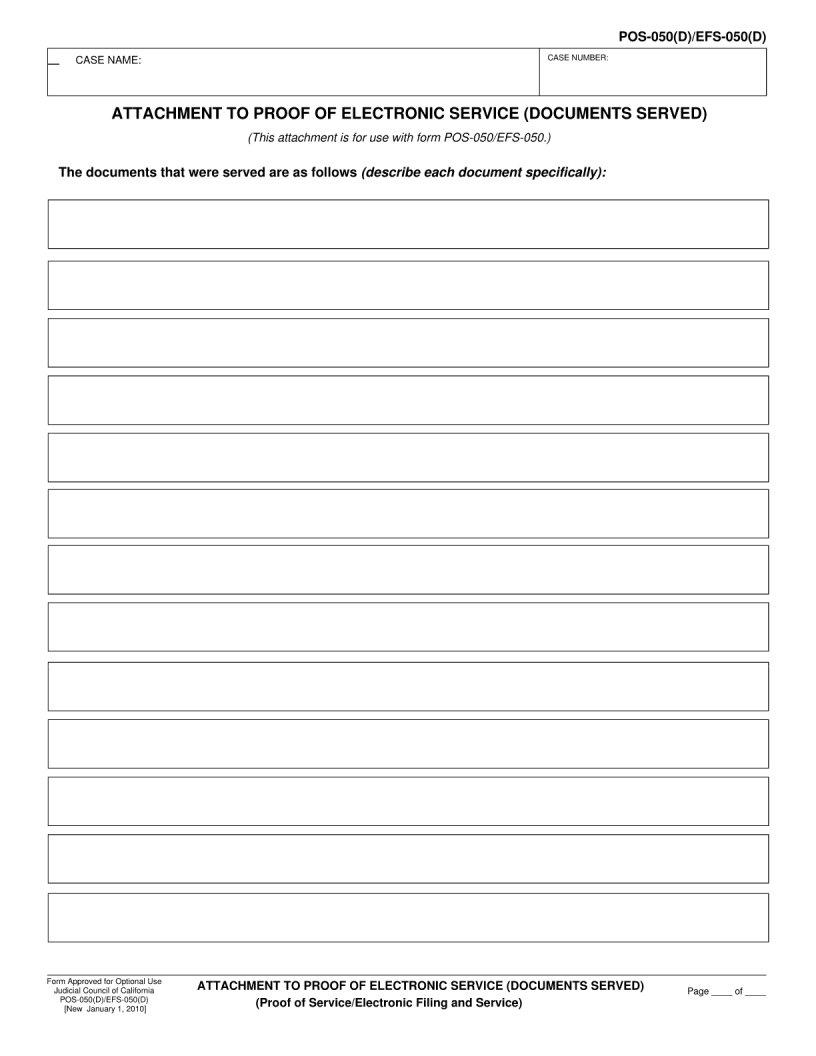

Form Pos 050 is a required form for all Pennsylvania businesses. The purpose of this form is to report the total wages and salaries paid to employees during a specific tax year. This form must be filed annually with the Department of Revenue by January 31st. Penalties may apply for businesses that do not file on time. Make sure you are familiar with the requirements of Form Pos 050 so that you can file properly and avoid penalties. For more information, contact the Department of Revenue or consult your tax professional.

| Question | Answer |

|---|---|

| Form Name | Form Pos 050 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | Optional, pos050, POS-050, California |