The Renter Rebate Program assists eligible renters by refunding the portion of rent paid that exceeds the established percentage of household income.

LANDLORD’S CERTIFICATE You need a Landlord's Certificate, Form LC-142, completed by the landlord for each rental unit occupied in calendar year 2007. The law requires landlords with more than 4 residential rental units to provide you with a completed certificate by January 31. Landlords with 4 or less residential rental units provide the certificate upon your request. Landlords complete the section on property taxes only upon request.

UNABLE TO GET A CERTIFICATE FROM YOUR LANDLORD? You may still file a renter rebate claim. Complete a Landlord's Certificate including your landlord's name, address, and telephone number, attach copies of your cancelled checks or receipts for rent paid, and attach a letter explaining why you could not get a Landlord's Certificate. To obtain a Landlord’s Certificate, contact the Department at (802) 828-2515, or e-mail taxforms@state.vt.us or fax to (802) 828-2701.

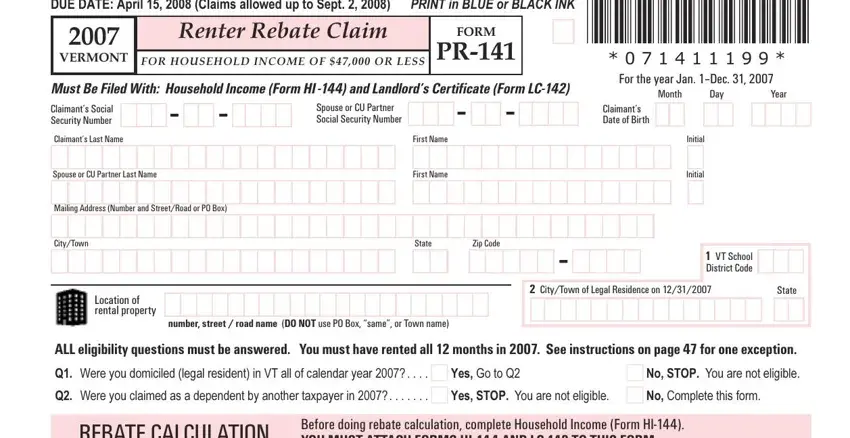

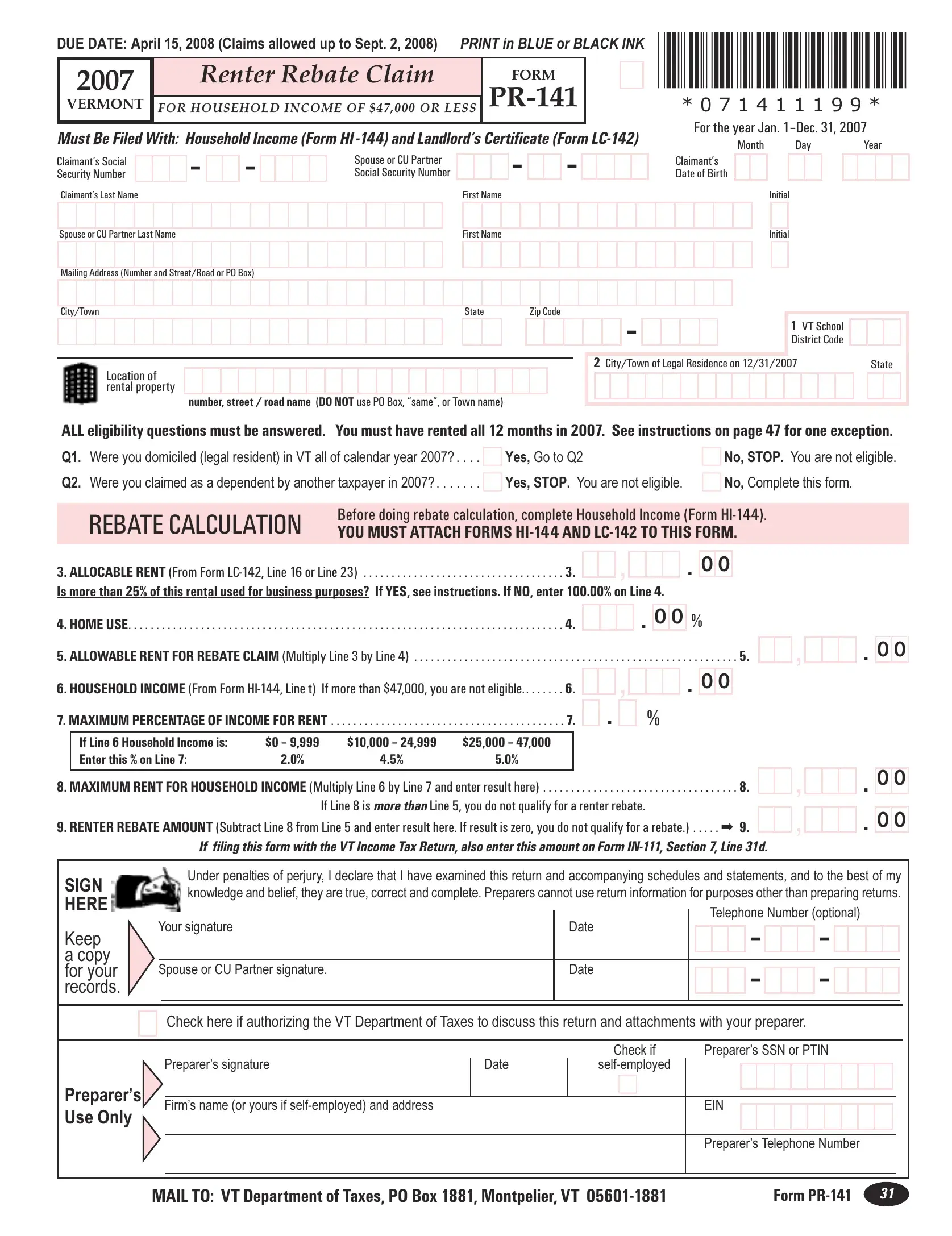

DUE DATE: APRIL 15, 2008 Claims may be filed up to SEPTEMBER 2, 2008. Returns filed after September 2nd cannot be accepted regardless of the reason the claim could not be filed.

TIMELY FILING The Department considers a renter rebate claim timely filed when mailed through the U.S. Post Office and the department receives it within 3 business days of the due date. If you bring the renter rebate claim to the Department in person, you must deliver it on or before the return due date.

REQUESTS FOR ADDITIONAL INFORMATION During processing, you may be asked to supply additional information to clarify items on your claim. A request does not mean you filed improperly or that your claim has been selected for an audit.

MISSING INFORMATION OR INCOMPLETE FILING Claims with incomplete or missing information are not considered filed. The information must be provided by the September 2 filing deadline or our request date, whichever is later. Information received after that time cannot be accepted which means the return is considered unfiled, and the claim is denied.

OFFSET OF REBATE OR INJURED SPOUSE CLAIMS Do you or your spouse or civil union partner owe tax or money to a VT state agency? VT law allows a claim against your renter rebate for unpaid bills for tax or other VT State agencies. Other agencies include Office of Child Support, Department of Corrections, VT courts, student loan agencies, and VT State Colleges.

If your spouse is responsible for the bill, and you are not, you need to file an "injured spouse" claim for your portion of the renter rebate. You may receive the portion of the renter rebate equal to the percentage of your income to the combined income of you and your spouse or civil union partner. See page 4 for filing an "injured spouse" claim.

$ The Department will notify you if the renter rebate is offset. You have 30 days from the date on the notice to submit the injured spouse claim to the Department.

AMENDING or CHANGING RENTER REBATE INFORMATION Correcting household income is the only amendment or change allowed. See page 48 for more information.

ELIGIBILITY FOR RENTER REBATE

You must meet ALL of the following eligibility requirements:

•You were a legal resident of VT for the entire calendar year 2007; and

•You were not claimed in 2007 as a dependent of another taxpayer; and

•Your household income in 2007 does not exceed $47,000; and

•You are the only person in the household making a renter rebate claim; and

•You rented for all 12 months in 2007. See page 47 for the one exception.

NOTE: Renter rebate claims based on the rental unit's property tax will be adjusted if your landlord charges you rent below market rate because you are related to the landlord, you hold an ownership interest in the rental unit, or for any other reason. The property tax will be adjusted to reflect the ratio of the rent charged to the fair market rent established by the Federal Housing and Urban Development Agency. See Technical Bulletin TB-28.

$ DECEASED RENTER: You may not file a claim on behalf of a deceased person. The right to file a renter rebate claim is personal to the Claimant and does not survive the Claimant's death.

$ NURSING OR RESIDENTIAL CARE HOME: The rebate claim is for room charge only. Services such as heat, electricity, personal services, medical services, etc., are deducted from the total. Generally, the room charge is 25% of the home's total charges to the person. For a percentage greater than 25%, the nursing home or residential care home must provide a breakout of costs. Payments by Medicaid on behalf of the Claimant to the nursing home are not part of rent paid.

32Form PR-141

NOTE: A person residing in a nursing or residential care home owning a homestead with a sibling or spouse can claim a renter rebate if a property tax adjustment claim is not made.

LINE-BY-LINE INSTRUCTIONS

$ Complete Form HI-144 FIRST. If Line t is more than $47,000, you are ineligible.

Supporting Documents Required: Forms HI-144 and LC-142

Claimant's Date of Birth Enter your date of birth (you are the claimant). Example: March 31, 1946, enter as 03 31 1946.

Claimant Information REQUIRED entries. Enter your name, your spouse or civil union partner (if applicable) name, mailing address and Social Security number(s). The rebate is issued to the name(s) and address on record. The Claimant is the leaseholder or the person responsible for the rent. Only one claimant per household is allowed, but there can be joint claimants (such as spouses or civil union partners).

Line 1 VT School District Code: REQUIRED entry. Go to the table on page 13 and select the three-digit school district code for the town where you lived on December 31, 2007.

Line 2 Legal Residence: REQUIRED entry. Enter your legal residence as of December 31, 2007. Your legal residence is where you live, and it may be different from your mailing address. If you live where there is both a city and town with the same name, please specify the one in which you reside. For example: St. Albans City or St. Albans Town.

Location of Rental Property: REQUIRED entry. Enter the physical location of

the homestead (street or road name). Examples: 133 Main Street, Apt 2C; 425 Farm Road 210 US Rt 7N Please do not enter post office box, "same", "see above," or the town name.

Eligibility Questions REQUIRED entries. Check the appropriate "Yes" or "No" box for Q1 and Q2 to determine your eligibility.

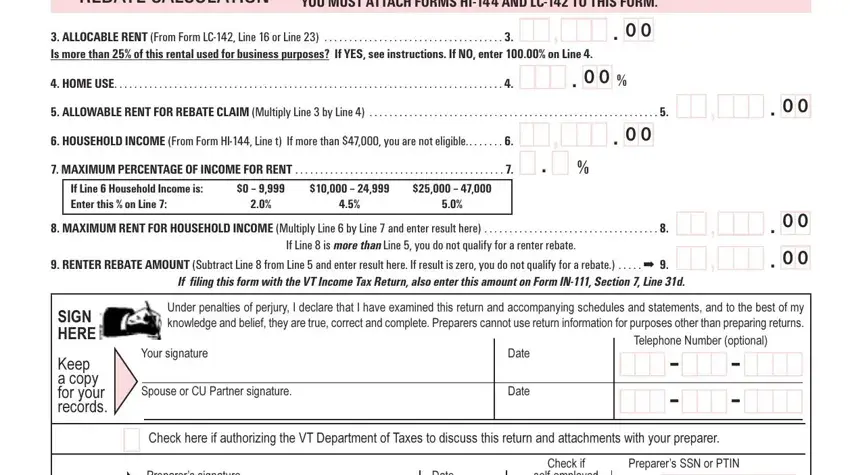

Rebate Calculation

Line 3 Allocable Rent Enter from the Landlord's Certificate, Form LC-142, the greater of Line 16 or Line 22. This will be either 21% of rent paid for the calendar year or the property tax allocable to your rental unit. MORE THAN ONE LANDLORD’S CERTIFICATE: Add the greater of Line 16 or Line 22 from each certificate and enter on this line. File all LC-142s with your claim.

Line 4 Home Use If you use more than 25% of your rental unit's floor space for business purposes, the allowable rent amount is adjusted. The percentage of business use is generally the same percentage used on your Federal income tax return when there is more than 25% business use. To calculate business use, divide the square feet used for business by the total square feet in the rental unit. Example: You use an 11' x 12' room for an office and inventory storage. Your rental unit is 484 square feet (including the business use). Your business use is 11 x 12 = 132 sf / 484 = .27 business use. Entry on Line 4 for home use is 73 (100% - 27%).

Line 5 Allowable Rent for Rebate Claim Multiply Line 3 by Line 4 and enter the result here. If all home use, enter 100.00% on Line 4.

Line 6 Household Income Enter the amount from Form HI-144, Line t. See page 48 for definition of household income.

Line 7 Maximum Percentage of Income for Rent Use the chart to find your household income group and applicable percentage. Enter that percentage here.

Line 8 Maximum Allowable Rent for Household Income Multiply Line 6 by Line 7 and enter the result here. If Line 8 is more than or the same as Line 5, you are not eligible.

Line 9 Renter Rebate Amount Subtract Line 8 from Line 5. This is your 2007 renter rebate. $ If you are filing the renter rebate claim with your 2007 VT income tax return, also enter this amount on Form IN-111, Section 7, Line 31d. You will be issued one check combining any income refund or rebate due you.

Signature REQUIRED Sign the claim.

Date Write the date on which the claim form was signed.

Disclosure Authorization If you wish to give the Department authorization to discuss your 2007 Renter Rebate Claim with your tax preparer, check this box and include the preparer's name.

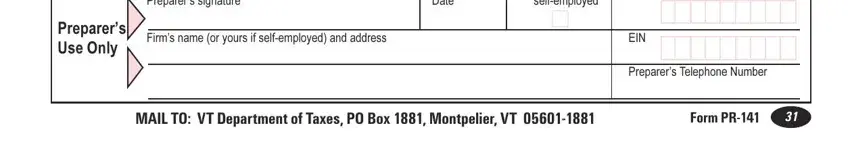

Preparer If you employed a paid preparer, he/she must also sign the claim. The preparer must enter his/her Social Security number or PTIN and, if employed by a business, the EIN of the business. If someone other than the filer(s) prepared the return without charging a fee, then that preparer's signature is optional.